Last updated: October 21, 2024

Navigating the highways of California’s business landscape requires more than just a roadmap. It demands a thorough understanding of local mileage reimbursement laws. It doesn’t matter if you’re an employer or self-employed. Strap in and prepare for a journey through the legal landscapes and practicalities of mileage write-offs in the Golden State. By the end, you will know how to ensure you and your business stay compliant and efficient.

Table of Contents

Federal and California Mileage Reimbursement Law and Guidelines

In the sunny state of California, both federal and state guidelines dictate mileage reimbursement. This process is not just a courtesy but a legal requirement in many scenarios. In the state of California, employees must be compensated for using their personal vehicles for business. Here, the Internal Revenue Service (IRS) sets baseline rates annually. These numbers serve as a benchmark for reimbursement calculations.

Rules in California for Mileage Reimbursement

California’s approach to mileage reimbursement is unique. This is because it insists that employers have fair mileage reimbursement policies. Although, paying the IRS mileage rate is not required by law. The California Labor Code Section 2802(a) obligates employers to cover all necessary expenses of employees incurred during their jobs.

What Does the IRS Mileage Rate Mean?

The IRS mileage reimbursement rate simplifies expense calculations for businesses and self-employed individuals. The rate is a set amount per mile that covers most vehicle-related expenses for work, medical, or charity trips. This covers gas, vehicle depreciation, insurance, fuel, repairs and more. To calculate your mileage deductions, you simply need to multiply the standard mileage rate by the number of miles taken.

Mileage Rates for 2024

The IRS announced its mileage rate for 2024, which is 67 cents per mile for business purposes. For medical purposes and moving for active military members, this amount is 22 cents per mile, and for charity purposes, it is 14 cents per mile in 2024.

Mileage Reimbursement of Employees

California’s robust employment laws ensure that workers are fairly reimbursed for using their cars for work. Understanding these laws can help both employers and employees oblige the requirements successfully.

Mandatory Reimbursement

In California, mileage refund isn’t just a perk—it’s a mandate. Employers must compensate employees for any personal vehicle use that occurs during work.

The Four Ways of Employee Reimbursement in California

- Lump-sum payments:

Employers have the option to give a set amount regularly, but at least quarterly, regardless of actual expenses and miles driven. This is often referred to as a car allowance or a “per diem”. - Actual mileage:

Reimbursement based on the actual miles driven, using the IRS rate, or at a different rate set by employers. If they choose to reimburse at a higher rate than the standard IRS rate, the additional mileage compensation will be taxed as income. - Actual expenses:

Compensation based on the actual costs of using the vehicle. These expenses include car depreciation, lease payments, gas and oil, tires, repairs and tune-ups, insurance, and registration fees. - Fixed and variable rates (FAVR):

This method combines two types of payments for employees who use their personal vehicles for work. It includes a fixed amount to cover ongoing expenses like insurance and car registration, and a variable per-mile rate to reimburse costs like fuel and maintenance based on the miles driven for work.

Duties of Employers and Employees

Setting the type of reimbursement, overseeing and collecting accurate expense or mileage logs, and handling tax implications are all critical. Employers must provide clear guidelines and systems for logging miles and must report to the IRS. On the other hand, employees need to maintain accurate records and submit them to their supervisors promptly.

Mileage Reimbursement for the Self-employed

For those running their own business in California, mileage reimbursement takes on a different form.

Standard Mileage vs. Actual Expense Method

Self-employed individuals can choose between the standard mileage rate and actual expense mileage reimbursement methods. The former offers simplicity, while the latter can provide larger deductions if substantial vehicle expenses are documented.

Duties with Quarterly Payments for “1099 workers”

Self-employed professionals and anyone who receives 1099 forms to prove their payments generally have to make estimated tax payments quarterly if they expect to owe $1,000 or more when their return is filed. Properly tracking and documenting business mileage or vehicle expenses is crucial for accurately reporting income and filing for deductions. View tax rates and calculate your California State self-employed 1099 taxes here.

Tips for Tracking Expenses and Miles

Effective tracking of expenses and mileage can save businesses and self-employed individuals a significant amount of effort, time, and money at tax time.

Options for Employers and Self-employed Individuals

- Receipt Collection Tips:

If you track actual expenses, always collect and categorize receipts related to business travel. Keep them safe from damage and always in the same places. Furthermore, make digital copies or log them in a software for a clear overview. - Spreadsheets and Software:

Using digital tools to track business mileage and expenses simplifies reporting and ensures accuracy. There are plenty of Excel and Google spreadsheet templates and mileage tracking software out there.

Benefits of Software and Apps Over Manual Methods

Software-based solutions provide a robust alternative to traditional paper logs, especially when it comes to mileage and expense tracking. By automating calculations, these tools significantly reduce the likelihood of human errors. This accuracy is crucial for adhering to strict IRS guidelines.

Additionally, digital systems streamline record-keeping, allowing for quick data retrieval and efficient organization. They also ensure data is backed up securely, safeguarding against loss due to physical damage or forgetfulness. Overall, the integration of these digital solutions into daily business practices not only meets but exceeds the capabilities of manual methods.

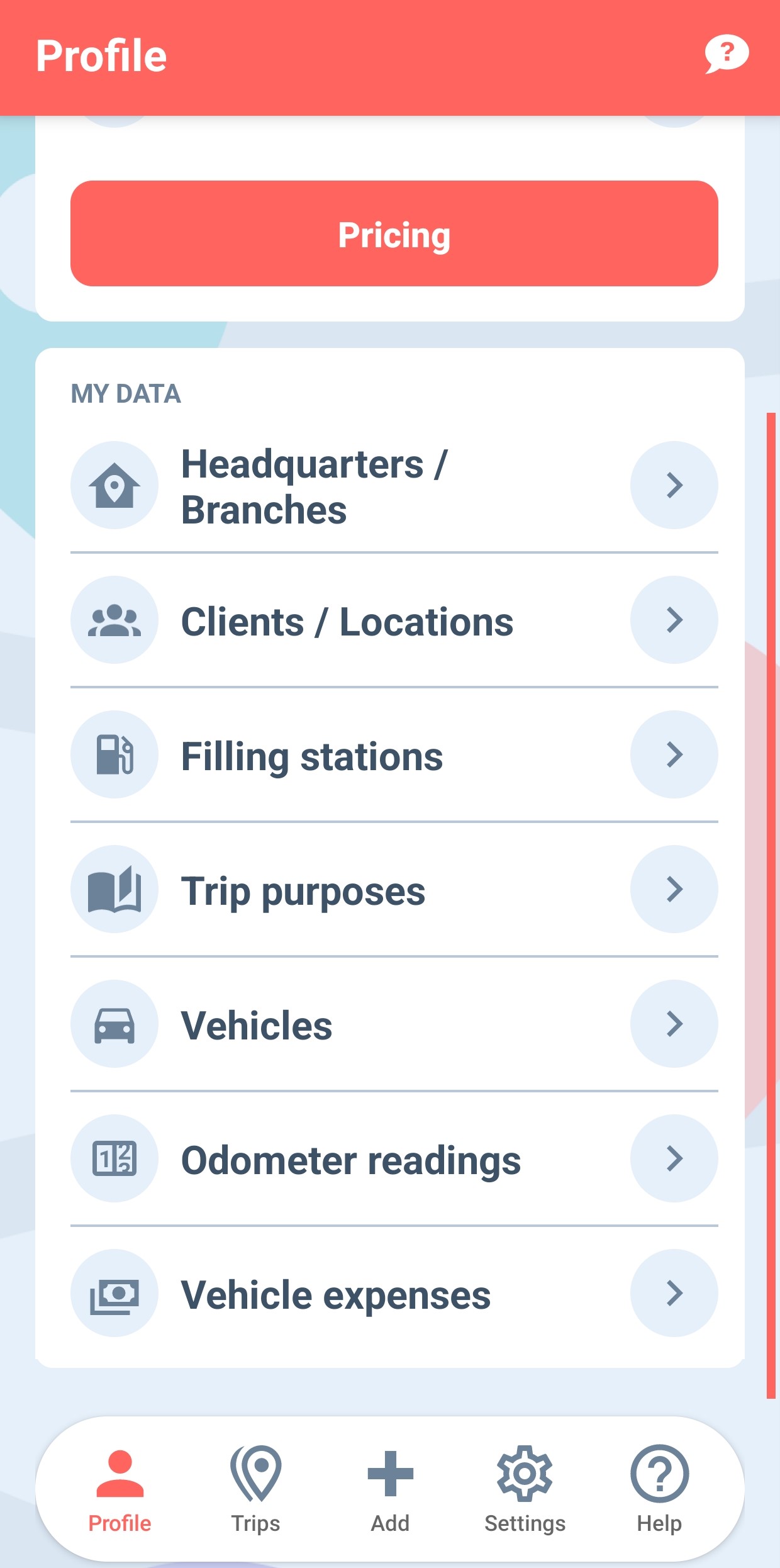

MileageWise: Your Vehicle Expense and Mileage Tracker

MileageWise provides tailored solutions for employers, employees, and self-employed individuals alike. The main focus is on efficient mileage tracking and reporting for tax deduction purposes.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

Here’s a breakdown of how each group can benefit from MileageWise

Employers

- Automated Mileage Logging:

Employees can automatically log their trips using the MileageWise app, reducing the hassle of manual entries and ensuring accuracy. - Separation of Business and Personal Trips:

The app allows employees to differentiate between business and personal trips easily, ensuring that only business mileage is reported and reimbursed. - Ease of Reporting:

Provides an easy way for employees to report their mileage logs to their employers, streamlining the reimbursement process. - Multiple Vehicle Management:

Employers can manage multiple vehicles and employee logs in one centralized system, simplifying fleet management. - Monitoring and Compliance:

Helps ensure compliance with IRS regulations, reducing the risk of audits and penalties. Employers can track the mileage logs submitted by employees, ensuring they are complete and accurate.

See how much you can save with MileageWise:

Self-Employed

- Maximize Tax Deductions:

Self-employed individuals can maximize their tax deductions with accurate mileage tracking. - IRS-Compliant Logs:

Generates IRS-compliant mileage logs automatically, which is crucial for audit protection. - Effortless Trip Categorization:

Users can categorize trips at their convenience, either at the time of the trip or later, making it easier to keep accurate and comprehensive records.

Calculate how much you can save with MileageWise:

These solutions integrate seamlessly with MileageWise’s software, providing a user-friendly interface and reliable tracking to meet the needs of employers, employees, and self-employed individuals alike.

FAQs

How do I calculate mileage reimbursement in California?

To calculate mileage reimbursement in California, multiply the total number of business miles driven by the IRS standard mileage rate for the year. For 2023, the rate is 65.5 cents per mile. Ensure you keep accurate logs of your business travel as documentation.

Is mileage reimbursement mandatory for all employers in California?

Yes, in California, employers are legally required to reimburse employees for miles driven using their personal vehicles for work-related activities. This requirement is outlined under California Labor Code Section 2802(a).

Can employers pay a rate different from the IRS standard mileage rate?

Employers in California can choose to pay a a differnent rate than the IRS standard mileage rate but are not obligated to strictly adhere to it. However, any amount reimbursed above the IRS rate may be considered taxable income.

What are the best practices for tracking business mileage?

Using a dedicated mileage tracking app or software is highly recommended for accuracy and ease. These tools automatically record miles and generate reports, which are essential for reimbursement and tax purposes.

What should I do if my employer does not reimburse for mileage?

If your employer fails to reimburse you for business mileage, you may file a claim with the California Labor Commissioner’s Office or seek legal advice to understand your rights and potential remedies.

How does mileage reimbursement work for self-employed individuals in California?

Self-employed individuals can deduct mileage on their tax returns using the IRS standard mileage rate. It’s essential to maintain meticulous records and logs of all business-related trips throughout the year.

Are there any specific tools recommended for mileage tracking in California?

Yes, tools like MileageWise are specifically designed to track mileage for reimbursement and tax purposes. These digital solutions ensure compliance, enhance accuracy, and simplify the process for both employees and self-employed individuals.

What if I use a vehicle for both personal and business purposes?

You must keep detailed logs that separate business use from personal use. Only the miles driven for business purposes are eligible for reimbursement and tax deductions.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

Rebeka Barefield

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |