Last updated: November 04, 2024

In today’s fast-paced world, keeping track of your mileage for business, tax purposes, or personal use has never been more crucial. With a plethora of options available, choosing the right mileage tracker app can be overwhelming. This blog post will help you make an informed decision that best suits your needs when trying to find the best mileage tracking app.

Table of Contents

What is a Mileage Tracker App?

A mileage tracker app is a specialized software designed to automatically record the distance you travel using GPS technology. These apps are essential for professionals who need to track their travel for mileage reimbursement, tax deductions, or budgeting purposes. They offer a convenient alternative to manual logging, ensuring accuracy and saving time.

Why Use a Mileage Tracker App?

Accuracy: GPS-based tracking ensures precise mileage records.

Convenience: Automatic tracking eliminates the need for manual logs.

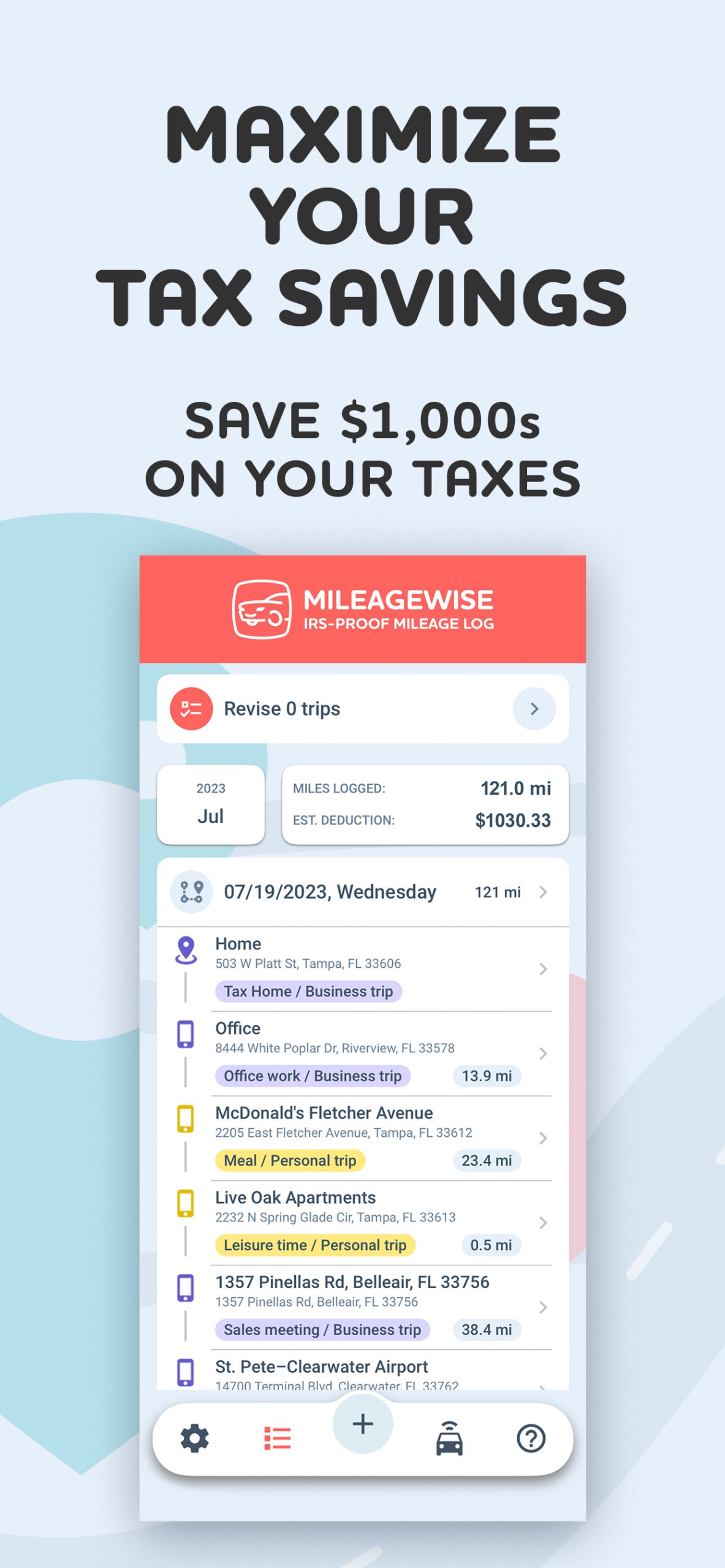

Tax Deductions: Accurate records can maximize your tax deductions for business travel.

Expense Reporting: Simplifies the process of reporting travel and vehicle-related expenses for reimbursement.

Key Features to Look for in a Mileage Tracker App

Automatic Tracking: The app should automatically detect and log trips.

Multi-Platform Compatibility: It should be available on multiple platforms, including iOS and Android.

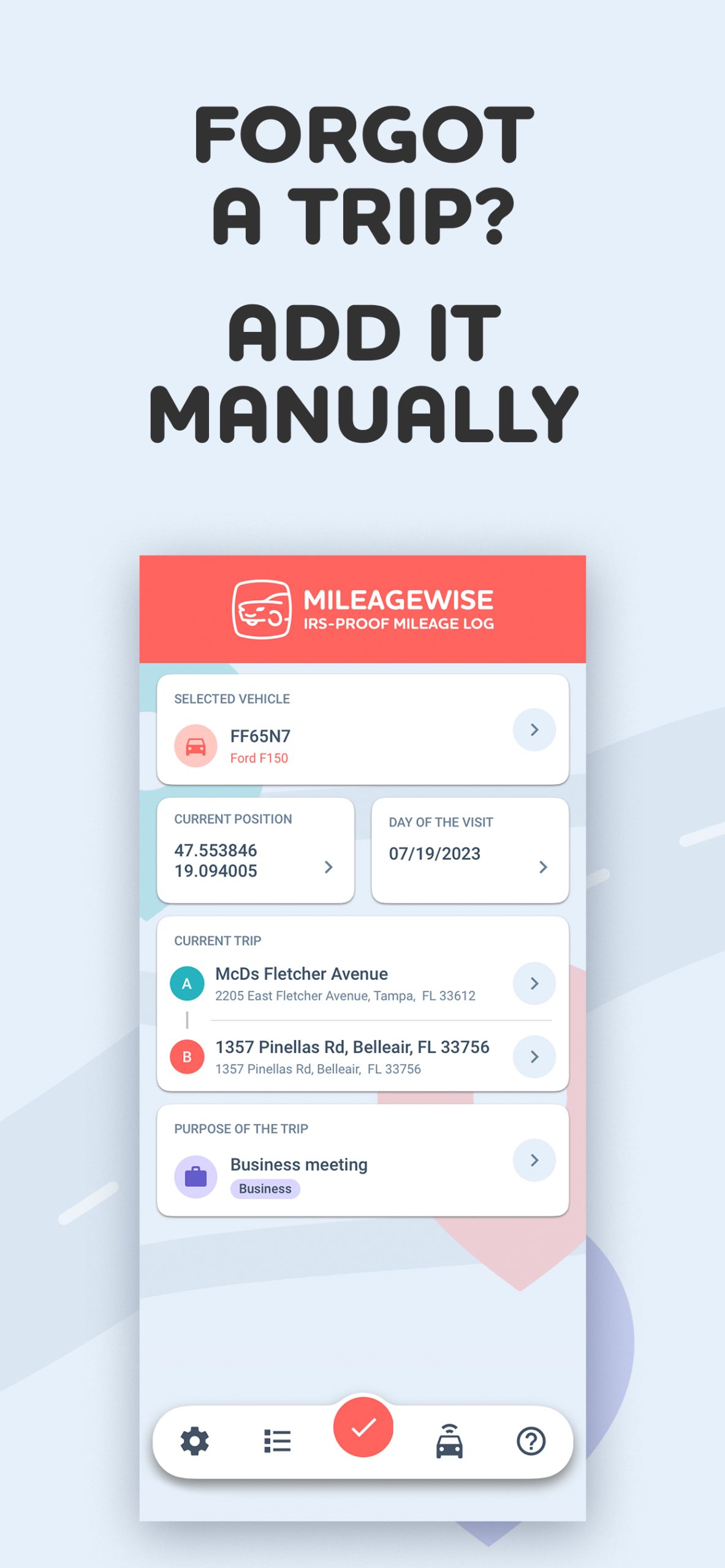

Retrospective Logging: To ensure that you can recover missing trip gaps in your yearly log

User-Friendly Interface: In a Mileage App ease of use is crucial for a hassle-free experience.

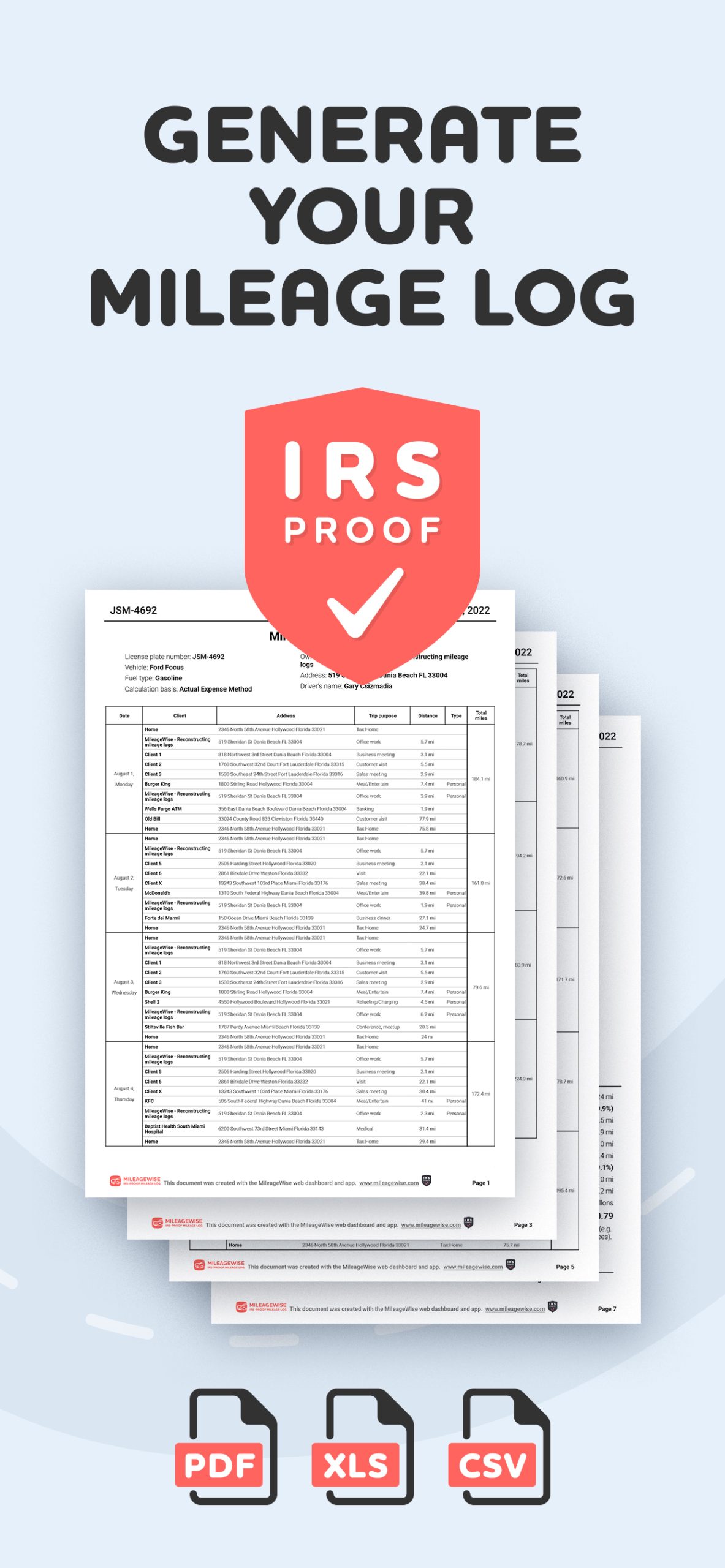

IRS-Proof Reports: The ability to generate detailed reports (logs) in a format that’s accepted by the IRS.

Maximizing Deductions with a Mileage Tracker App

Let’s take a brief look at how you can use a mileage tracker app for maximizing your mileage deductions.

Effective Strategies for Maximizing Deductions:

- Regular Use: It might sound obvious, but make sure to use the app for all business-related travels. You can leave it on and it’ll track your mileage in the background.

- Understanding Tax Laws: Keep yourself updated with IRS guidelines to enhance deduction claims. The good news is, the app gets regularly updated and will automatically use the latest mileage rates to count your deductible mileage.

- Leveraging App Features: Trip categorization, automatic tracking, and IRS-Proof report generation can aid in maximizing deductions.

Let’s See How Much You Could Save With MileageWise

FAQs on Maximizing Mileage Deductions:

- Q: How often should I log trips for optimal deductions?

- A: Regular logging of all business-related trips is recommended for the most comprehensive deduction claim. MileageWise will log each and every trip for you even if you don’t open the app.

- Q: Can the app help me understand IRS mileage rates and rules?

- A: Yes, most mileage tracker apps provide information on current IRS rates and rules. MileageWise has all IRS rules built in so you don’t even have to worry about the changing regulations.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days.

Keep your mileage log on your phone!

Now that you’ve got a general introduction to the world of mileage tracker apps, let’s dive into the details with MileageWise.

MileageWise lets you record your trips on the go manually or track them fully automatically with its iOS or Android mileage tracker app! At the end of the month, get an IRS-Proof mileage log recommendation for your missing trips. This way your mileage log will meet every expectation.

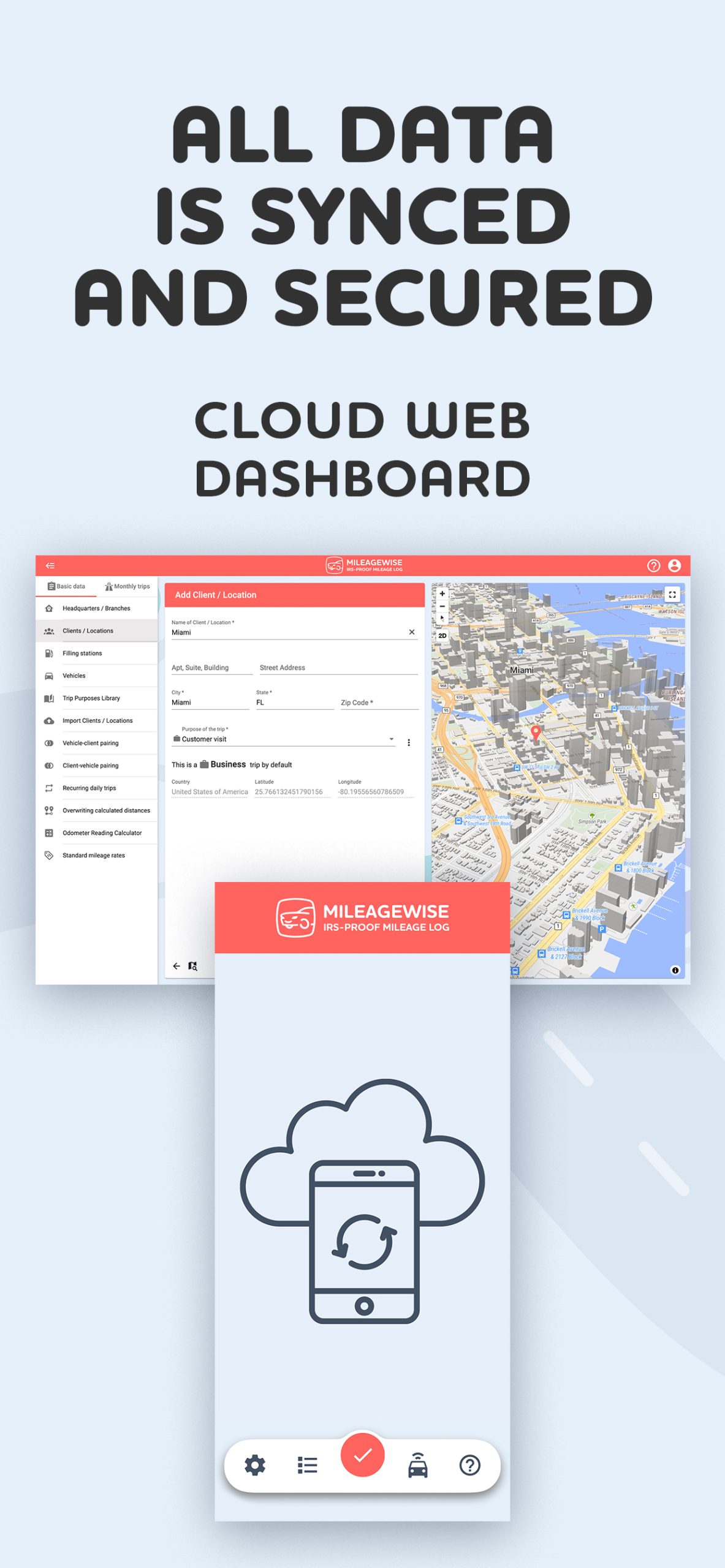

The app will display your vehicles, headquarters/branches, clients/addresses, filling stations, and trip purposes already included in your web dashboard.

You can record your client or filling station with the touch of a button, and with our numerous auto-tracking features, most of the time you won’t even need to do that. Simply leave your vehicle and start walking to your destination – our app recognizes your movement as a “fitness activity” and consequently logs your arrival point.

What makes this Mileage Tracker App unique?

- Multiple recording modes: With our app, you have several methods to track your trips, such as vehicle movement monitoring, Bluetooth monitoring (iOS, Android), or Plug’N’Go monitoring functions

- With manual recording, you only need to record your trip when you arrive at a destination. This way the app doesn’t drain your battery nor consume your data by constantly monitoring your route.

- Unlike with other mileage tracker apps, you’re not constantly tracked by GPS even when you automatically record your trips. This is possible because the app only records your arrivals to destinations while trip distances are calculated by our servers in the background, providing compliance with privacy laws

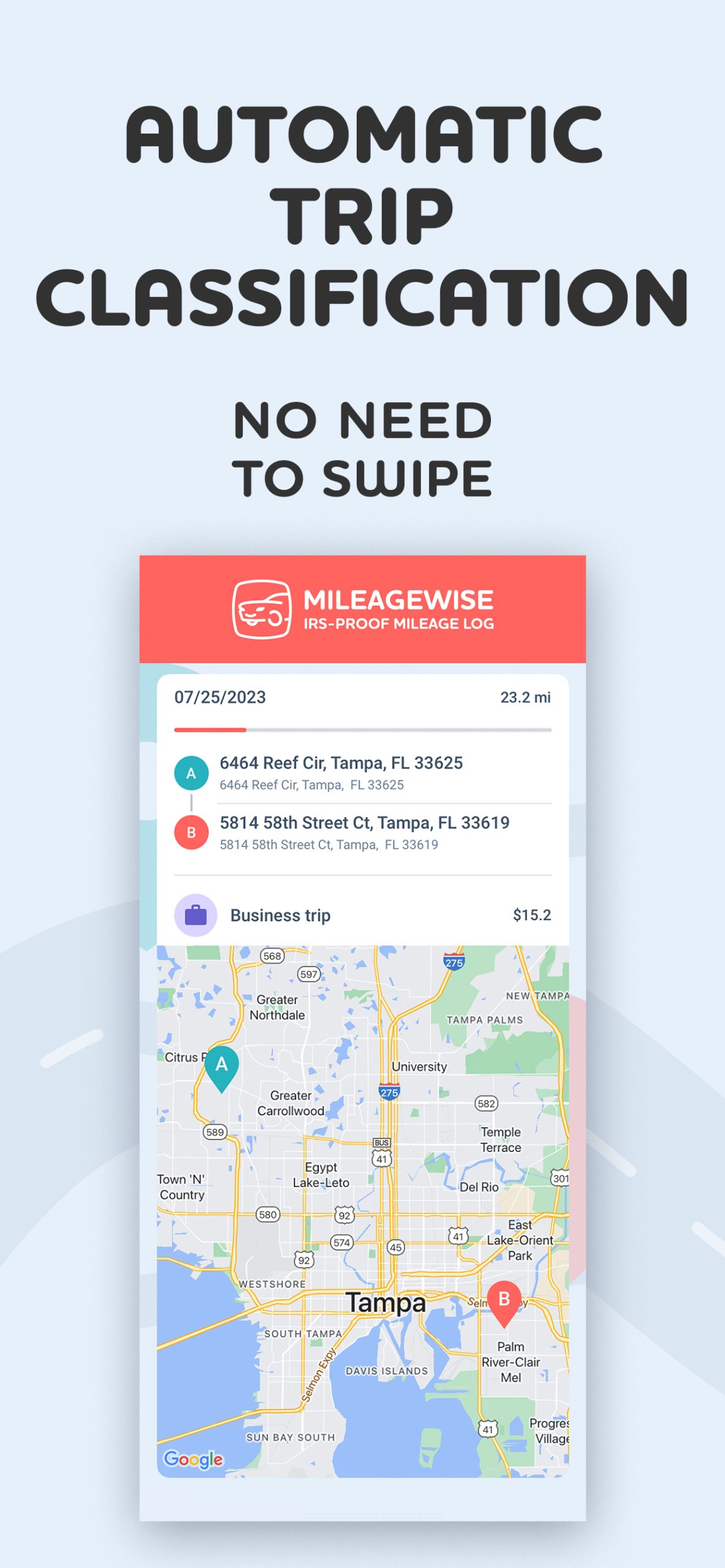

- Automatic business and personal trip purpose classification since clients have default trip purposes (no annoying left-right swipes anymore)

- Manage multiple cars in the app

- Manage one car on multiple phones

- If you previously added clients to your client list in your MileageWise dashboard, when visiting these clients the mileage tracker app will recognize them and save them automatically

- Waze integration: You can plan a trip directly to your saved Clients at the touch of a button with this integration unique to MileageWise

- Display companies near your current location so you can save them to your client list with the touch of a button

- Insert addresses as the Client’s names with a touch of a button

- You can name your addresses

- Company name and POI search for client recording

- You can record any GPS points even without an address (even in the middle of the forest)

- Record end-of-month odometer readings for even more accuracy

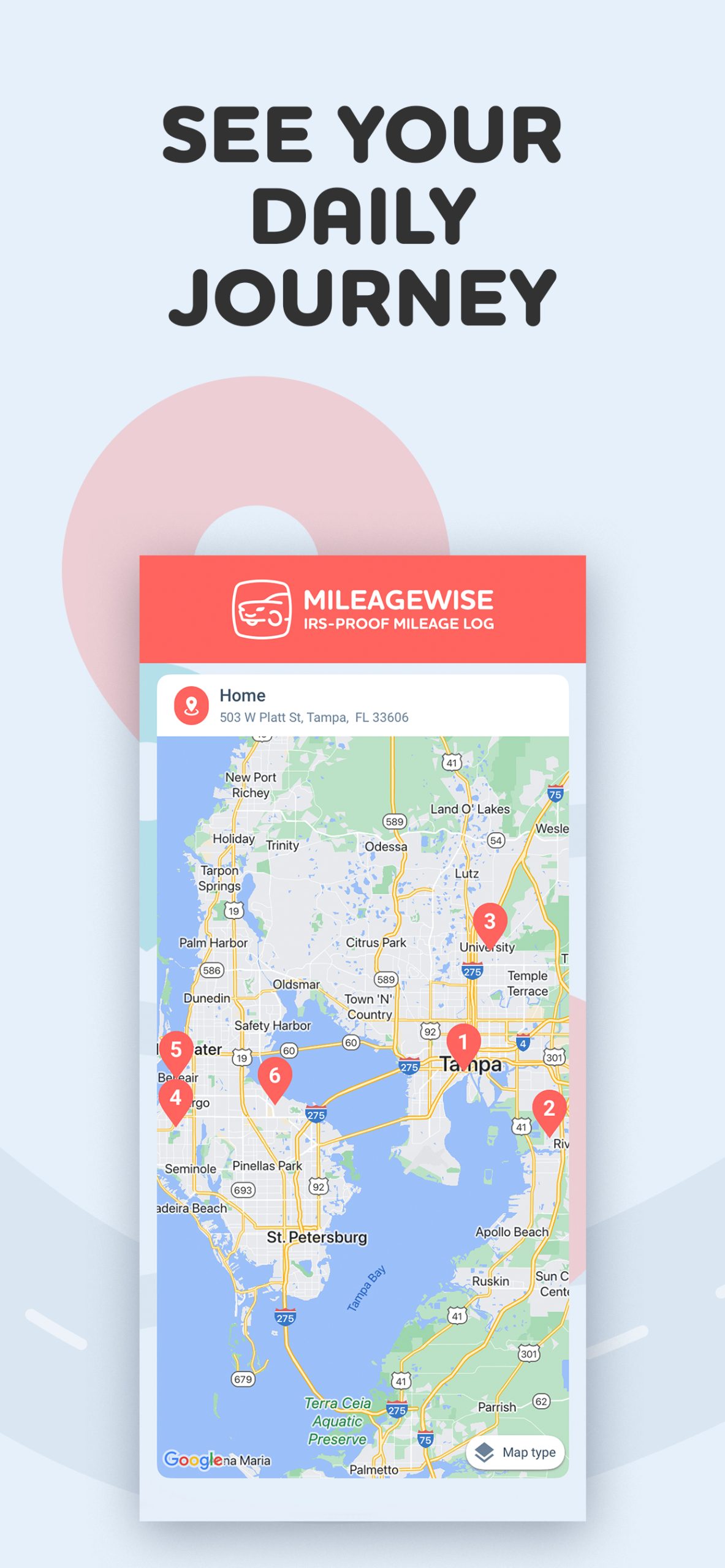

- Map view of Daily Trips

- Built-in tutorial

- There is no obligation to buy anything before trying MileageWise!

- Exceptional Customer Service: choose your preferred platform of chat, email, or telephone

- This is not just a standalone app, so you don’t have to work on a small screen when editing your mileage log, you can do the rest on your computer in the web dashboard. The dashboard offers you a range of options such as getting a mileage log recommendation with the help of our AI Wizard technology for your forgotten trips, for retrospective log creation with the help of imported data such as the Google Maps Timeline, or checking and correcting 70 logical conflicts in your mileage log before printing it out.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days.

Real-World Applications

Navigating the world of automatic mileage tracker apps can be a thrilling journey, especially when you see them in action in the real world. Let’s dive into how various professionals are using these apps to streamline their work and make life a tad easier.

For Freelancers and Independent Contractors

A Day in the Life: Imagine Sarah, a freelance graphic designer. She often travels to client meetings and coworking spaces. With her mileage tracker app, every trip she makes is automatically logged. At the end of the month, Sarah simply reviews and categorizes her trips for client billing or tax deductions.

Top Benefits:

- Time-Saving: No more manual logs.

- Accuracy: Every mile is accurately recorded.

- Peace of Mind: Focus on work, not tracking miles.

For Sales Professionals

Maximizing Client Visits: Take John, a sales rep. He’s on the road frequently, visiting clients across the state. His mileage tracker app not only records each trip but also helps plan efficient routes for client visits.

Key Advantages:

- Efficiency: Optimal route planning.

- Reliability: Accurate client billing.

- Professionalism: Detailed reports for expense claims.

For Small Business Owners

Streamlining Operations: Consider Lisa, who owns a small catering business. Deliveries and supply runs are part of her daily routine. Her mileage tracker app helps differentiate between personal and business trips, ensuring accurate expense tracking.

Essential Perks:

- Organization: Easy separation of business and personal trips.

- Cost-Effective: Track every business mile for tax purposes.

- Simplicity: Intuitive and easy-to-use interface.

For Enterprises

Managing company trips: Larry is a financial manager at his company. He is responsible for coordinating expenses of office supplies and vehicles. He uses MileageWise to track vehicle usage and maintenance for company cars, not to mention for proper documentation.

Features he appreciates the most:

- Vehicle fleet management: Clear overview of car usages and trip classifications.

- Exceptional Customer Support: Great customer service to anwer all questions

- Multiple platforms: Even though the drivers use their phones to track vehicle movement, Larry can access everything on his PC.

See how much you can save as a self-employed or as a business owner!

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days.

Frequently Asked Questions (FAQs)

This feature automatically classifies trips based on user preferences, patterns, or set parameters, helping distinguish between business and personal trips or categorize them by project assignments. It reduces manual input and errors, offering insights into travel patterns.

Absolutely! These apps provide detailed reports that are compliant with tax regulations, making them perfect for deductions.

- Many apps run in the background and automatically detect driving, so you don’t have to remember to start a trip. But even if you realize at the end of the month that you must have forgotten to record a few trips, MileageWise’s Google Timeline Importer can help you recover them based on your Google Maps record.

Reputable apps prioritize data security, using encryption and secure servers to protect your information.

Yes, many apps offer team features, allowing businesses to track and manage mileage for multiple employees. Here’s MileageWise’s offer for teams.

Tracking your miles has never been easier, thanks to automatic mileage tracking features available in the best mileage tracker apps. One such app is MileIQ, which allows you to start tracking your business mileage with just a few taps. The app automatically detects when you begin and end a trip, making it simple to track mileage without the hassle of manual entry. Whether you are on a business trip or running personal errands, this mileage tracker helps you keep a comprehensive mileage logbook and generate IRS-compliant mileage reports at tax time.

With options for both a free version and a free trial, you can easily test out the app before committing. The app keeps a detailed record of every mile you drive, allowing you to categorize trips as business or personal. This not only makes it easier to track miles driven but also ensures you can accurately report business expenses when needed. If you’re looking for the best app to manage your mileage and expense records, consider using a vehicle mileage tracker that automatically track your mileage.

Are you looking for a free app to help you with mileage tracking? There are several mileage tracking apps available that can assist you in keeping track of your car mileage without paying an upfront fee. One popular option is MileageWise an auto mileage app that allows you to start and stop tracking without opening up the app. With this miles tracker, you can log the mileage for each trip and even swipe right for business miles. The app automatically tracks your journey, making it easy to generate IRS-compliant mileage reports for tax purposes.

For those who prefer a more hands-on approach, there’s also the option of manual mileage entry or paper mileage logs. However, using a reliable mileage app streamlines the process significantly. The app records every detail, providing you with comprehensive mileage reports for tax preparation that are both efficient and accurate. Overall, these tools make it simple to track all your miles and manage your mileage expense effectively.

Many users wonder if Google Maps has a mileage tracker. While the app offers gps tracking for directions, it lacks a dedicated mileage tracker. However, there are third-party apps like MileageWise that provide reliable mileage tracking and can be great for logging with MileageWise. For those looking for a way to track miles, these apps can help track miles a week for tax deduction purposes and lowering your tax bill.

While Google Maps can help with directions, it is not designed for miles tracking or trip tracking. If you’re looking to log miles and expenses, consider using specialized apps that offer more features. With the right tool, you can easily track gas mileage and ensure you are accurately reporting your 1 mileage for tax deduction purposes.

While a mileage tracking app can simplify your record-keeping, there are some downsides to consider. For instance, many users find that the expense tracker features are often not as comprehensive as they would like. (This is not the case with MileageWiswe) Additionally, if you want to get a free version, you may encounter limitations on tracking standard mileage or accessing advanced functionalities. Ultimately, if you drive many miles, finding an app that meets your needs is crucial, as none of the other apps may offer the same level of service.

Tracking your mileage for tax deductions can be made easy with MileageWise. One effective way is to use our app designed specifically for this purpose. Mileagewise allows you to log your trips effortlessly, ensuring you capture every mile. When using mileage tracking apps, make sure to note the purpose of each trip, as this information is crucial for accurate deductions. MileageWise can do that automatically. Consistent tracking throughout the year will help you maximize your tax benefits come tax season.