WHAT IF I DIDN'T KEEP TRACK OF MY MILEAGE?

Figuring out how to keep track of mileage for taxes can be tricky, especially if you’ve been relying on a free mileage template or struggling with Excel, perhaps a faulty app.

But don’t worry, MileageWise has you covered. Our advanced Automatic Mileage Log Creator, the Google Maps Timeline import feature or our expert Mileage Log Preparation Service can take the load off your shoulders.

Avoid IRS Trouble with an Automatic Mileage Log Creator

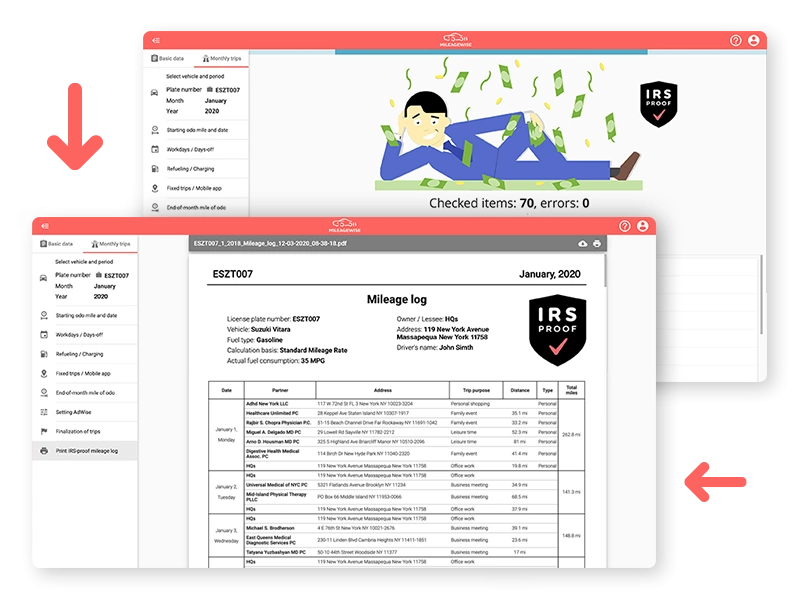

Many people worry about IRS penalties for incomplete or rejected mileage logs. So much so that “mileage log IRS did not accept” is a common Google search. Hastily assembled logs that don’t show your total mileage can cause serious problems, especially if the IRS comes knocking.

Google Timeline Mileage Log Creator

If your Location History is turned on in your Google account, you can export your trips from Google Maps Timeline on your phone — trips that were automatically recorded in the background. With MileageWise, you can turn those trips into a mileage log in just a few steps.

In case you have any gaps in your log, our Automatic Mileage Log Creator can fill them in to make sure every mile is accounted for.

Create IRS-Proof Mileage Logs in Minutes

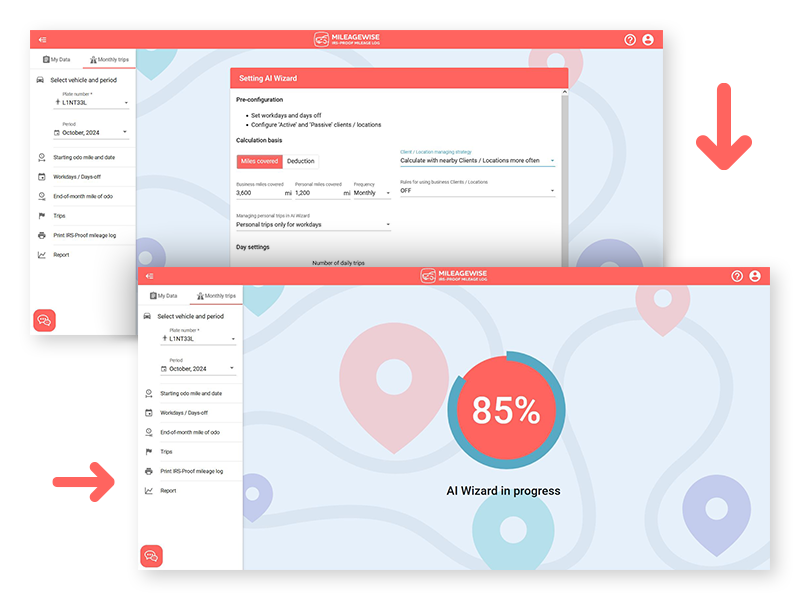

Didn’t track your mileage, or only have a few entries? No problem! Even if you barely recorded any trips, MileageWise can help you reconstruct a complete, IRS-compliant mileage log.

By intelligently filling in the gaps and estimating your drives based on available information, the Automatic Mileage Log Creator auto-populates your mileage log for a complete and IRS-proof result. No spreadsheets, no stress.

Let Us Handle Your Mileage Log

Short on time or just don’t want to deal with your mileage logs? Let our Mileage Log Preparation Service handle it! It’s like handing the task over to an accountant, only better because this is our specialty.

Backed by over 20 years of experience and equipped with an advanced Automatic Mileage Log Creator, we’ll provide you with fully audit-proof mileage logs.

“DOES THE IRS APPROVE OF IT?”

As stated in IRS’s Publication 463, documentary evidence recorded retroactively is legally acceptable. And with MileageWise, the process is so easy— thanks to our Automatic Mileage Log Creator — you won’t procrastinate or stress about how to track your business miles anymore.

You also won’t have to worry about how to prove your mileage to the IRS — we’ve got you covered. Whether you want to backtrack your mileage logs yourself or have our experts help you, choose whichever solution you prefer.