With the MileageWise mobile app report generation feature, you can create, review, and download monthly mileage reports effortlessly.

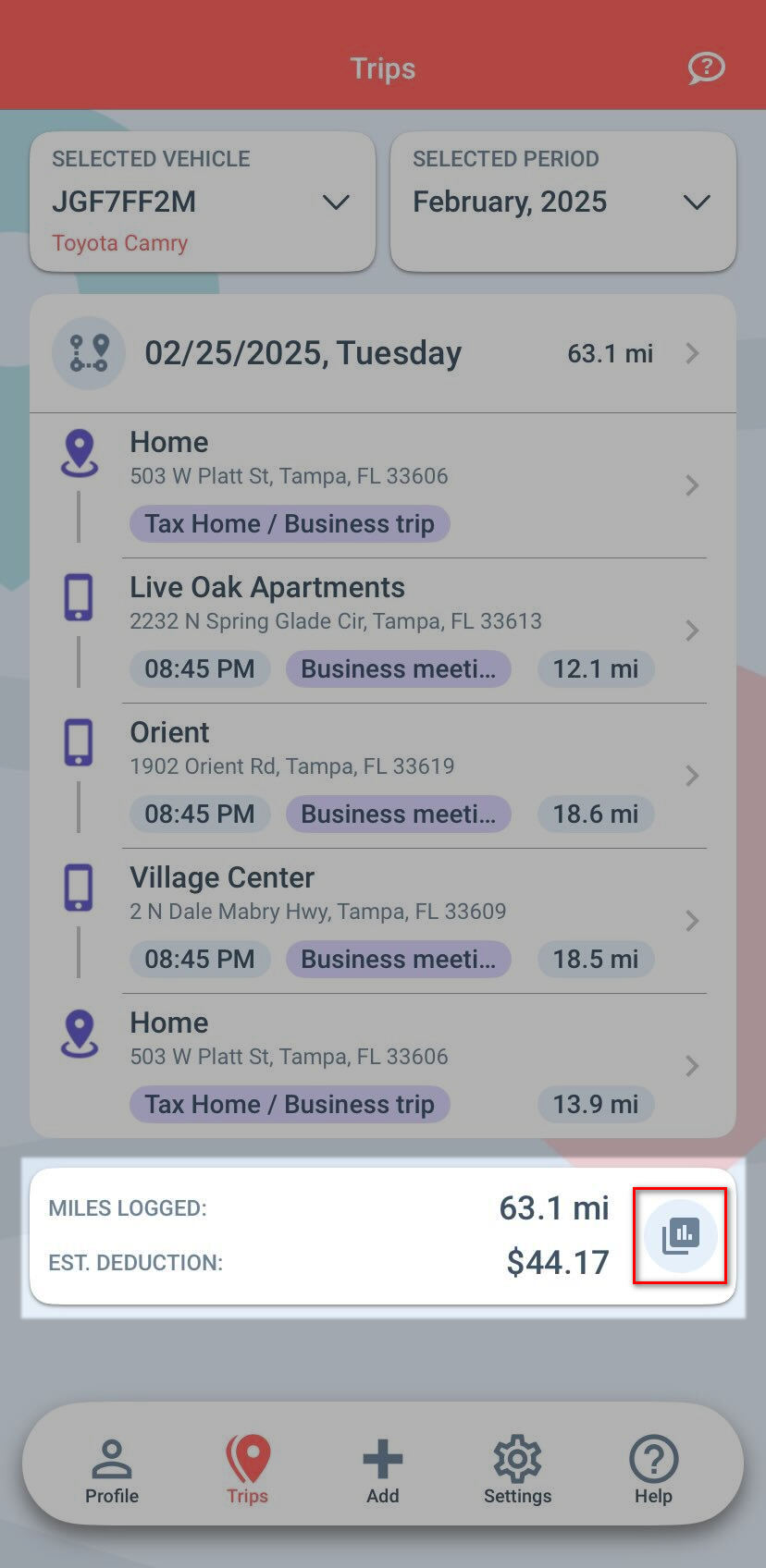

1️⃣ Go to the Trips Menu

2️⃣ Find the Report Icon

Once you’ve entered the Report section, you can choose the time frame for your mileage logs:

✔️ Current Year – Generate reports for this year’s mileage.

✔️ Previous Year – View and download last year’s reports.

✔️ Custom Date Range – Manually select a specific time frame (e.g., last 3 months).

🔹 View Your Reports – A list of your monthly mileage reports will appear.

🔹 Modify if Needed – Tap on a report to make adjustments before downloading.

🔹 Download & Share – Instantly download your report in PDF format or share it via email, cloud storage, or messaging apps.

✅ Check your trips beforehand – Make sure all recorded trips are categorized correctly.

✅ Use the Revise Trips feature – If you notice discrepancies, correct them before generating reports.

✅ Keep track of your odometer readings – Ensure that your mileage logbooks match your real-world driving.

This mileage tracker app goes beyond the basics! Automatically track your trips and customize your settings to match your needs. Designed to be battery-friendly, data-efficient, and fully ad-free — all while respecting your privacy. No upselling, no distractions — just the features you need.

With our Google Maps Timeline integration for importing your Location History, the AI Wizard Mileage Log Generator for recovering past trips, and our Built-in IRS Auditor that spots 70 potential red flags, MileageWise makes sure your mileage logs are always 100% IRS-proof.

April 29, 2025 Are you a freelancer or independent contractor? Do you get paid with a 1099 form? Then you need a 1099 tax calculator!

If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this post, we’ll break down what

Last Updated: April 7, 2025 If you use the internet for work, you might be able to claim a deduction on your tax return. But

Last Updated: March 3, 2025 If you regularly pay tolls for work-related travel, you may be wondering: Are tolls tax-deductible? The short answer is yes,

© 2025 MileageWise – originally established in 2001