Our Reviews & Experiences

Home » MileIQ Alternatives » Stride Review

Last Updated: September 22, 2025

This Stride review covers a popular free app for gig workers and freelancers to track mileage and expenses for tax deductions. It’s perfect if you need a basic, no-cost tool. However, if you drive a lot and need in-depth, audit-proof mileage logs and advanced features, you might find more specialized solutions a better fit. Read on to see if the Stride: Mileage & Tax Tracker app is indeed the right fit for you!

Table of Contents

Stride: Mileage & Tax Tracker Overview

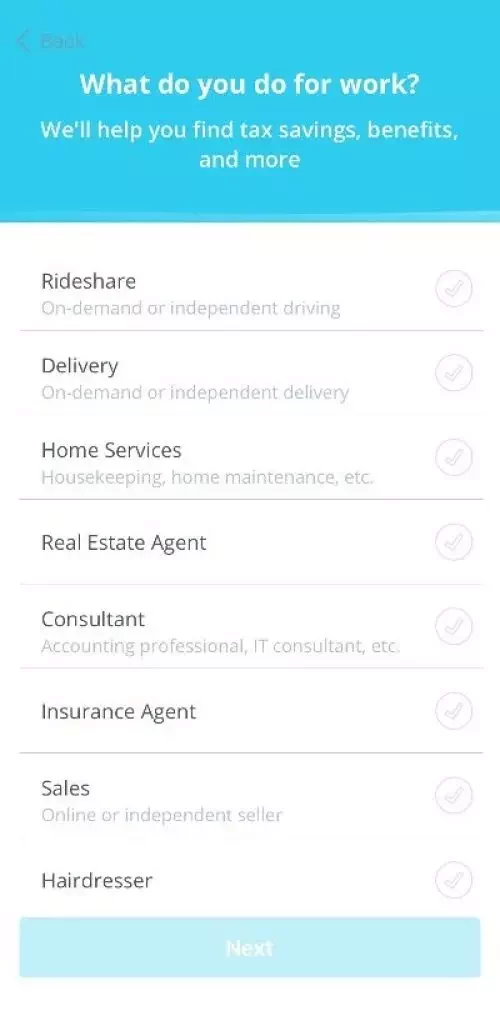

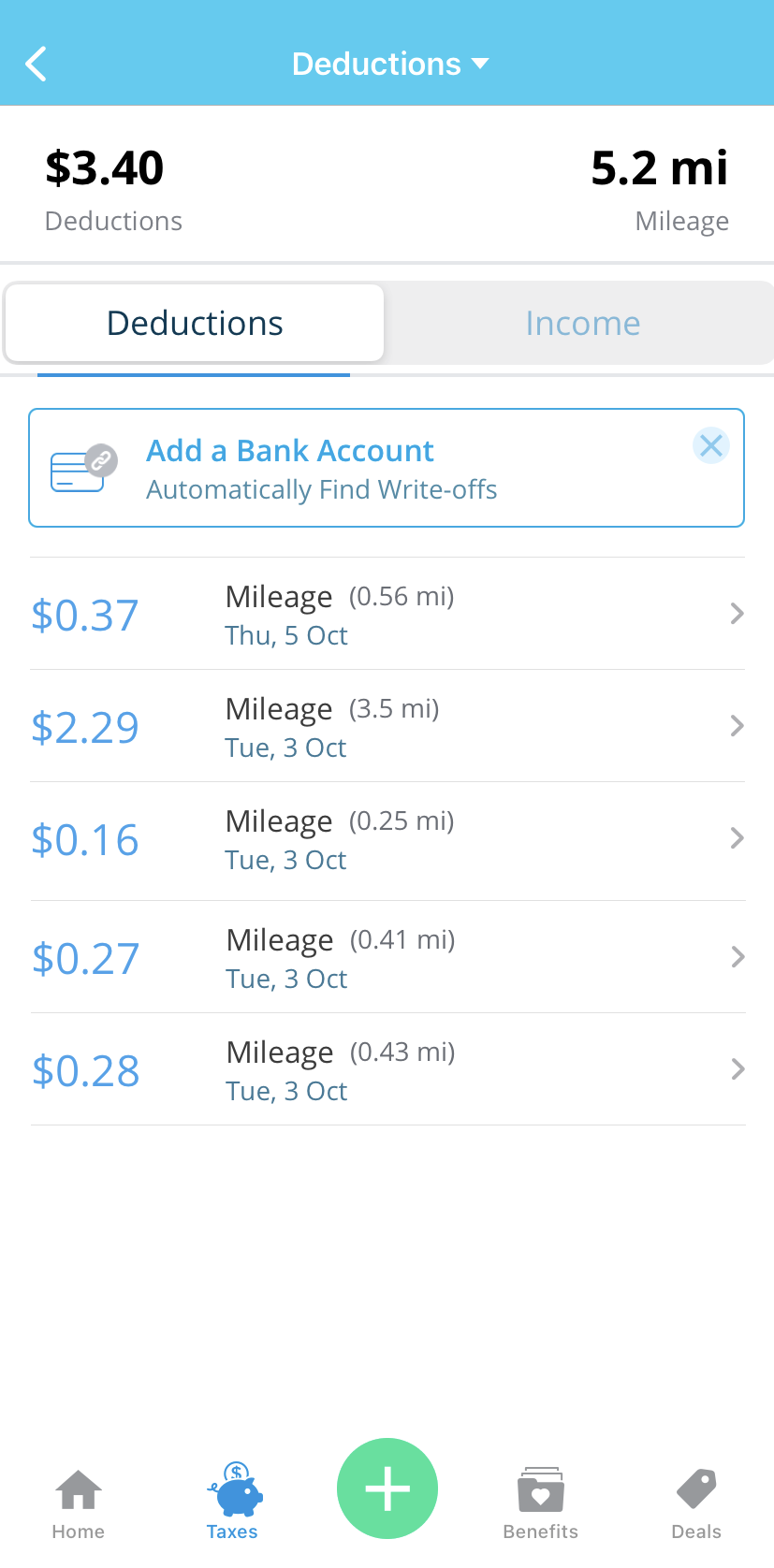

Stride is a well-known free app designed to help self-employed individuals, including rideshare drivers and delivery drivers, manage their business mileage, expenses, and income. It aims to simplify self-employed tax preparation by providing an easy way to log deductible activities:

- Free App: The biggest draw is that Stride is completely free to use for its core features, including mileage, expense, and income tracking.

- Reporting: It creates reports that are suitable for tax filing, helping you deduct business expenses.

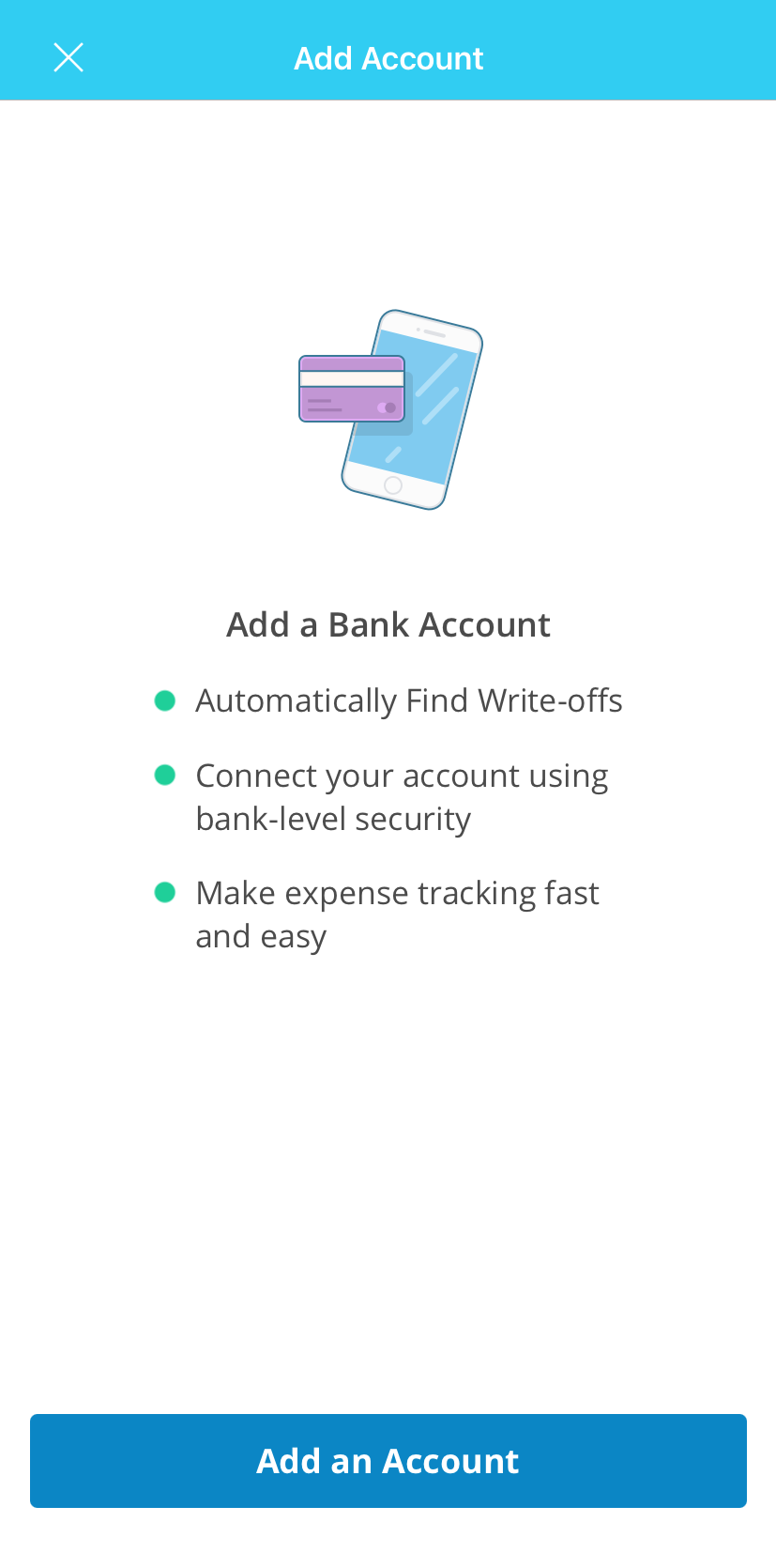

- Expense and Income Tracking: Stride lets you snap photos of receipts, categorize your expenses, and manually record your income. It even connects with your bank account.

- Mileage Tracking Options: You can start and stop trips manually or set it up to track automatically.

- Platform Availability: Stride is available on both Android and iOS devices, reaching a broad user base.

Youtuber Your Driver Mike compares Stride with alternatives to mileage tracking in this video.

User Testimonials of the Stride App

Users already familiar with Stride’s mileage tracking and expense features report mixed experiences: Google Play rating: 3,1 (low compared to similar options); Play Store rating: 4.8. Overall, long-time users praise simplicity and all-in-one tracking, but recent updates drew frequent complaints about reliability and data integrity.

Positive Feedback

- Simple to use for manual mileage and income entry; clear, helpful notifications/reminders

- Convenient all-in-one place for mileage, receipts (photo capture), and expenses; quick profit/deduction estimates

- Report exports (PDF/CSV) useful at tax time; some users and CPAs found outputs easy to work with

- Many long-time users relied on it for rideshare/delivery; some preferred it over competitors and would pay for premium if core tracking remains solid

Negative Reviews

- Reliability issues after updates: missing or partial trips, straight-line paths, big under/over counts, drives stopping early, or “0 uploaded” with data not saving/recovering

- Crashes, lag, and login errors; some say tracking only works when the app is open or requires restarts/reinstalls

- Data loss (mileage/income) reported after updates/reinstalls; syncing inconsistencies and disappearing trips/notes

- UX/regression pain: extra steps to stop notifications, removed at-a-glance comparisons, list appearance issues when reviewing trips

- Feature gaps: weak search/filter for expenses, confusing/limited totals, can’t rename/use multiple “Other” categories, requests for widgets/CarPlay/auto-start not met

MileageWise: The Dedicated Mileage Tracking Expert

If your income heavily relies on driving, or if you need an IRS-proof mileage log without the hassle of manual tracking, a specialized solution like MileageWise might serve you better. MileageWise focuses on providing complete and compliant mileage logs, helping you maximize your tax deductions with confidence. It goes beyond basic tracking to offer advanced features tailored for heavy drivers.

MileageWise stands out by offering a comprehensive suite of tools designed to ensure every mile counts toward your tax deductions and remains fully compliant with IRS rules.

Mobile App for Effortless Mileage Tracking

- Automatic Mileage Tracking: Capture every drive without lifting a finger.

- Quick Setup: Start logging trips in minutes, no tech headaches required.

- Privacy First: No ads, no selling your data — just secure tracking.

- Backup Mileage Capture: Reliably record trip start points even when other apps fail.

- Flexible Route Options: Choose between actual routes or optimized distances.

- Seamless Waze Integration: Navigate with Waze while trips log automatically in the background.

- Expense Tracking Sync: Keep your mileage and expenses side by side for stress-free tax prep.

Dashboard for Complete Mileage Logs

- Google Maps Timeline Import: Pull in your Location History and instantly fill in your mileage log. Ideal if you forgot to track during busy days.

- AI Mileage Wizard: Let smart automation rebuild past trips for you, saving hours of manual data entry while keeping your mileage log precise.

- IRS Compliance Checker: Run your logs through a built-in audit to ensure every trip follows IRS rules, giving you peace of mind at tax time.

- Bulk Import Options: Add entire client lists or recurring routes in one step, making it easy for agents or contractors who juggle many accounts.

- Advanced Trip Management: Organize your drives with batch editing, categories, and recurring trip handling.

Unique Selling Points of MileageWise

MileageWise distinguishes itself with features focused on long-term value and user support.

- Lifetime Plans: MileageWIse is a pioneer in offering lifetime deals, giving you significant savings over recurring subscription models. You pay once and use it forever.

- Outstanding Support: Our dedicated customer service team and extensive resources help you navigate the platform and maximize your tax deductions.

Comparing the Stride App and the MileageWise App

| Feature | Stride (Mileage & Tax) | MileageWise (Dedicated Mileage Tracking) |

|---|---|---|

| Primary Focus | Mileage, income, and expenses tracking for gig workers. | Specialized, IRS-proof mileage tracking and log management. |

| Pricing | Free for core features. | Free trial, then paid plans (with lifetime options). |

| Mileage Tracking (Mobile App) | Manual start/stop, or auto-trigger with phone connection | Multiple automatic tracking modes, several customization options. |

| IRS Compliance (Reports) | Tax-ready reports. | Built-in IRS Auditor and detailed, IRS-compliant reports. |

| Automation Level | Requires frequent user input. | High automation with smart trip detection and auto-classification. |

| Reporting Depth | Wide range of reports for taxes. | Compliant and audit-ready mileage logs. |

| Support | App-based help, community forums. | Dedicated customer support and extensive resources. |

| ➕Optional Desktop Tools: - Google Maps Timeline Import - AI Wizard Mileage Log Generator |

Try MileageWise for free for 14 days. No credit card required!

Customer Story: Upgrading Mileage Trackers

I first came across Stride when I needed an app for tax deductions. At first, it seemed simple enough, but after digging deeper, I wasn’t impressed with the Play Store rating. The reviews made me doubt if it could really keep up with my mileage tracking needs.

Since driving is a big part of my work, I needed a tool I could rely on every single day. That’s when I found MileageWise. Setting it up was quick, and once I started logging trips, I immediately noticed the difference in accuracy and organization. With MileageWise, I finally have peace of mind knowing my trips are tracked properly and my mileage logs are ready when tax season rolls around.

Conclusion: Making the Right Choice for Your Miles

This Stride review makes it clear that the Stride: Mileage & Trax Tracker app offers a valuable, free service for basic mileage and expense tracking, especially for new gig economy workers. It’s convenient for those who look for a compact and simple tax app.

However, if your business depends heavily on driving, or if you want absolute confidence in your mileage logs, a specialized tool like MileageWise offers a powerful, customizable, and audit-proof solution.

FAQ

Is Stride really free to use?

Yes, Stride is free for its core features like mileage, expense, and income tracking. This makes it appealing for beginners or anyone on a tight budget. However, the free version comes with trade-offs such as fewer advanced tools and occasional reliability concerns.

How accurate is Stride’s mileage tracking?

Based on many Stride review comments, the app can track trips manually or through Bluetooth triggers. While convenient, some users reported missing trips, partial tracking, or drives stopping unexpectedly. For those who rely on precise mileage logs, this may be an issue.

Do AI mileage logs protect my privacy and data?

Reputable apps encrypt trip data and follow GDPR/CCPA regulations. Always check individual app privacy policies, but major players don’t sell location data and offer in-app controls for data management.

Who is Stride best suited for?

This Stride review shows the app works well for freelancers, gig workers, or delivery drivers who want a simple, no-cost way to log mileage and expenses. It’s less ideal for professionals who drive a lot and need highly detailed reporting.

What alternatives should I consider if the Stride app isn’t enough?

Other popular tax apps include Hurdlr and QuickBooks Self-Employed, but they tend to focus on broader expense tracking and may not be as specialized for mileage logs. If you need advanced features like backup trip capture and audit-proof mileage logs, MileageWise is a stronger choice