November 29, 2023

For professionals who spend a significant amount of time on the road, whether for sales, services, or self-employment, mastering the art of mileage reporting is not just a matter of compliance—it’s a strategic approach to financial management. Here’s a detailed guide to help you navigate through the nuances of mileage logs and how tools like MileageWise can simplify the process.

Understanding Mileage Logs

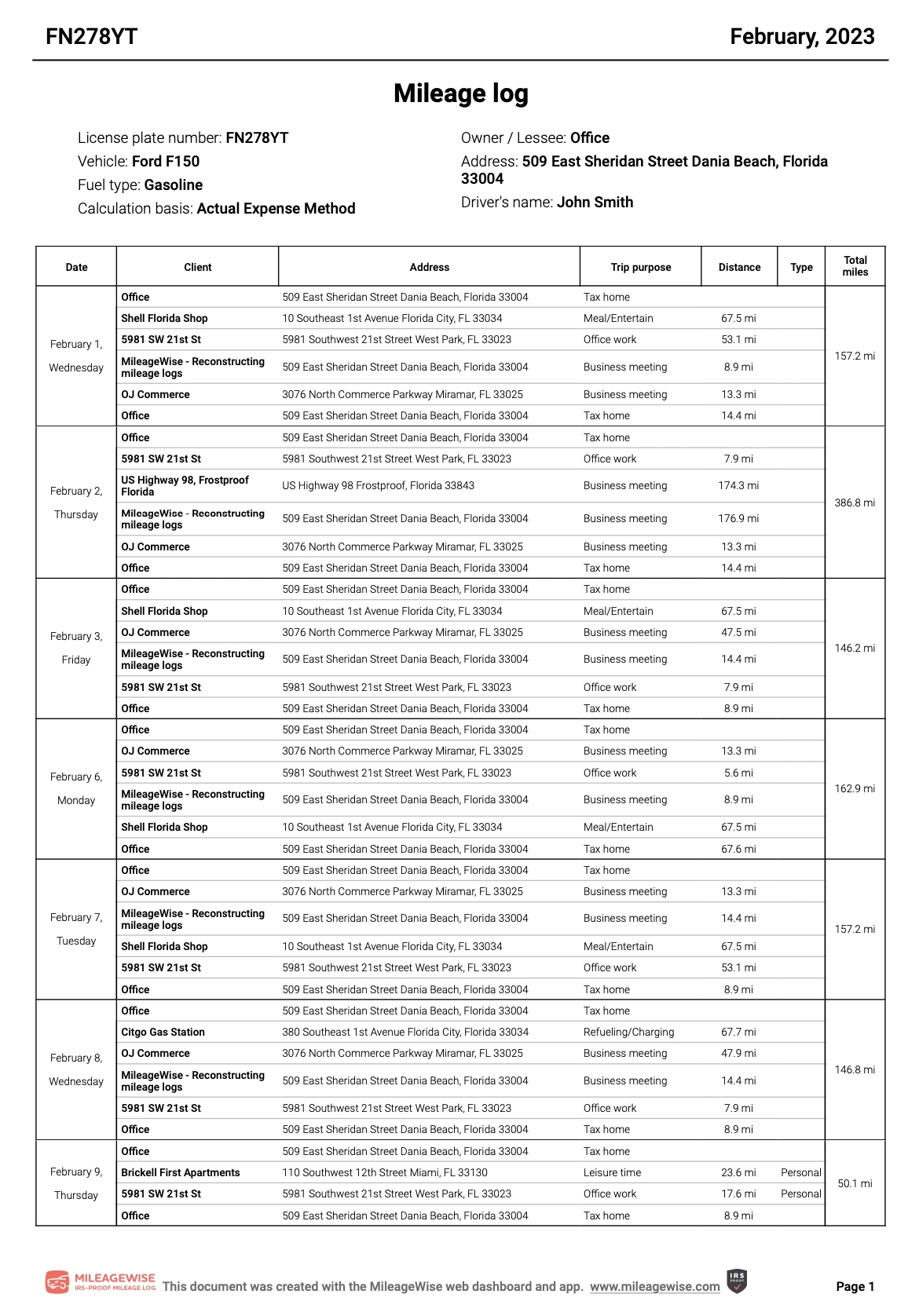

A mileage log is more than just a record of distances traveled. It’s a crucial tool for managing business expenses and ensuring you’re reimbursed accurately or claiming the right tax deductions. These logs should detail every business-related trip, including the date, destination, purpose, and miles covered.

The Importance of Accurate Mileage Tracking

Tax Deductions

Accurate mileage logs are essential for claiming deductions on your tax returns. The IRS requires detailed documentation of business travels to allow these deductions.

Expense Management

For self-employed individuals and businesses, tracking mileage helps in budgeting and financial planning, ensuring that vehicle-related expenses are accounted for.

Reimbursements

Employees who use personal vehicles for business purposes can use mileage logs to claim reimbursements from their employers.

Creating a Mileage Log: What to Include

Your mileage log must be detailed and include:

- Date of the Trip

- Starting Point and Destination

- Purpose of the Trip

- Vehicle Used

- Total Miles Covered

Choosing Between Standard Mileage and Actual Expenses

When it comes to tax deductions, you have two choices:

Standard Mileage Deduction: This involves multiplying your total business miles by the IRS’s standard rate. More on this here.

Actual Expense Method: Here, you deduct all car-related expenses, like gas, repairs, insurance, and depreciation. More on this here.

Each method has its pros and cons, and your choice will depend on which option yields the higher deduction.

Tips for Effective Mileage Tracking

Daily Tracking: Make it a habit to log your miles daily to avoid missing out on any trips.

Using Technology: Apps and digital tools can automate the tracking process, saving you time and increasing accuracy.

Back-Up Records: Always have a backup, like a paper log or digital copies, in case of technological failures.

How MileageWise Can Help

MileageWise offers innovative solutions to streamline the mileage reporting process. Their Mileage Log Template for Google Sheets and Mileage Log Samples are designed to simplify record-keeping. These tools offer:

- Customizability: Adapt the templates to your specific needs.

- Ease of Access: Update your logs from anywhere, anytime.

- Accuracy: Reduce the risk of errors in your mileage reports.

Here is a sample of an IRS-Proof mileage log created by MileageWise:

Final Thoughts

Effective mileage reporting is a vital aspect of professional life for many. By utilizing tools like MileageWise and following best practices, you can ensure compliance, optimize tax deductions, and manage expenses more efficiently. Remember, a well-maintained mileage log is not just a record—it’s a financial asset.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!