TOO MUCH TO DO, TOO LITTLE TIME

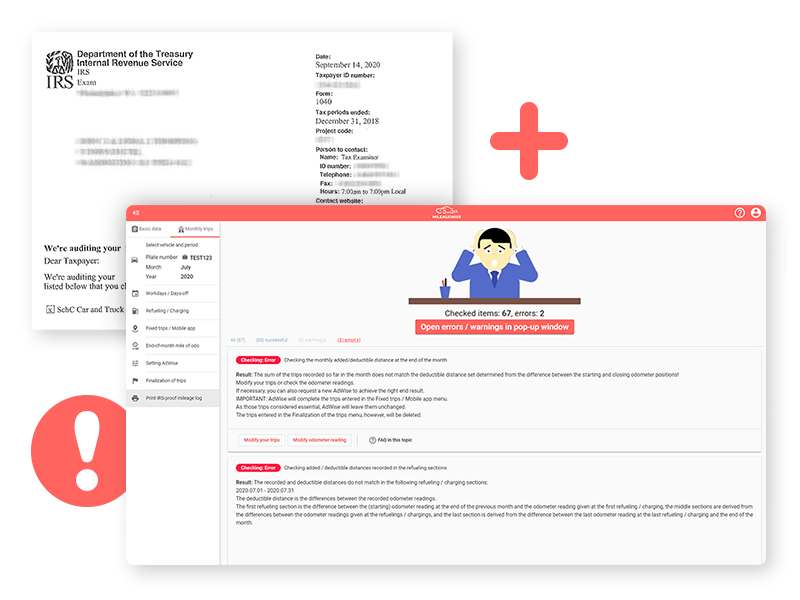

Are you being audited by the IRS for mileage? Have they requested additional documentation? Would your mileage logs hold up in an IRS audit if you had to create them now? If you’re unsure or short on time, let our experts handle it. We’ll create IRS-Proof mileage logs for you.

THE DEVIL IS IN THE DETAILS

Traditional mileage tracker apps / software packages / Excel or Google Sheets files / templates / samples won’t help you fix mileage logs from a prior year. Submitting incomplete mileage logs with gaps could lead to a hefty IRS fine.

SIT BACK AND RELAX

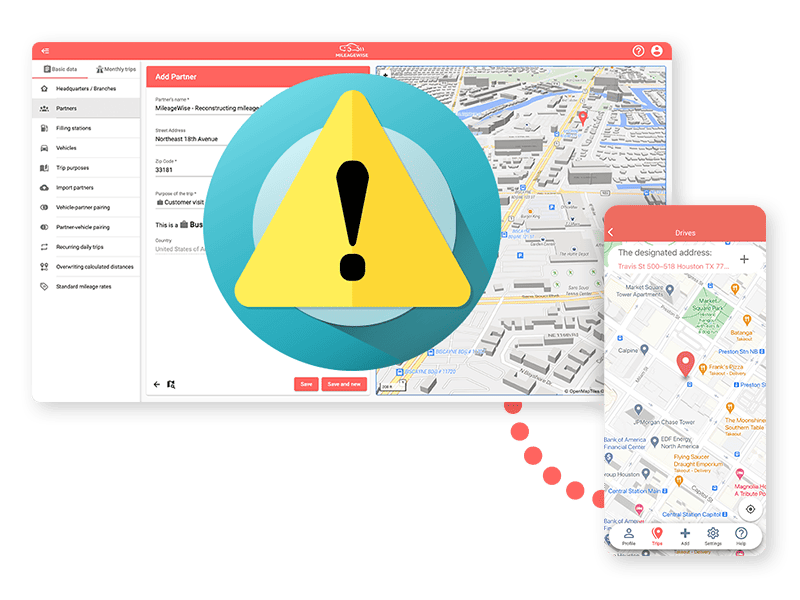

Just gather the data you have, such as trips or client locations from Google Timeline and let our mileage log experts do the rest.

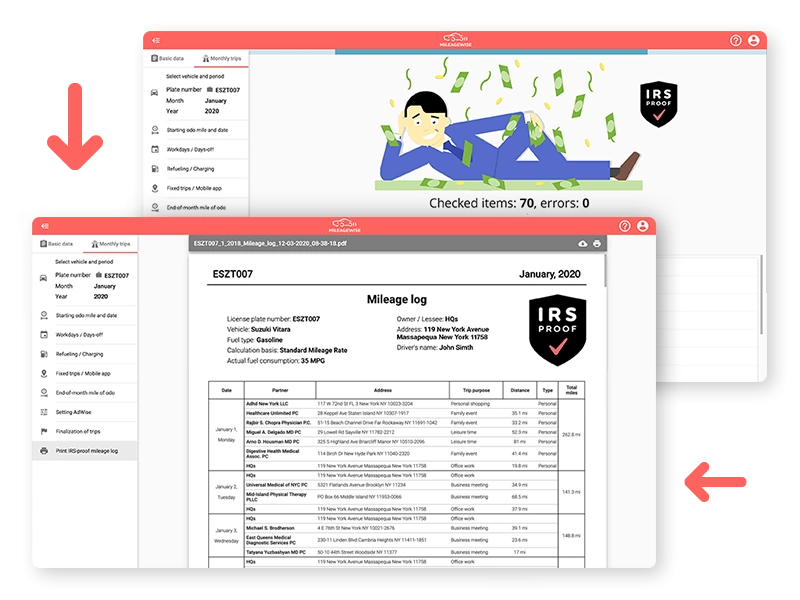

Using MileageWise’s software, they’ll compile your mileage logs while automatically checking and correcting 70 potential red flags to ensure they’re 100% IRS-proof.

“DOES THE IRS APPROVE OF IT?”

It’s like outsourcing your mileage log management to an accountant, except we have far more expertise, because this is all we do, 24/7.

With our Mileage Log Tax Preparation Service, you’ll receive a mileage log draft (just like tax return drafts). Review your mileage log, request edits if needed, and download it when you’re 100% satisfied.

By clicking on the Submit button, you agree to our Terms of Service and Privacy Policy.