Last Updated: February 3, 2025

Whether you’re a seasoned filer or a first-timer, the thought of tax season often brings a mix of apprehension and uncertainty. But fear not! This comprehensive guide is your beacon through the maze of tax codes and IRS guidelines.

We’re not just going to walk you through the essentials of tax preparation; we’re going to transform it into an understandable and even empowering experience. This article is designed to dismantle the complexities of tax filing, offering clear, concise, and actionable advice. From decoding the cryptic language of tax forms to maximizing deductions and understanding the nuances of tax brackets, we’ve got you covered.

Try MileageWise for free for 14 days. No credit card required!

AI Logs & Google Timeline Import

Decoding Tax Forms: Simplifying IRS Documents for Everyday Taxpayers

Navigating through IRS tax forms can feel like deciphering a cryptic code. Let’s simplify this for you! Here, we break down the most common forms, making them easy to understand.

List of Key Tax Forms:

- Form W-2: This is your wage and tax statement, showing your annual income and taxes withheld.

- Form 1040: The standard IRS form for individual tax returns. Here’s where you report your income, deductions, and credits.

- Schedule C: Essential for self-employed individuals, this form details your business income and expenses.

Tax Preparation Checklist

Creating a tax preparation checklist for the year 2025 can help ensure you have all necessary documents and information ready for a smooth filing process. Here’s a comprehensive checklist to guide you:

Personal Information

- Social Security Numbers for you, your spouse, and dependents.

- Dates of birth for you, your spouse, and dependents.

Income Information

- Forms W-2 from all employers for you and your spouse.

- Forms 1099 from all sources of income (e.g., freelance work, interest, dividends, pensions, retirement distributions).

- Unemployment income statements, if applicable.

- Social Security benefits statements, if applicable.

- Alimony received information, including the payer’s name and SSN, if applicable.

Investment Income Information

- Statements of interest (Forms 1099-INT).

- Dividend statements (Forms 1099-DIV).

- Proceeds from sales of stocks or bonds (Forms 1099-B).

- Records of any cryptocurrency transactions.

Deduction Documents

- Mortgage interest statements (Form 1098).

- Real estate and personal property tax records.

- Receipts for charitable donations.

- Medical and dental expense records.

- Educational expenses (tuition paid, student loan interest statements).

- Retirement plan contributions (e.g., IRA, Roth IRA, 401(k)).

Credits Information

- Childcare expenses: provider’s name, address, tax ID, and amount paid.

- Adoption expenses.

- Educational credits: Form 1098-T from educational institutions, receipts for educational materials.

Bank Account Information

- Routing and account numbers for direct deposit of your refund or to set up direct debit for payment.

Records of Estimated Tax Payments

- Dates and amounts of payments made during the year, if you made estimated tax payments or applied last year’s refund to this year’s tax.

Previous Year’s Tax Return

- Copy of last year’s federal and state tax returns for reference.

Miscellaneous

- Records of business income and expenses, if you are self-employed.

- Records of rental property income and expenses, if applicable.

- Health Insurance Marketplace statement (Form 1095-A) if you purchased insurance through the marketplace.

- Any notices received from the IRS or state tax authority.

For Specific Situations

- Foreign income and foreign taxes paid documentation, if applicable.

- K-1 Forms from partnerships, S corporations, estates, or trusts.

- Debt cancellation Form 1099-C, if applicable.

Before you begin your tax preparation, ensure you have the latest tax filing requirements and standard deductions, as these can change from year to year. Also, consider any tax law changes for 2025 that may affect your filing. If you’re unsure about your tax situation or have complex issues, consulting a tax professional may be beneficial.

FAQs:

- Q: What if I have multiple W-2s?

- A: No worries! Just include information from all of them when you file.

- Q: Is filing electronically better than paper filing?

- A: Electronic filing is faster, more secure, and often more accurate.

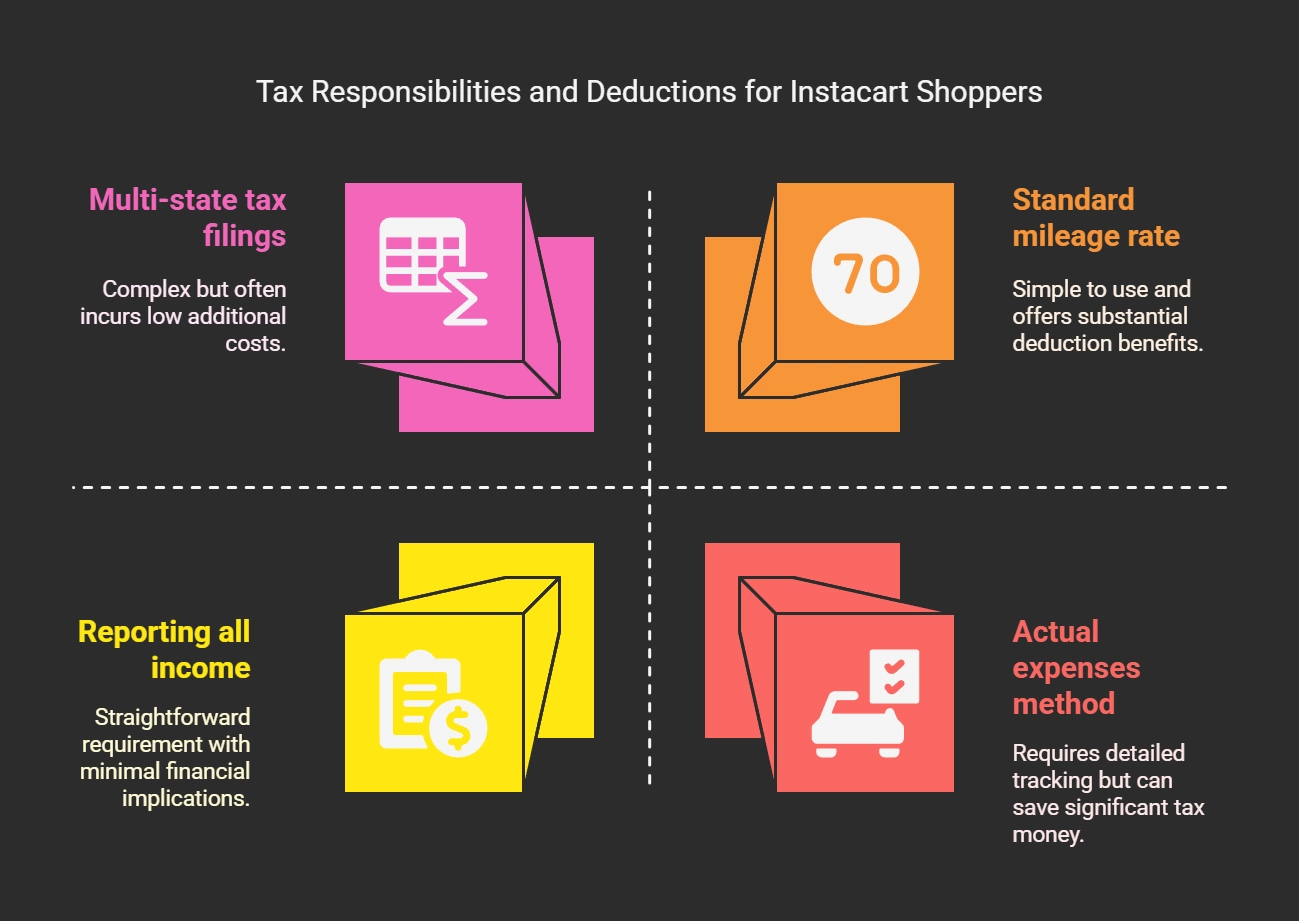

Maximizing Your Mileage Deduction: A Guide for Self-Employed Individuals and Business Owners

If you’re using your car for business, you might be leaving money on the road (and the table too)! Let’s explore how to claim your mileage deduction properly.

Steps to Maximize Mileage Deduction:

- Track Every Mile: Keep a detailed log of your business miles.

- Understand the Standard Mileage Rate: This changes annually, so stay updated. This is your 2024 rate calculator.

- Know What Counts as Business Mileage: Commuting doesn’t count, but traveling to meet a client does.

- Make It IRS-Proof: Since you ultimately want your file to pass IRS scrutiny, why not make it IRS-Proof from the get go? Whether you need ongoing or retrospective logging, MileageWise has your back.

FAQs:

- Q: Can I deduct mileage for volunteer work?

- A: Yes, but the rate is different from the business rate.

- Q: Should I use the standard mileage rate or actual expenses?

- A: It depends. The standard rate is simpler, but actual expenses could yield a bigger deduction if you have high car expenses.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

The Streamlining Combo: MileageWise and Freshbooks for Mileage Deduction

The MileageWise-FreshBooks integration can significantly streamline the tax preparation process for individuals and businesses by automating and simplifying the recording and reporting of mileage for tax deductions or reimbursements. Here’s how this integration can assist in tax preparation:

1. Automated Mileage Tracking

- Saves Time: Automatically tracks business mileage, eliminating the need for manual trip logging.

- Accuracy: Ensures the accuracy of mileage records, reducing the risk of errors that can occur with manual tracking.

2. Maximizing Deductions

- Optimized Deductions: MileageWise can help identify the most tax-efficient way to claim mileage, ensuring you maximize deductions.

- IRS Compliance: Keeps mileage records in compliance with IRS requirements, including the date, miles, and purpose of each trip.

3. Seamless Financial Management

- Expense Integration: Vehicle expenses tracked by MileageWise can be directly integrated into FreshBooks, streamlining expense management and reporting.

- Invoicing: The integration allows for easy inclusion of mileage expenses in invoices, simplifying billing for business travel.

4. Detailed Reports

- Tax-Ready Reports: Generates detailed reports that can be used for tax filing, ensuring that all deductible mileage is accounted for.

- Customizable Reports: Users can generate reports based on specific criteria, such as date ranges or types of trips, to meet their tax preparation needs.

5. Reduced Paperwork

- Digital Record-Keeping: Keeps a digital log of all mileage, reducing the need for physical paperwork and making it easier to store and retrieve records.

- Ease of Access: Mileage and expense records can be accessed from anywhere, providing convenience and flexibility for tax preparation.

6. Improved Accuracy and Compliance

- Audit Protection: Accurate and detailed mileage logs can provide protection in the event of an IRS audit.

- Policy Compliance: Helps businesses ensure that mileage reimbursement policies comply with IRS regulations, avoiding potential legal and tax issues.

As you can see, integrating MileageWise with FreshBooks not only makes the task of tracking and reporting mileage for tax purposes more efficient but also ensures that businesses and individuals can accurately claim all eligible deductions, ultimately saving money and enhancing compliance with tax laws.

This integration represents a powerful tool for managing one of the more tedious aspects of tax preparation, making it an invaluable asset for freelancers, small business owners, and anyone else who frequently travels for business.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

Understanding Tax Brackets and Rates: How Your Income Affects What You Owe

Tax brackets can be baffling. But don’t worry, we’ll break it down so you can see exactly how much you owe based on your income.

Overview of Tax Brackets:

- Tax brackets are ranges of income taxed at specific rates.

- As your income increases, only the income above each bracket’s threshold is taxed at the higher rate.

FAQs:

- Q: Does moving into a higher tax bracket mean all my income is taxed more?

- A: No, only the income over the threshold of the new bracket is taxed at the higher rate.

- Q: How do tax deductions affect my tax bracket?

- A: Deductions lower your taxable income, which could place you in a lower bracket.

Tax Deductions vs. Tax Credits: What’s the Difference and How Can They Benefit You?

Tax deductions and credits can significantly reduce your tax bill, but they work in different ways. Let’s demystify these terms!

Key Differences:

- Tax Deductions: Lower your taxable income. Examples include mortgage interest and charitable donations.

- Tax Credits: Directly reduce the amount of tax you owe. Think of credits like education credits.

FAQs:

- Q: Are there tax credits for homeowners?

- A: Yes, like the Homebuyer Tax Credit for first-time buyers.

- Q: Can I claim both deductions and credits?

- A: Absolutely! Use both to maximize your tax savings.

Preparing for Tax Season: Essential Tips for Efficient and Accurate Filing

Tax season doesn’t have to be a headache. With these tips, you’ll be prepared, organized, and ready to tackle your taxes with confidence!

Preparation Checklist:

- Gather all necessary documents: W-2s, 1099s, receipts for deductions, mileage logs, etc.

- Review last year’s return: It can guide you and ensure you don’t miss anything.

- Consider professional help: Especially if your taxes have become more complex. If you need help with preparing your mileage log, consider MileageWise’s Tax Preparation Service.

FAQs:

- Q: When should I start preparing for tax season?

- A: Start as soon as you receive your first tax document.

- Q: What’s the best way to avoid an audit?

- A: Be accurate, honest, and thorough. Keep good records in case the IRS has questions.

- Q: What are the deadlines for the tax year 2025?

- A: The next “Tax Day” will be April 15 2025. State returns usually line up with the federal deadlines, but there are exceptions. Note, that you may be eligible for deadline extension.

Choosing the Right Tax Preparation Service: Software, Professionals, and Checklists

I guess it’s true for each country, but “US tax preparation”, as a process, has its particular challanges, and selecting the right tools that can possibly assist you can be overwhelming. From tax preparation software to professional tax prep services, each choice caters to different needs and levels of complexity.

This section will guide you through selecting the best tax preparation solution for your situation, whether you’re an individual filer, a small business owner, or just looking for the most efficient way to navigate your taxes.

Key Considerations:

- Tax Preparation Software: Ideal for those comfortable with a DIY approach. Many tax preparation websites offer user-friendly software that simplifies the filing process, often with step-by-step guidance.

- Professional Tax Prep Services: For those who prefer expert assistance or have complex tax situations. A tax preparation service can offer personalized advice, especially beneficial for small business tax prep or more complicated tax scenarios.

- Tax Preparation Checklist: Regardless of your chosen method, a tax preparation checklist is invaluable. It ensures you have all necessary documents and information ready, whether you’re using software or a service. This is even more critical for business tax preparation, where record-keeping and details are crucial.

FAQs:

- Q: How do I decide between tax preparation software and a professional service?

- A: Consider your comfort level with financial matters, the complexity of your tax situation, and your budget. Tax software is typically more cost-effective and suitable for straightforward tax situations, while a professional service can be valuable for complex scenarios or if you prefer personalized guidance.

- Q: What should I look for in a tax preparation software?

- A: Key features to look for include ease of use, comprehensive coverage of tax situations, availability of customer support, and the software’s ability to handle state and federal returns. Also, check for audit support or assistance features.

- Q: When is it advisable to use a professional tax preparation service?

- A: Consider professional help if you have a complex tax situation, like owning a business, having multiple income sources, or needing to file in multiple states. Also, if you’ve experienced major life changes (like marriage, buying a house, or having a child), a professional can provide valuable advice.

- Q: Are there specific tax preparation considerations for small businesses?

- A: Yes, small businesses often have more complex tax situations, including deductions, asset depreciation, and possibly payroll taxes. A business tax preparation checklist and potentially a professional service can be very helpful in ensuring all aspects are covered.

- Q: Can tax preparation services assist with audits?

- A: Many services do offer audit assistance, which includes guidance on what to expect during an audit and how to prepare. However, this might come at an additional cost, so it’s important to confirm this with the service provider.

What happens if I file incorrectly?

If you forget to file a tax document, file incorrectly, or miss the deadline, several consequences can arise, depending on the nature of the document and your specific tax situation. Here’s a breakdown of potential scenarios and outcomes:

Immediate Consequences

- Delayed Refunds: If the missing document affects your tax return and you’re due a refund, the IRS may delay processing your return until the missing information is provided, thereby delaying your refund.

- IRS Notices: The IRS may notice the discrepancy between the information they have on file (e.g., from an employer or financial institution) and your tax return. In such cases, they will send you a notice or letter requesting the missing information or informing you of the discrepancy.

Potential Penalties

- Failure-to-File Penalty: If the forgotten document results in you not filing your taxes at all, the IRS may impose a failure-to-file penalty. This penalty is typically 5% of the unpaid taxes for each month or part of a month that a tax return is late, up to a maximum of 25%.

- Failure-to-Pay Penalty: If the missing document means you underreport your income and end up paying less tax than you owe, you might face a failure-to-pay penalty. This penalty is 0.5% of your unpaid taxes for each month or part of a month after the due date, up to 25%.

- Interest: Besides penalties, interest accrues on the unpaid tax amount from the due date of the return until the date of payment.

How to Rectify the Situation

- Amend Your Return: If you realize you forgot to include a tax document after you’ve already filed, you can file an amended return using Form 1040-X. This form allows you to make corrections to previously filed tax returns.

- Respond Promptly to IRS Notices: If the IRS contacts you about a missing document, respond promptly with the requested information to minimize potential penalties and interest.

- Pay Any Owed Amount: If you owe additional taxes due to the forgotten document, pay the amount as soon as possible to stop further penalties and interest from accruing.

Prevention Tips

- Organize Tax Documents Early: Keep a folder or digital space for tax documents throughout the year, so you have everything in one place when it’s time to file.

- Use a Checklist: Create or use a comprehensive tax preparation checklist to ensure you’ve gathered all necessary documents before filing.

- Consult a Professional: If your tax situation is complex, consider hiring a tax professional who can help ensure that all necessary documents are filed correctly.

Forgetting to file a tax document can be rectified, but it’s best to be proactive in organizing and reviewing your tax documents to avoid potential issues with the IRS.

Wrapping It Up

As we wrap up our journey from confusion to clarity in the world of tax preparation, remember that this process doesn’t have to be a daunting labyrinth. With the knowledge and tools you’ve gained from this guide, you’re now better equipped to navigate the intricacies of tax filing with confidence and efficiency. Whether it’s understanding the nuances of tax deductions, leveraging credits to your advantage, or simply organizing your financial records, every step you take brings you closer to mastering this essential life skill.

Keep this guide handy as a reference, and don’t hesitate to seek professional advice when needed. Here’s to a smoother tax season ahead, where you’re in control and well-prepared to make the most of your financial situation. Happy filing, and may your tax returns be ever in your favor!