Welcome to your comprehensive guide on ‘Modifying an End-of-Month Odometer’ – an essential feature of MileageWise. We understand how important accuracy is when it comes to IRS-Proof mileage logs, and that’s why we’ve made it easy to adjust your odometer records for precision down to the last mile.

Whether you missed a few entries or simply need to align the numbers, our step-by-step instructions ensure a swift, seamless process. Say goodbye to discrepancies and navigate month-end adjustments with confidence. Armed with this guide, you’ll not only master mileage logging but also stay ahead of IRS requirements. Explore MileageWise’s intuitive features and make mileage tracking work effortlessly for you. Remember, with MileageWise, you’re always on the right track.

Now let’s see this step-by-step guide to how to do this process exactly:

First of all, recorded end-of-month odo readings cannot be deleted, as this is necessary for the preparation of the mileage log.

However, you can, of course, make changes if you accidentally recorded the wrong data in our odometer reading calclator.

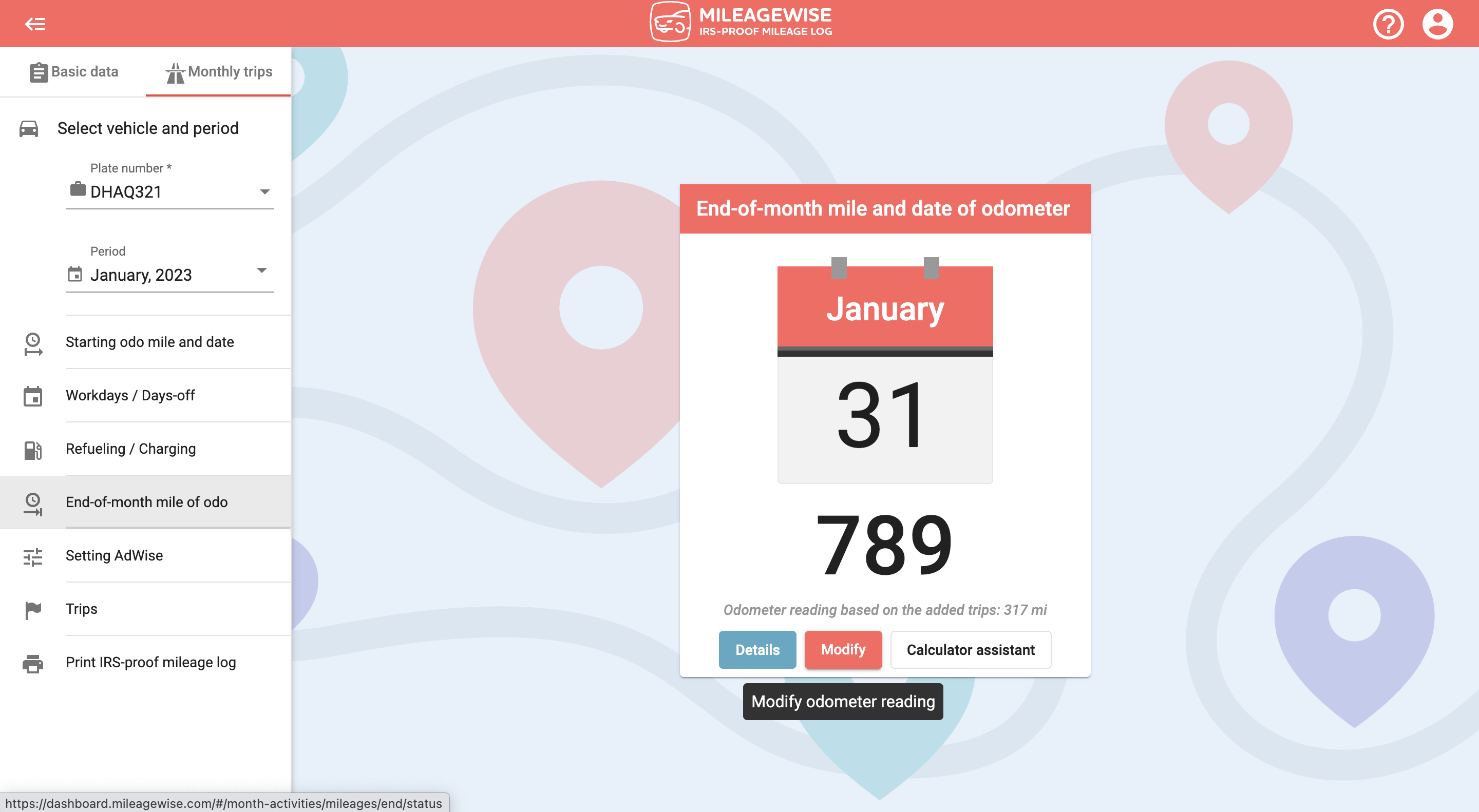

Click on the Modify button.

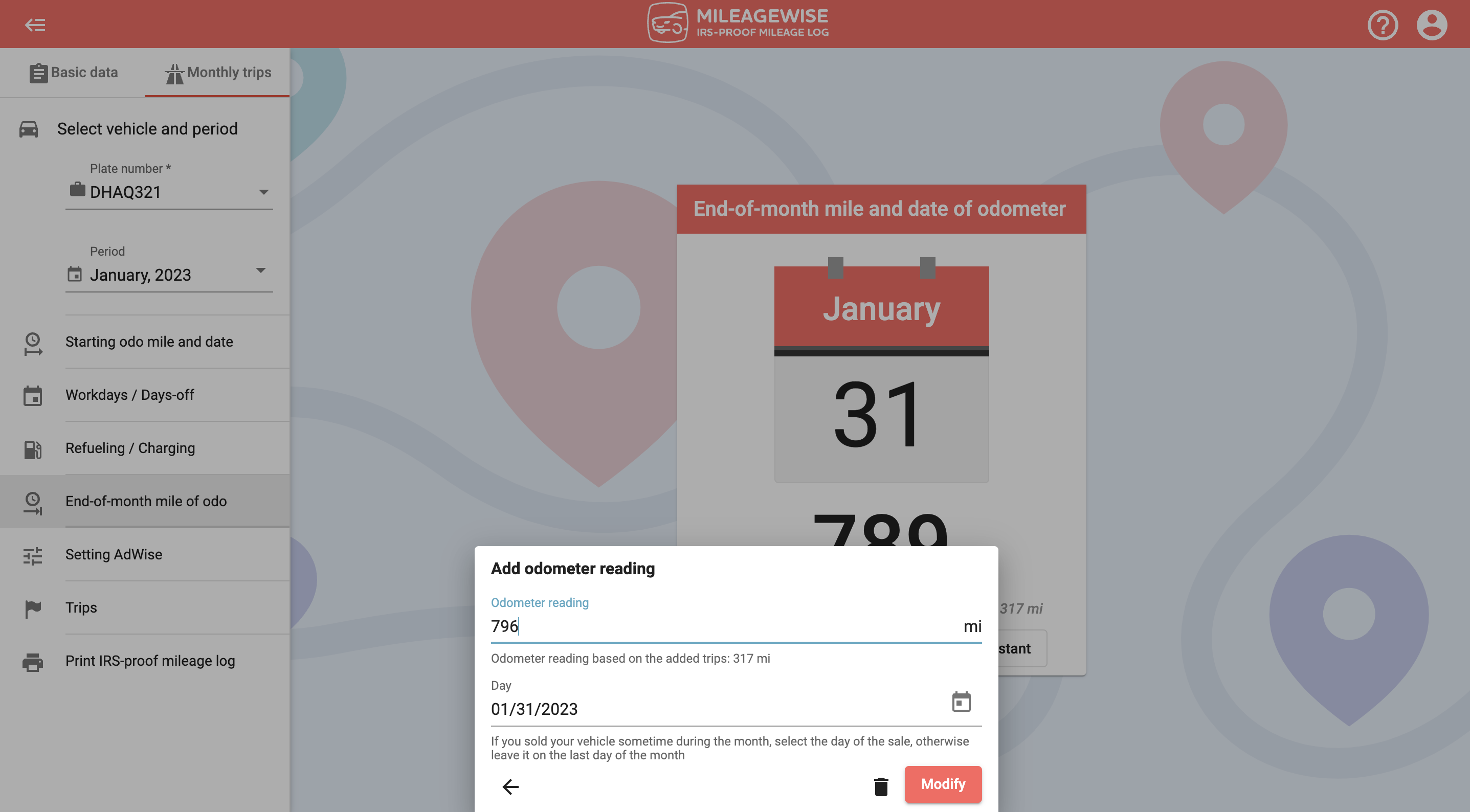

Rewrite the odometer reading and then click Modify.

AI Wizard for past trip recovery, built-in IRS auditor that checks and corrects 70 logical contradictions in your mileage log before printing – this is how MileageWise makes sure you’ll have 100% IRS-proof mileage logs!

We’re thrilled to share exciting news with our community: MileageWise is now an officially registered trademark! 🎉 After years of dedication and hard work, we’ve

Google Maps Timeline, formerly Location History, has been a trusted tool for tracking routes, visualizing travel patterns, and managing location data since 2015. However, recent

Starting a small business can feel overwhelming, but it doesn’t have to be. You don’t need a degree, a huge budget, or even a perfect

Running a small business is a big challenge. Choosing the right car is key. It can save money, look good, and even help with taxes.

© 2025 MileageWise – originally established in 2001