IN NEED OF a Mileage log Book?

Do you have to keep ongoing Mileage logs or you have to Retrospectively Recover your Past Miles? You don’t know where to Start, what to Use? Would it be Useful if the Mileage log Book that you use would Know the Rules and Pitfalls of Mileage Logging so you would not have to learn Everything on your Own?

Be careful with manual logs!

Keeping your Mileage logs on a Mileage Log Book / Excel / Template / Sample can take 3-5 hrs/Month. Not to mention that the IRS can request ALL of your Business Data: Business Expense reports, Traffic cams, Tolls, Fees, etc. If these documents won’t match with your Mileage logs an IRS Fine can be 50% of your Yearly Income!

CHOOSE THE SMARTEST SOLUTION

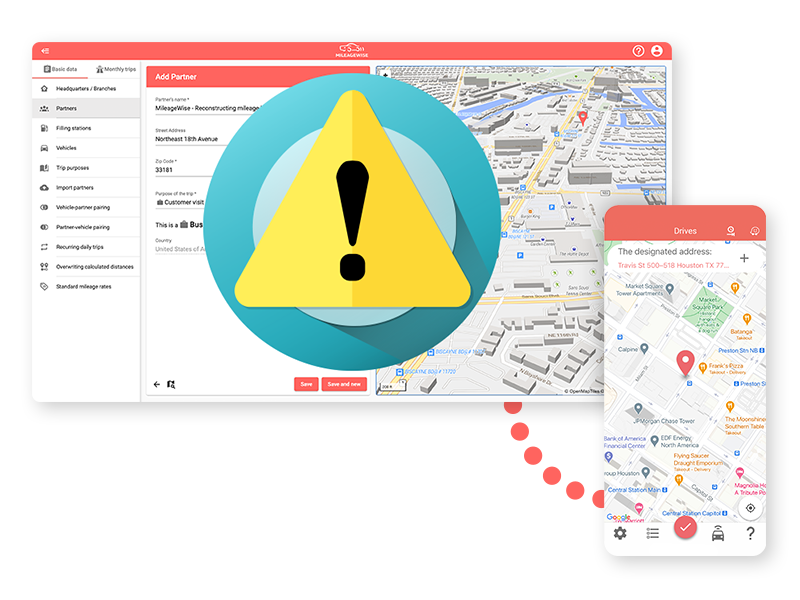

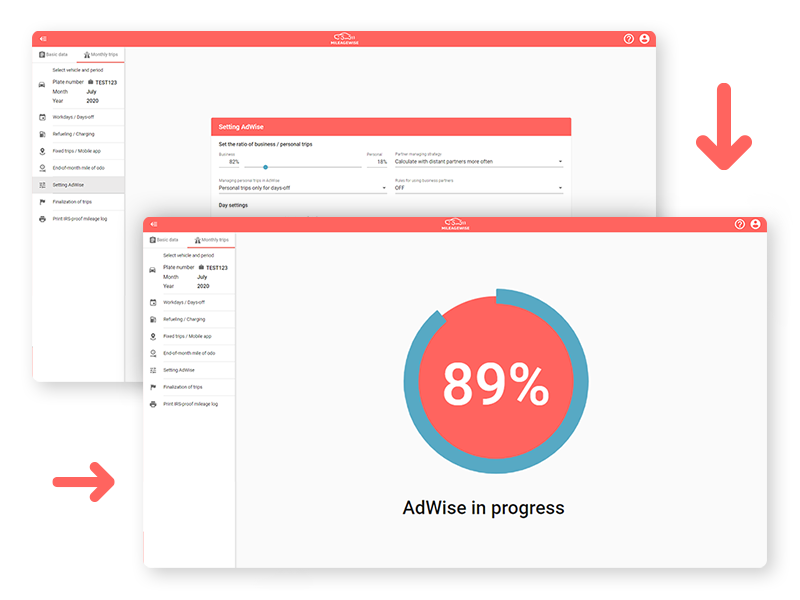

Track your trips with our Mobile App and at the end of the month use the Web Dashboard where The Built-In IRS Auditor checks and corrects 70 Logical Conflicts. For Past, Lost, or Possible Mileage Recovery just set a few Parameters and our AI Wizard technology will fill in the Gaps for an IRS-Proof Result!

“GREAT, BUT SOUNDS EXPENSIVE…”

Take Advantage of our 14-Day Free Trial Period, Try ALL of our Unique Features! You will see for Yourself that by creating IRS-Proof Mileage logs in 7 mins/Month and saving Yourself from the Consequences of Inaccurate Mileage Logs, MileageWise becomes the cheapest solution on the Mileage Log Market.