What do you want to find out?

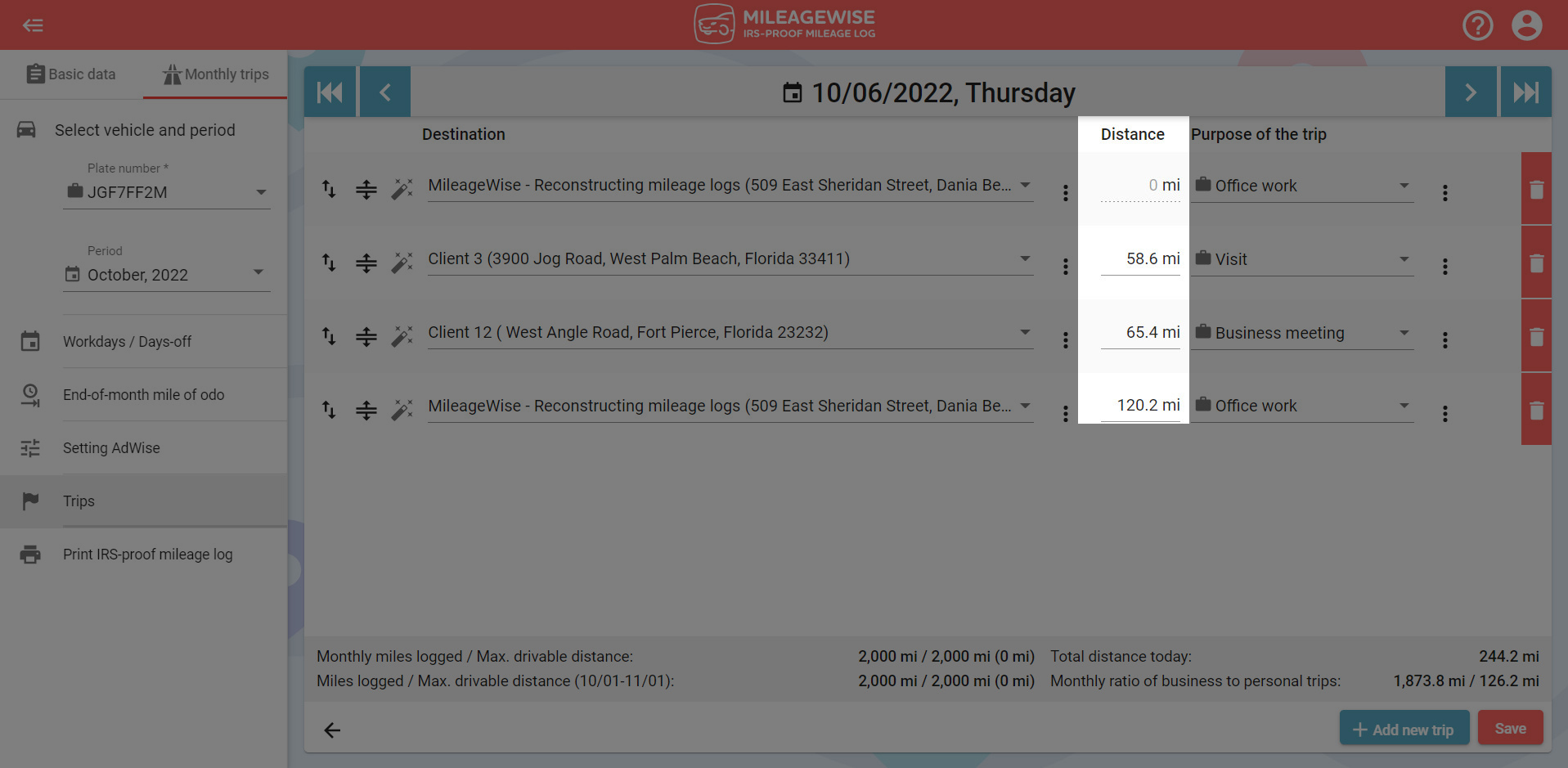

MileageWise will calculate the distances from client to client simultaneously. The system calculates optimum routes that are the most ideal for your mileage log in order to for it to be IRS-proof.

You can overwrite the distance for each trip by clicking on the distance column.

If you would like to permanently calculate with a different distance for a specific trip in the future, then you can set it with the ‘Overwriting calculated distances’ feature. You can specify the distance between two specific clients (instead of the program’s calculated distances). You can read more about this in this article.