Last updated on October 24, 2023

Oh, the age-old paper mileage logbook. We’ve all been there—scribbling down miles and destinations in a little notebook in the glove compartment or maybe on that free printable mileage log template you found online. But let’s be real: the world’s gone digital, and so should your mileage tracking for tax purposes. In this blog post, we’ll dive deep into why it’s high time you say goodbye to the manual approach and switch to a digital mileage tracker app. Ready to leap? Let’s go!

Why Even Bother with a Mileage Log Book?

Before we dive in, let’s address the elephant in the room: Why bother keeping a mileage deduction record? For those new to the world of taxes or those fortunate enough to have never been questioned by the IRS (touch wood!), maintaining a business mileage log is essential if you’re claiming vehicle expenses as deductions. The IRS requires a meticulous record of all your drives for work, charity, or medical purposes. Miss out on this, and you risk losing precious deductions or worse, drawing unwanted attention from the IRS.

Now that we’ve settled the ‘why,’ let’s discuss the ‘how.’

The Challenges of Paper-based Mileage Record Books

Paper mileage logbooks, like that IRS mileage log template you printed off the web or those popular best mileage log books available in stationery shops, are a staple for many. But they come with challenges:

Prone to Errors and Loss: Whether it’s spilling coffee on your mileage and expense journal or accidentally leaving it behind after a business meeting, the risk of loss or damage is high.

Time-consuming: Maintaining a business trip logbook manually demands constant attention. Forget to log a trip? You’re out of luck and missing out on potential deductions.

Audit Worries: The IRS loves documentation. A hastily scribbled car mileage log for tax purposes might not hold up well under scrutiny.

Enter: Digital Mileage Tracking Apps

Let’s face it: Our smartphones are an extension of ourselves. From setting reminders to capturing memories, we rely on them for almost everything. So, why not for a tax-compliant mileage logbook?

Benefits of Digital Mileage Trackers:

Automated Tracking: Say goodbye to the days of jotting down miles. These apps automatically track every drive, ensuring you never miss a mileage reimbursement log entry.

Backup & Safety: Digital logs mean your data is backed up in the cloud. Lose your phone? Your mileage record book for tax deduction is still safe and sound.

IRS-Proof Reports: Some advanced mileage tracking apps offer IRS-compliant reports, taking the guesswork out of how to keep a mileage log for taxes.

Integration with Other Tools: From accounting to navigation, these apps seamlessly integrate, making the entire process of maintaining a mileage log and vehicle expense tracker protocol hassle-free.

Eco-Friendly: Ditching the paper means doing a bit for the planet. Your green efforts could also translate to more green in your pocket through tax savings!

Making the Right Choice

With so many apps in the market, look for a professional mileage tracker for taxes that caters to your specific needs. Whether you’re an individual tracking commutes for a side gig or a business owner keeping track of an entire fleet, there are important features to look for.

MileageWise: The Modern Solution to Mileage Tracking Woes

After diving deep into the challenges of traditional mileage tracking methods, it’s essential to highlight a solution that truly stands out in the crowded digital market: MileageWise. Here’s a comprehensive breakdown of why and how MileageWise addresses the problems associated with manual mileage recording.

Why Choose MileageWise?

Adaptability: Whether you’re a freelancer, a small business owner, or somewhere in between, MileageWise scales to fit your needs. It’s designed with everyone in mind, from those tracking a few drives a month to those managing large fleets.

IRS-Proof: MileageWise isn’t just another mileage-tracking app. It ensures your logs are 100% IRS-compliant, eliminating the constant fear of audits.

Built-in Recommendation Engine: Worried about gaps or inaccuracies in your mileage records? MileageWise’s unique recommendation engine, called AI Wizard, identifies these for you, helping ensure a full-proof mileage log.

Outsourcing: Too busy to assemble and organize your records into an IRS-Proof log to be submitted come tax season? Request MileageWise’s Mileage Log Tax Preparation Service to guarantee your logs are in order, even if you need to recover them retrospectively!

How MileageWise Offers Solutions

MileageWise offers you a powerful combo of its dedicated Dashboard and a complimentary mobile app. Let’s explore how the software can ease the burden of tracking and assembling your mileage for you.

Automated Tracking with Precision: With MileageWise, manual entries are a thing of the past. The app uses advanced technology to track drives with precision, ensuring every mile counts towards your tax deductions.

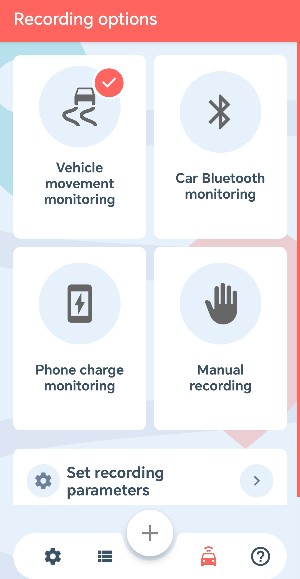

MileageWise provides four distinct trip recording methods: vehicle movement tracking, Bluetooth monitoring, Plug’N’Go monitoring, and manual recording. This allows you to choose the method that best fits your requirements. Additionally, you can specify when the app logs your journeys, like only during business hours.

Cloud-based Secure Backup: Say goodbye to the fear of losing your records. MileageWise stores your logs in the cloud, ensuring they’re safe, accessible, and protected against loss or theft.

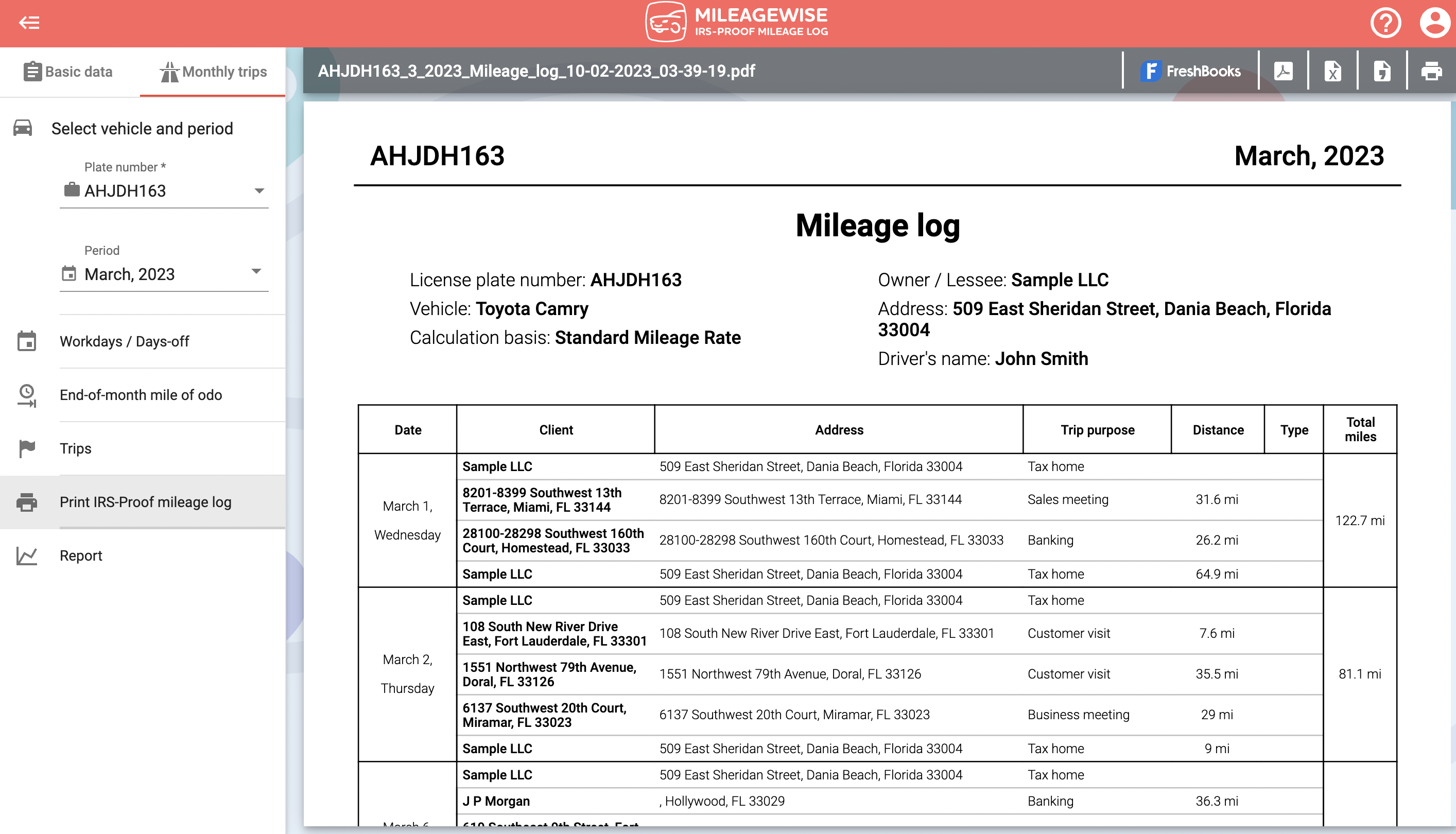

Simplified Reporting: Generating a mileage report for IRS submissions has never been easier. With a few clicks, you can have a detailed, compliant report, eliminating the tedious task of consolidating manual logs.

Automatic trip classification: Trips to recurring or new clients/locations will automatically be classified by the default purpose set in advance, so you won’t need to update each trip manually after arrival. The feature offers you further benefits.

Integrated Expense Tracking: Beyond just mileage, MileageWise acts as a comprehensive vehicle expense tracker. From fuel to maintenance, track all your vehicle-related expenses in one place.

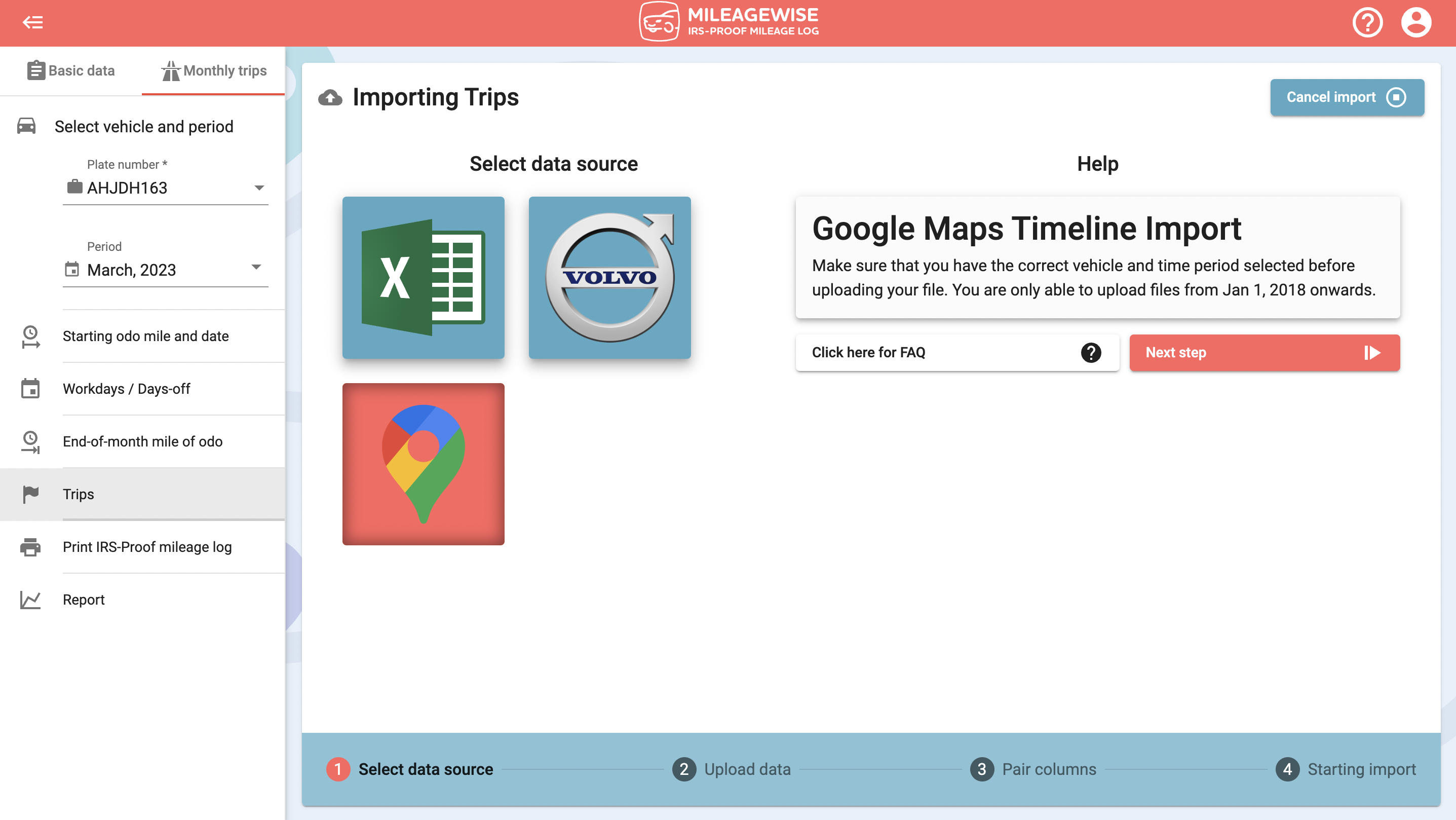

Retrospective Logging: This feature set helps users fill in missing or incorrect mileage logs, ensuring compliance with IRS requirements. Features include the ability to import Google Maps Timeline records and convert them into IRS-approved logs, and a unique built-in IRS auditor that guarantees compliant logs in just seven minutes monthly. Additionally, the AI Wizard can suggest and automatically fill in forgotten trips. This tool aims to prevent IRS penalties and maximize potential deductions for users. The image below shows the Google Timeline Import feature:

Time to Make the Switch

Keeping track of mileage for IRS purposes needn’t be tedious. By transitioning from a traditional paper log to a digital solution, you not only save time and reduce errors but also ensure you’re maximizing your tax deductions.

So, next time you reach for that driving log for the tax deduction, pause and consider making the switch. Your future tax-compliant self will thank you!

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

Why Do We Believe That MileageWise Is the Best Choice? Here's the Proof!

| MileageWise | TripLog | MileIQ | Everlance | Driversnote | SherpaShare | Hurdlr | Excel | |

User Ratings (Trustpilot) | N/A | N/A | N/A | |||||

iOS App User Ratings | ||||||||

Android App User Ratings |

| |||||||

Average Possible Business Mileage Deduction | $12,000 | $6,300 | $8,400 | $6,500 | $6,000 | $5,600 | $5,600 | $200-$2,000 |

Imports Trips and locations from Google Timeline | ||||||||

Produces IRS-Proof Mileage Logs | ||||||||

Creates Retrospective Mileage Logs | ||||||||

AI Wizard Technology for Mileage Recovery | ||||||||

| Sampling / Recurring Daily Trips | ||||||||

| Mass Distance Calculation | ||||||||

| Built-In IRS Auditor for 70 Logical Conflicts Correction | ||||||||

| Web Dashboard | ||||||||

| Mileage Tracker App | ||||||||

| Vehicle Expense Tracker | ||||||||

| Manual Trip Recording | ||||||||

| Bluetooth Auto Tracking - with no hardware needed | ||||||||

| Plug'N'Go Auto Tracking | ||||||||

| Vehicle Movement Monitoring | ||||||||

| Battery and Data Friendly | ||||||||

| Other Software Integrations | ||||||||

| Trip List Import from other Mileage Trackers | ||||||||

| Trip List Import from GPS | ||||||||

| Shared Dashboard for Teams | ||||||||

Features are all related to mileage tracking | ||||||||

Pricing | Price list | Price list | Price list | Price list | Price list | Price list | Price list | Price list |