What do you want to find out?

Record and keep track of all of your tax-deductible vehicle-related expenses.

NOTE: Expense tracking in the Vehicle expenses tab is only available for vehicles using the Actual Expenses Method as their calculation basis.

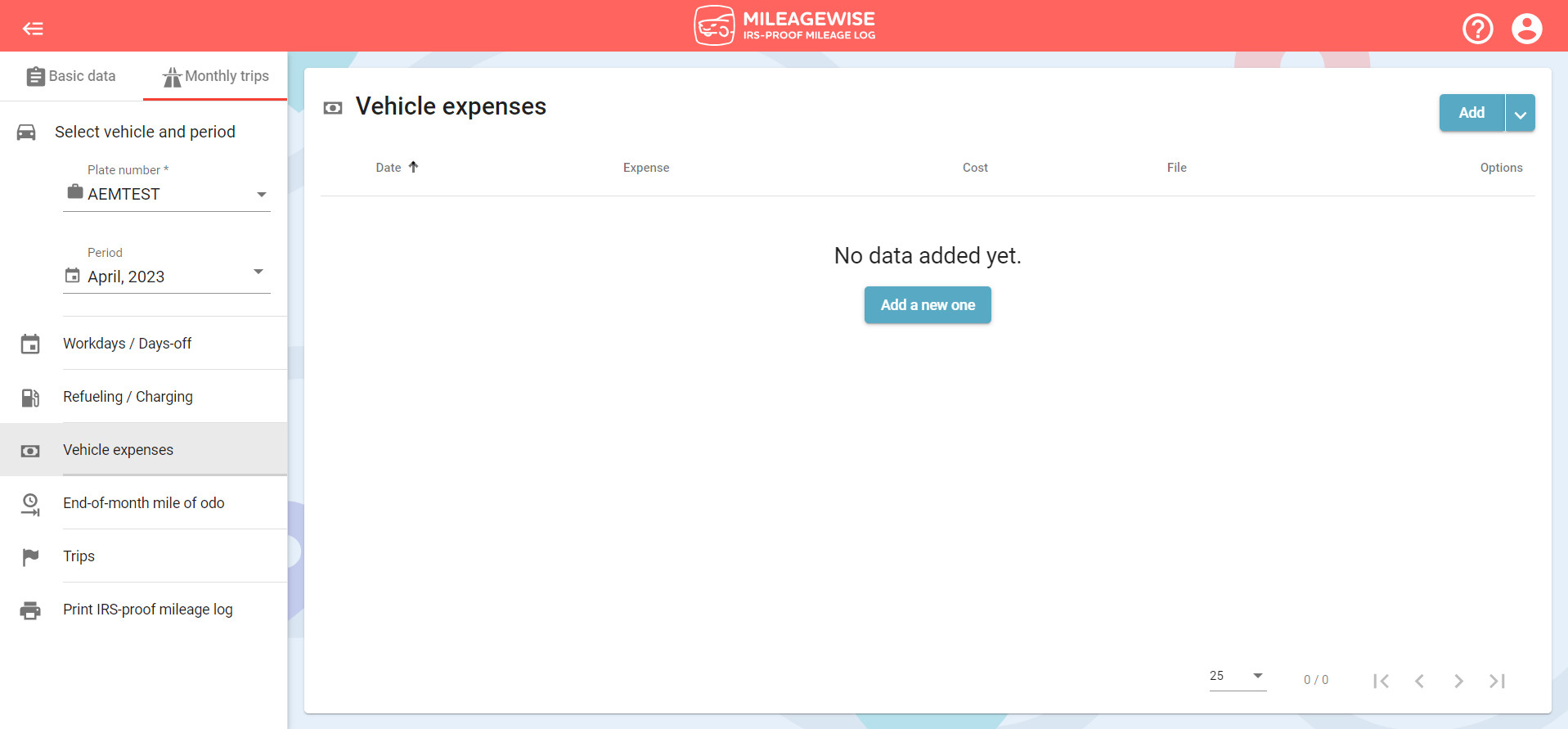

You can find the Vehicle expenses tab within the Monthly trips menu.

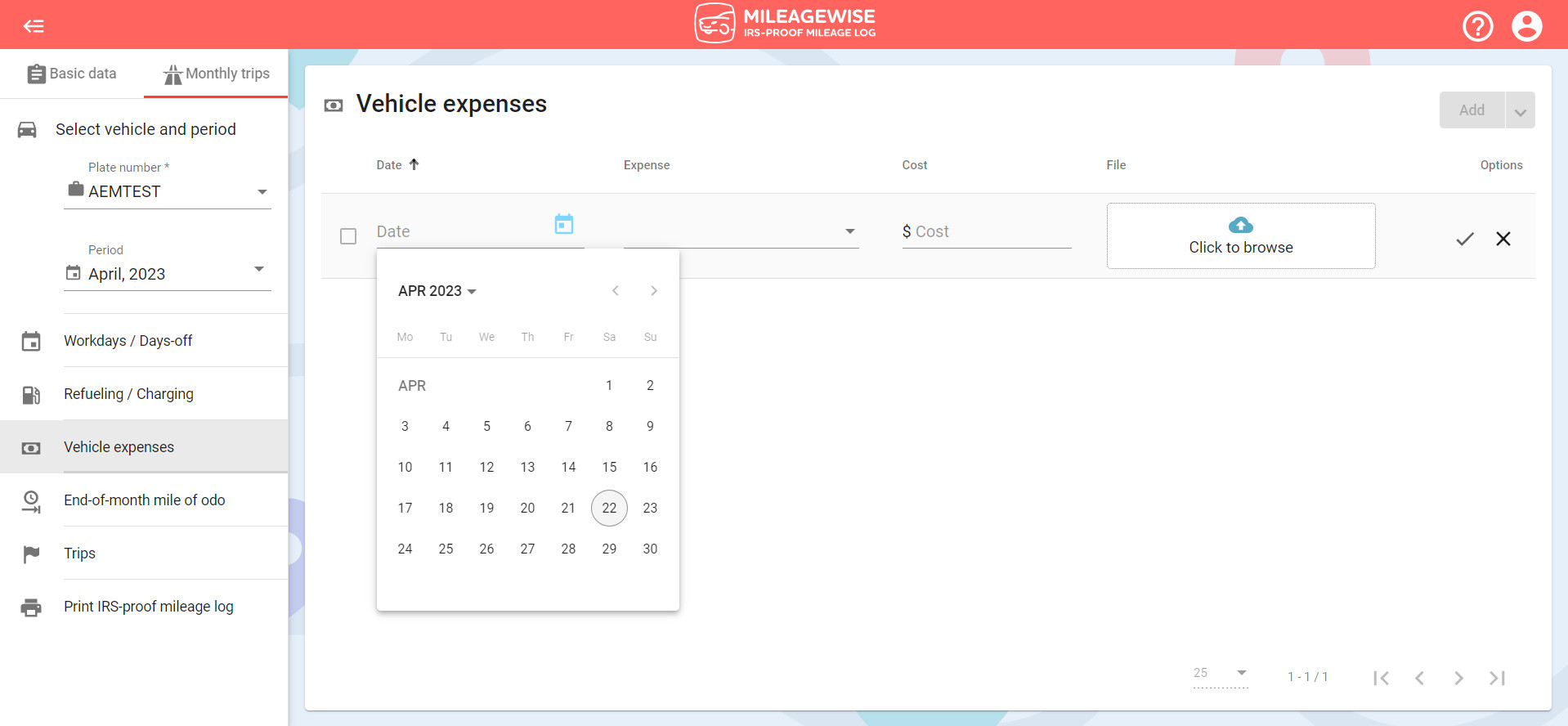

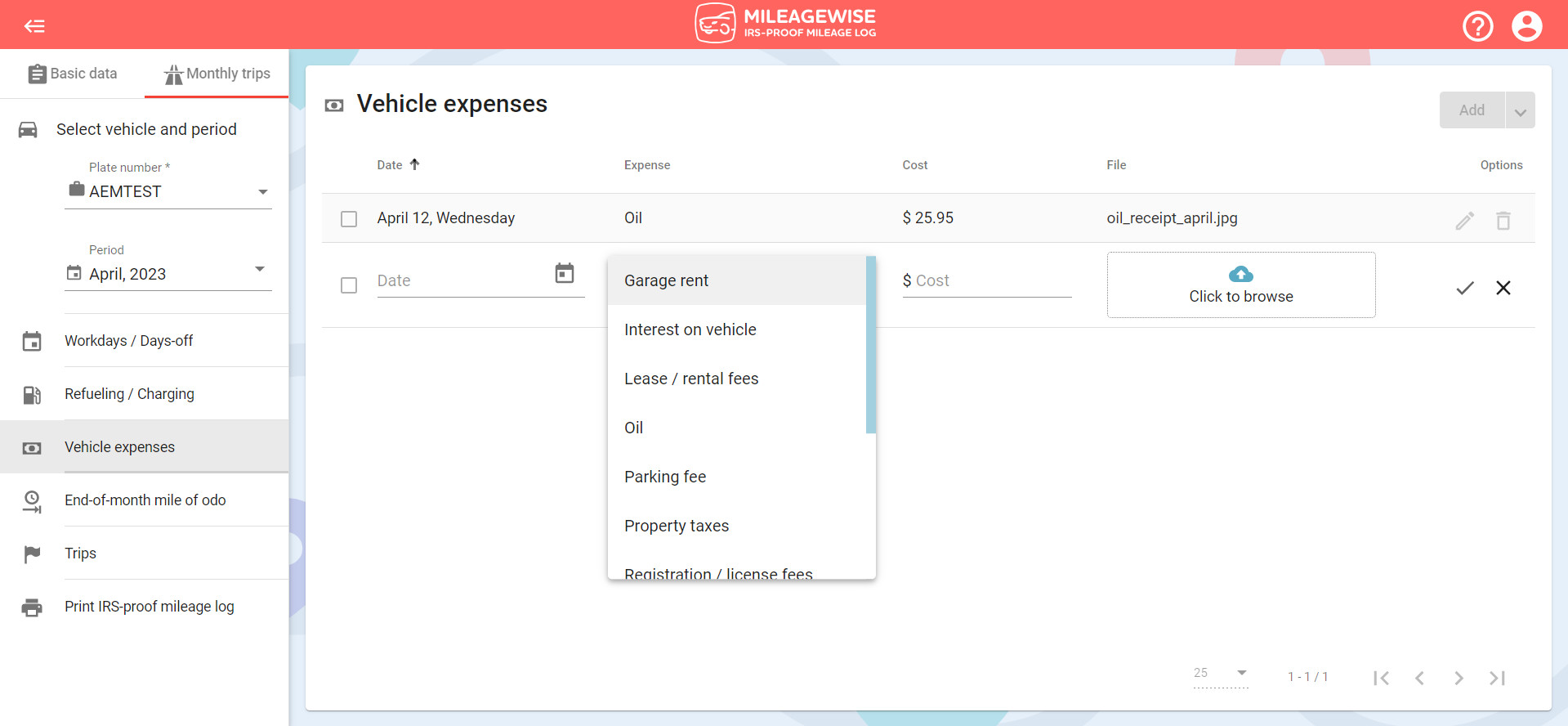

Select the date of the expense –> Select the type of expense –> Enter the $ amount –> Upload a file as supporting documentation (not required) –> Click the checkmark to save.

Available expenses to choose from:

- Garage rent

- Interest on vehicle

- Lease / rental fees

- Oil

- Parking fee

- Property taxes

- Registration / license fees

- Repairs and maintenance

- Tires

- Toll

- Vehicle insurance

- Other expenses

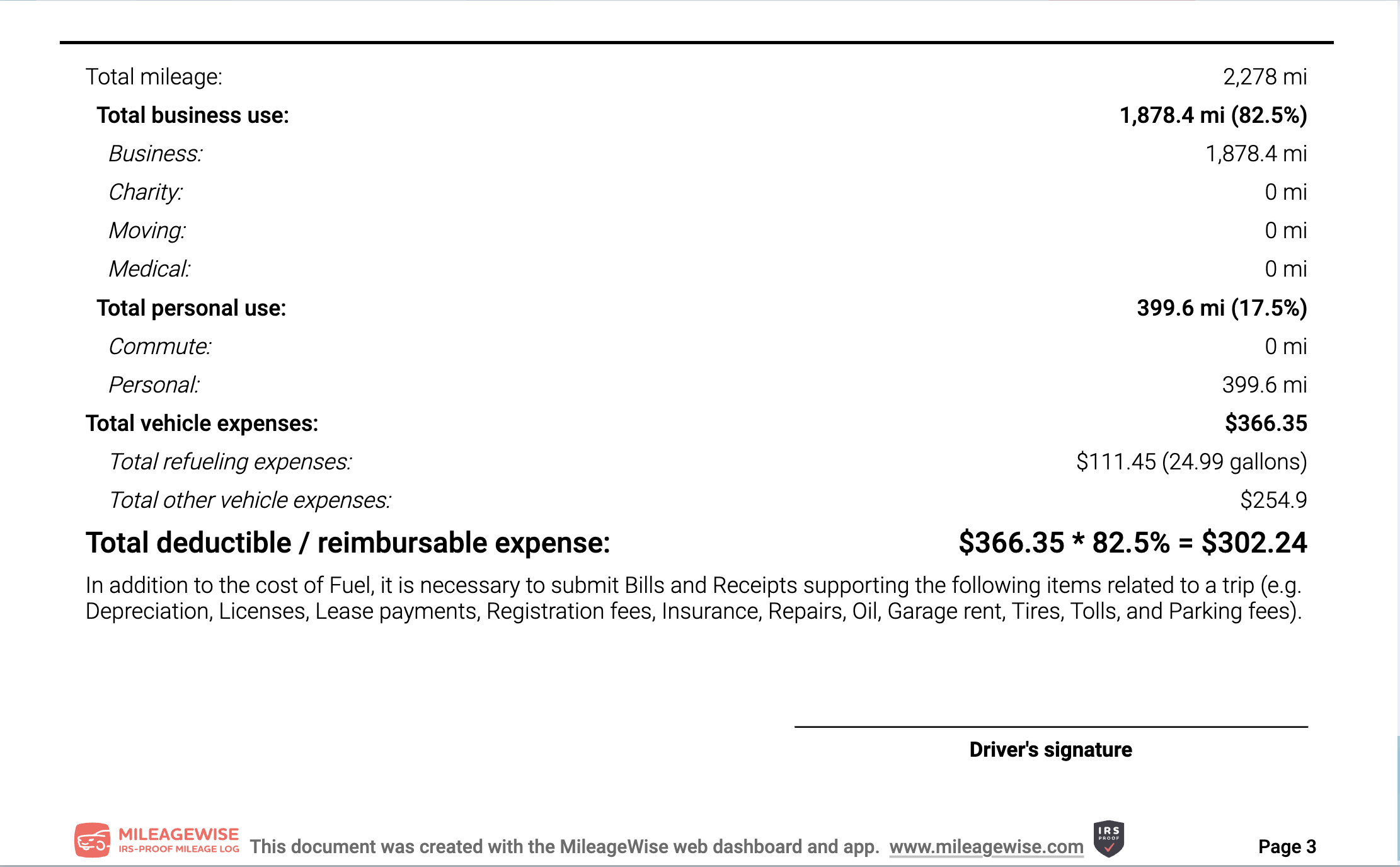

Your recorded expenses will appear as an expense report at the bottom of your finalized IRS-Proof mileage log.

Watch this short video about how to find the Vehicle Expenses tab in the Web Dashboard: