Mileage reimbursement is the payment that businesses provide to employees for using their personal vehicles for work-related travel. Understanding how it works can greatly benefit both employees and employers.

If you drive a vehicle for your employer, you may be wondering “How much should I be reimbursed for mileage?” On the other hand, if you are an employer, you’ll need to ensure your employees will get paid for miles driven when they use their personal vehicles for work-related travel and expect fuel mileage reimbursement.

Luckily, we can help. In this article, we focus on the specifics around car mileage for business purposes and the employee rules. We’ll also delve into the best practices from both an employee’s and an employer’s point of view, covering the full spectrum with IRS-Proof solutions.

Automate Your Company Mileage Reimbursement

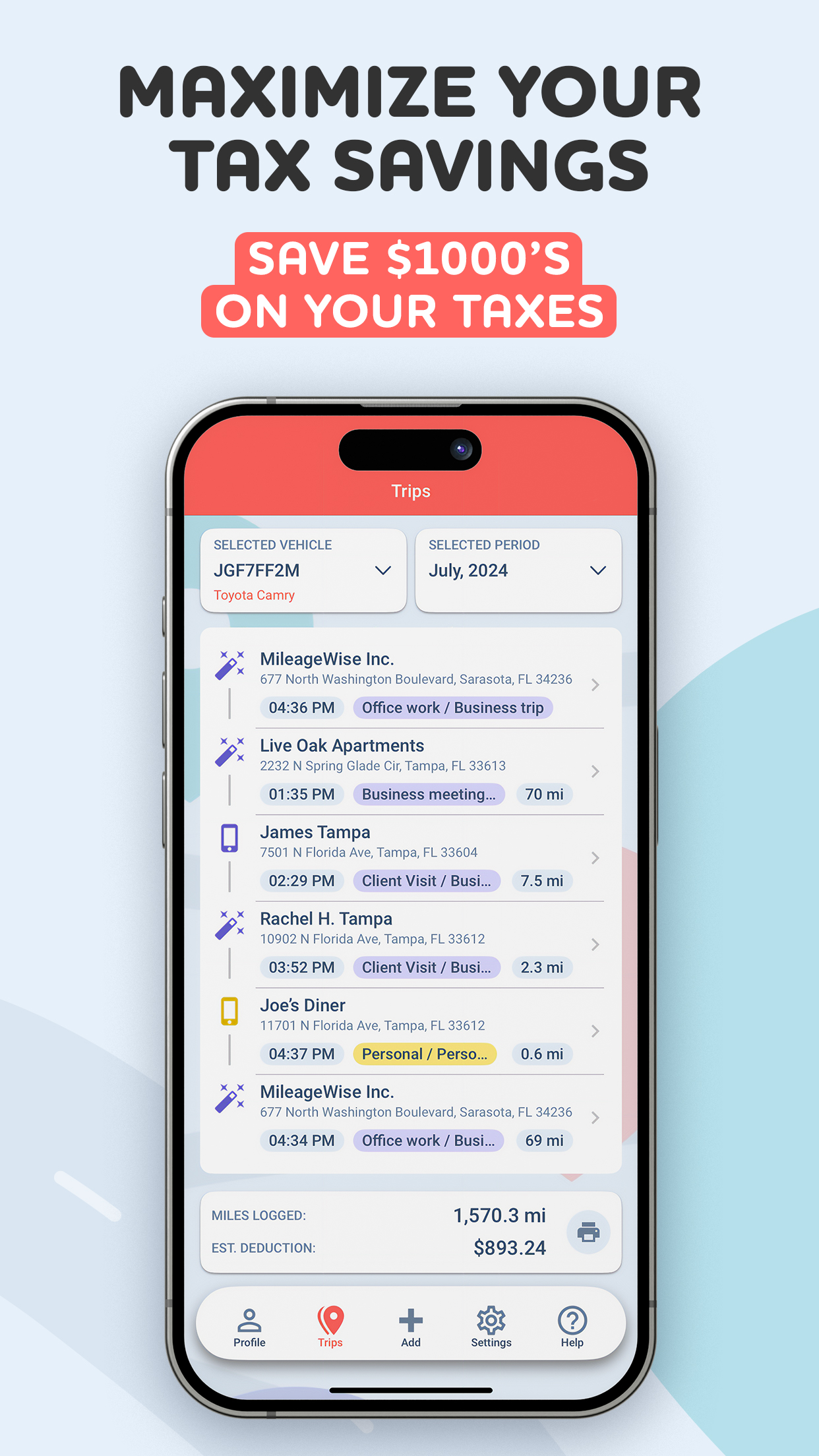

MileageWise: Tracks trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-Powered Mileage Recovery: The AI Wizard helps reconstruct past mileage logs, filling gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 logical errors in logs, ensuring they meet IRS standards for tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Try it for free for 14 days. No credit card required!

Table of Contents

What is Mileage Reimbursement?

This overarching term refers to several possible situations that can occur for employers, independent contractors, and employees. Essentially if you are an employee or you own and run a business, one of the following scenarios is likely:

- Employees in the business use a privately owned vehicle for business-related activities.

- Employees are provided with a company car, which belongs to the business

- You are self-employed

We’ll cover each category in more detail a little later, though the above scenarios account for all possible contexts in which mileage reimbursement is relevant.

Let’s Calculate Your Mileage Deduction Based On Your Approximate Mileage

If you are an employer use our advanced mileage reimbursement calculator.

What does Mileage Reimbursement Cover? Does it include gas and tolls?

While people often ask “What is a mileage tax?” or “How to deduct mileage on taxes?”, it is essential to first understand what mileage reimbursement actually covers, as it is only after this question is answered that the aforementioned questions can truly be answered.

In short, mileage reimbursement covers the numerous costs of operating a vehicle for business reasons. That means oil, gas, and general maintenance as a result of wear and tear are covered – as are parking fees and tolls, depending on what your employer decides to include.

To delve a little deeper, we’ll first need to go through the rules of mileage reimbursement.

The Rules: Creating a Mileage Reimbursement Policy

First off, it’s worth mentioning that it is not mandatory for an employer or business to even have a mileage reimbursement policy, except in the state of California, Massachusetts, and Illinois. It is, however, recommended that employers offer some kind of plan to their employees – driving a vehicle for work is a large expense, and most employees expect some kind of reimbursement on their fixed and variable costs as they are not eligible for an itemized deduction since the 2017 Tax And Jobs Cut (TCJA).

Nowadays, if employees don’t get reimbursed for their mileage, their salary is often effectively and drastically reduced, and those employees may look for work elsewhere. This is why it is typically the case that employers do provide some kind of plan, and there are many plans to choose from. The most common thing to do is simply to use the Internal Revenue Service’s (IRS) standard mileage rate, which accounts for both variable and fixed costs.

Mileage Reimbursement of Employees for the year 2024

Tax Cut and Jobs Act of 2017 temporarily abolished various personal itemized deductions until December 31, 2025, prohibiting taxpayers from claiming deductions for unpaid employee travel expenses. Previously, various personal deductions of over 2% of Adjusted Gross Income (AGI) had been deductible.

Many companies use the IRS rate to reimburse employees for business trips by car. Mileage Reimbursement is a profitable financial solution for both the employer and the employee, depending on what method the parties use:

- Car allowance (fixed monthly lump sum)

- Standard mileage rate

- FAVR (Fixed And Variable Rate), which is the combination of the first two

Claiming Mileage Reimbursement for Previous Years

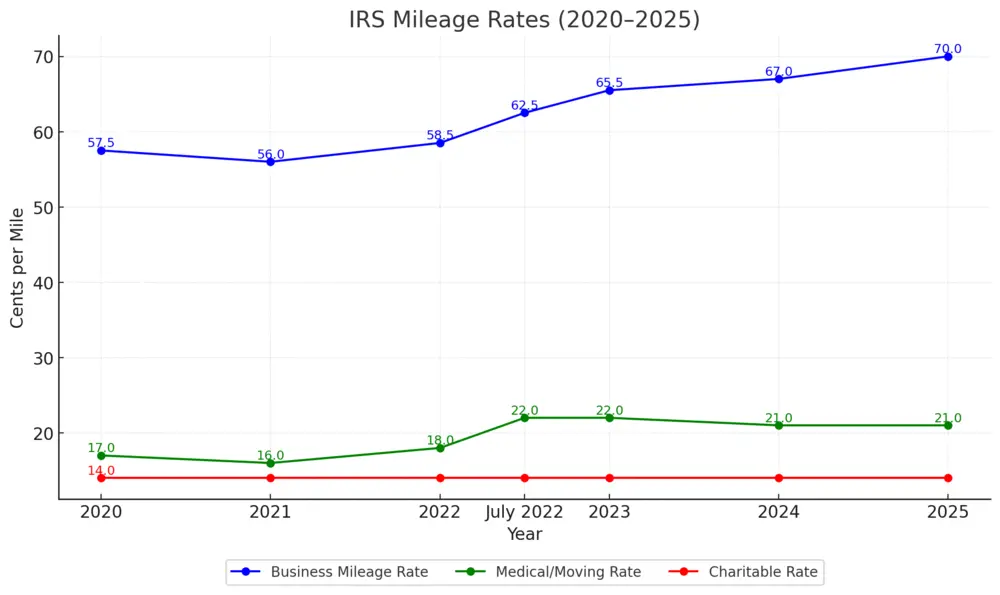

You might be surprised to learn that you can claim a mileage deduction for 3 years retrospectively. You can amend your tax returns to claim additional deductions, such as mileage, within three years from the date you filed the original return or within two years from the date you paid the tax, whichever is later. See the change of IRS Rates in the past years you might still be eligible for:

Electrical vs. Gas Vehicle Reimbursement

The reimbursement rate for electric cars differs from that of traditional gas-powered cars due to factors such as energy costs and depreciation. While gas prices fluctuate, electricity costs are often more stable. Furthermore, the wear and tear on EVs and the overall maintenance required are different from gas vehicles, leading to unique reimbursement needs.

Factors Affecting Electric Car Mileage Reimbursement Rates

Energy Costs and Efficiency

Electric cars are generally more energy-efficient than gas-powered vehicles. The cost of charging your car, whether at home or at public stations, directly affects the reimbursement rate. Charging prices depend on location and electricity rates, making it important to track these costs closely.

Depreciation Considerations

Just like traditional vehicles, electric cars depreciate over time. However, EVs often have a different depreciation curve due to factors like battery life. Depreciation is an important factor in setting a fair electric car mileage reimbursement rate.

Maintenance and Repair Expenses

Electric vehicles have fewer moving parts than gas-powered cars. That means lower maintenance and repair costs. This difference should be considered when determining a fair mileage reimbursement rate for EVs.

It is also important that when you do mileage for your employer, that mileage must be connected to the business in some way. As an employee, you need to have incurred and consequently paid deductible expenses while performing various services for your employer.

Using a Custom Cost-Per-Mile Mileage Rate

While many employers certainly just use the federal rate, any business owner can also choose to use their own custom cost-per-mile rate or a fixed amount which is referred to as a car allowance. When a car allowance is given to an employee, it functions as an upfront payment that is meant to cover all of the employee’s vehicle costs. While many businesses still use this method, it can sometimes be problematic in the face of a constantly changing economy.

What’s more, some employees come up short with a car allowance because of depreciation, exorbitant service costs, or simply higher prices across the board. If you already receive a car allowance from your employer and it is insufficient to cover all of your vehicle costs, then it might be worth discussing a change of policy with whoever is responsible for reimbursement for mileage at your company.

Fixed and Variable Rate (FAVR)

FAVR is an alternative that many employers use – it incorporates a fixed amount intended to pay fixed costs such as lease payments, insurance premiums, or depreciation. It also contains a variable travel rate or cost-per-mile component – this reflects your variable costs such as gas, oil, and maintenance.

We should point out that under the FAVR reimbursement the cost-per-mile component is likely to be significantly lower than the IRS’s federal mileage rate, simply because that rate incorporates both fixed and variable costs and a general assessment of the costs involved in the operation of a vehicle.

Level Up Your Mileage Tracking For Reimbursements

Automatic Tracking: Tracks trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-Powered Mileage Recovery: The AI Wizard helps reconstruct past mileage logs, filling gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 logical errors in logs, ensuring they meet IRS standards for mileage tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

Mileage Reimbursement Scenarios

As we mentioned earlier, there are a number of scenarios that are possible relating to mileage reimbursement. Let’s examine each situation in more detail. We will also consider the best arrangement for each one.

You are Self Employed

If you are self-employed, you do not fit into the usual category for mileage reimbursement. However, the IRS will reimburse you for your mileage. You just need to submit an accurate mileage log to them. This can be a relatively simple endeavor. You should take a look at the IRS mileage rate 2024, which is essentially the standard mileage rate of 67 cents per mile driven for business purposes.

This is indeed the most common way for independent contractors to claim tax deductions on their mileage, and it requires you to keep a comprehensive, IRS-Proof mileage log of your trips, which you then submit to the IRS. Inaccurate mileage logs can lead to audits and the rejection of your mileage log.

You Drive a Company Car to Work

If you drive a company car for work, it is likely that you must pay for some variable costs related to that vehicle as you use it – for example gasoline and servicing fees. Often, employers may take care of the fixed costs involved in that vehicle, which means that the cost per mile you can claim through your employer is likely to be subject to a substantial reduction when compared to the IRS’s standard mileage rate. Exactly what that cost per mile mileage rate ultimately depends on what an employer decides.

You Drive a Personal Vehicle for Work

This scenario is also especially common among employees that drive a vehicle for business purposes, usually as a part of a smaller business or enterprise company. Typically, employers use one of several methods:

- A cost-per-mile type of reimbursement, e.g. the standard federal mileage rate

- A lump sum as a car allowance

- FAVR, which is intended to cover both variable and fixed costs

As we’ve already discussed here today, there are benefits and disadvantages to each method, though the federal mileage rate and FAVR are generally the fairest to employees.

You Are An Employer

Let’s say you run a restaurant and you also offer home delivery services. As an employer, you want to ensure that your mileage reimbursement policy not only meets legal requirements but also promotes fairness and efficiency. Here are some best practices to consider when creating or revising your company’s policy, along with answers to common questions:

Best Practices for Employers:

A. Customize Rates (If Applicable):

- Consider customizing mileage reimbursement rates based on factors like location and job roles. This can ensure that employees in high-cost areas or those with extensive travel responsibilities receive fair compensation.

B. Clear Communication:

- Communicate your mileage reimbursement policy clearly to all employees. Provide written guidelines and offer training or resources to help them understand the process.

C. Streamline Documentation:

- Encourage employees to use mileage tracking apps or templates to streamline documentation. Digital tools can reduce paperwork and errors, making the process more efficient for everyone.

D. Regular Audits:

- Periodically audit mileage reimbursement claims to ensure compliance with your policy and tax regulations. This can help identify any discrepancies or issues that need correction.

E. Stay Informed:

- Stay updated on changes in tax laws and regulations related to mileage reimbursement to ensure your policy remains compliant. Consulting with tax professionals can be beneficial.

By following these best practices and remaining attentive to your employees’ needs and evolving tax regulations, you can create a mileage reimbursement policy that benefits both your organization and your workforce. A well-designed policy not only saves costs but also fosters employee satisfaction and productivity.

.

Company Mileage Reimbursement

Reimbursement Alternatives For Employers

The IRS sets a mileage rate each year for businesses. For 2025, the standard mileage rate it’s 70 cents per mile.

But, businesses can also use other rates or methods:

- Custom mileage rate: Companies can pay a different rate than the IRS recommends.

- Actual Expense Method: Paying based on actual vehicle costs, like fuel, repairs, and insurance. This needs detailed expense records.

- Flat Monthly Stipend: A fixed amount, no matter the miles. It’s simple but might not be fair.

- Combination of Fixed and Variable Costs: In this case, a fixed amount is paid for regular costs, like depreciation and insurance, and an additional variable amount covers maintenance, fuel, oil changes, etc. This variable amount is usually determined according to mileage.

- Per Diem Allowance: A daily rate for travel expenses, often for business trips.

Each method has its pros and cons. The standard rate is easy but a flexible allowance might be more accurate for changing vehicle use.

Tax Implications of Company Mileage Reimbursement

Reimbursements under an accountable plan —where employees track and report mileage accurately—aren’t taxed. This helps both employees and employers. It lowers taxable income for employees and payroll taxes for employers. But, if you pay more than the IRS rate, the extra amount is taxed. Also, without proper mileage records, all reimbursements might be subjected to taxes.

Common Challenges in Company Mileage Reimbursement

Setting up a mileage reimbursement policy can be tough. Here are some common challenges for employers:

- Ensuring accuracy in mileage reporting: Use apps to avoid errors and keep records right.

- Managing costs: Watch how reimbursement affects your budget. Also, consider other options if needed.

- Compliance with legal regulations: Keep up with IRS and local laws on reimbursement.

- Handling disputes: Have a clear way to solve mileage reporting issues.

By addressing these challenges head-on, you can make a smooth reimbursement system that works for everyone.

How to Estimate your Mileage Reimbursement

Now let’s get into some examples which pertain to each of the above situations. We’ll take a look at each situation and a real-world example with the figures.

Self-employed

Gary drives his Audi TT for his private detective business which contracts with individual clients. As a part of this job, he must visit various locations on behalf of his clients – these trips would be constituted as business trips. Commuting to and from his place of residence to a client would not, however, constitute a business trip, and therefore should be logged as personal in his mileage log.

In total, Gary typically does around 27,000 miles for business purposes in a year, which means that under the standard mileage rate, he qualifies for a $18,090 rebate from the IRS.

Driving a company car for work

Jessica drives her company car – a Toyota Corolla – for a large IT consultancy firm that often visits clients to discuss projects and various other matters. Because her firm covers the fixed costs of the Corolla, the cost per mile rate offered by her employer for business purposes is just 50 cents per mile. Jessica mostly visits clients within her city, which means that she does a little less mileage than self-employed persons who drive long distances more frequently.

Last year, Jessica’s mileage totaled 9,000 miles, meaning that she was able to be paid $4,500 for mileage reimbursement by her employer – this money was also tax-free.

Driving a personal vehicle for work

Audrey works for a small marketing firm that provides advice on content strategy for a variety of businesses looking for more engagement on their online platforms. As part of the work, she has to drive to a number of locations, some of which are outside the city where she lives. In total, Audrey does around 15,000 miles per year, which, under the federal mileage rate, would qualify for $10,050 in mileage reimbursement from her employer.

However, Audrey currently receives a car allowance of just $6,000 per year from her employer – meaning that she misses out compared to other people in the industry who have mileage reimbursement plans more suited to their needs.

Audrey should probably talk to her employer about an alternative cost per mile rate – either to cover her fixed and variable costs or, to use FAVR, which would likely also prove favorable compared to her current situation.

How Does Mileage Tax and Reimbursement Work?

A big part of making sure your mileage reimbursement is tax-free is meeting the requirements of what the IRS calls an accountable plan. An accountable plan has to fulfill certain needs in order to be accepted, let’s examine the IRS’s requirements:

- Miles you drive must be in the context of business, i.e. you have to have incurred deductible costs while carrying out various functions in your role as an employee of a company.

- You need to inform your employer of your expenses within what is considered a reasonable period of time, stipulated as 60 days by the IRS.

- You have to return any mileage reimbursement money you have received in excess of what you needed within 120 days of when it was paid by your employer.

As long as these conditions are fulfilled, your mileage reimbursement money will usually be tax-free, though if that money exceeds the IRS’s federal mileage reimbursement rate then it will be counted as additional income on top of your salary, and that excess is also taxed by the IRS.

Effective Mileage Tracking Options

Fundamentally, there are three main choices: a paper-based logbook, Excel, or a mileage tracking app. These options are, however, not equal – an app will save you tons of time and money so that you can focus on the things in life that really matter to you. MileageWise Automatic Mileage Tracker App has 3 auto-tracking methods, an in-built IRS auditor, a Team Web Dashboard for companies, and numerous other features – check out all of our features.

Savvy employers often use an app like MileageWise’s – we offer a Team Web Dashboard where all employees can submit workflows and get paid for their mileage reimbursement quickly. Try MileageWise’s IRS-Proof mileage tracker app and its accompanying web dashboard free with all of the features for 14 days!

FAQ

What's the difference between mileage reimbursement vs a company car?

Mileage reimbursement involves compensating employees for the expenses they incur when using their personal vehicles for work-related travel. On the other hand, a company car is a vehicle provided by the employer for exclusive business use. While mileage reimbursement covers various expenses, a company car eliminates the need for employees to use their personal vehicles for work purposes.

When should a company consider offering a company car instead of mileage reimbursement?

Employers should consider offering a company car when employees require a dedicated vehicle for their job roles, and it’s more cost-effective or practical than reimbursing for mileage and gas. The decision may also depend on the nature of the job and the frequency of business travel.

Can employees receive both mileage and gas reimbursement?

Yes, some employers may choose to reimburse employees for both mileage and gas expenses. Mileage reimbursement typically covers a broader range of expenses related to using a personal vehicle for work, while gas reimbursement specifically reimburses employees for fuel costs. Employers can combine these approaches to ensure that employees are adequately compensated for all related expenses.

What is the FAVR vehicle program?

The FAVR (Fixed and Variable Rate) vehicle program is an IRS-approved method for reimbursing employees for the use of their personal vehicles for business purposes. It combines a fixed monthly allowance with a variable rate based on actual mileage. This program aims to provide more accurate and equitable reimbursements.

Is there a mileage reimbursement tracker that can help manage expenses efficiently?

Yes, there are several mileage reimbursement tracker apps and software solutions available. These tools make it easier for employees to record their mileage, track expenses, and calculate accurate reimbursement amounts. Employers can also benefit from using these trackers to streamline expense management.

How can I ensure I receive job mileage reimbursement?

To ensure you receive job mileage reimbursement, it’s essential to maintain accurate records of your business-related travel, including dates, distances, purposes, and expenses. Familiarize yourself with your employer’s reimbursement policy and submit your mileage reports promptly according to their guidelines. Open communication with your employer or HR department can also help clarify any uncertainties regarding reimbursement.

Does mileage reimbursement get taxed?

Generally, mileage reimbursement is considered non-taxable income for employees, provided it doesn’t exceed the IRS standard mileage rate. However, any reimbursement exceeding this rate may be subject to taxation. It’s essential for both employers and employees to be aware of the tax implications and reporting requirements.

Is mileage reimbursement required by law? Does a company have to pay for mileage?

Generally, employers are not legally mandated to offer mileage reimbursement, but it is often provided to cover the costs of operating a vehicle for business purposes. Exceptions are the states of California, Massachusetts and Illinois.

Why should my company have a mileage reimbursement policy?

A mileage reimbursement policy helps your organization manage expenses effectively, promote fairness among employees, and comply with tax regulations. It also provides clarity and consistency in how mileage-related expenses are handled.

Should I provide a company vehicle instead of reimbursing employees for using their cars?

The decision to provide company vehicles or reimburse employees for using their own cars depends on various factors, including budget, usage patterns, and tax implications. Carefully weigh the pros and cons to determine the best approach for your organization.