Home » Log Mileage for Taxes Effortlessly in 2025 » Mileage Log Sample & Your Guide to Easy Tracking

Last Updated: June 23, 2025

Are you looking for a mileage log sample? If you do, it’s because you know how crucial it is to track your driving for tax deductions or reimbursements. Getting started with a sample is a fantastic way to grasp the requirements, see a clear structure, and begin your journey toward stress-free, IRS-compliant mileage tracking. You can also find free samples below. Let’s dive in!

Table of Contents

What is a Mileage Log and Why Do You Need One?

A mileage log is simply a detailed record of your vehicle’s trips. Logging mileage is crucial for individuals and businesses aiming to track vehicle use for tax purposes, reimbursement claims, or business accounting. It helps you keep organized and can save you a bundle.

Definition and Common Uses

Think of a mileage log as your car’s diary, specifically focused on its movements. It’s used to reimburse trips for:

- Business Travel: Deducting costs for client visits, supply runs, or trips to job sites.

- Charitable Purposes: Tracking miles driven for volunteer work.

- Medical Reasons: Recording trips to doctors, hospitals, or pharmacies for medical care.

Who needs a mileage log?

Almost anyone who uses a vehicle for work or contributes to a business. This includes:

- Employees seeking reimbursement from their company.

- Freelancers and self-employed individuals.

- Small business owners.

- Gig economy workers (think rideshare drivers or delivery services).

- Companies with fleets or employees who drive for work.

The IRS (Internal Revenue Service) has clear rules about what makes a mileage log acceptable. Without one, you could miss out on thousands of dollars in deductions or face problems in an audit.

Why a Mileage Log is a Must-Have

Having an accurate mileage log isn’t just about good record-keeping; it’s about protecting your finances.

- Tax Deduction Eligibility: This is huge! You can deduct the cost of using your car for business, medical, or charitable purposes. You can’t claim these deductions if you don’t track your miles.

- IRS Audit Protection: An audit can be stressful. A well-maintained mileage log acts as irrefutable evidence of your driven miles. The IRS often scrutinizes vehicle expense deductions, so a strong log can save you a lot of headaches.

- Employer Reimbursement: If your employer reimburses you for mileage, a clear log ensures you get paid back accurately and on time.

- Business Tracking: It helps you understand your operational costs and can inform decisions about vehicle use and efficiency.

In fact, accurate logs can yield business tax deductions worth thousands of dollars annually. Small businesses often save $2,500–$3,000 per year just by diligently logging every mile.

What Should a Compliant Mileage Log Include?

To be considered IRS-compliant, your mileage log needs specific details for each trip. This isn’t just a suggestion; it’s a requirement to avoid issues during an audit.

IRS-Required Fields for Your Mileage Log

Your mileage log sample should always feature these key pieces of information:

- Date of Trip: When did the trip happen?

- Starting Location and Destination: Where did you start, and where did you go? Be specific.

- Purpose of the Trip: Was it business, medical, or charitable? Why did you make this trip? For example, “Meeting with client John Doe at ABC Co.”

- Total Miles Driven: Calculated from your odometer readings.ű

- Odometer Readings (Start and End of the year): Crucial for determining exact mileage.

- Vehicle and Driver Identification: Which vehicle was used, and who drove it?

It’s best if you log your trips as they happen, or at least very close to the time they occur (e.g., daily or weekly). Don’t wait until tax season to try to remember all your trips from a year ago. That’s a recipe for inaccuracies and audit flags!

For a deeper dive into the rules, check out the IRS’s official publication.

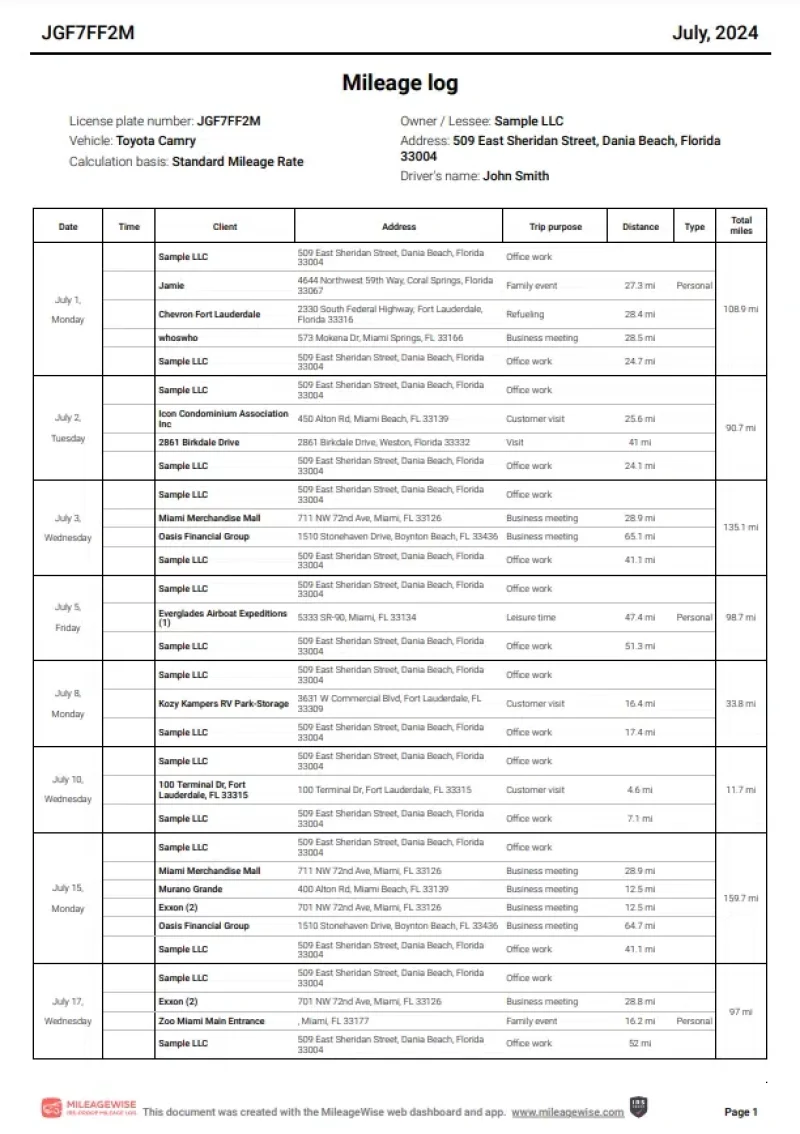

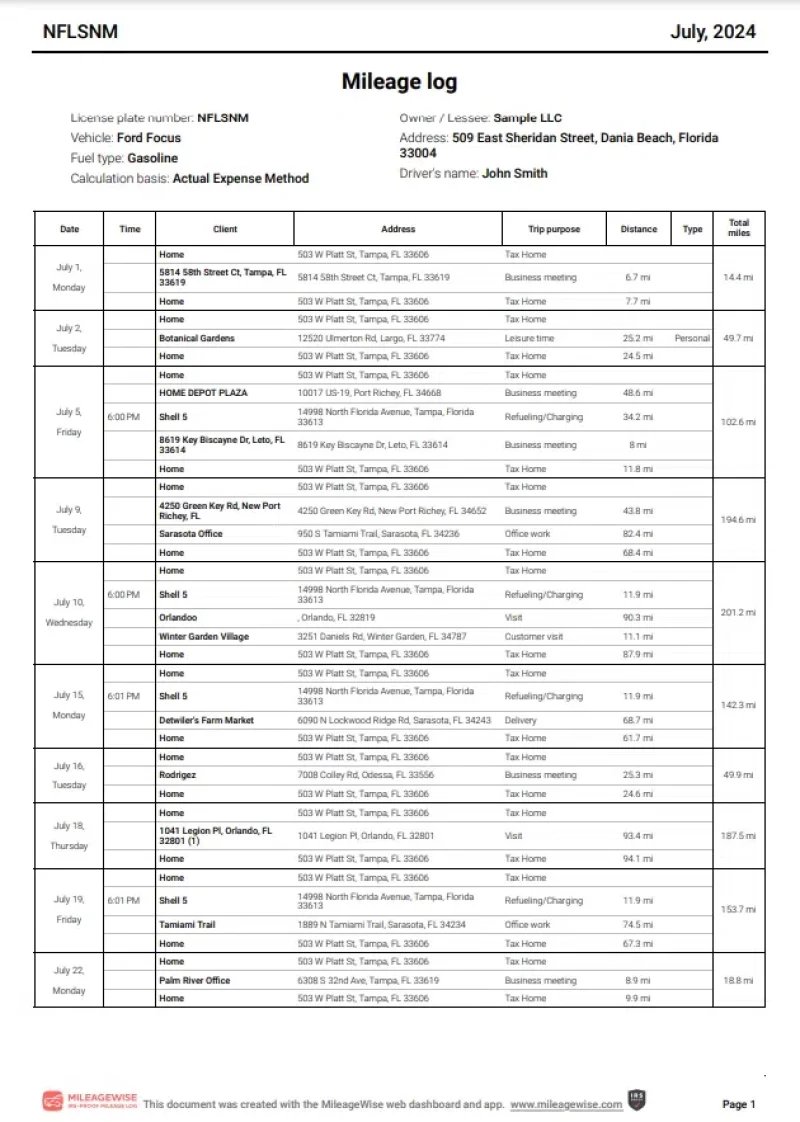

Free Mileage Log Sample

Now that you know why you need a mileage log and what it should contain, here are some simple mileage log samples to look at:

MileageWise: Your Ultimate Solution for Accurate Mileage Logs

So, you’ve seen what a mileage log sample looks like and why it’s so important. But managing these logs manually, day in and day out, can feel like a heavy burden. This is where MileageWise steps in, offering innovative, user-friendly solutions that simplify your life and maximize your tax deductions. We understand the challenges of maintaining accurate, IRS-compliant mileage logs. That’s why we’ve developed tools that not only meet every IRS requirement but also save you time and provide peace of mind.

MileageWise offers two primary solutions tailored to your specific needs: a mobile app for real-time tracking and a powerful dashboard for retroactive log creation:

Mobile App for Seamless Mileage Tracking

Our mobile app makes tracking effortless. Choose from multiple automated tracking options, set it up quickly, and forget about manual entries.

- Automatic Mileage Tracking: Let the app do the work! Choose from 3 automatic tracking modes.

- Quick Setup: Get started in minutes.

- Ad-Free Experience: No annoying pop-ups or distractions.

- Data Safety: Your privacy is always respected.

Dashboard for Retroactive Log Creation

Life gets busy, and sometimes, you forget to track trips. MileageWise’s dashboard is a game-changer for creating accurate logs even if you’re playing catch-up.

- Google Maps Timeline Integration: You can import your Google Location History directly into MileageWise. From there, it’s incredibly easy to manage your past trips and generate precise logs. No other competitor offers this seamless integration.

- AI Recommendation Wizard: Our exclusive AI Wizard reconstructs past trips, fills in any missing data, and ensures your log is 100% IRS-compliant. It’s like having a personal tax assistant.

- Comprehensive Trip Management: Easily categorize trips, add notes, and refine your data.

Unique Benefits

MileageWise goes beyond just tracking capabilities. We offer benefits designed to provide long-term value and support:

- Lifetime Plans: We were the first in the industry to offer lifetime deals. Pay once, and enjoy our services forever, saving you money on recurring fees.

- Comprehensive Support: Access to a dedicated customer service team and a wealth of resources to help you master the platform and maximize your deductions.

Try MileageWise for free for 14 days. No credit card required!

AI Logs & Google Timeline Import

A Tax Savings Success Story: Meet Alex

I’m a freelance contractor constantly on the move. For years, my mileage tracking was a mess. I had scribbled notes and had to guess my odometer readings, which I pieced together with the help of basic mileage log samples. I knew I was losing money because I drove way more than what I wrote down. And worrying about an audit didn’t help either.

Then a friend told me about MileageWise. I was skeptical, especially about fixing my past mileage log mess. But the Google Maps Timeline integration blew me away. I imported my location history, and trips I’d forgotten about popped up. Their AI Wizard cleaned it up into a decent mileage log. What used to take me days took just an afternoon. I realized this tool actually understood freelancers like me. So I got my biggest refund yet.

Final Tips: Staying Compliant Year-Round

Keeping your mileage log perfect isn’t a one-time job; it’s an ongoing commitment. But with the right tools, it’s easier than you think.

- Start Now: Don’t wait! Download a mileage log sample or sign up for MileageWise today.

- Log Religiously: Make it a habit to record every trip. Automatic trackers from MileageWise make this effortless.

- Back Up: If you’re using physical logs, make copies. If digital, ensure regular backups.

- Review Regularly: Glance over your log weekly or monthly to catch any missing info.

- Automate When Possible: Solutions like MileageWise remove the burden of manual logging, ensuring accuracy and compliance.

By taking these steps, you’ll not only save time and stress during tax season but also maximize your legitimate tax deductions and feel confident knowing your records are audit-proof. Get started with your mileage log sample today and experience the peace of mind that comes with accurate tracking!

FAQ

Is there an official IRS mileage log template or sample?

No, the IRS does not provide an official template. Many reputable tax websites and apps offer free basic mileage log samples.

Can I use a digital app for keeping a mileage log, or does it have to be on paper?

Yes, digital apps are acceptable as long as they record the necessary information, and you can produce a printable report if needed. The IRS accepts electronic records as long as they are accurate and complete.

Where can I download a free mileage log sample?

Many mileage tracker companies offer simple mileage log samples. Here is MileageWise’s samples:

- for the standard mileage rate method

- for the actual expense method