CONTRADICTIONS IN YOUR MILEAGE LOGS?

Do the trips in your mileage logs match the data the IRS requires? The IRS may demand all of your business data: refueling receipts, business expense reports, odometer readings recorded at the mechanic or during safety inspections, traffic cams, tolls, parking fees, etc. A “homemade” mileage log won’t fly under the radar.

EXCEL IS NOT ENOUGH ANYMORE

Knowing that even beginner IRS auditors easily spot the lack of documents mentioned above, what would happen in the case of a thorough investigation? Handing in mileage logs with contradictions can result in rejected mileage logs and an enormous fine.

DON’T MISS OUT ON CLAIMING $1,000S

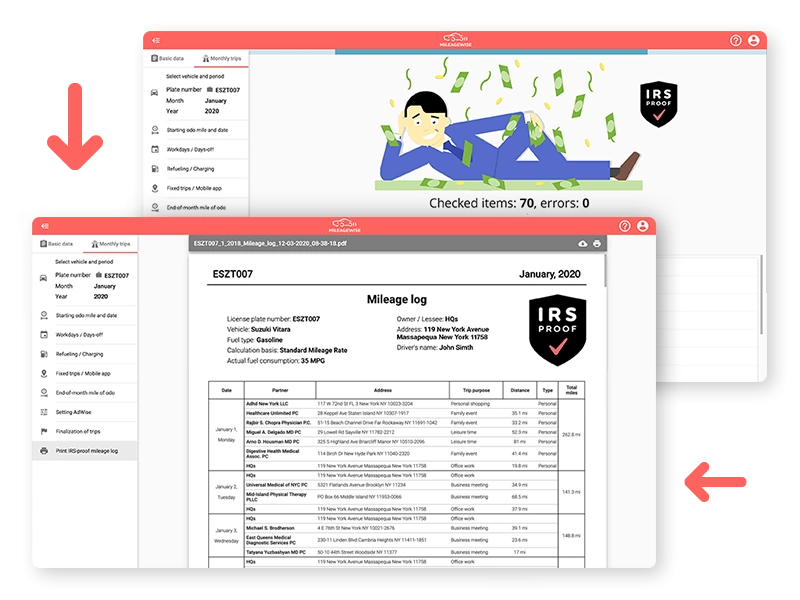

Add & edit your data manually in MileageWise’s Web Dashboard platform or import it from other sources like Google Timeline. Before printing your mileage log, MileageWise checks & corrects 70 logical contradictions in it to ensure that your mileage report is 100% IRS-proof.

“ARE MILEAGEWISE LOGS IRS-PROOF?”

We have packed our 20 years and 35191 vehicles’ worth of experience into this software to provide you with the fastest and most stress-free mileage logging experience ever. We ensure that your mileage logs are all state-of-the-art and IRS-proof!