Note: Adding a refueling / charging is only necessary when using the Actual Expense Method. In case of using the Standard Mileage Rate, you only need to log your arrival at the gas / charging station (the trip itself), as you would with any other client / location.

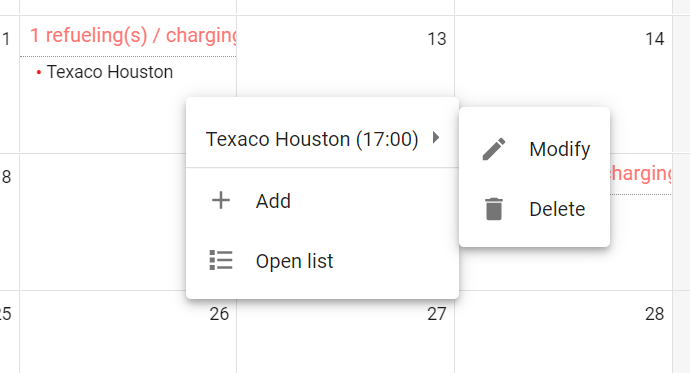

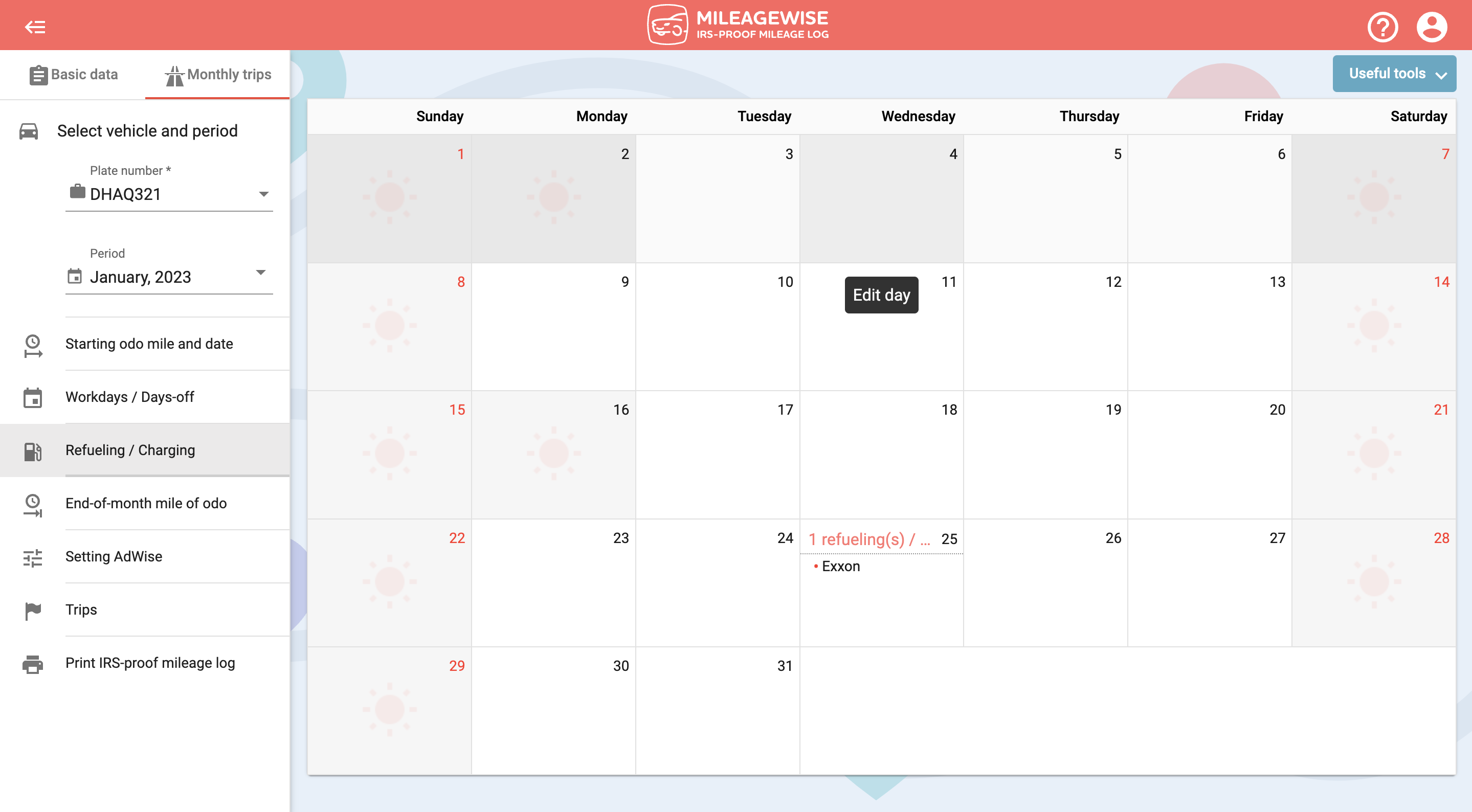

In the calendar view, double-click the day where you want to change a refueling / charging. Or right-click and select Delete from the drop-down menu.

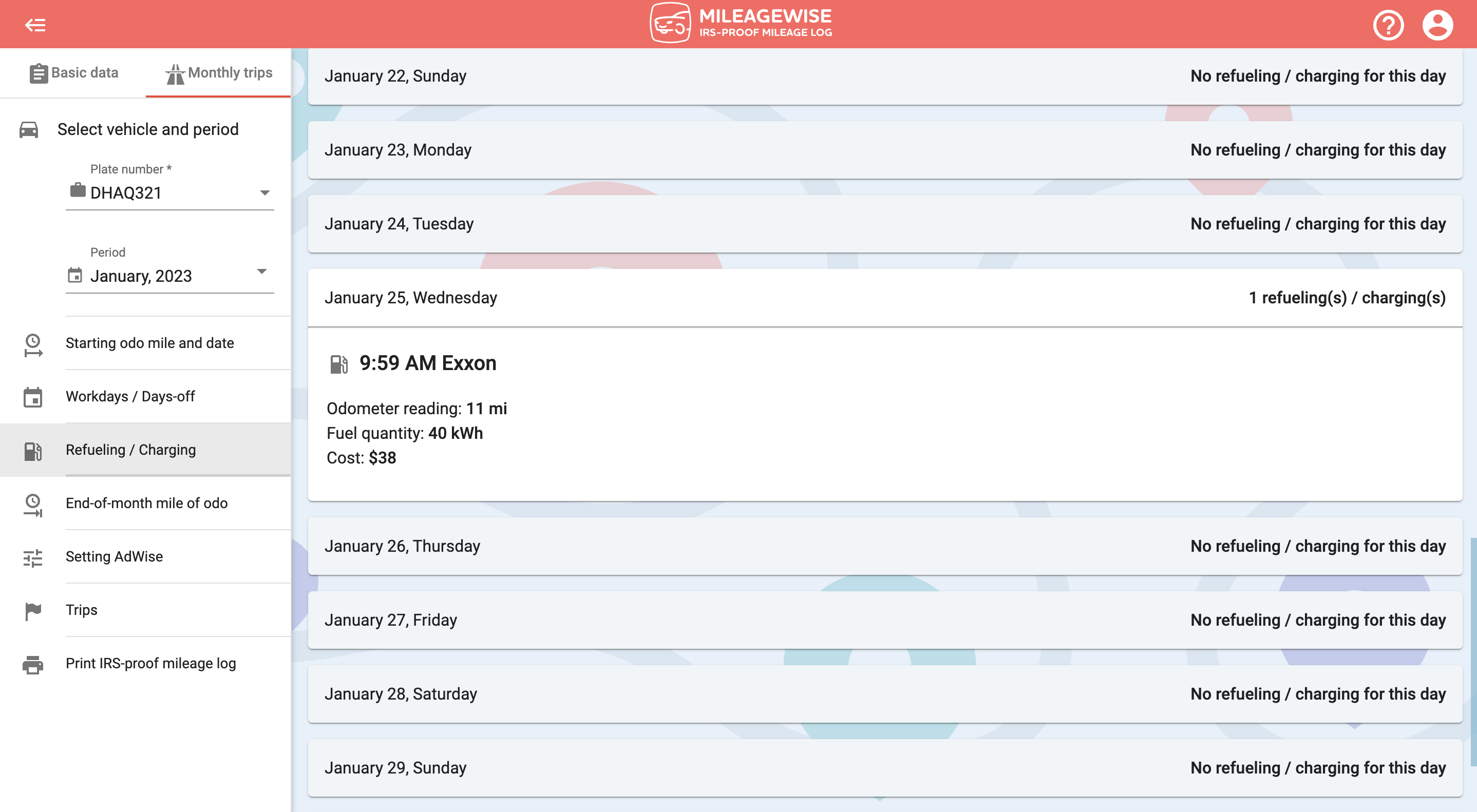

In list view, click on the pencil icon on the day you want to cancel refueling / charging!

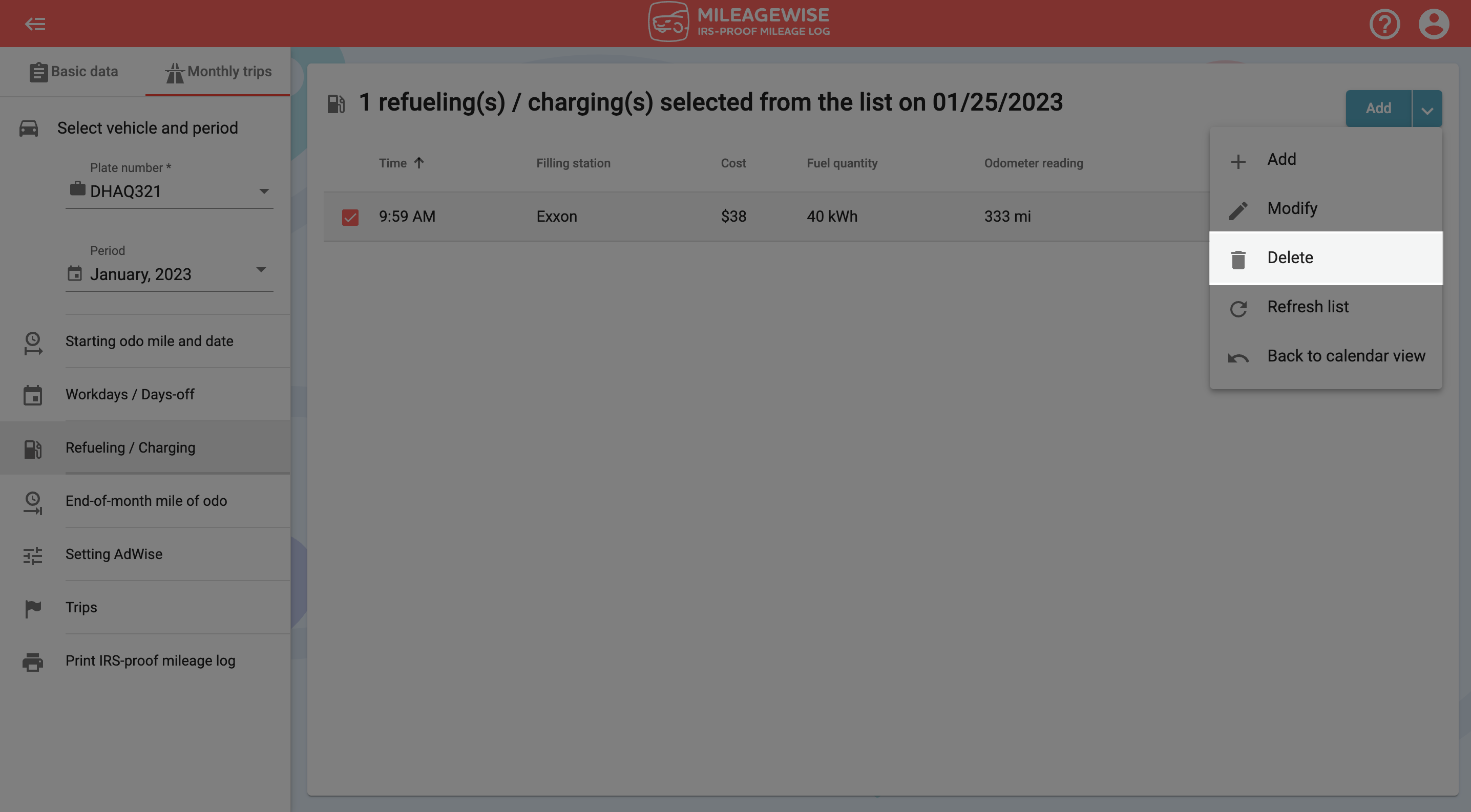

Use the checkbox to select the refueling / charging you want to delete.

Open the red menu in the top right corner and click the

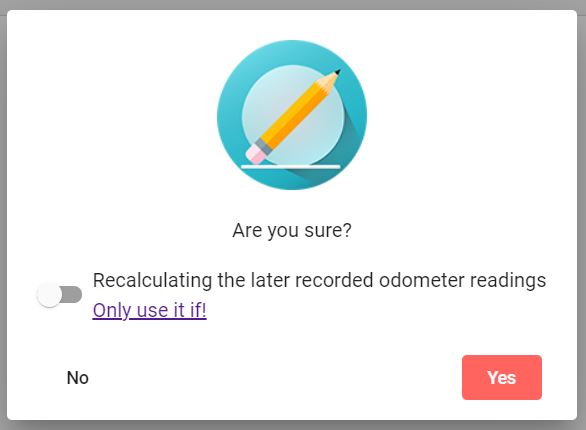

Click Yes to confirm your intention to delete.

AI Wizard for past trip recovery, built-in IRS auditor that checks and corrects 70 logical contradictions in your mileage log before printing – this is how MileageWise makes sure you’ll have 100% IRS-proof mileage logs!

We’re thrilled to share exciting news with our community: MileageWise is now an officially registered trademark! 🎉 After years of dedication and hard work, we’ve

Google Maps Timeline, formerly Location History, has been a trusted tool for tracking routes, visualizing travel patterns, and managing location data since 2015. However, recent

Starting a small business can feel overwhelming, but it doesn’t have to be. You don’t need a degree, a huge budget, or even a perfect

Running a small business is a big challenge. Choosing the right car is key. It can save money, look good, and even help with taxes.

© 2025 MileageWise – originally established in 2001