Last updated: June 6, 2024

Even though we now live in a time where a wealth of digital technology can make everyone’s lives easier, many prefer to write a mileage logbook with a pen or pencil. If you wish to do that, don’t worry – we have you covered.

Since the IRS can request mileage logs retrospectively for up to three years, we have tempates available for the previous years as well:

Free Google Sheets Mileage Log Template for 2021

Free Google Sheets Mileage Log Template for 2022

Free Google Sheets Mileage Log Template for 2023

Free Google Sheets Mileage Log Template for 2024

How to Use the Mileage Logbook Spreadsheets

If you choose to use our mileage tracker spreadsheet, you will first need to copy the one we have linked here and paste it into your own Google Docs, as this one is publicly available and therefore cannot be altered.

From there, you can edit it as you choose, and when you are finished you can either print the file directly or download it into one of many formats, namely PDF versions, XLXS files (Excel), or even CSV files, all of which are accepted by the IRS.

On the other hand, if you are looking to join the many efficient business people who now use a mileage logging app to create flawless printable mileage logs, then read on.

What is a Mileage Log?

In the case of employees, taxes are already withheld from their payment, whereas business owners and self-employed people have to manage their taxes themselves. These generally include the self-employment tax, which covers Social Security and Medicare, and the income tax.

You may be eligible for various deductions from your income taxes, depending on your work type. For example, deductions of office supply costs, internet and phone bills, meals, and vehicle expenses.

This is where the mileage log comes into the picture. You have the option to record all vehicle-related expenses or your miles traveled in a detailed trip log to deduct a set amount of cents per mile.

What Are the Advantages of Logging Mileage?

There are several benefits to creating a mileage log from your logged miles. First, tracking the miles that you traveled is much easier than tracking your car expenses. There is no need to hoard receipts and keep all of your car expenses in mind, like fueling or recharging, repairs and maintenance, parking, insurance, and more.

Moreover, the IRS mileage rate encompasses all vehicle-related deductible expenses and usually results in more tax savings. Furthermore, you get an overview of your daily operations, which helps you identify areas where you can improve and save more.

Logs, Logbooks, and the Standard Mileage Rate

Before we delve any deeper, it’s worth talking about the standard mileage rate, since a car mileage logbook or log is only required for those who choose this mileage calculation approach. Most people do – indeed; contractors, small business owners, and self-employed persons most commonly use this method. It is also worth noting that if this is your first year using a vehicle for business purposes, you must use the standard mileage rate if you ever plan to switch between that and the actual expense method in the future.

From a financial standpoint, this method offers sizeable kickbacks on the miles that you drive – allowing you to deduct 67 cents from every mile for business purposes in 2024.

For example, if you drive 20,000 business miles in a year, the standard mileage rate will provide you with tax deductions totaling $13,400 – provided that you submit an IRS-compliant mileage logbook.

The alternative is the above-mentioned actual expenses method, where you must instead keep itemized receipts of all of your vehicle expenses. These expenses include things such as oil, gas, insurance premiums, depreciation, repairs, tires, registration fees, and more.

IRS Mileage Log Requirements

There are some basic requirements that your mileage log needs to meet in order to be IRS-compliant. Let’s take a look at some of these:

- You must record the date and purpose of any trips you make for business purposes

- You also have to record both the departing and the arrival point

- You have to own or be leasing the vehicle in question

Currently, there is no law suggesting that you need to record your odometer at the beginning and the end of each trip other than the yearly starting and ending odometers, but we do recommend that you record your closing odometer reading at least every month and at refuelings. If you need to reconstruct your mileage log, a past odometer reading calculator is going to come in handy for you.

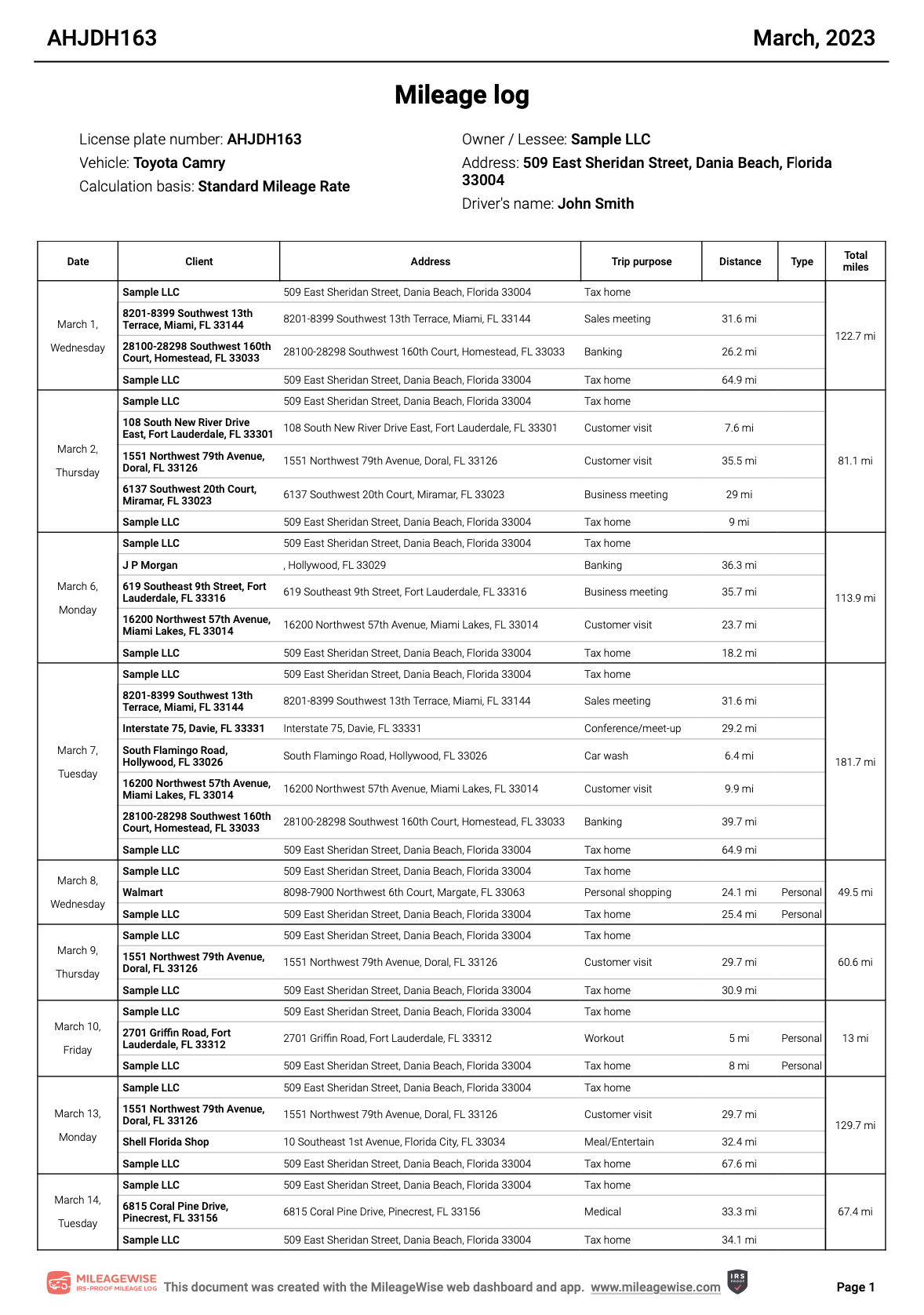

Here’s a sample for a monthly mileage logbook:

What about my personal trips?

Although the IRS doesn’t require personal trips in your mileage log, it’s strongly recommended that you include them because it will provide clarity for both yourself and the IRS since you need to separate your total business mileage, total personal mileage, and total commuting mileage for the year.

Also, logging your personal trips boosts the proficiency of MileageWise’s built-in IRS auditor function, which you need for an IRS-Proof result.

Is a Logbook Required At All for Accounting Purposes?

You do not specifically need a paper mileage logbook for taxes – a simple printable logbook will suffice, but a mileage log that is created in software is an even better choice. In other words:

Can I still deduct mileage without a logbook?

In fact, you should. The log does, naturally, need to be IRS-compliant, though most people simply use an app to record their mileage along with a web dashboard to actually print that log. If you’re new to all this – the app is what you take with you on your phone, and the web dashboard is only useable on a PC or a laptop.

Should you use a printable mileage logbook?

While the IRS still accepts them, it is becoming increasingly uncommon to submit them. The vast majority of people submitting these logs do not know that there is an easier way to do things. With that in mind, let’s examine the benefits of using a mileage logbook app over a paper-based mileage deduction logbook.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

Printable vs Digital Mileage Logbook

The truth is that there’s no real comparison. MileageWise offers the best mileage logbook app for taxes which is unrivaled in features and precision.

Let’s take a look at some reasons why an electronic mileage logbook tool is clearly better than a paper-based logbook:

IRS-Proof Mileage Log

If you’re using a paper-based mileage logbook, you’re going to make mistakes. That’s nothing personal – it’s just human nature. With MileageWise’s software, however, you can use our AI Wizard technology to correct those errors, provided that you have some idea of your odometer readings at various points throughout the year.

Automatic Mileage Tracker App

With our software’s auto-tracking features, you don’t even need to worry about recording each trip individually – you can simply use Bluetooth or plug in your phone and you’re ready to go. MileageWise’s mileage tracker app and its accompanying web dashboard companion also allow you to put in your trips manually if that’s what you prefer.

Retrospective Mileage Logs

If you’re using paper, you might find yourself in a bind when you realize that you have lost old logs and now you need all of your documentation because you are facing an IRS audit. The good news is, that you can reconstruct those logs as long as you can provide your odometer readings and a list of destinations you typically travel to for business purposes.

Perhaps the ultimate reason why using MileageWise’s software is so superior is because it saves you time and therefore money. Any business person worth their salt understands that time is money. You could spend hours upon hours every month making sure that your paper-based logbook fits the needs of the IRS (and you still won’t be sure), or, you could finalize all of your logs in just 7 minutes per month – with our software. The choice is yours.

For a full list of all of our software’s benefits vs our competitors, you can find a mileage tracker app comparison table. We strongly believe that MileageWise is the best mileage tracker app out there.

FAQs

Do I need a mileage log for tax purposes?

Yes, you need a mileage log for tax purposes if you plan to deduct vehicle expenses using the standard mileage rate. This log helps you track your business miles and ensure you are compliant with IRS requirements, which allows you to claim deductions effectively.

Do you need an odometer reading for taxes?

While there is currently no law that mandates recording your odometer reading at the beginning and the end of each trip, it is recommended to record your closing odometer reading at least every month and at refuelings. You must, however, record the yearly starting and ending odometers to ensure your mileage log is IRS-compliant.

How long do you need to keep a logbook for tax purposes?

You need to keep your mileage logbook for at least three years, as the IRS can request mileage records retrospectively for up to three years. It’s important to maintain these records to substantiate your mileage deductions if audited by the IRS.

| MileageWise | TripLog | MileIQ | Everlance | Driversnote | SherpaShare | Hurdlr | Excel | |

User Ratings (Trustpilot) | N/A | N/A | N/A | |||||

iOS App User Ratings | ||||||||

Android App User Ratings |

| |||||||

Average Possible Business Mileage Deduction | $12,000 | $6,300 | $8,400 | $6,500 | $6,000 | $5,600 | $5,600 | $200-$2,000 |

Imports Trips and locations from Google Timeline | ||||||||

Produces IRS-Proof Mileage Logs | ||||||||

Creates Retrospective Mileage Logs | ||||||||

AI Wizard Technology for Mileage Recovery | ||||||||

| Sampling / Recurring Daily Trips | ||||||||

| Mass Distance Calculation | ||||||||

| Built-In IRS Auditor for 70 Logical Conflicts Correction | ||||||||

| Web Dashboard | ||||||||

| Mileage Tracker App | ||||||||

| Vehicle Expense Tracker | ||||||||

| Manual Trip Recording | ||||||||

| Bluetooth Auto Tracking - with no hardware needed | ||||||||

| Plug'N'Go Auto Tracking | ||||||||

| Vehicle Movement Monitoring | ||||||||

| Battery and Data Friendly | ||||||||

| Other Software Integrations | ||||||||

| Trip List Import from other Mileage Trackers | ||||||||

| Trip List Import from GPS | ||||||||

| Shared Dashboard for Teams | ||||||||

Features are all related to mileage tracking | ||||||||

Pricing | Price list | Price list | Price list | Price list | Price list | Price list | Price list | Price list |