Have you lost track of past trips for your mileage log? MileageWise will help you get them back!

WHEN THE CLOCK IS TICKING...

Do you have to create your mileage logs for tax deduction in a short period of time? Are you in a pinch? Do you barely have any data? Creating IRS-Proof mileage logs might seem to be a complex task, especially under pressure.

THE DEVIL IS IN THE DETAILS

Traditional mileage tracker apps, Excel sheets, templates, or samples can’t help you in this situation. Handing in a mileage log with trip gaps or contradictions may result in a hefty fine from the IRS. If you have trips to import from Google Timeline, you’re already in a better situation.

CREATE GAP-FREE MILEAGE LOGS IN 7 MINS

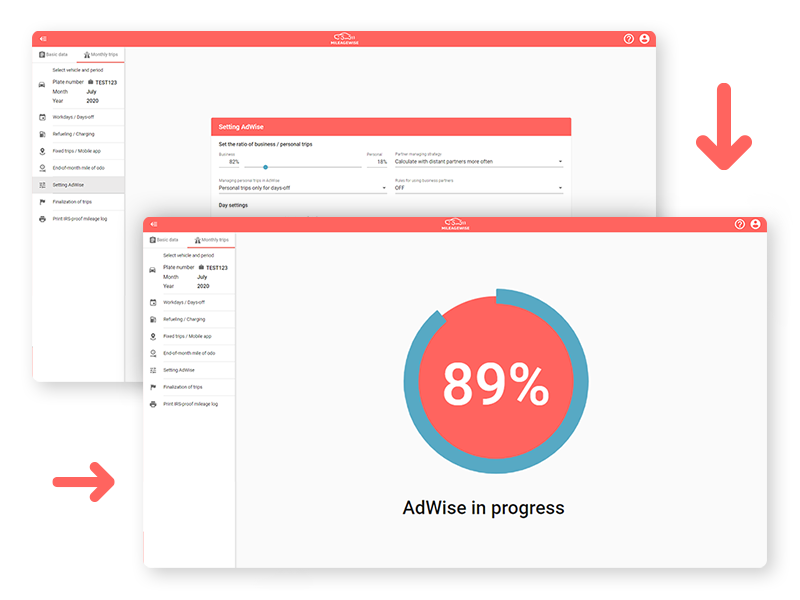

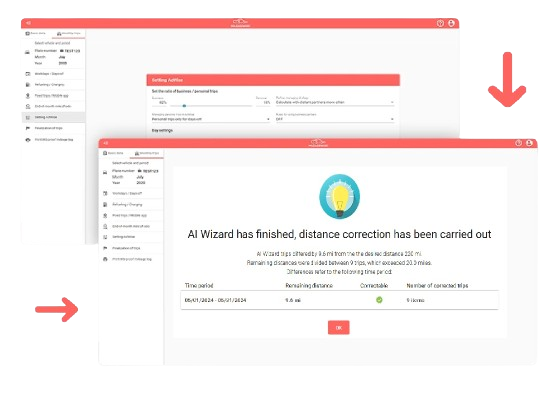

MileageWise’s AI Wizard function gives you trip recommendations for filling trip gaps that were created during manual trip recording or a trip import. Set up AI Wizard in a few seconds to your liking and MileageWise will auto-populate trips into your mileage log, based on previously visited locations and your clients’ addresses.

Your log - Just as you like it

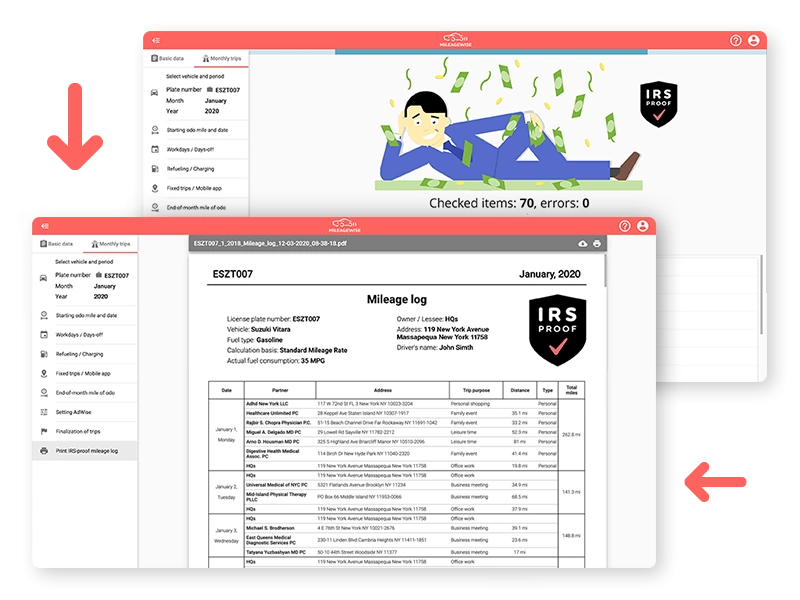

MileageWise offers several solutions to create personalized results. Whether you need recurring trips, a maximum number of client visits or miles traveled a day, or a log to back up a certain amount of deduction, MileageWise can do it all. Download your IRS-compliant log in Excel (xls), CSV or PDF and maximize your deductions!

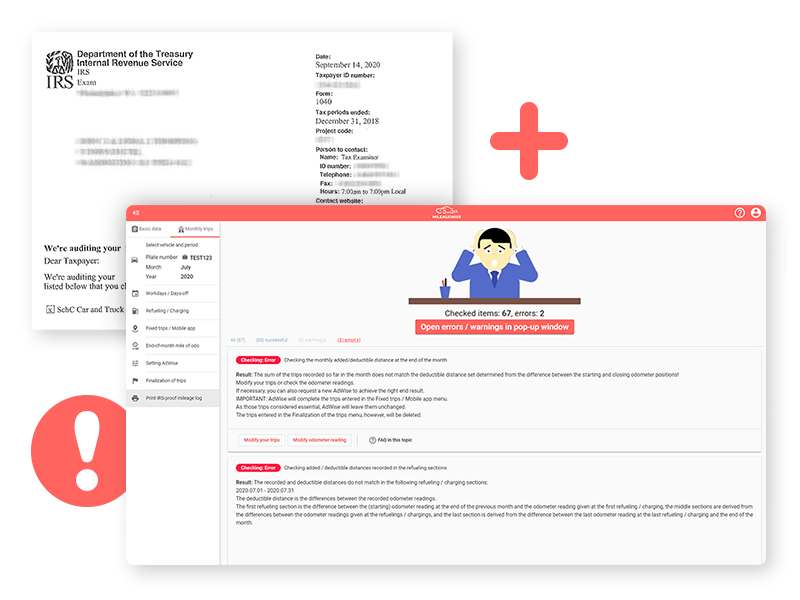

“DOES THE IRS APPROVE OF IT?”

The software’s built-in IRS auditor checks and corrects 70 logical contradictions in your mileage log before letting you print it – this ensures that your mileage report is 100% IRS-Proof. As stated in Publication 463, documentary evidence recorded retrospectively is also adequate.