Last Updated: January 6, 2025

As your business grows, you might find it hard to manage tasks. Many employers struggle with company mileage reimbursement. However, helps employees stay compliant and fairly compensates them.

In this article, we’ll explain company mileage reimbursement laws. Also, we’ll show how to use mileage reimbursement programs. By the end, you’ll know how to handle business mileage easily.

Simplify Company Reimbursements

MileageWise: Tracks trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-Powered Mileage Recovery: The AI Wizard helps reconstruct past mileage logs, filling gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 potential red flags in logs, ensuring they meet IRS standards for tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Try it for free for 14 days. No credit card required!

Table of Contents

What is Mileage Reimbursement?

Mileage reimbursement is what employees receive if they use their car for work. The rate depends on the employer-employee agreement. The amount of reimbursement employees get can be based on a custom rate but they can also use the standard mileage rate.

While federal law doesn’t require it, some states like Massachusetts, California, and Illinois do.

Company Mileage Reimbursement

Reimbursement Alternatives For Employers

The IRS sets a mileage rate each year for businesses. For 2025, the standard mileage rate it’s 70 cents per mile.

But, businesses can also use other rates or methods:

- Custom mileage rate: Companies can pay a different rate than the IRS recommends.

- Actual Expense Method: Paying based on actual vehicle costs, like fuel, repairs, and insurance. This needs detailed expense records.

- Flat Monthly Stipend: A fixed amount, no matter the miles. It’s simple but might not be fair.

- Combination of Fixed and Variable Costs: In this case, a fixed amount is paid for regular costs, like depreciation and insurance, and an additional variable amount covers maintenance, fuel, oil changes, etc. This variable amount is usually determined according to mileage.

- Per Diem Allowance: A daily rate for travel expenses, often for business trips.

Each method has its pros and cons. The standard rate is easy but a flexible allowance might be more accurate for changing vehicle use.

Tax Implications of Company Mileage Reimbursement

Reimbursements under an accountable plan —where employees track and report mileage accurately—aren’t taxed. This helps both employees and employers. It lowers taxable income for employees and payroll taxes for employers. But, if you pay more than the IRS rate, the extra amount is taxed. Also, without proper mileage records, all reimbursements might be subjected to taxes.

Common Challenges in Company Mileage Reimbursement

Setting up a mileage reimbursement policy can be tough. Here are some common challenges for employers:

- Ensuring accuracy in mileage reporting: Use apps to avoid errors and keep records right.

- Managing costs: Watch how reimbursement affects your budget. Also, consider other options if needed.

- Compliance with legal regulations: Keep up with IRS and local laws on reimbursement.

- Handling disputes: Have a clear way to solve mileage reporting issues.

By addressing these challenges head-on, you can make a smooth reimbursement system that works for everyone.

The Rules: Creating a Mileage Reimbursement Policy

First off, it’s worth mentioning that it is not mandatory for an employer or business to even have a mileage reimbursement policy, except in the state of California, Massachusetts, and Illinois. It is, however, recommended that employers offer some kind of plan to their employees – driving a vehicle for work is a large expense, and most employees expect some kind of reimbursement on their fixed and variable costs as they are not eligible for an itemized deduction since the 2017 Tax And Jobs Cut (TCJA).

Nowadays, if employees don’t get reimbursed for their mileage, their salary is often effectively and drastically reduced, and those employees may look for work elsewhere. This is why it is typically the case that employers do provide some kind of plan, and there are many plans to choose from. The most common thing to do is simply to use the Internal Revenue Service’s (IRS) standard mileage rate, which accounts for both variable and fixed costs.

Mileage Reimbursement of Employees for the year 2025

Tax Cut and Jobs Act of 2017 temporarily abolished various personal itemized deductions until December 31, 2025, prohibiting taxpayers from claiming deductions for unpaid employee travel expenses. Previously, various personal deductions of over 2% of Adjusted Gross Income (AGI) had been deductible.

Many companies use the IRS rate to reimburse employees for business trips by car. Mileage Reimbursement is a profitable financial solution for both the employer and the employee, depending on what method the parties use:

- Car allowance (fixed monthly lump sum)

- Standard mileage rate

- FAVR (Fixed And Variable Rate), which is the combination of the first two

Mileage ReimBursement Policies From The Business Owner’s Perspective

Let’s say you run a restaurant and you also offer home delivery services. As an employer, you want to ensure that your mileage reimbursement policy not only meets legal requirements but also promotes fairness and efficiency. Here are some best practices to consider when creating or revising your company’s policy, along with answers to common questions:

Best Practices for Employers:

A. Customize Rates (If Applicable):

- Consider customizing mileage reimbursement rates based on factors like location and job roles. This can ensure that employees in high-cost areas or those with extensive travel responsibilities receive fair compensation.

B. Clear Communication:

- Communicate your mileage reimbursement policy clearly to all employees. Provide written guidelines and offer training or resources to help them understand the process.

C. Streamline Documentation:

- Encourage employees to use mileage tracking apps or templates to streamline documentation. Digital tools can reduce paperwork and errors, making the process more efficient for everyone.

D. Regular Audits:

- Periodically audit mileage reimbursement claims to ensure compliance with your policy and tax regulations. This can help identify any discrepancies or issues that need correction.

E. Stay Informed:

- Stay updated on changes in tax laws and regulations related to mileage reimbursement to ensure your policy remains compliant. Consulting with tax professionals can be beneficial.

MileageWise: The Solution for Your Mileage Reimbursement Challenges

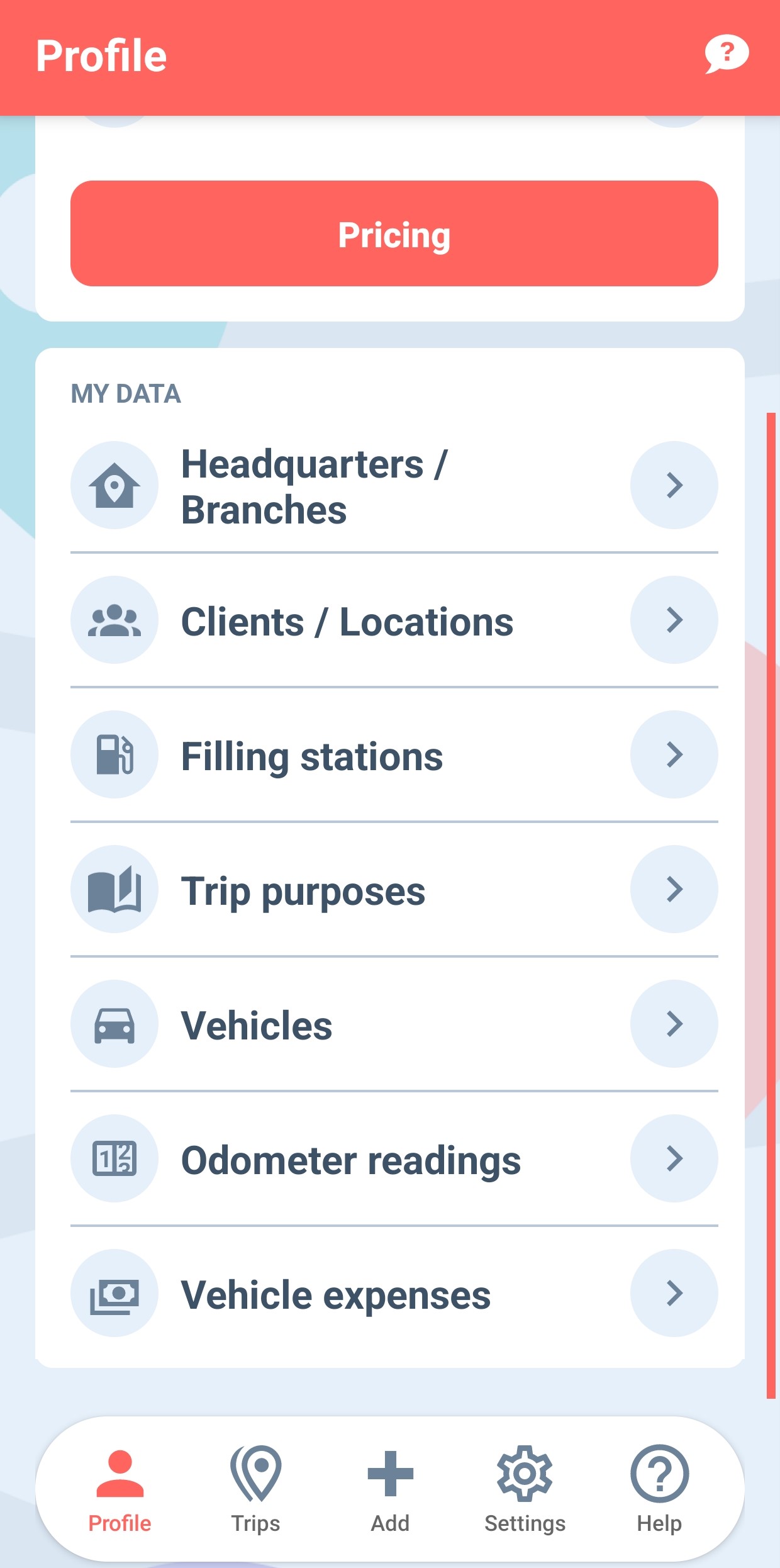

Mileage reimbursement can be time-consuming and error-prone. MileageWise is a great solution for employers. It offers a top mileage tracker app to simplify your reimbursement process.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

How MileageWise Helps You

Accurate Mileage Logs

The MileageWise app automatically records your employees’ mileage. It makes precise and IRS-Proof mileage logs. Furthermore, the built-in IRS Auditor stops errors, keeps you safe during tax time, and makes sure everyone is clear.

Team Management

With MileageWise, you can manage all your team’s mileage logs from one place. You can assign vehicles, track who drove where, and make sure everyone is accountable for their miles.

Saving Time and Money

Using MileageWise saves you time that you would spend on manual entry. Also, it makes sure you don’t pay too much for mileage reimbursement.

IRS Compliance

Stay fully compliant with up-to-date IRS requirements. MileageWise makes logs that follow the rules. This keeps your business safe from audits and fines.

Transparency and Dispute Prevention

MileageWise makes it clear how mileage is tracked. This means less chance of disagreements. Your team will trust the app because it’s fair and open.

Easy Tax Filing

MileageWise makes tax time easier. It creates detailed mileage logs ready for tax submissions. This helps your business get the right deductions while following IRS rules.

Calculate How Much You Can Save with MileageWise:

Ready to Enhance Your Business’s Mileage Reimbursement Process?

Sign up with MileageWise today. Enjoy easy mileage tracking, lower costs, and no IRS worries! Take control of your mileage reimbursement process.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

FAQs

Companies compensate employees for using their personal vehicles for work-related trips by paying them based on a set mileage rate or actual vehicle expenses.

The IRS sets a standard mileage rate, which covers vehicle-related expenses like gas and maintenance. Companies can use this rate or choose alternative methods.

Companies can follow the IRS standard mileage rate, but they can also create a custom rate or reimbursement method, as long as it is fair and documented.

If a company reimburses above the IRS standard rate or if employees fail to provide proper documentation, the excess or the entire reimbursement can be subject to taxation.

See a list of the best mileage tracker apps:

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |

Similar blog posts:

FAVR Vehicle Reimbursement Explained

Last Updated: March 3, 2025 Companies that reimburse employees for driving their personal cars for work have several options. One of the most effective and

How to Create an Effective Mileage Reimbursement Policy

A well-defined mileage reimbursement policy is essential for any business that relies on employees using their personal vehicles for work purposes. Whether employees are visiting

Your Ultimate Mileage Reimbursement Guide 2024

Understanding mileage reimbursement is crucial for anyone using their car for work. It’s a simple way to reduce your tax liability and get compensated for

Your Complete Mileage Deduction Guide

Are you a self-employed individual or an employee with business-related travel expenses? If so, claiming a mileage deduction can significantly reduce your tax liability. In

California Mileage Reimbursement 2024: Laws, Methods, and Tools

Last updated: October 21, 2024 Navigating the highways of California’s business landscape requires more than just a roadmap. It demands a thorough understanding of local

Navigating the IRS Rule for Mileage Reimbursement

July 10, 2023 Well, hello there, business owners, entrepreneurs, gig workers, and freelancers! Have you ever looked at your vehicle and thought, “Boy, if only