November 24, 2023

In today’s fast-paced world, where every mile and minute counts, tracking your mileage has become essential, whether for work and tax purposes, or personal record-keeping. With a plethora of mileage tracker apps available, it can be overwhelming to choose the right one. That’s where MileageWise enters the scene as a standout choice. But before we delve into why MileageWise might be your go-to app, let’s explore what makes a mileage tracker app so crucial.

Why Track Mileage?

Tracking mileage is more than just noting the distance traveled. It’s about efficiency, accuracy, and simplifying the process of logging trips for various purposes such as business expenses, tax deductions, or reimbursement. With the right app, this process becomes seamless and automated.

Choosing the Best Mileage Tracking App

While looking for the best mileage tracking app, you might come across names like MileIQ, Everlance, Stride, SherpaShare, Driversnote, Gridwise, QuickBooks, Hurdlr, and TripLog. These apps offer a range of features from simple mileage logging to detailed reports suitable for tax purposes. Each app has its unique strengths, catering to different needs and our extensive list of reviews gives you a great opportunity to get the lowdown on each of them.

The Allure of Free Mileage Tracker Apps

For those who are budget-conscious, a free mileage tracker app is an attractive option. Apps like Stride Mileage Tracker or the QuickBooks Mileage Tracker provide essential functions without a price tag. However, it’s important to consider the features you might need that could be available only in paid versions.

MileageWise: A Comprehensive Solution

MileageWise emerges as a strong contender in this crowded field. It’s not just a simple mileage tracker; it’s a comprehensive tool designed for various needs, but most importantly, to ensure that users can count on mileage logs that are 100% IRS-Proof. As you can see from the comparison table at the end of this post, this feature is really a unique offering from MileageWise.

For the Business Savvy: Mileage Tracking App for Business

Business professionals, particularly those using services like DoorDash or needing a vehicle mileage tracker, will find MileageWise especially beneficial. It serves as an efficient mileage app for taxes, ensuring that every mile counts towards your tax deductions.

The Mileage Log for Taxes: Simplifying the Complicated

One of the standout features of MileageWise is its ability to create a detailed mileage log for taxes. This feature makes it the best mileage tracking app for those who need to maintain accurate and IRS-compliant records.

Mileage Tracker for Taxes and More

MileageWise isn’t just a mileage app for taxes; it’s also a versatile tool for everyday use. Whether you need a simple mileage tracker, a car mileage tracker, or an app to track mileage for work, MileageWise covers all bases.

Features Unique to MileageWise

We’ve extensively tested MileageWise against a dozen industry leading competitors and we are proud to share the list of features that make MileageWise stand out from the pack.

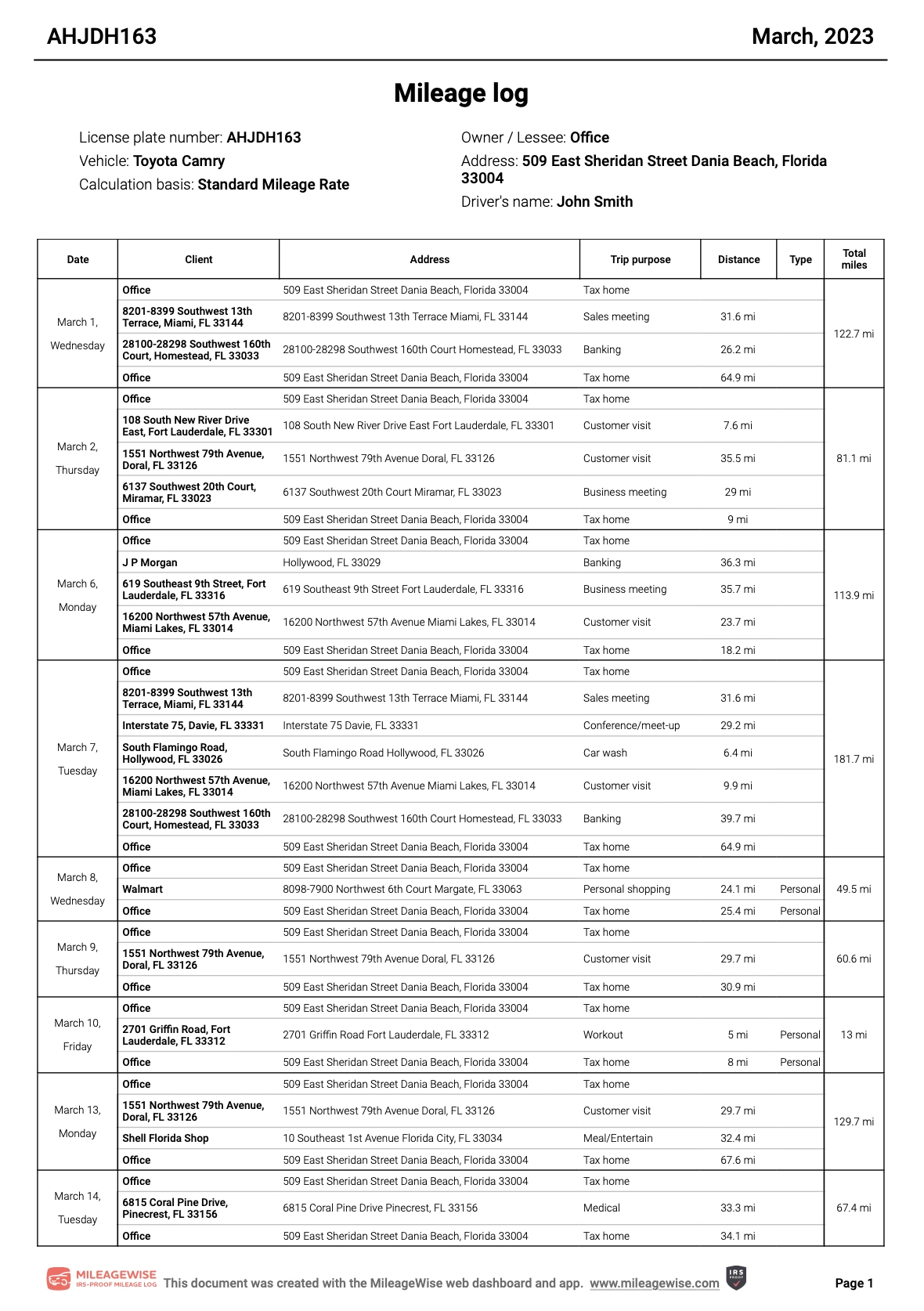

- IRS Compliance Focus: MileageWise emphasizes IRS compliance, with a built-in “IRS Auditor” that checks mileage logs for inconsistencies to avoid fines. Here’s a sample of how detailed the reports created by MileageWise are:

- FreshBooks Integration: It integrates seamlessly with FreshBooks, allowing for easy export of mileage data.

- Google Maps Timeline Integration: It can import data from Google Maps Timeline and convert it into IRS-Proof mileage logs.

- Prepaid Mileage Log Audit Defense: MileageWise offers its users a unique protection against IRS scrutiny for only $49.99 per vehicle/year.

- Pricing: Plans start at $9.99 per vehicle per month, with various options including annual plans and lifetime packages.

- Expense Tracking Feature: MileageWise also offers built-in expense tracking for vehicle-related expenses and car repairs, though this is primarily for mileage and car-related expenses.

- Ease of Use: The app has a clean and easy-to-navigate user interface, with comprehensive customer support.

- User Reviews: It has received positive reviews for its accurate business mileage tracking and usefulness during tax season.

- Team Options: Ideal for businesses with a large fleet of vehicles needing mileage tracking, especially those using FreshBooks

The Verdict: MileageWise for Seamless Mileage Tracking

In conclusion, while there are many options like the MileIQ app, Everlance app, or the free mileage tracker from QuickBooks, MileageWise stands out for its comprehensive features and ease of use.

It’s the best mileage tracking app for business and personal use, offering a robust solution for anyone looking to track mileage efficiently. Whether you’re a freelancer, a business owner, or someone who needs to track their vehicle’s mileage for any reason, MileageWise is the ideal choice. So, say goodbye to manual logs and hello to convenience with MileageWise, the ultimate tool in mileage tracking.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

| MileageWise | TripLog | MileIQ | Everlance | Driversnote | SherpaShare | Hurdlr | Excel | |

User Ratings (Trustpilot) | N/A | N/A | N/A | |||||

iOS App User Ratings | ||||||||

Android App User Ratings |

| |||||||

Average Possible Business Mileage Deduction | $12,000 | $6,300 | $8,400 | $6,500 | $6,000 | $5,600 | $5,600 | $200-$2,000 |

Imports Trips and locations from Google Timeline | ||||||||

Produces IRS-Proof Mileage Logs | ||||||||

Creates Retrospective Mileage Logs | ||||||||

AI Wizard Technology for Mileage Recovery | ||||||||

| Sampling / Recurring Daily Trips | ||||||||

| Mass Distance Calculation | ||||||||

| Built-In IRS Auditor for 70 Logical Conflicts Correction | ||||||||

| Web Dashboard | ||||||||

| Mileage Tracker App | ||||||||

| Vehicle Expense Tracker | ||||||||

| Manual Trip Recording | ||||||||

| Bluetooth Auto Tracking - with no hardware needed | ||||||||

| Plug'N'Go Auto Tracking | ||||||||

| Vehicle Movement Monitoring | ||||||||

| Battery and Data Friendly | ||||||||

| Other Software Integrations | ||||||||

| Trip List Import from other Mileage Trackers | ||||||||

| Trip List Import from GPS | ||||||||

| Shared Dashboard for Teams | ||||||||

Features are all related to mileage tracking | ||||||||

Pricing | Price list | Price list | Price list | Price list | Price list | Price list | Price list | Price list |