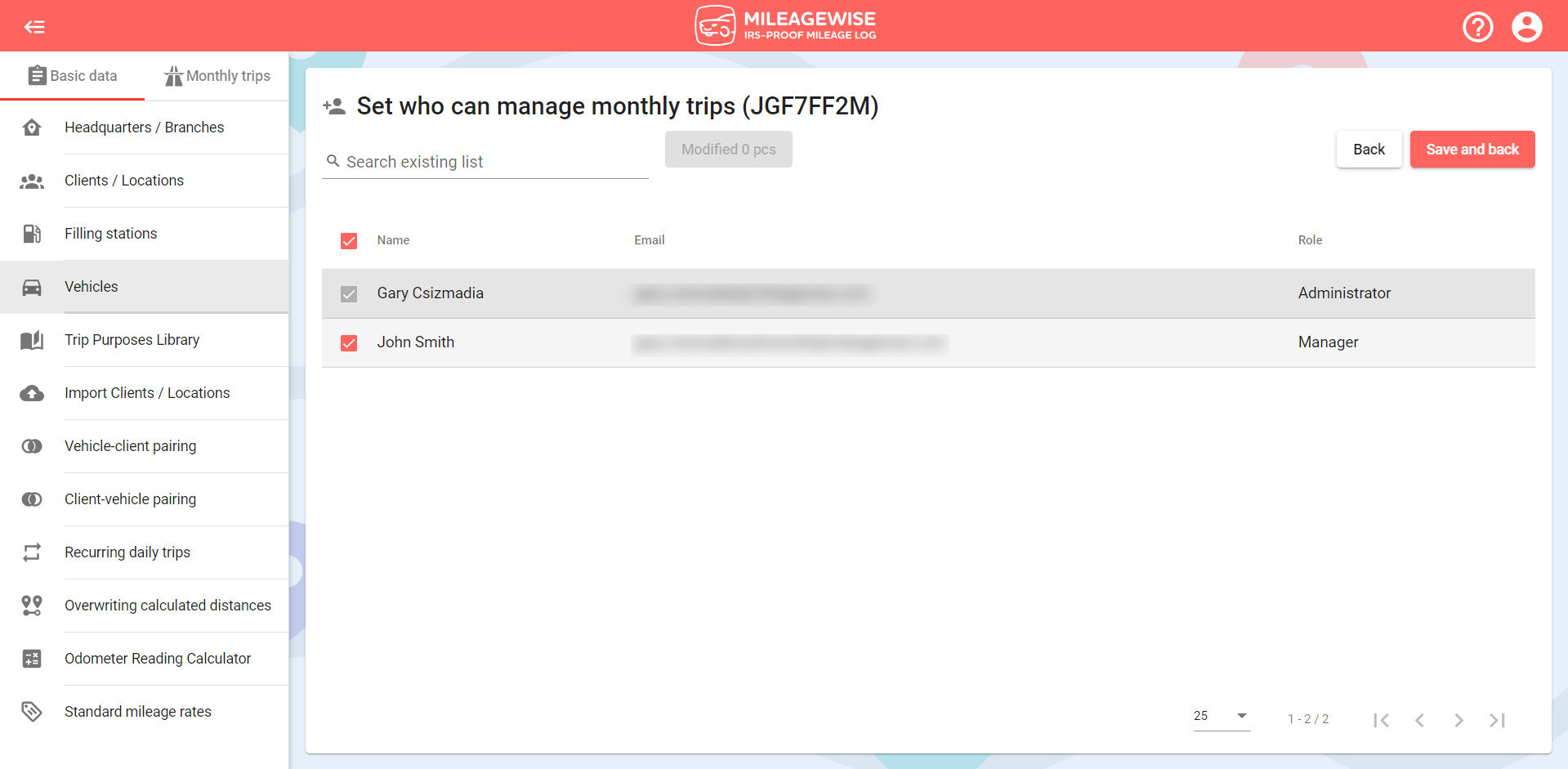

For multiple users, as an Administrator or Manager, you need to set up which users can work with which vehicle. Who can record and modify a particular vehicle’s monthly trip data, pair vehicles with clients, or set up the recurring daily trips function.

The Administrator and Manager have the authority to manage each vehicle, which cannot be changed.

After adding a new user, by default, the new user will not have permission to operate any vehicle and will not see them in the system. Once the authorization is set, the new user will only see the vehicle(s) he/she is entitled to.

After inviting a new user, as an Administrator or Manager, you don’t have to wait for them to activate their account by creating a password. We recommend you assign the new users to the vehicle(s) they will have access to right after sending out the invitation email.

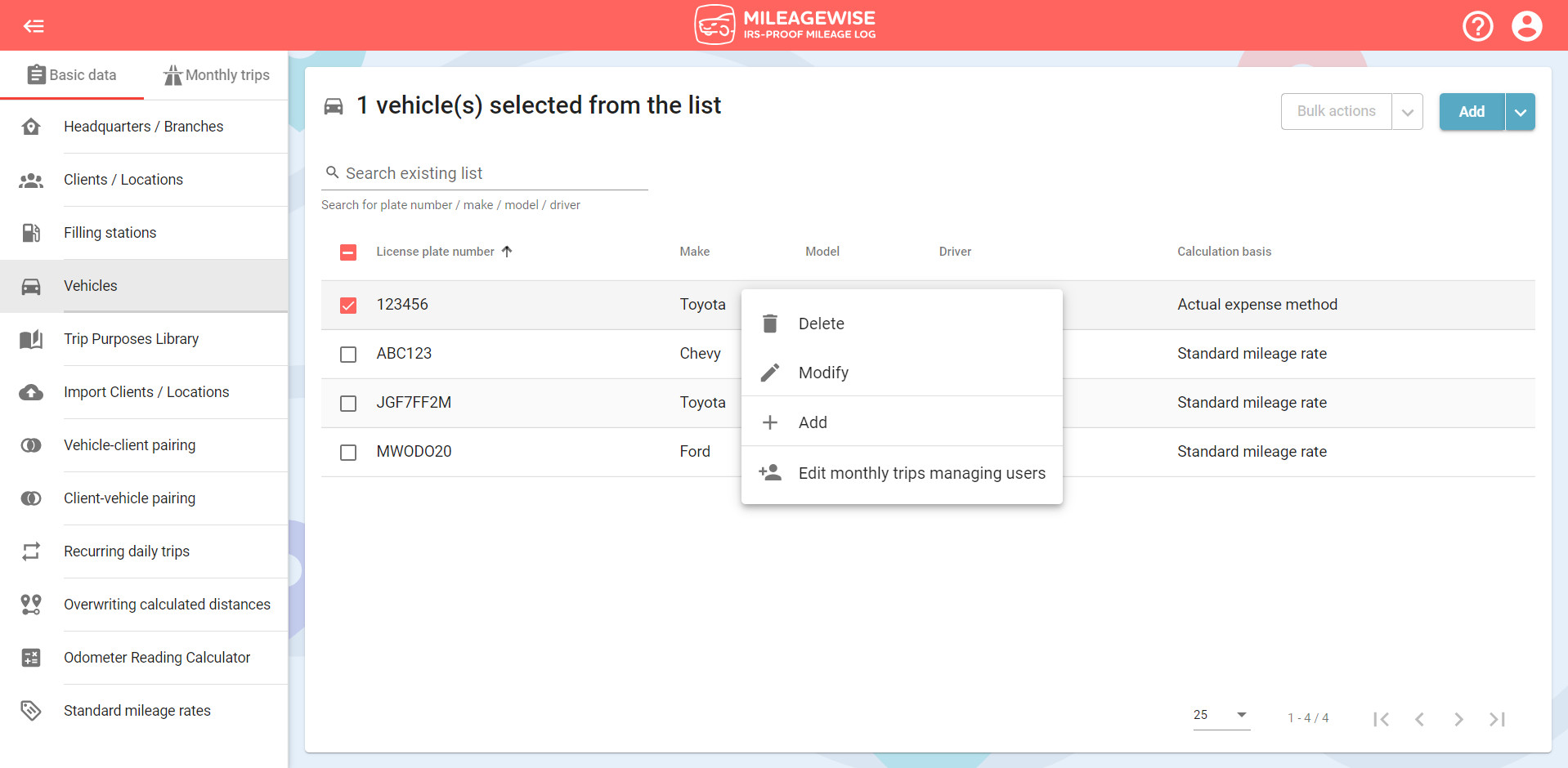

You can set the permissions in the Vehicles menu by right-clicking on the given vehicle, then clicking on Edit monthly trips managing users.

If you have not yet added the vehicle that you would like to pair your new user with, click Add. You can get help with adding a new vehicle by clicking here.

Then use the checkbox at the beginning of the row to select which users will be paired with the vehicle. You can assign multiple users to one vehicle, and vice versa, one user may be authorized to manage multiple vehicles.

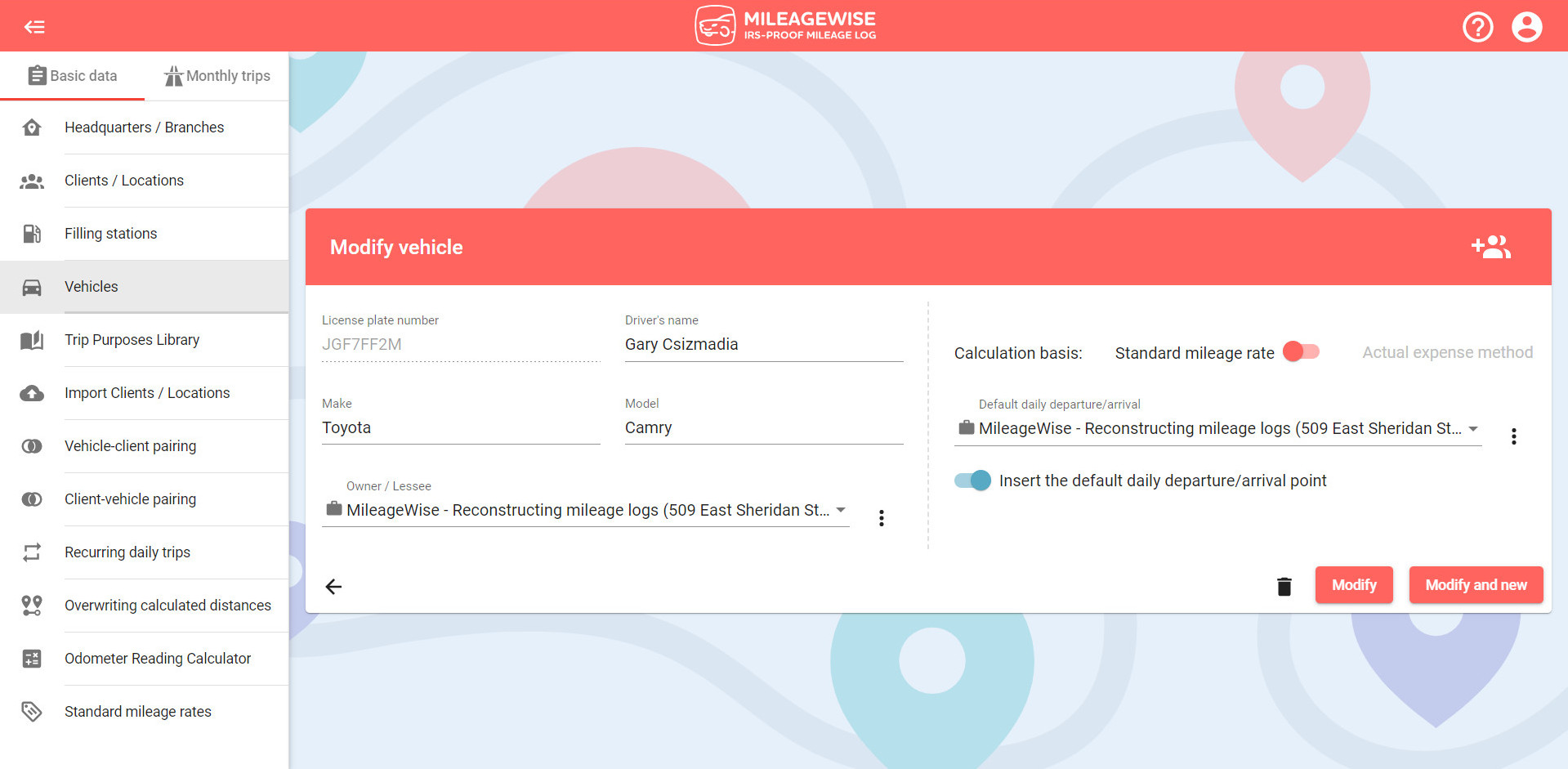

After setting up, click the Save and back button and then the Modify button in the vehicle editing window.