Last Updated: November 17, 2025

Becoming a Bird scooter charger offers an exciting opportunity to earn extra income while contributing to eco-friendly urban mobility. Bird scooter chargers, often referred to as Bird Chargers, play a critical role in ensuring that electric scooters are readily available and fully charged for riders. This guide will walk you through everything you need to know about becoming a Bird scooter charger, including the requirements, pay structure, and essential tax information.

Table of Contents

What is Bird Scooter Charging?

Bird scooter charging involves collecting low-battery electric scooters, charging them at home, and then returning them to designated drop-off points. As a Bird scooter charger, you use the Bird app to locate scooters that need charging. Once you collect the scooters, you take them to your charging station—usually your home—where you plug them in using compatible charging equipment. After charging, you return the scooters to specified locations (“bird nests”) in the morning, ready for riders to use.

Getting Started with Bird Charging

Requirements

To become a Bird scooter charger, you must meet a few basic requirements. First, you need to be at least 18 years old and be legally authorized to work in the United States. You should also have access to a vehicle, such as a car or a truck, to transport the scooters. Additionally, you’ll need a smartphone with the Bird app installed and a suitable place to charge multiple scooters.

Signing Up

Applying to become a Bird scooter charger is a straightforward process. Start by visiting the Bird website or downloading the Bird app. Complete the Bird scooter charging job application by providing your personal information and agreeing to the terms and conditions. Once approved, you’ll receive the necessary charging equipment and instructions on how to get started.

Pay Structure

The pay structure for Bird scooter chargers varies depending on several factors, including location, demand, and the number of scooters you charge. Typically, you earn a fee for each scooter you charge and return. Bird scooter charger pay can range from $3 to $20 per scooter, depending on how long ago it was charged and how accessible it is. Furthermore, understanding the pay structure and planning your charging schedule effectively can help you maximize your earnings.

Taxes and Deductions for Bird Scooter Chargers

Tax Obligation of Chargers

As an independent contractor, you are responsible for managing your taxes. This means that if your earnings surpass $600 a year, you have to report your income from Bird Scooter charging on your tax return, pay self-employment tax, and pay state and federal income tax. If this is the case, you will receive a 1099 form from Bird that will be your key document to file your earnings. To estimate your taxes, use our 1099 tax calculator.

Common Tax Deductions for Bird Chargers

Bird scooter chargers can benefit from several tax deductions that can help reduce taxable income. Common deductions include the cost of charging equipment, such as cables and adapters, and expenses for your vehicle. Additionally, if you use part of your home exclusively for charging activities, you may qualify for a home office deduction. Keep detailed records of all business-related expenses to maximize your deductions.

What is Mileage Deduction?

The mileage deduction allows you to deduct the cost of using your vehicle for business purposes, which is crucial for Bird scooter chargers who frequently drive to collect and return scooters. This deduction can reduce your taxable income by thousands of dollars, making it an important consideration for anyone in this line of work.

How Do I Claim Mileage Deduction?

To claim mileage on your taxes, you must keep a detailed mileage log of all business-related trips. This log should include the year starting and ending odometer readings of your vehicle; furthermore, the date, purpose, and number of miles driven during each trip. The IRS provides a standard mileage rate that you can use to calculate your deduction. For the latest rate, check the IRS website or consult with a tax professional.

Benefits of Using a Mileage Tracker App

Using a mileage tracker app can simplify the process of keeping accurate records of your business miles. These apps automatically track your trips, making it easier to claim the mileage deduction accurately and efficiently. Moreover, they provide detailed reports that you can use when filing your taxes. Use an app that guarantees IRS-compliant reports, like MileageWise.

MileageWise: A Comprehensive Tool for Bird Scooter Chargers

MileageWise is a powerful application designed for gig workers and freelancers to track their business mileage effectively. It offers features that guarantee effortless tracking and IRS-compliant mileage logs. Among many options available, MileageWise stands out for its exceptional customer support and distinctive functionalities:

- Automatic Mileage Tracking – logs every trip between charging zones and delivery points

- Quick Setup – get your tracking running in just a few minutes

- Ad-Free & Privacy-Focused – enjoy seamless tracking without ads or data worries

- Backup Mileage Capture – keeps recording even when your signal drops

- Flexible Routing/Distance Calculations – track your real routes or use optimized mileage estimates

- Routing Integration with Waze – navigate efficiently and log your drives automatically with Waze

- Expense Tracking Integration – connect your charging and vehicle expenses for easier record-keeping

Try MileageWise for free for 14 days. No credit card required!

Conclusion

Becoming a Bird scooter charger is a practical way to earn extra income while helping keep shared mobility running smoothly. When you understand the requirements, the signup steps, the pay system, and your tax responsibilities, it becomes much easier to make the most of this side gig. Pairing your work with a reliable mileage tracker can also boost your efficiency and ensure you claim every tax deduction you’re entitled to.

FAQ

Can I Charge Multiple Scooters at Once?

Yes, you can charge multiple scooters at the same time if you have the necessary equipment and capacity.

How Much Can I Earn as a Bird Charger?

Earnings can vary, but many chargers report making between $100 to $500 per week, depending on the number of scooters charged and the rates in their area.

How Do I Sign Up to Become a Bird Charger?

You can sign up by visiting the Bird website or downloading the Bird app and completing the application process.

What Equipment Do I Need to Get Started?

What Equipment Do I Need to Get Started?

How can I maximize my income?

Since vehicle expenses can make up a considerable amount of your overall expenses (same with other gigs like Uber Eats, Lyft, Shipt, or Instacart), they can also bring greater tax deductions. To make the most of it, you need to keep tabs on all of your business vehicle expenses or keep a detailed log of your business miles. Use a mileage tracking app to enhance efficiency, save time, and bring IRS-Proof results.

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

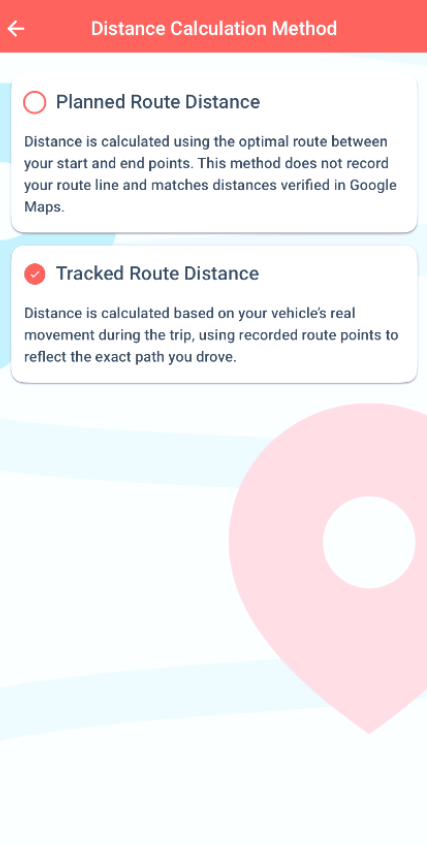

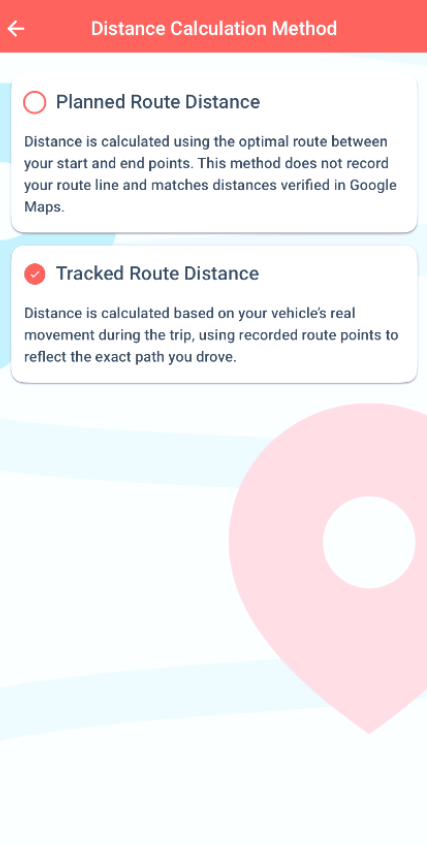

Only at MileageWise: Choose the Way to Calculate Your Mileage

We’ve upgraded how mileage is calculated in our mileage tracker app. 🎉 From now on, you can choose between two distance calculation methods depending on

Company Car vs Car Allowance: Which is Better for Your Business?

Last Updated: January 19, 2025 Deciding between a company car vs car allowance for your employees involves weighing costs, flexibility, and tax implications. For U.S.

Vehicle Fleet Software to Boost Your Business

Last Updated: January 19, 2026 Vehicle fleet software helps businesses handle their vehicles much better, cutting down costs and making everything run smoother. This type

Is Mileage Reimbursement Taxable? The Need to Knows

January 16, 2026 Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard

Freshly Announced: See The IRS Mileage Rates for 2026

January 2, 2025 The IRS has officially announced the IRS mileage rates for 2026, and they bring important updates for self-employed individuals, gig workers, small

Try MileageWise for free for 14 days. No credit card required!

Related Guides

Related Blogposts

Now on the App Store: Mileage Log from Google Maps for iPhone

It’s Finally Here! Google Maps Timeline Import from Mobiles

Transform your Trip Lists into Mileage Logs with MileageWise

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Only at MileageWise: Choose the Way to Calculate Your Mileage

We’ve upgraded how mileage is calculated in our mileage tracker app. 🎉 From now on, you can choose between two distance calculation methods depending on

Company Car vs Car Allowance: Which is Better for Your Business?

Last Updated: January 19, 2025 Deciding between a company car vs car allowance for your employees involves weighing costs, flexibility, and tax implications. For U.S.

Vehicle Fleet Software to Boost Your Business

Last Updated: January 19, 2026 Vehicle fleet software helps businesses handle their vehicles much better, cutting down costs and making everything run smoother. This type

Is Mileage Reimbursement Taxable? The Need to Knows

January 16, 2026 Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard

Freshly Announced: See The IRS Mileage Rates for 2026

January 2, 2025 The IRS has officially announced the IRS mileage rates for 2026, and they bring important updates for self-employed individuals, gig workers, small

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Introducing the Mileage Log from Google Maps App

We’re excited to share our latest development! You can now convert your Google Maps Timeline drives directly into an IRS-compliant mileage log right on your

Was Your Google Timeline Deleted? Here’s What Happened:

Last updated: November 20, 2025 If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this

It’s Finally Here! Google Maps Timeline Import from Mobiles

Struggling to Manage Your Trips After Google’s Timeline Update? If you’re reading this, you’ve likely encountered the recent update affecting Google Maps Timeline. With Timeline

Transform your Trip Lists into Mileage Logs with MileageWise

Last Updated: October 1, 2025 Do you have a list of monthly trips from a data source like Excel or Google Timeline, but need to

How to Download Google Timeline Data: A Guide

Google Timeline Import Hub Last Updated: October 30, 2025 Want to download Google Timeline data? This guide shows you how to extract your location history

How to Export Google Maps Timeline: Get Your Data

Google Timeline Import Hub Last Updated: October 29, 2025 It can be tricky to export Google Maps Timeline data after Google’s recent updates. Many users

Google Maps Mileage Tracker: From Timeline to Mileage Log

Google Timeline Import Hub Last Updated: October 29, 2025 If you’re an active user of Google Maps Timeline you likely already know how convenient it

Timeero

Table of Contents Timeero Timeero is a time, location, and mileage tracking app designed for businesses and teams in the United States. It helps employers

Milewise by Allstate

Table of Contents Milewise by Allstate Milewise by Allstate is a pay-per-mile car insurance program offered by Allstate Insurance in the United States. It’s designed

Hurldr

Table of Contents Hurdlr Hurdlr is a finance and expense tracking app designed for self-employed professionals, freelancers, and gig workers in the United States. It