Home » Log Mileage for Taxes Effortlessly in 2025

MILEAGE LOG STRUGGLES

Logging mileage for taxes is a real struggle for many, especially if they use paper logs or spreadsheets. With these methods, it’s easy to forget trips and to make errors that the taxman might not accept. Furthermore, manual tracking takes a lot of time, and the results are not always good.

Missing Tax Money

Mistakes in your mileage log for taxes can lead to big problems. If you don’t write down every required detail of your trips, you might lose your tax deductions and get fined. Plus, reporting unrealistic miles increases the chance of audits. The IRS wants a log with dates, locations, trip purposes, and how much you drove.

MileageWise Solves Logging

MileageWise is a smart mileage tracker that helps you log your mileage for taxes. It automatically tracks miles using GPS and records every required detail. You’ll never miss recording a trip again.

This intuitive app provides an ad-free experience while preserving your battery life and respecting your privacy!

Recover Lost Miles Easily

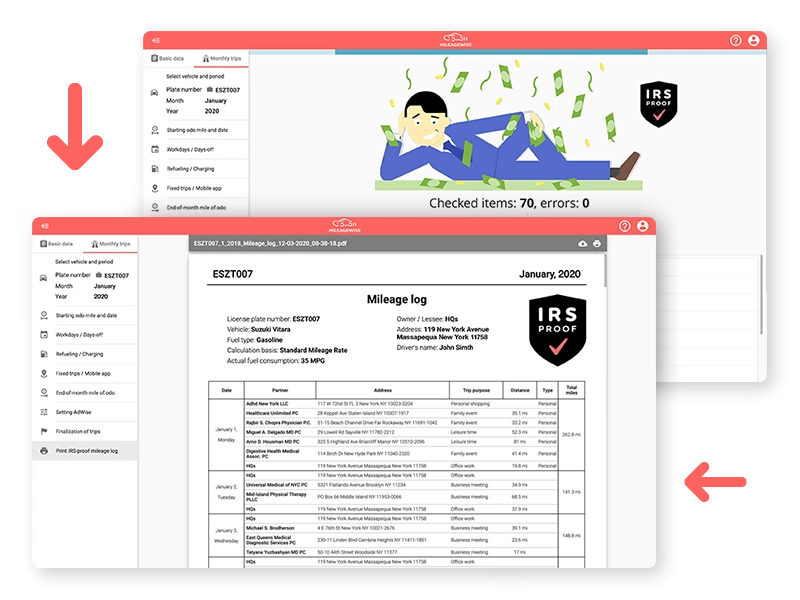

What if you missed trips? MileageWise has you covered. Features like the AI Wizard and Google Timeline Import let you import or reconstruct past drives. You can even request the Mileage Log Preparation service for professional help in audit-proofing your log.

Is It WORTH IT?

You might think this sounds a little complicated, but it’s not. MileageWise is made for real drivers and self-employed people like you. It saves your data safely in the cloud, so you won’t lose it. You get more done and worry less about your mileage log.

GO WITH THE WISEST SOLUTION

With MileageWise, you only need to spend 7 minutes per month creating your mileage logs, while claiming $1,000s in deductible taxes a year.

You have options:

- Log your mileage on paper and pay with your time.

- Use free or cheap software and risk receiving an IRS Fine.

- Use MileageWise and save more money and many hours each month.

- Outsource the task to our mileage log experts, and save your time, money, and effort.