Calculate How Much You Can Save with MileageWise:

A little lost about reimbursement?

Reimbursing your Employees for their Business miles costs a lot More than expected? Their Claimed Miles are not related to Company activities? Is it time-consuming to identify what was real Business Mileage? On average over $3,000 / vehicle is lost Every Year due to Fraudulent Claims.

Out with the old, in with the new

Forget about Paper Mileage Logbooks and Manual Recording. Keeping Mileage logs on Paper or with Traditional Software Solutions can take 3 hrs /Vehicle /Month. Reduce Mileage Reimbursement Costs and Save Time for your Team by using the Mileage Tracker App’s Automatic Tracking Methods.

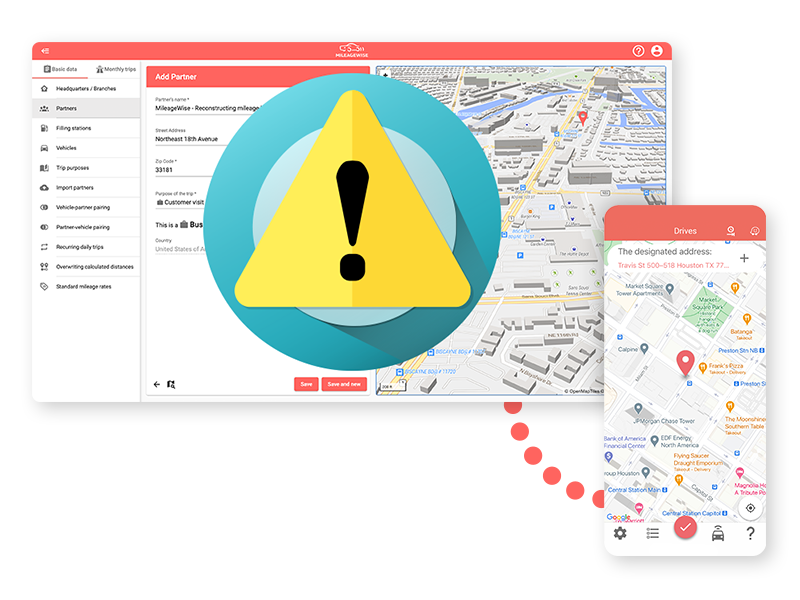

TAKE back CONTROL of your Expenses

Set User roles for your Employees and Admin roles for the Management with the User Management function. Employees track their miles with the Mobile App, Admins monitor their activity from the Web Dashboard. You can be sure that the Reimbursement you pay is for Company Mileage only.

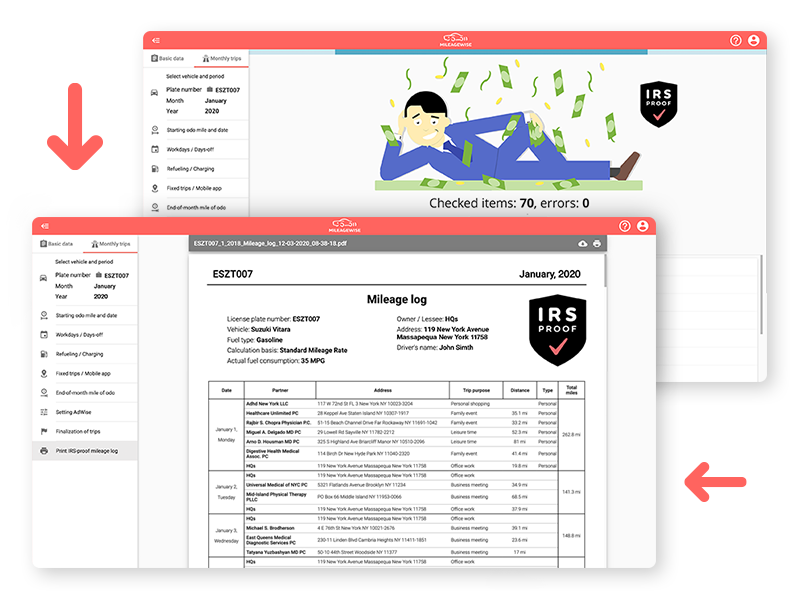

STAY IRS-PROOF while saving money

The Software calculates with optimal distances to maximize Reimbursement Savings for your Company and at the end of the month, the Built-In IRS Auditor will check 70 Logical Conflicts in your Employees’ Mileage logs for an IRS-Proof Result!