Last Updated: March 3, 2025

Business owners and self-employed people might find making the most of their tax deductions challenging. However, many overlook a simple strategy that can lead to significant savings: create a mileage log. A mileage log serves as an essential document for saving on business travel expenses. This guide explores the benefits of mileage logging, listing its advantages, requirements, and the innovative ways technology can transform this routine task into a strategic advantage for maximizing your deductions.

What is a Mileage Log?

In the case of employees, taxes are already withheld from their payment, whereas business owners and self-employed people have to manage their taxes themselves. These generally include the self-employment tax, which covers Social Security and Medicare, and the income tax.

You may be eligible for various deductions from your income taxes, depending on your work type. For example, deductions of office supply costs, internet and phone bills, meals, and vehicle expenses.

This is where the mileage log comes into the picture. You have the option to record all vehicle-related expenses or your miles traveled in a detailed trip log to deduct a set amount of cents per mile.

What Are the Advantages of Logging Mileage?

There are several benefits to creating a mileage log from your logged miles. First, tracking the miles that you traveled is much easier than tracking your vehicle expenses. There is no need to hoard receipts and keep all of your car expenses in mind, like fueling or recharging, repairs and maintenance, parking, insurance, and more. The IRS mileage rate encompasses all vehicle-related deductible expenses and usually results in more tax savings. Furthermore, you get an overview of your daily operations, which helps you identify areas where you can improve and save more.

What Should I Include in my Mileage Log?

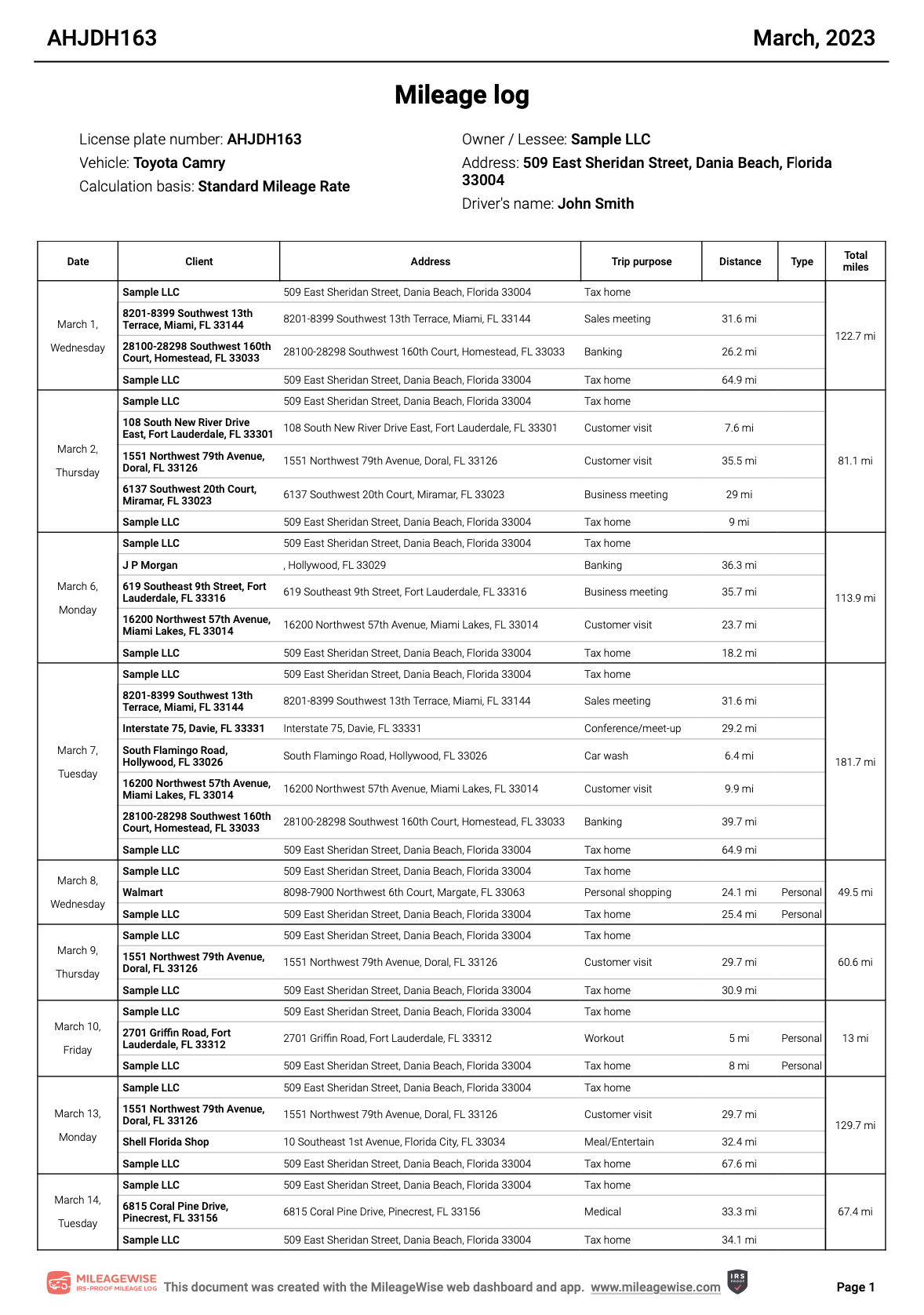

When it comes to the question of how to log miles for taxes and the content of a mileage log, there are several criteria that it has to meet. Here is a detailed list of information the IRS requires you to include in your mileage logbook:

Personal Information

Present your name/ business, your address, and the period of logging on the header of your log.

Vehicle Information

Include details of the vehicle used (make, model, year) and when it was placed in service for business purposes.

Accurate Dates and Times

Record the date of each trip.

Detailed Trip Purpose

Specify the purpose of each trip (e.g., client meeting, supply run).

Complete Start and End Locations

Include the exact starting point and destination for each journey.

Exact Mileage

Document the miles driven for each trip. Use your vehicle’s odometer or a reliable GPS tracking system.

Separate Business and Personal Use

Clearly distinguish between business and personal trips.

Annual Summary

Prepare an annual summary of the total miles driven, including business, commuting, and personal miles with start-of-year and end-of-year odometer readings.

Example of a monthly mileage log:

Further tips to ensure consistency and accuracy

Regular Updates

Update your log regularly (ideally daily or weekly) to ensure accuracy and add your odometer reading periodically for accuracy.

Consistent Record Keeping

Use the same method for logging throughout the year to maintain consistency.

Retention of Supporting Documents

Keep receipts, calendars, and appointment books that corroborate your trips.

Should I Choose Manual or Digital Mileage Logging?

When it comes to the mode of mileage tracking for your car, it all comes down to personal preferences. Let’s overview the options to see what suits you best.

Manual Tracking

For those who like to be in control of the whole process of mileage tracking and have a knack for numbers, spreadsheets might be the ideal choice. They allow for a tailored approach to tracking, giving you the freedom to design a system that fits your way of thinking and your specific requirements.

However, this method demands regular data input and maintenance, as it’s up to you to keep your financial records up-to-date. To ease the process, consider adopting a pre-made vehicle mileage log tracker template from an online service, available for both Excel and Google Sheets, designed for small business expense tracking. Look for printable worksheet templates if you prefer to jot down miles on the road.

Digital Tracking

On the other hand, if you’re looking for a more hands-off method, automated solutions provide easy and efficient tracking. Specialized software are invaluable tools for effortlessly monitoring everything you need for your mileage log.

Apps, in particular, are popular for being instantly downloadable to your smartphone and for offering a broad selection of features to track mileage for work.

Regardless of the method you opt for, both manual and digital paths can be efficient ways to create compliant trip logs.

How MileageWise Simplifies Mileage Logging

MileageWise emerges as a unique solution among tax-purpose digital mileage tracker software, designed to streamline the process for companies, businesses, and self-employed individuals alike. Its standout features not only ease the mileage recording and reporting of mileage but also ensure that your logs adhere strictly to IRS standards.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days.

Join out community of 20k+ users

Key Features of MileageWise

Automatic Tracking

MileageWise provides the option of automatic tracking via GPS and vehicle movement data, ensuring no trip is ever missed. No more worrying about precise manual logging!

IRS Compliance

The platform is built to collect all data needed to create IRS-Proof mileage logs. Furthermore, the built-in IRS Auditor Tool detects and corrects up to 70 potential IRS red flags, ensuring that your log is free from any inconsistencies that might trigger an audit.

Easy Reporting

Generate comprehensive reports with a few clicks, ready to be used for tax filings or reimbursement claims.

Data Security

With cloud storage, your mileage logs are securely stored and accessible from any device, offering peace of mind against data loss.

User-Friendly Interface

The simple, user-friendly interface allows users to quickly familiarize themselves with the app’s features and start logging immediately.

AI-Powered Recommendations

The AI Wizard feature is an invaluable assistant for filling gaps and correcting inconsistencies in your mileage logs. Its recommendations aim to ensure accuracy and completeness.

Mastery of your mileage log is more than just a practice in meticulous record-keeping; it’s a strategic approach to securing the maximum possible tax deductions available to you as a self-employed individual or business owner. From the ease of tracking to the peace of mind that comes with IRS compliance, the benefits of a well-maintained mileage log are indisputable.