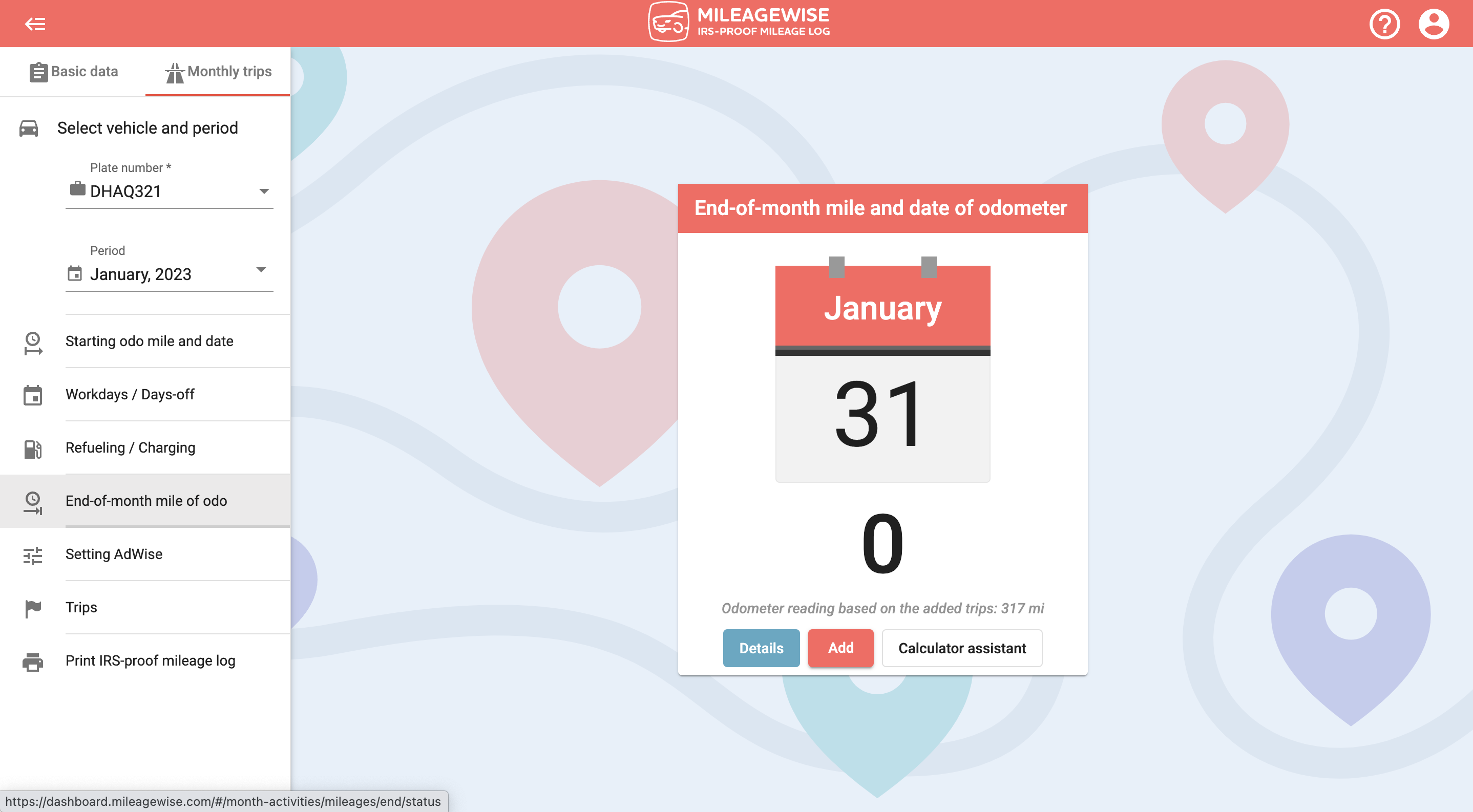

It is absolutely necessary to provide an end-of-month odometer reading in order to create a mileage log. Click the Add button to record one.

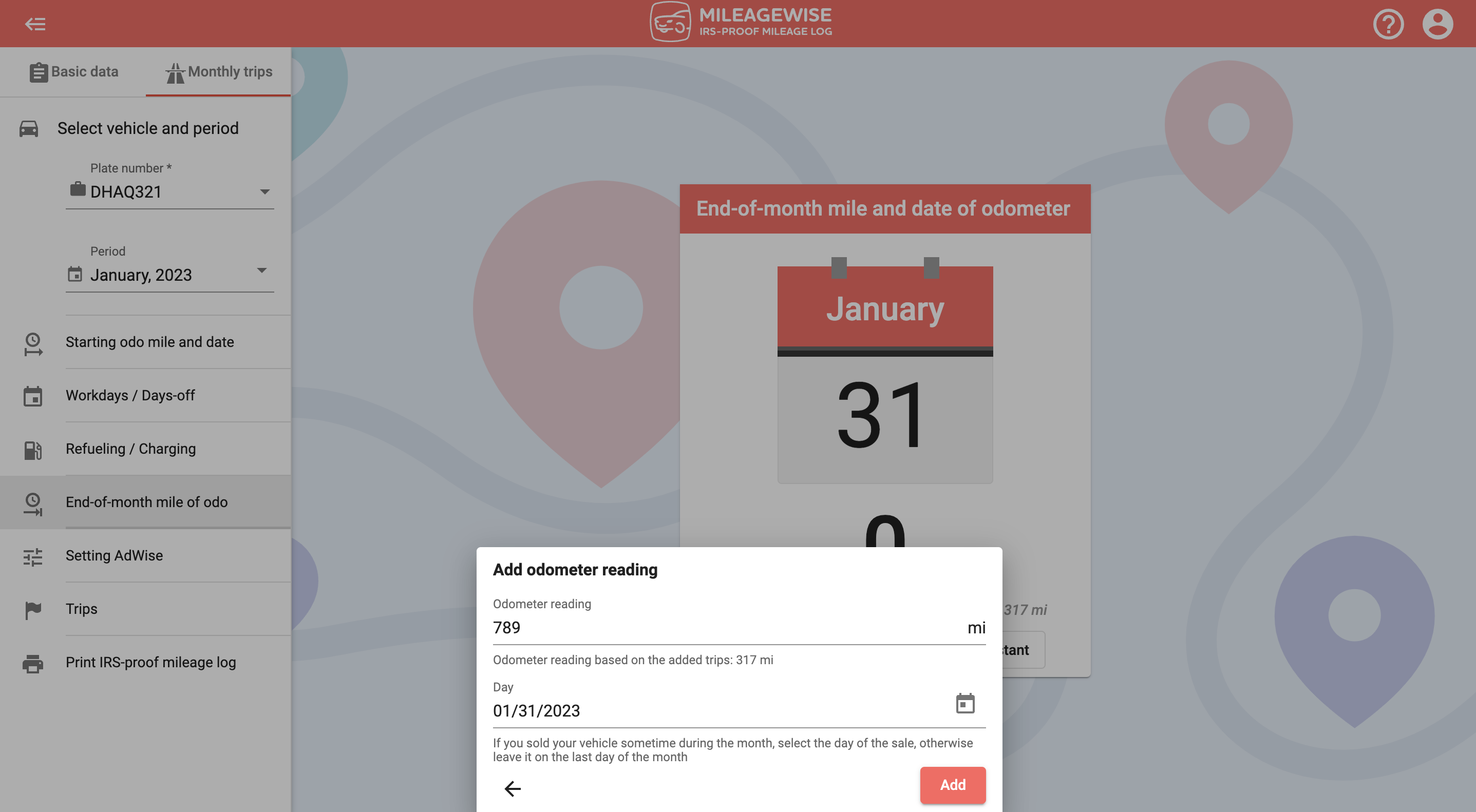

We recommend that you record your odometer reading at each refueling / charging and at the end of the month, and enter this into the program as well! Enter the value and click Add.

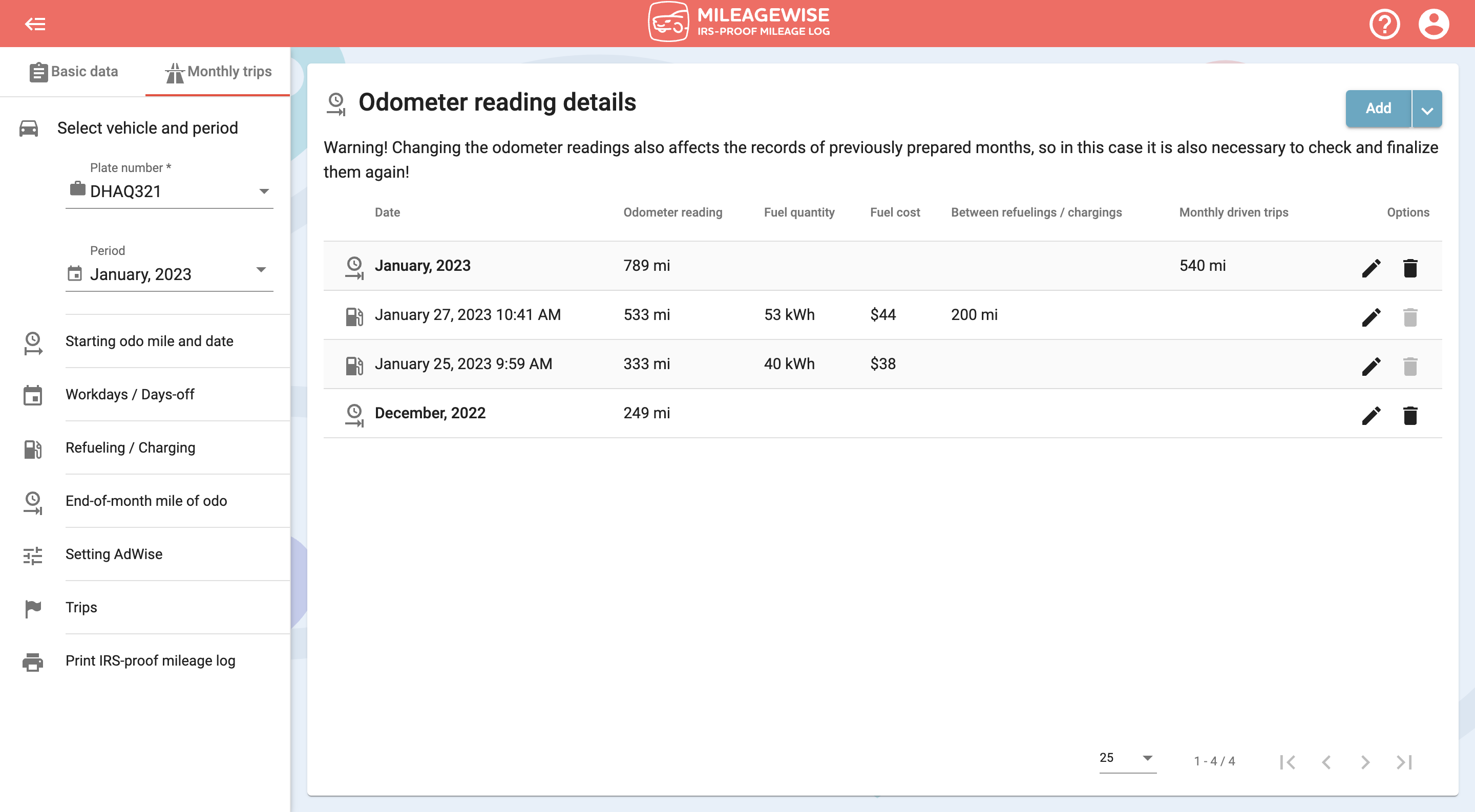

If the data may not be available, you can see in the Details window what odometer readings you have previously recorded.

The end-of-month odometer reading must always be greater than the value specified at the last refueling. You can calculate these with the Calculator assistant.

AI Wizard for past trip recovery, built-in IRS auditor that checks and corrects 70 logical contradictions in your mileage log before printing – this is how MileageWise makes sure you’ll have 100% IRS-proof mileage logs!

July 19, 2024 Charging Lime scooters offers a unique opportunity to earn extra income while contributing to eco-friendly urban transportation. Lime scooter chargers, often called

July 12, 2024 Becoming a Papa Caregiver, also called “Papa Pal”, through the Papa Care program is a rewarding opportunity for individuals who enjoy helping

July 4, 2024 Are you looking for a flexible and rewarding gig that fits your schedule? Becoming a Dolly Helper could be the perfect opportunity

June 28, 2024 Becoming a Wag caregiver is an exciting opportunity for animal lovers who wish to turn their passion into a rewarding career. This

© 2024 MileageWise – originally established in 2001