Last Updated: October 7, 2024

Greetings, highway heroes! Have you ever daydreamed about those mundane miles magically morphing into moolah? Well, rub that proverbial lamp because your genie is about to make an appearance. Buckle up as we decode the magic mantra that could save you a hefty sum – the art and science of how to claim mileage on your taxes. Sounds like a fairy tale, doesn’t it? Stay with us, and you’ll soon discover this isn’t just a tall tale!

The Magic of Claiming Mileage on Taxes

Let’s cut to the chase. If you’re a small business owner, freelancer, or gig worker constantly on the move, you’re sitting on a gold mine. Yes, indeed! Those miles you’ve been crunching could be your ticket to tax savings. When you claim a mileage tax deduction, every mile you drive for work can potentially reduce your taxable income. The IRS isn’t exactly Santa, but hey, when it comes to business mileage claims, they do play fair!

The IRS Mileage Claim Way or the Highway

At this point, you may be scratching your head, thinking, “This sounds great, but I’m not exactly a tax savant.” Don’t fret! You don’t need to be a certified CPA to get this right. Your first stride toward claiming mileage reimbursement starts with a detailed mileage log.

But the question still stands, where to put down your mileage expenses? Well, say goodbye to that age-old, dust-collecting notebook. We’re zipping along in the digital age, after all!

Now, here’s the scoop. You’ll be logging these precious miles on the trusty Schedule C (Form 1040), line 9– the tax form that’s the best buddy of self-employed folks and independent contractors like you. This is where you report your income and expenses to figure out the profit or loss of your business.

And, the best part? It has a special spot just for your car and truck expenses. This is where your diligently kept mileage logs will shine. Simply tally up those business-related miles, do a little multiplication with the standard mileage rate, and voila! You’ve got yourself a dollar figure to plug right into Schedule C, line 9.

A word of caution, though. The IRS likes things nice and tidy. That means no guesstimates or rough figures. They want to see clear records of your mileage. Thankfully, in this tech-savvy era, there are apps (like MileageWise) that can make this task a breeze. So, no worries, even if you’re not a tax wizard, you’ve got this!

Introducing MileageWise: The Magic Solution for All Your Mileage Woes

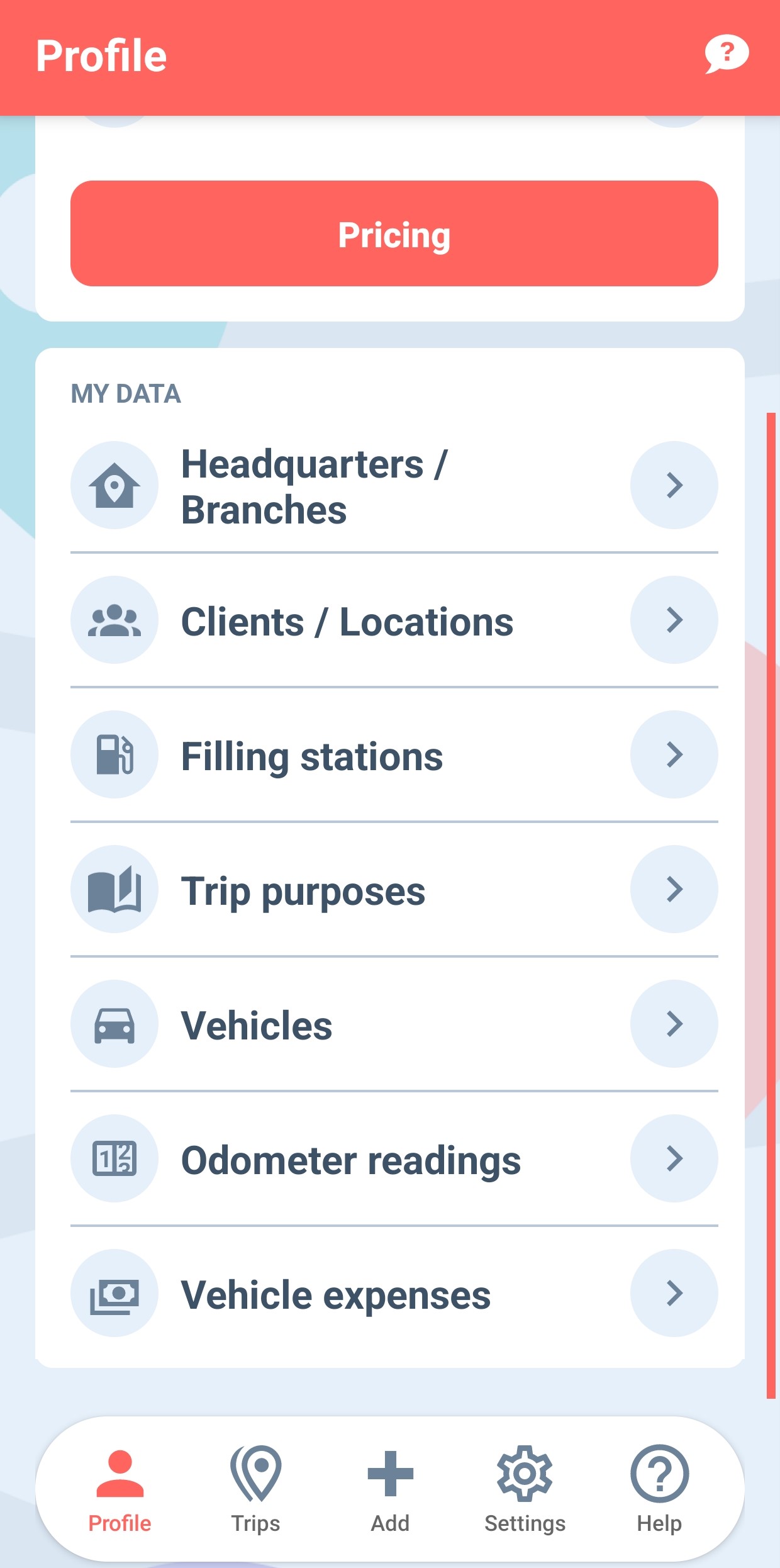

Speaking of this modern era, say hello to MileageWise, your magic wand for managing all things mileage. Need a mileage claim form template? Check. How about an employee mileage claim for your small business? Check. A mileage claim calculator that doesn’t make your head spin? Check. MileageWise is the one-stop-shop for all your mileage needs.

Driving Tax Deductions: MileageWise’s Innovative Tools Unleashed

When it comes to maximizing your tax deductions, MileageWise is the ace up your sleeve. This powerhouse tool pulls no punches in ensuring you get every penny due to you. How, you ask? Let’s take a closer look at a few of its proprietary functions that give you the upper hand.

First off, the retrospective mileage log creation feature. Think of it as a personal time machine, allowing you to go back and meticulously document all those previously untracked miles. Did you miss a week, a month, or even a year? No problem! MileageWise has you covered, helping you retroactively create a complete, IRS-friendly log, ensuring no deduction is left unclaimed.

Next up, is the innovative Google Timeline import function. Say goodbye to manually logging every single trip. By seamlessly syncing with your Google Timeline, MileageWise automatically tracks your journeys, ensuring each business mile is accounted for. This function provides an accurate, effortless, and time-saving way to bolster your mileage claim.

Lastly, the crown jewel of MileageWise’s arsenal – is the AI Wizard function. This feature doesn’t just help you track your mileage; it guides you on how to optimize it for maximum deductions. It smartly suggests missing trips and helps you keep your records consistent, minimizing the chances of an audit and maximizing your refund.

With these game-changing functions, MileageWise transforms the daunting task of claiming mileage into a walk in the park, ensuring you drive off with the maximum tax deductions you rightfully deserve.

It’s Not Just About the Money

Alright, now that we’ve covered how to claim mileage, let’s talk about the why. Aside from the obvious perk of saving some serious cash, claiming your mileage gives you a better understanding of your business expenses. It’s not just about claiming business mileage; it’s about being in the driver’s seat of your business’s financial future.

Now, isn’t it time you turned those hard-earned miles into money? Remember, every mile matters, and with MileageWise by your side, you’re well on your way to a smoother, more prosperous ride. So buckle up and enjoy the journey, folks!