You will receive the following email when invited to your MileageWise company account. If you have any questions about the invitation, you can contact your company’s Administrator by replying to this email.

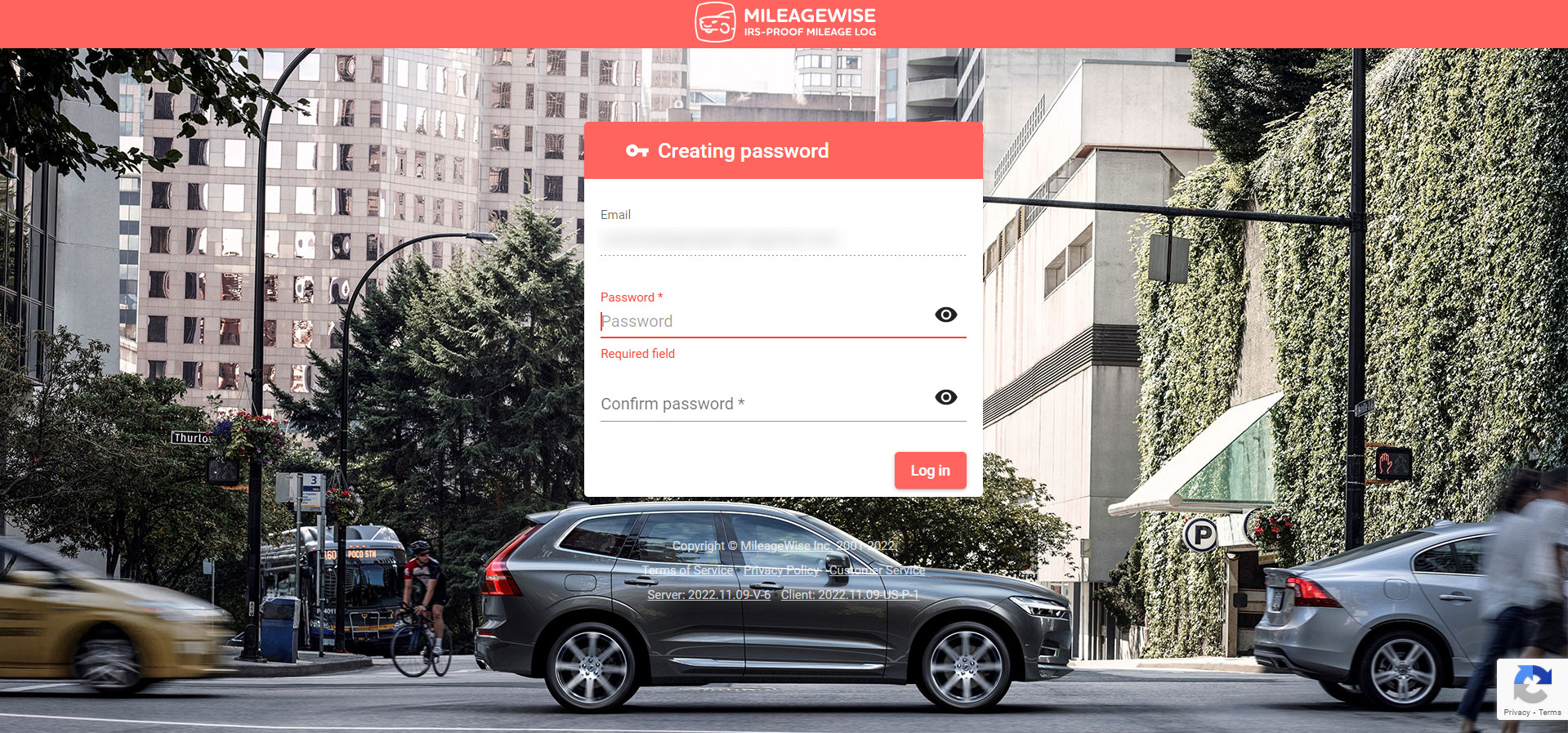

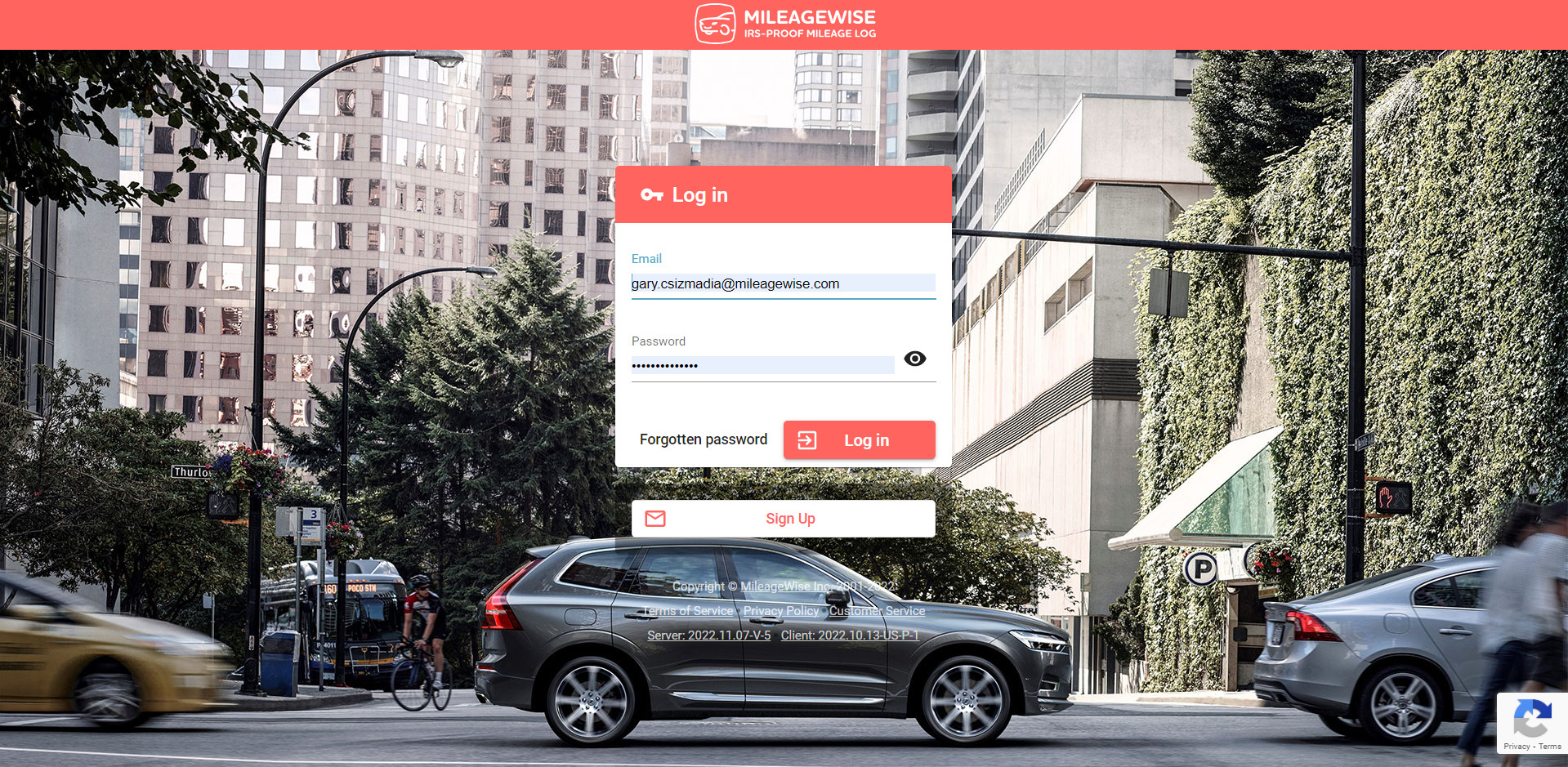

Click the Confirm and Login button. Then, on the page that opens, enter your password and click on Log in. You can do this process on your desktop browser or on your cell phone too.

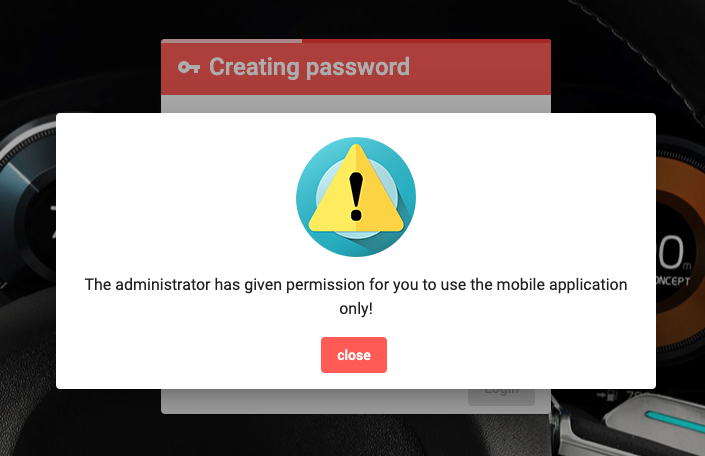

If your Administrator has granted you access only to the mobile app, you will receive the following message in your desktop browser. Download our mileage tracker app and sign in there!

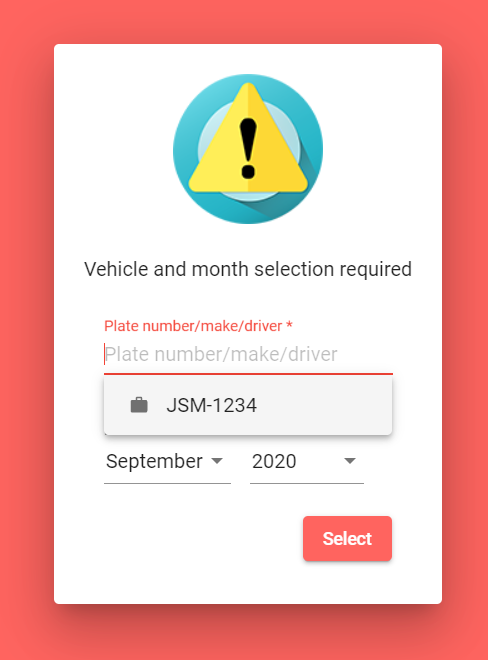

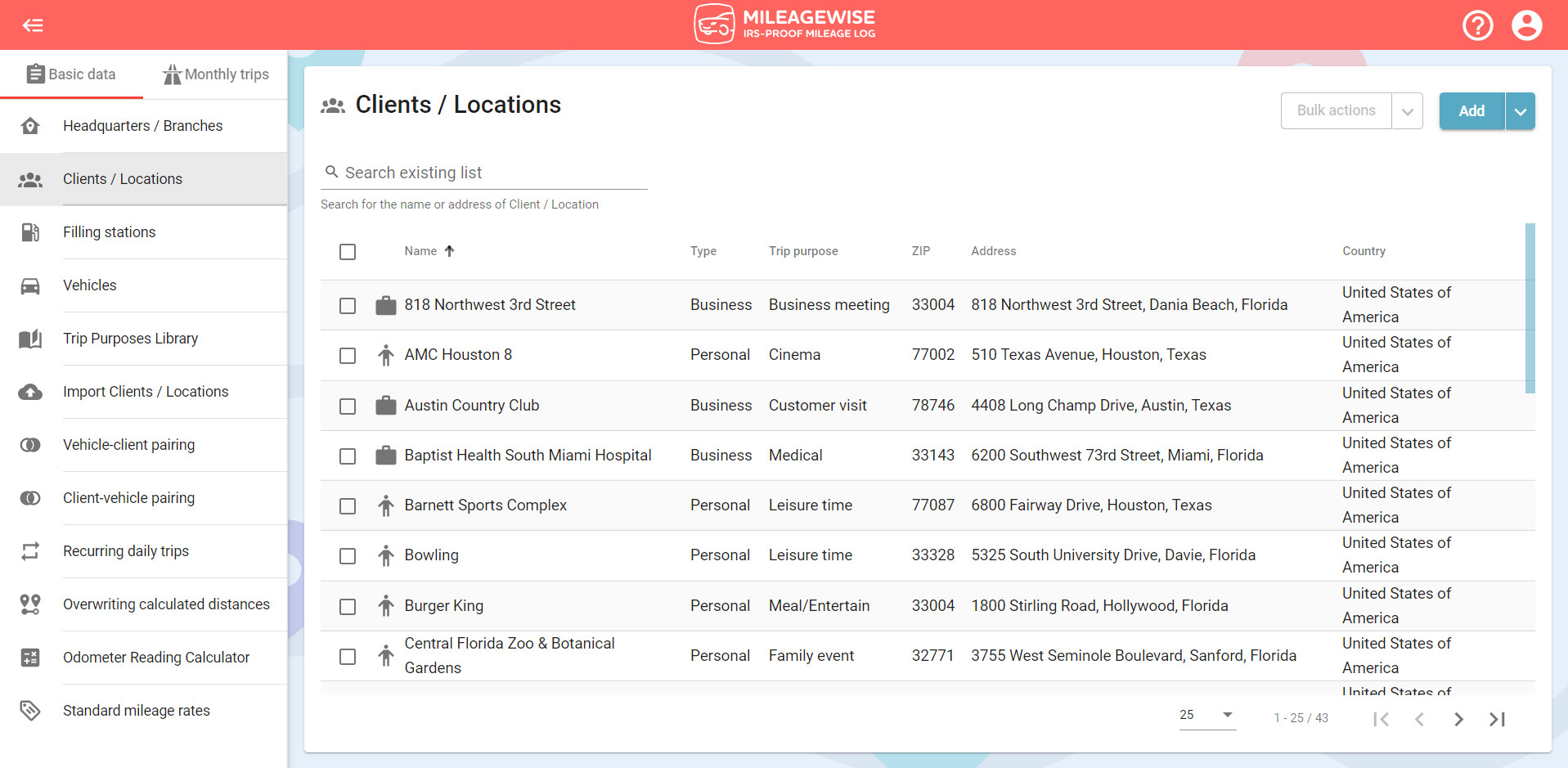

If you also have access to the web dashboard, you must first select the vehicle and the time period.

Then you can use the web dashboard.

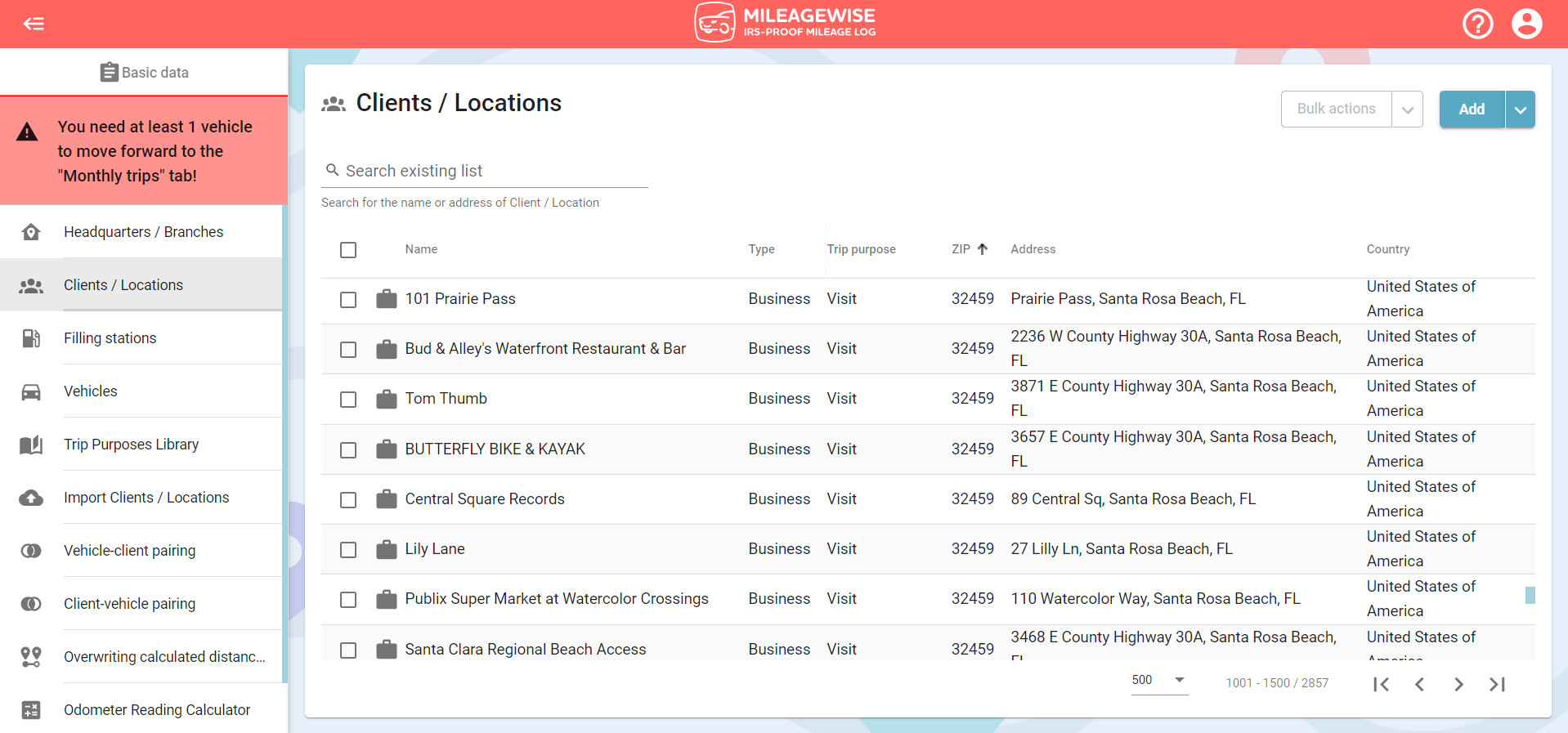

If your Administrator has not given you permission to operate any of the vehicles, the following screen will appear after you log in. Contact the Administrator! More about vehicle-user pairing here!

The next time you use your browser (Chrome, Firefox, Safari, or Edge) you can log in to dashboard.mileagewise.com with your email address and the password you entered earlier during the registration process.

This mileage tracker app goes beyond the basics! Automatically track your trips and customize your settings to match your needs. Designed to be battery-friendly, data-efficient, and fully ad-free — all while respecting your privacy. No upselling, no distractions — just the features you need.

With our Google Maps Timeline integration for importing your Location History, the AI Wizard Mileage Log Generator for recovering past trips, and our Built-in IRS Auditor that spots 70 potential red flags, MileageWise makes sure your mileage logs are always 100% IRS-proof.

April 29, 2025 Are you a freelancer or independent contractor? Do you get paid with a 1099 form? Then you need a 1099 tax calculator!

If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this post, we’ll break down what

Last Updated: April 7, 2025 If you use the internet for work, you might be able to claim a deduction on your tax return. But

Last Updated: March 3, 2025 If you regularly pay tolls for work-related travel, you may be wondering: Are tolls tax-deductible? The short answer is yes,

© 2025 MileageWise – originally established in 2001