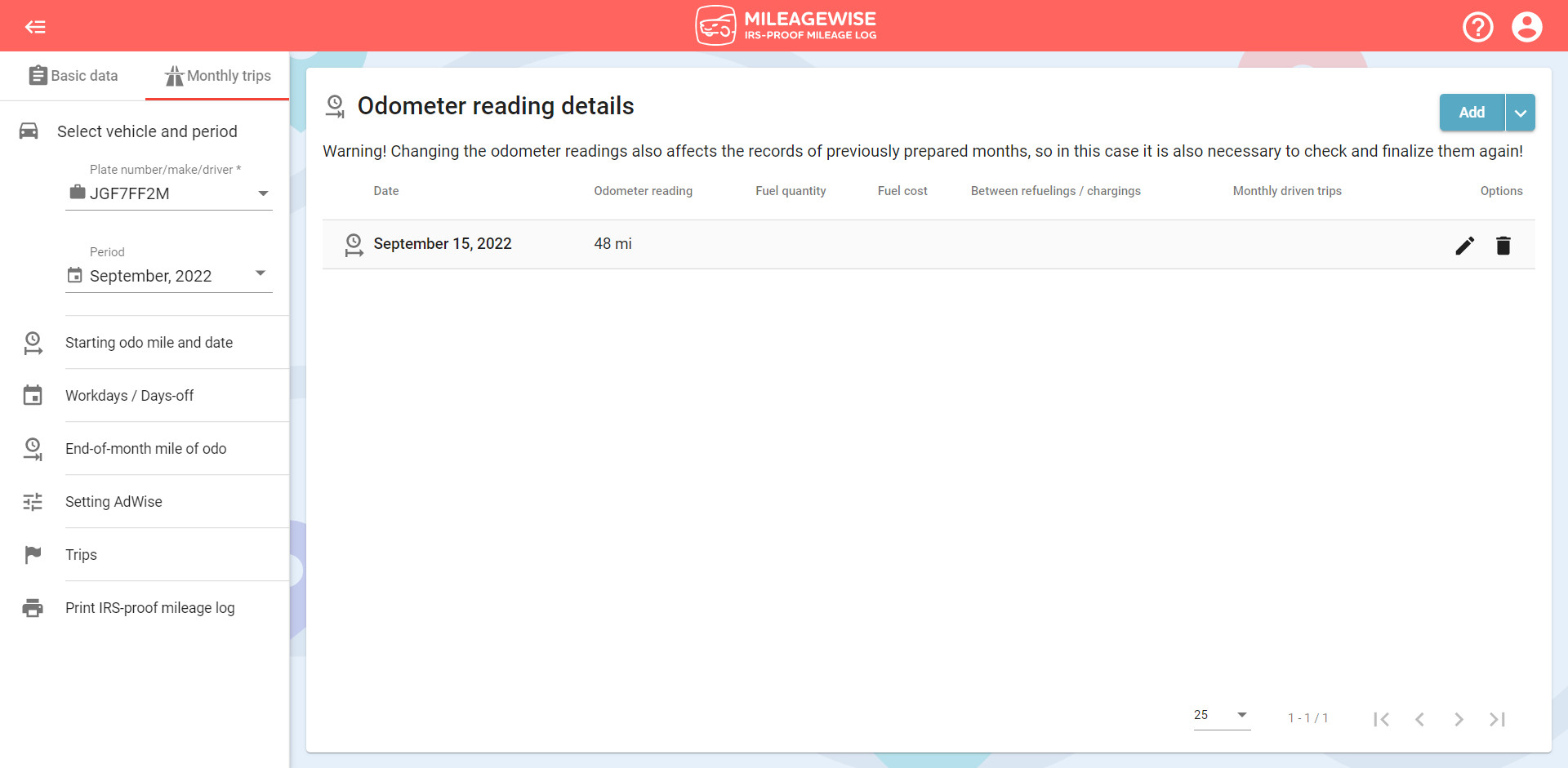

It is highly recommended to have a monthly starting odometer reading for each month. If you have a starting and ending odometer reading for each month, the difference between the two numbers is how many miles you can realistically travel. For an IRS-proof result, use your mile readings as a base to make sure that your trips realistically correspond with your max. drivable distance for the month.

Note: Your end-of-month reading for a given month will be used as the starting odometer record for the following month.

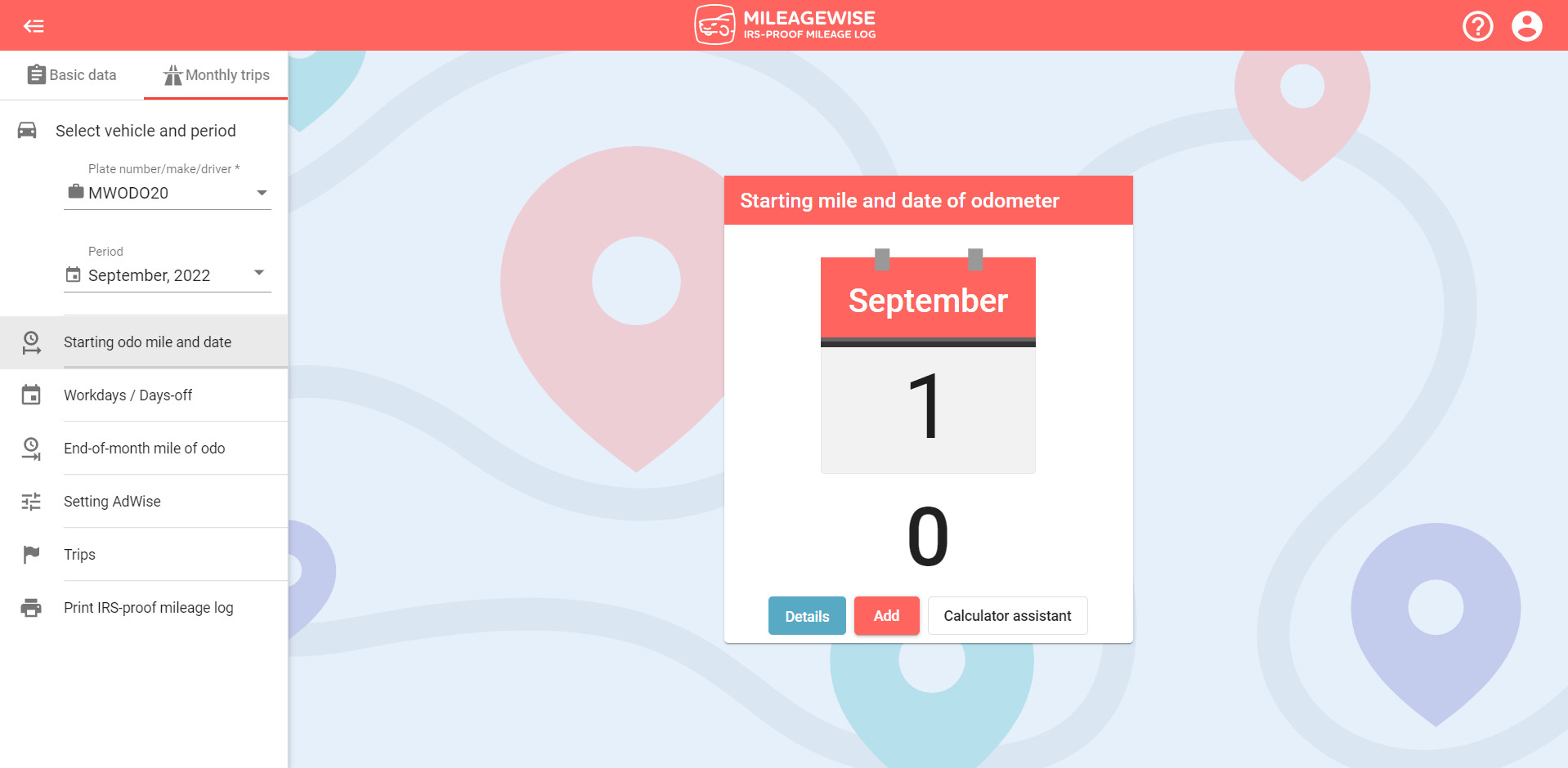

Click the Add button to enter the data.

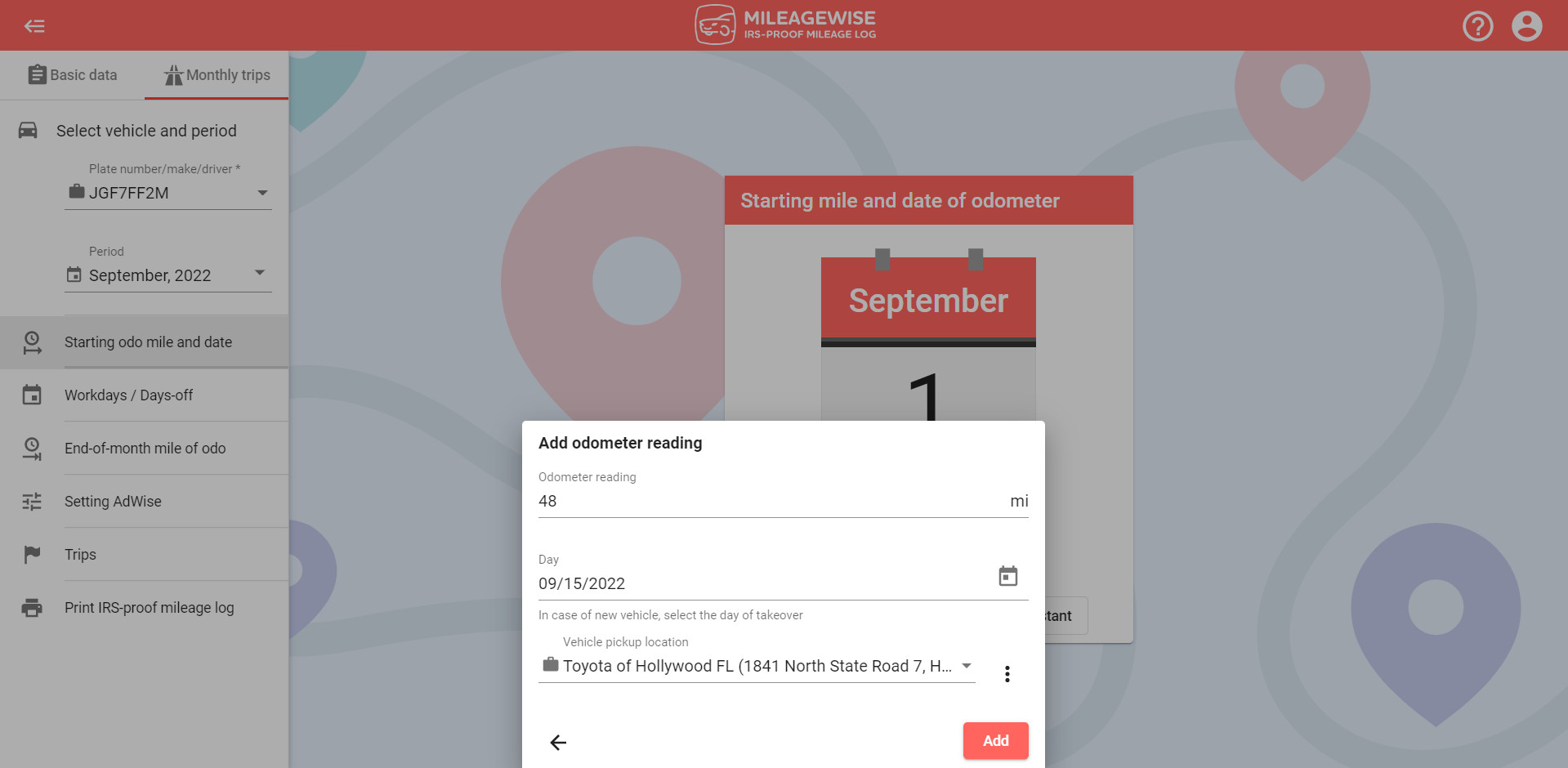

If you have purchased your new vehicle in the middle of the month, select the day of the pick-up and enter the odo reading at that time of the vehicle pick-up (there are always a few miles in a brand new vehicle already, so ‘0’ is impossible).

If you previously used some kind of mileage logging software or kept track of your mileage otherwise, set the first day of this month as the starting date for your mileage log in the dashboard and add the mileage recorded at the end of the previous month.

After inputting all the data, click Add.

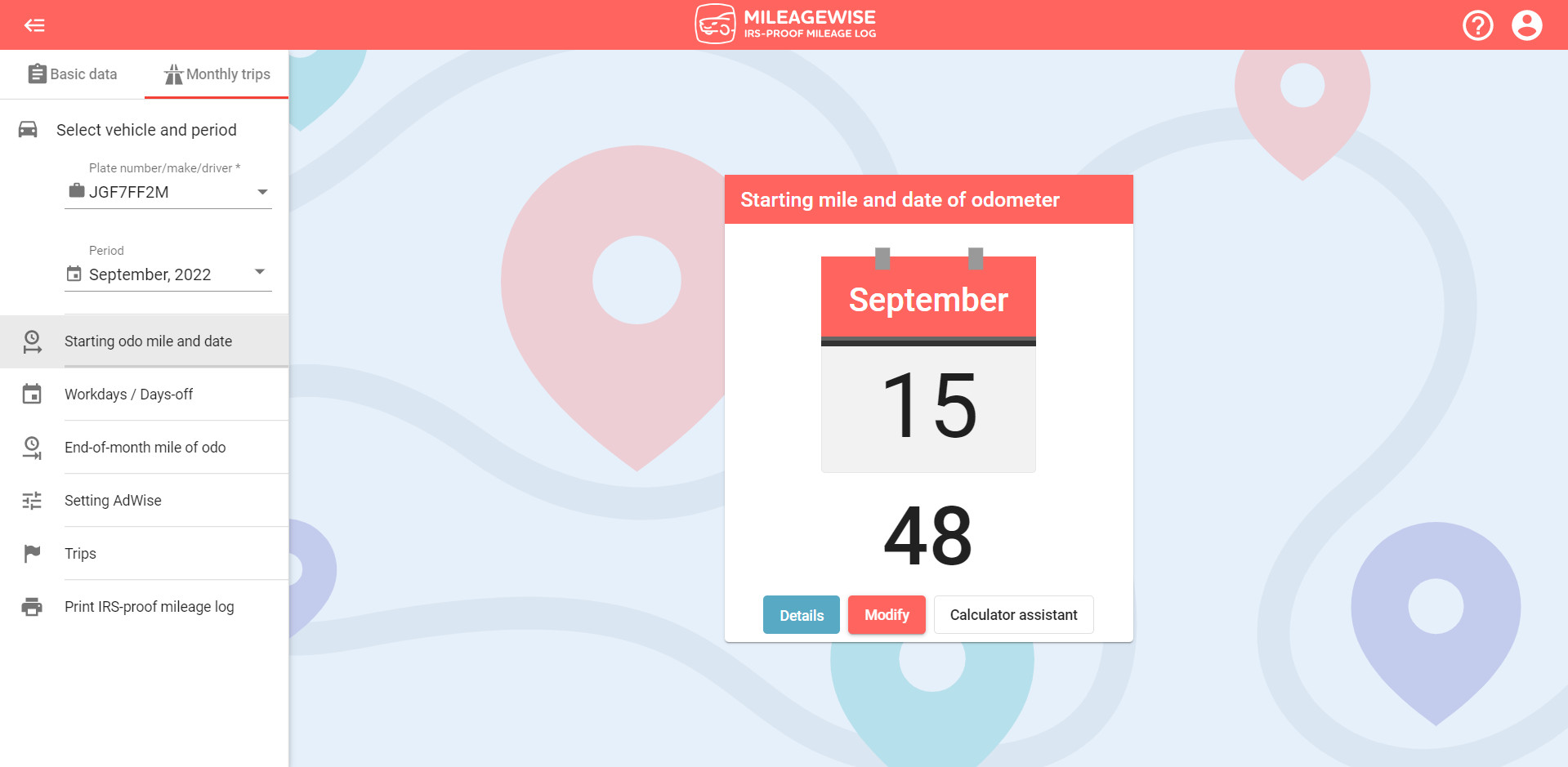

By clicking on the Details button, you will also be able to see all recorded odo readings, such as ones logged for refuelings / chargings, fixed trips, and end-of-month odometer recordings. Also, with the Calculator assistant, you can calculate these if they are not available.

This mileage tracker app goes beyond the basics! Automatically track your trips and customize your settings to match your needs. Designed to be battery-friendly, data-efficient, and fully ad-free — all while respecting your privacy. No upselling, no distractions — just the features you need.

With our Google Maps Timeline integration for importing your Location History, the AI Wizard Mileage Log Generator for recovering past trips, and our Built-in IRS Auditor that spots 70 potential red flags, MileageWise makes sure your mileage logs are always 100% IRS-proof.

April 29, 2025 Are you a freelancer or independent contractor? Do you get paid with a 1099 form? Then you need a 1099 tax calculator!

If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this post, we’ll break down what

Last Updated: April 7, 2025 If you use the internet for work, you might be able to claim a deduction on your tax return. But

Last Updated: March 3, 2025 If you regularly pay tolls for work-related travel, you may be wondering: Are tolls tax-deductible? The short answer is yes,

© 2025 MileageWise – originally established in 2001