November 27, 2023

Whether you’re a freelancer, a small business owner, or an employee who frequently travels for work, understanding the ins and outs of expensing mileage is crucial. This guide is tailored for anyone who needs clarity on mileage allowance, reimbursement for mileage, and how to efficiently track and claim these expenses.

The Significance of Mileage Expensing

In today’s fast-paced business environment, travel is often a necessity. That’s where expensing mileage comes in. It’s not just about getting back the money spent on travel; it’s about recognizing the cost of business operations. Properly managing mileage expenses ensures compliance with tax laws, especially concerning IRS reimbursement for mileage and federal reimbursement for mileage.

How to Claim Mileage

Understand the Rates

Familiarize yourself with the mileage allowance and the reimbursement mileage rates set for 2023 by the IRS. These rates change yearly, reflecting the average cost of operating a vehicle.

Use a Mileage Tracking Tool

Tools like MileageWise simplify logging every mile. While small business owners and self-employed people tend to choose simple, user-friendly mileage tracker apps like MileageWise, larger organizations often choose software such as SAP Concur mileage for their integration with expense management systems.

Maintain Mileage Logs

Keeping detailed mileage logs is crucial. While using a simple Excel mileage log is better than nothing, relying on a sophisticated app that record every trip automatically is way safer in the long run.

Calculating Mileage

While manual logging is still a common practise, calculating mileage accurately is tough challenge. It’s too easy to forget to log trips, or to make mistakes when trying to recover past trip gaps. Advanced mileage tracker apps can do that for you.

Claiming Mileage for Business Use

When filing your expenses, ensure you accurately report the business miles for reimbursement or tax deductions. And again, advanced mileage tracker apps can help you with this by offering a built in “IRS auditor“.

Key Considerations

FAVR Mileage Reimbursement: The Fixed and Variable Rate (FAVR) allows more accurate reimbursement than standard rates for employees. It considers both fixed costs (like insurance) and variable costs (like gas). If you’re managing a fleet, mileage tracker apps can help you with that.

IRS Car Allowance and Auto Allowance Taxable 2023: Be aware of the taxable implications of car allowances from your employer.

Business Mileage Reimbursement (aka Federal Gas Reimbursement): Always separate personal travel from business travel to avoid any legal or tax complications.

Average Mileage Reimbursement 2023: Knowing the industry average helps you gauge if your company’s reimbursement policy is fair.

Leveraging MileageWise for Effective Mileage Management

What is MileageWise?

As we mentioned above, it’s recommended that you rely on an advanced mileage tracker app. MileageWise stands out as a comprehensive solution in the realm of mileage tracking and reimbursement. Designed for both individual and corporate use, it offers a suite of features that simplify the process of recording, calculating, and reporting mileage.

Features of MileageWise That Enhance Mileage Management

Intuitive Mileage Tracking: MileageWise offers an easy-to-use interface for tracking your travel. Whether it’s for business mileage reimbursement or claiming mileage for business use, the app accurately records every trip.

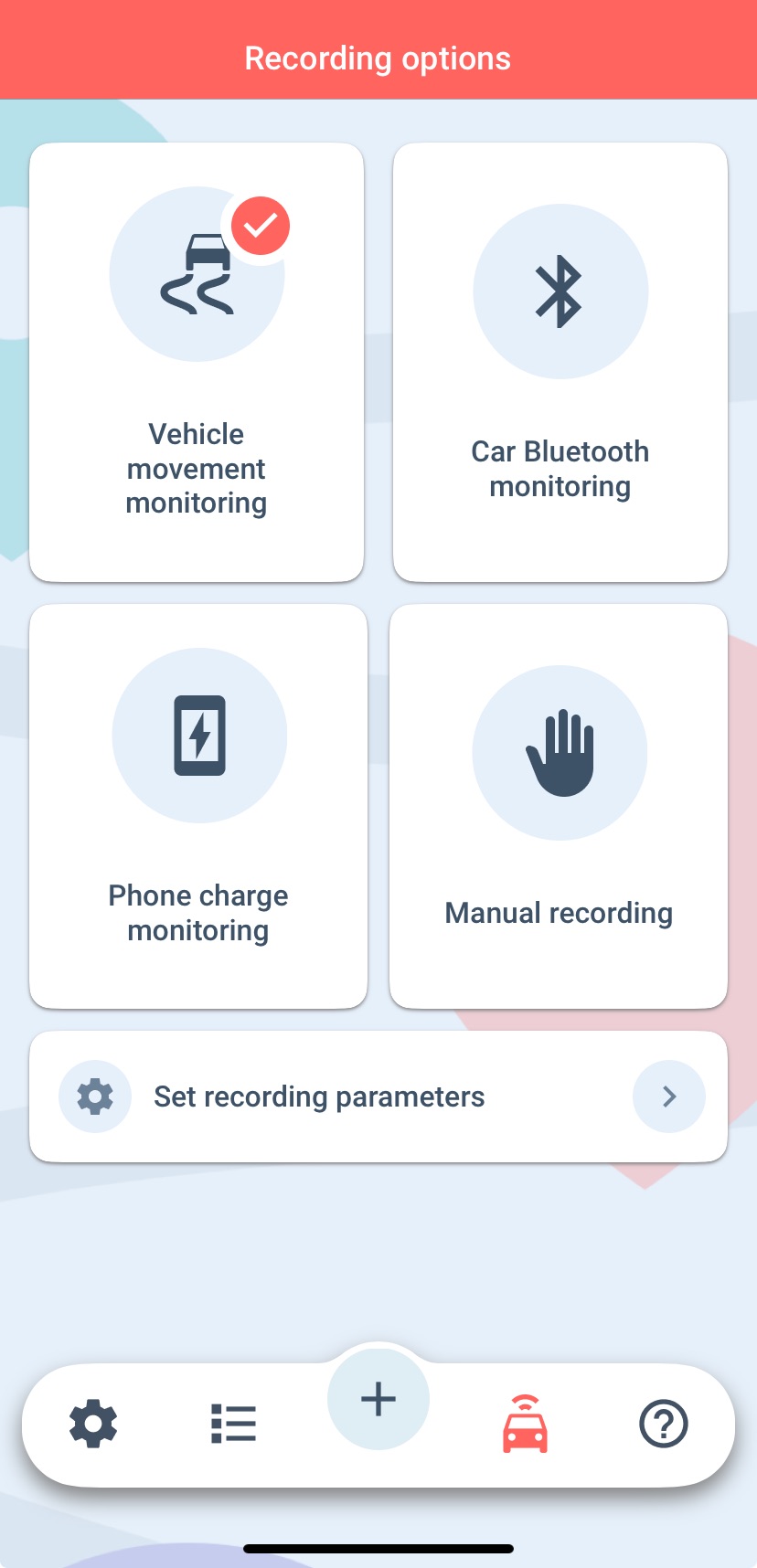

Automatic Trip Detection: One of the standout features of MileageWise is its automatic trip detection. This ensures that all business-related travel is captured without the need for manual entry. You can select Car Bluetooth monitoring, Phone charging monitoring, or Vehicle movement monitoring.

IRS-Proof Logs: With the increasing importance of adhering to IRS guidelines, MileageWise ensures that your mileage logs are compliant with the latest IRS reimbursement regulations. This is crucial for anyone concerned about federal reimbursement for mileage and IRS car allowance rules.

Customized Reporting: The application allows users to generate customized reports, and plan for reimbursement for mileage in 2023. This feature aligns well with the needs of those using SAP Concur mileage and QuickBooks mileage reimbursement systems.

Integration with Accounting Software: For businesses using accounting software, MileageWise offers seamless integration with FreshBooks, making the process of expensing mileage more efficient and reducing the likelihood of errors.

Vehicle Expense Tracker: The platform offers insights into travel patterns and expenses. This is particularly useful for assessing average mileage reimbursement and vehicle-related spending in 2023 and planning for future allowances.

Retrospective Logging: MileageWise’s Google Timeline Importer helps user cover past trip gaps by importing records from their Google Timeline. The software turns these records into proper, IRS-Proof mileage logs.

The Advantages of Using MileageWise

Time-Saving: Automating the process of tracking and reporting mileage saves significant time, especially for those previously reliant on manual Excel mileage logs.

Accuracy and Compliance: The accuracy of MileageWise in calculating mileage and its adherence to IRS standards helps in minimizing audit risks.

Cost-Effective: By accurately tracking and reporting mileage, users ensure they are claiming the full amount they are entitled to, which can lead to substantial cost savings over time.

User-Friendly Interface: The app’s design is intuitive, making it accessible for users who might be new to mileage tracking or those transitioning from traditional methods like Expensify mileage or FAVR mileage reimbursement systems.

Conclusion

MileageWise emerges as a powerful ally in the complex task of mileage management. Its blend of user-friendly features, IRS compliance, and integration capabilities makes it an indispensable tool for anyone looking to streamline their expensing mileage process. Whether you’re an individual consultant or part of a larger organization, incorporating MileageWise into your routine can lead to more accurate reimbursements and smoother financial management.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!