Rebeka Barefield

April 17, 2024

Maintaining an accurate mileage log for taxes is essential for anyone looking to maximize their mileage tax deductions. Whether you’re self-employed or maneuvering between business, medical, charity, or military duties, understanding the essence of a mileage log is paramount. In this article, we explore what constitutes a mileage log, the stringent requirements set by the IRS, and how best to track your travel to remain compliant and maximize your deductions.

What is a Tax-Purpose Mileage Log?

A mileage log for taxes serves as a detailed record designed to prove the distances traveled for various deductible purposes. These purposes can broadly be categorized as business, medical, charity-related travels, or moving between posts if you are in the military or an employee whose job requires constant relocation.

- Business mileage: This includes all miles driven for business-related activities, excluding commutes between home and work.

- Medical mileage: Miles covered to obtain medical care for yourself or your dependents, which can be deductible under certain conditions.

- Charitable mileage: Travel expenses incurred while working for a charity, often deductible under tax regulations.

- Military moves: For military personnel, relocating due to a permanent change of station can also involve deductible mileage.

Depending on your trip purpose, the IRS allows you to reimburse a certain amount per mile traveled from your taxes. The significance of an accurate mileage log is that it serves as the base of your yearly mileage tax deduction and can be reviewed by the IRS for up to three years.

What Are the Requirements for a Mileage Log for Taxes?

The IRS mandates that any mileage log for taxes must be timely and accurate with comprehensive details of every trip. This includes

- The personal information of the driver,

- Vehicle information (note that one log can only include one vehicle),

- the date of the trip,

- the trip’s purpose (personal trips and commuting are not deductible, therefore should be clearly distinguished),

- the start and finish locations,

- the total miles traveled during the trip, and

- the year’s start and end odometer readings.

Moreover, you must be able to produce receipts or other corroborative evidence to back up the log entries if required.

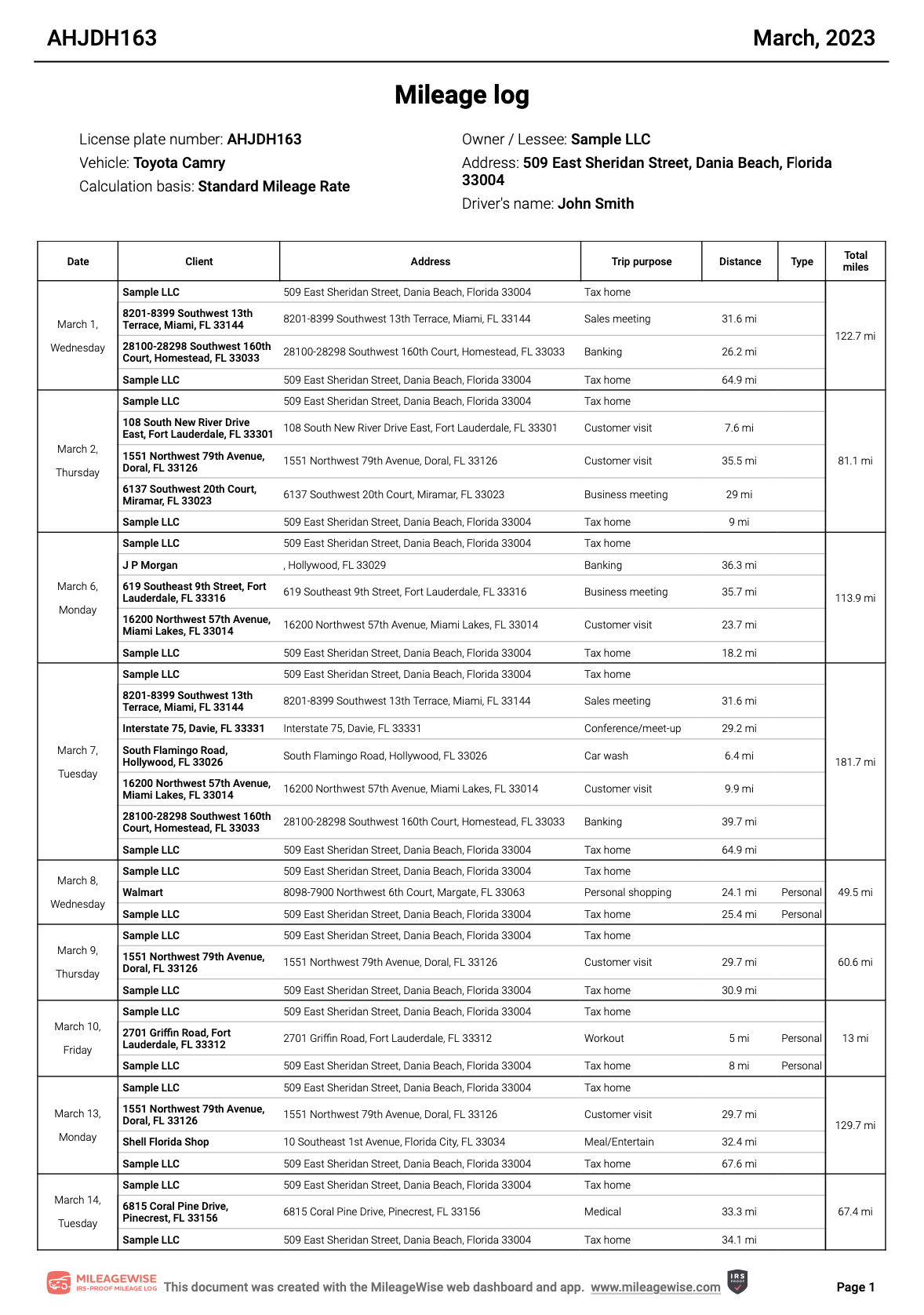

Here is an example of a car’s mileage log with all records required by the IRS:

How do I Keep a Compliant Mileage Log?

To stay compliant with IRS regulations, you can opt for either the standard mileage rate deduction or track actual vehicle expenses.

Tracking Methods:

- Manual tracking: This method involves maintaining a physical logbook or using a digital mileage log sheet where you jot down details for every trip. It’s simple but prone to errors or omissions. There is also a myriad of free printable templates and forms available, designed for IRS tax filing.

- Automatic tracking: With technological advancements, automatic trackers and mobile apps can log the trips of your car without needing manual input, using GPS to ensure accuracy and compliance.

Tips for Effective Mileage Logging:

- Regularly update your log to avoid backtracking and potentially forgetting important details.

- Use a dedicated software designed for tracking mileage for taxes- like Mileagewise, which help maintain accurate and IRS-approved records.

What Happens if I Fail to Meet the IRS Requirements?

Non-compliance with IRS mileage log requirements can lead to disallowed deductions and potential penalties. If audited, lacking a proper log can be costly, with denied deductions and additional taxes due, plus interest and penalties.

Mileagewise: The Mileage Logging Solution for Tax Deductions

Mileagewise is a mileage tracker and mileage log creator software that stands out as a robust solution for those looking to ensure their mileage logs meet IRS standards. It not only tracks your trips automatically but also provides detailed reports suitable for tax filing, ensuring that every deductible mile is accounted for.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

MileageWise’s Features to Carry the Load for You

Automatic tracking option

The MileageWise App offers an automatic mileage tracking feature that captures every trip made, ensuring no mileage is missed. This feature is particularly useful for individuals and businesses looking to maximize their mileage deductions without the need for manual logging.

Auto trip classification

This functionality allows users to classify trips automatically as business or personal based on customizable rules, which helps streamline the record-keeping process and ensures accurate reporting for tax or reimbursement purposes.

Built-in IRS Auditor

MileageWise includes a built-in IRS Auditor that checks mileage logs to ensure they are IRS-compliant. This tool reviews past logs for up to 70 errors or inconsistencies, offering corrections to avoid issues during tax audits.

Retrospective mileage log creation

Users can retrospectively generate past mileage logs if they did not track their mileage as it occurred. This feature is designed to help users reconstruct accurate logs using historical data and patterns, like Excel sheets or Google Timeline.

AI Wizard function

The AI Wizard assists in optimizing mileage logs by recommending the best possible trips and setups based on the user’s driving habits and historical data. In addition to maximizing deductions, it also helps fill gaps and recreate past trips to match your odometer readings or the deductions claimed.

When Time is of the Essence: The Mileage Log Tax Preparation Service

Opting for a dedicated tax preparation service that specializes in mileage logging can be a game-changer for those who

- find themselves close to the tax deadline and need accurate logs,

- have inaccurate or non-existent mileage documentation for prior years,

- are being audited and are unsure about their log’s compliance or,

- find maintaining a mileage log challenging or time-consuming.

Our Mileage Log Tax Preparation Service ensures your travel records are meticulously maintained and fully compliant with IRS requirements, offering peace of mind and potentially greater tax savings. Our experts use the data you can provide to put your IRS-Proof mileage log together, aligned with the latest tax regulations, and ready for tax filing or your audit.

FAQs

What kind of mileage logs for taxes does the IRS accept?

The IRS accepts detailed mileage logs, and provide a thorough record of all business-related trips. An acceptable log must include the date of each trip, the trip’s purpose, the starting point and destination, the total miles driven, and the vehicle’s odometer readings at the start and end of the year.

What is the best way to track mileage for taxes?

The best way to track mileage for taxes is to use a dedicated mileage tracker app that complies with IRS requirements. These apps typically use GPS to accurately record distances traveled and generate reports that meet the documentation standards required for tax purposes. Automatic tracking ensures that all trips are logged, reducing the risk of errors and omissions that can occur with manual tracking methods.

How do I calculate my deductible mileage expenses?

To calculate your deductible mileage expenses, you can use the standard mileage rate provided by the IRS or calculate your actual vehicle expenses. The standard mileage rate method is simpler, as it involves multiplying the business miles driven by the IRS rate for that tax year. Alternatively, calculating actual expenses involves tallying up all vehicle-related expenses such as gas, repairs, and depreciation, and then multiplying those costs by the percentage of the vehicle’s total annual mileage used for business purposes.

The IRS did not accept my mileage log. What should I do?

If the IRS did not accept your mileage log, you should first review the reasons for rejection. Common issues include incomplete information or lack of adequate documentation. Once you understand the discrepancies, you can amend your mileage log to address these issues or gather additional supporting documentation, such as repair receipts or appointment confirmations that corroborate your travel. If the issue escalates to an audit, having professional assistance can be crucial.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

Join our community of 20k+ users

A

| MileageWise | TripLog | MileIQ | Everlance | Driversnote | SherpaShare | Hurdlr | Excel | |

User Ratings (Trustpilot) | N/A | N/A | N/A | |||||

iOS App User Ratings | ||||||||

Android App User Ratings |

| |||||||

Average Possible Business Mileage Deduction | $12,000 | $6,300 | $8,400 | $6,500 | $6,000 | $5,600 | $5,600 | $200-$2,000 |

Imports Trips and locations from Google Timeline | ||||||||

Produces IRS-Proof Mileage Logs | ||||||||

Creates Retrospective Mileage Logs | ||||||||

AI Wizard Technology for Mileage Recovery | ||||||||

| Sampling / Recurring Daily Trips | ||||||||

| Mass Distance Calculation | ||||||||

| Built-In IRS Auditor for 70 Logical Conflicts Correction | ||||||||

| Web Dashboard | ||||||||

| Mileage Tracker App | ||||||||

| Vehicle Expense Tracker | ||||||||

| Manual Trip Recording | ||||||||

| Bluetooth Auto Tracking - with no hardware needed | ||||||||

| Plug'N'Go Auto Tracking | ||||||||

| Vehicle Movement Monitoring | ||||||||

| Battery and Data Friendly | ||||||||

| Other Software Integrations | ||||||||

| Trip List Import from other Mileage Trackers | ||||||||

| Trip List Import from GPS | ||||||||

| Shared Dashboard for Teams | ||||||||

Features are all related to mileage tracking | ||||||||

Pricing | Price list | Price list | Price list | Price list | Price list | Price list | Price list | Price list |