It is highly recommended to have a monthly starting odometer reading for each month. If you have a starting and ending odometer reading for each month, the difference between the two numbers is how many miles you can realistically travel. For an IRS-proof result, use your mile readings as a base to make sure that your trips realistically correspond with your max. drivable distance for the month.

Note: Your end-of-month reading for a given month will be used as the starting odometer record for the following month.

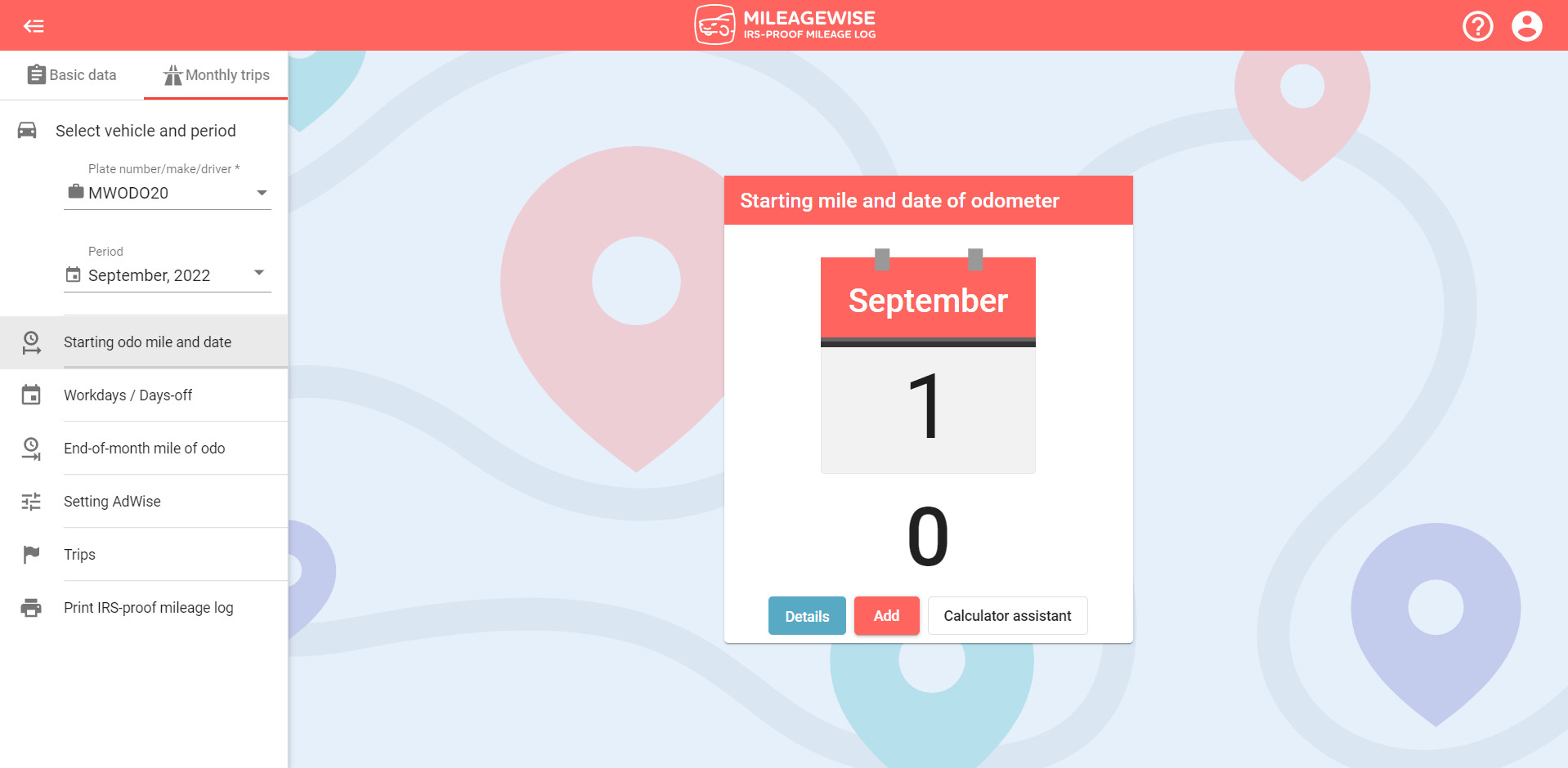

Click the Add button to enter the data.

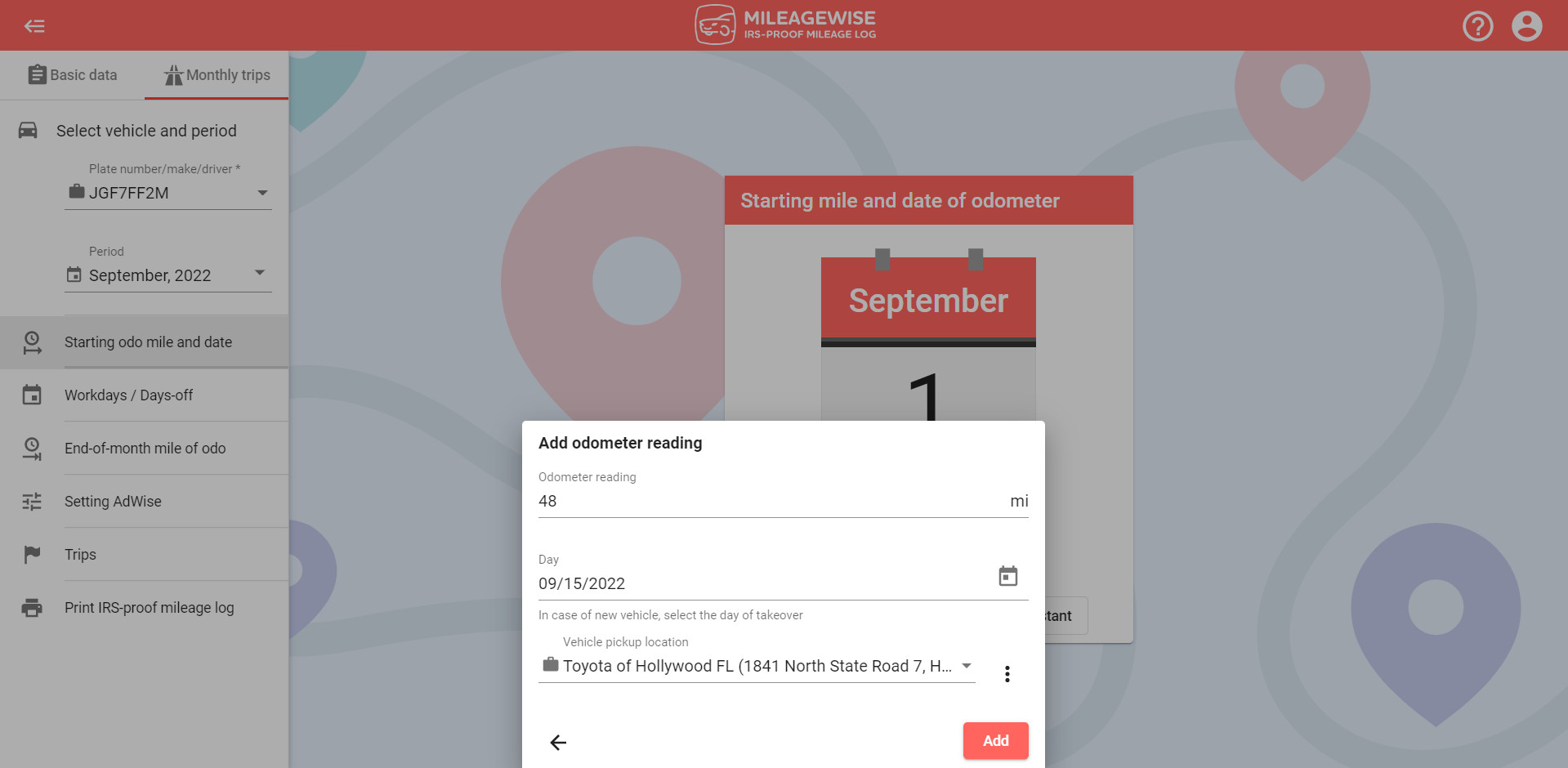

If you have purchased your new vehicle in the middle of the month, select the day of the pick-up and enter the odo reading at that time of the vehicle pick-up (there are always a few miles in a brand new vehicle already, so ‘0’ is impossible).

If you previously used some kind of mileage logging software or kept track of your mileage otherwise, set the first day of this month as the starting date for your mileage log in the dashboard and add the mileage recorded at the end of the previous month.

After inputting all the data, click Add.

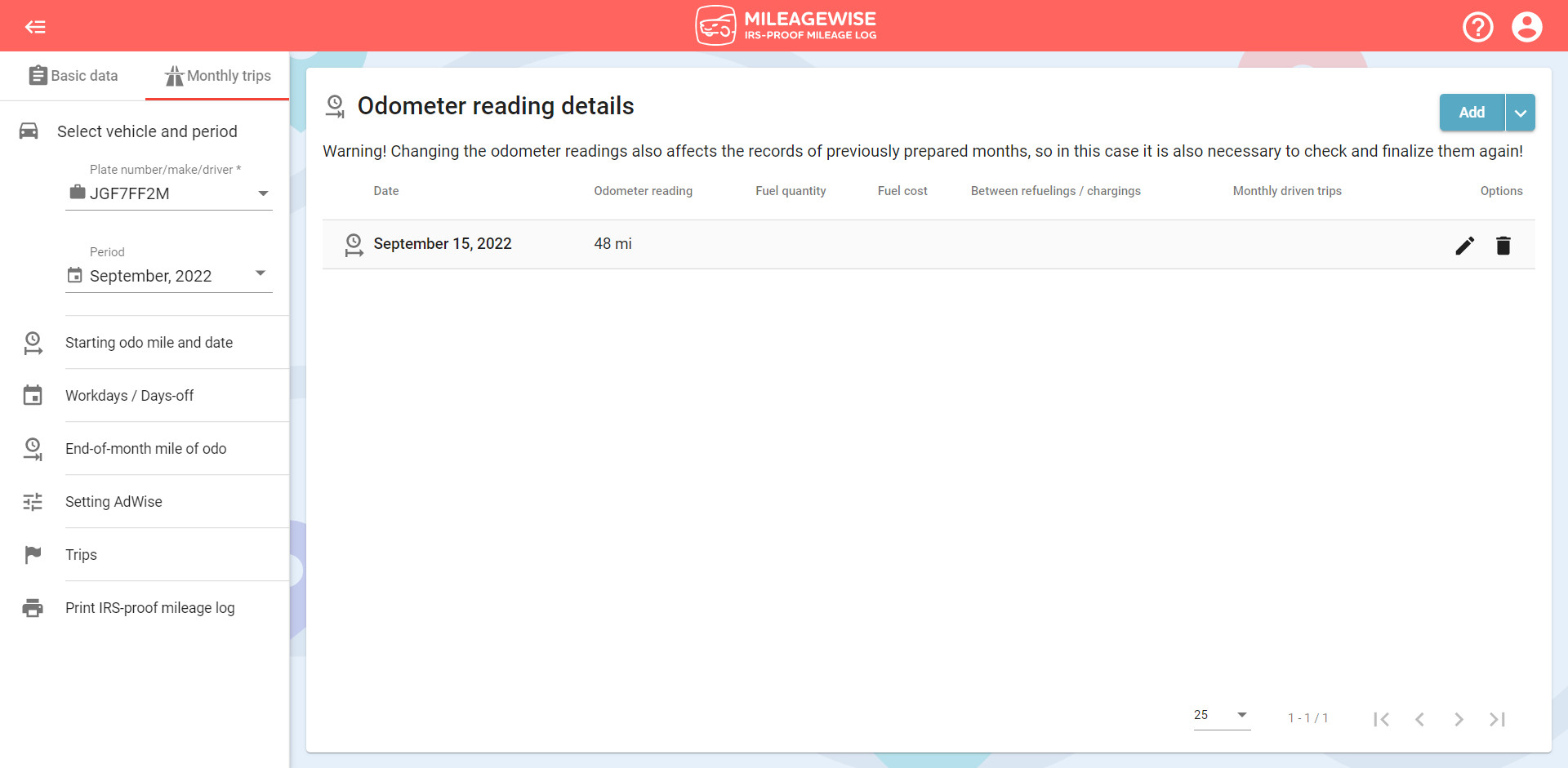

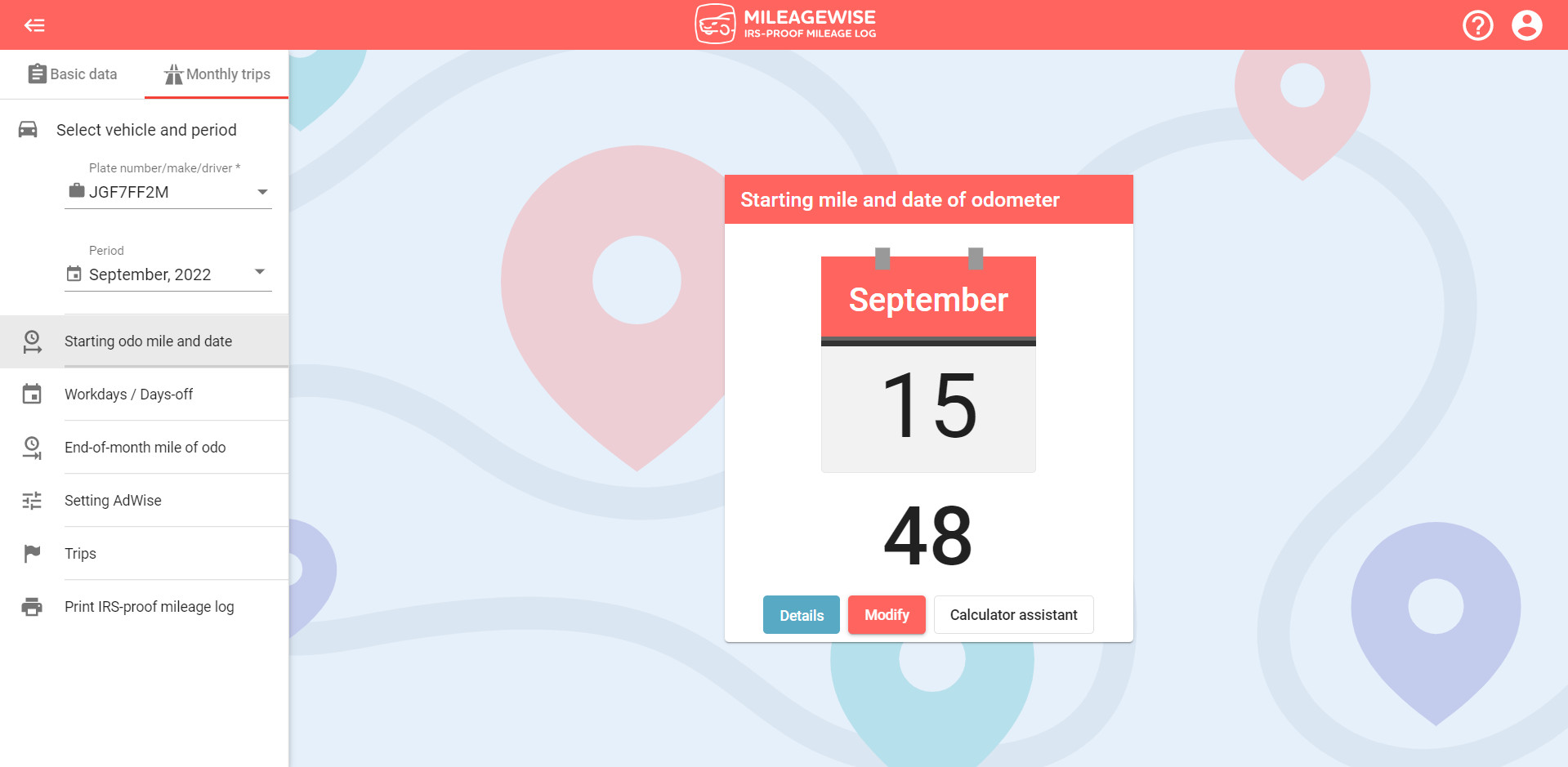

By clicking on the Details button, you will also be able to see all recorded odo readings, such as ones logged for refuelings / chargings, fixed trips, and end-of-month odometer recordings. Also, with the Calculator assistant, you can calculate these if they are not available.