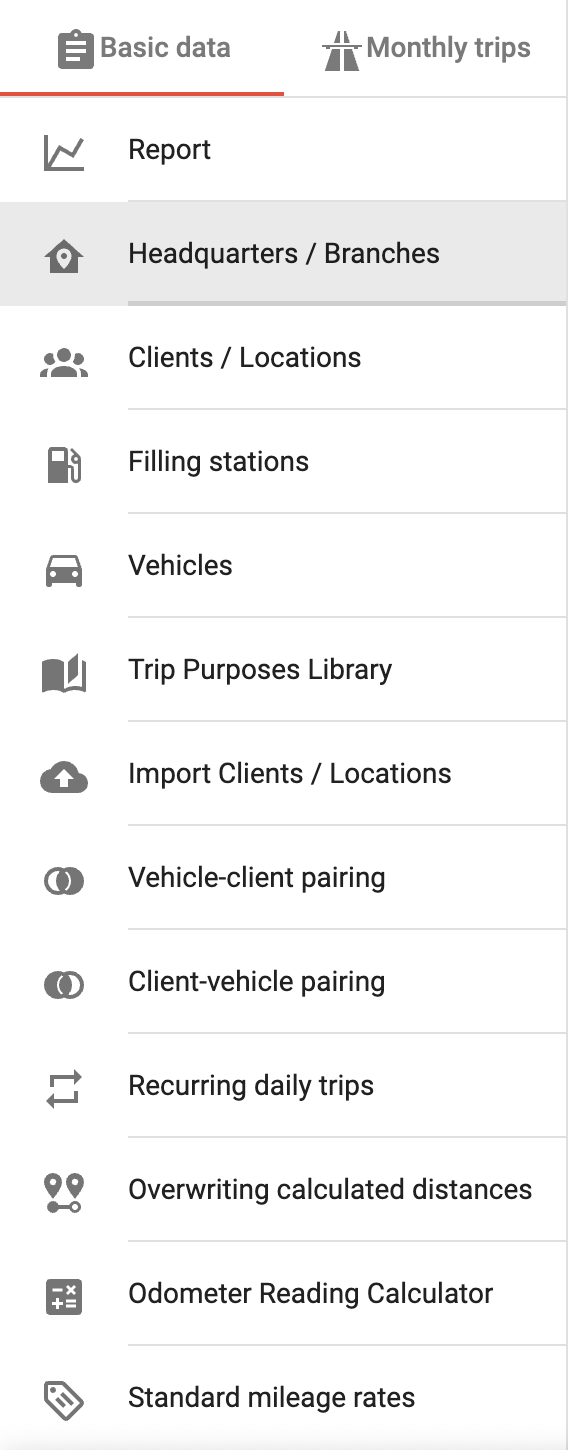

In the program, the menu layout is designed to guide the user.

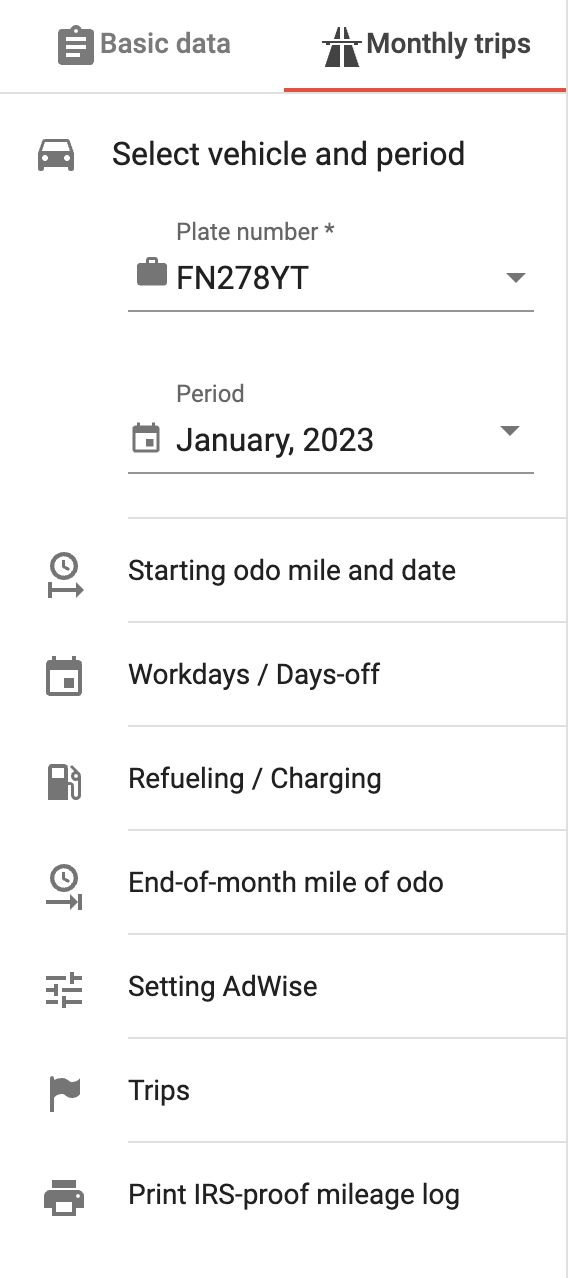

You should go from top to bottom in the Basic data and Monthly trips tabs.

We advise you to enter the Basic data first, including the recurring daily trips.

After that, on the Monthly trips tab, enter the Starting odometer reading (if necessary), then your workdays and days off, and then refuelings / chargings.

Proceed with entering the fixed trips (i.e. record trips connected to the data of parking, speeding tickets, car-related bills, etc.) and then enter the end-of-month odometer reading.

If necessary, set your preferred parameters in the AI Wizard function settings, and following that, in the Trips tab, you can put the finishing touches on your mileage log.

If the entered and deductible distances match the IRS-proof mileage log is ready to be generated.

It’s important to know, that any entered monthly data can be edited or supplemented at any time, you can’t go wrong with MileageWise.