Our Reviews & Experiences

Home » MileIQ Alternatives » Gridwise Review

Last Updated: October 3, 2025

Looking for a detailed Gridwise Review? Gridwise consistently ranks high as a leading gig-driver assistant app across platforms like Uber, Lyft, DoorDash, and Instacart. It offers excellent tools for tracking earnings, mileage, and providing event alerts, all designed to boost your performance. Read more for details and user feedback.

Table of Contents

What is Gridwise and How Does It Help Gig Drivers?

Gridwise is a popular companion app for rideshare and delivery drivers, designed to streamline their work and maximize their income. It helps gig workers manage the complexities of their multi-platform jobs. The app is widely available on both iOS and Android, earning its place as a trusted tool in the gig economy.

Gridwise goes beyond simple tracking. It offers a suite of tools that help drivers work smarter, not just harder:

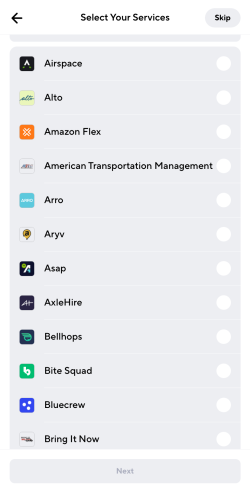

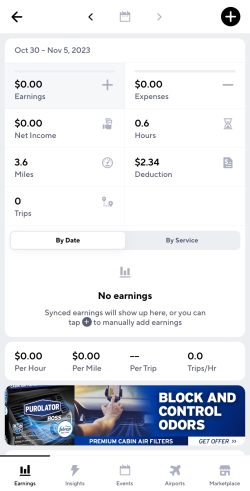

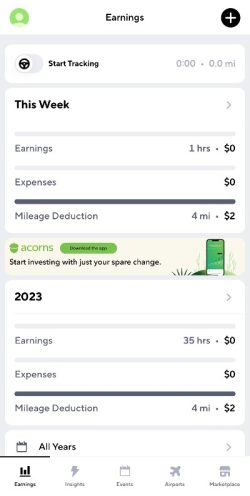

- Automatic Tracking: Gridwise automatically tracks earnings, mileage, and expenses across nearly 100 different gig platforms. This means less manual data entry for you, saving valuable time. Drivers frequently praise this feature, noting it saves hours of manual log-keeping by automatically syncing with gig apps.

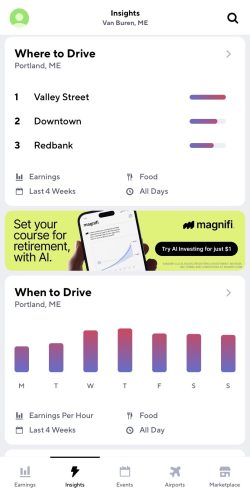

- Performance Insights: The app provides personalized analytics. You can see your earnings per hour and trips per hour, helping you understand where and when you earn the most. These real-time analytics and personalized recommendations help drivers choose optimal times and locations to maximize their hourly rate.

- Demand Alerts: Gridwise alerts you to local events and airport data. This means you know when and where demand will be highest, allowing you to position yourself for better-paying trips. User reviews often highlight how most appreciate the event and airport alerts, which lead to higher driver earnings during busy periods.

- Gridwise Plus: For those looking for an extra edge, Gridwise Plus offers advanced analytics, an ad-free experience, and easier tax report exports.

Gridwise by the Numbers: Facts and Statistics

Gridwise’s popularity isn’t just anecdotal. The numbers speak for themselves, showing a strong user base and high satisfaction.

- Active Users: Over 150,000 active users rely on Gridwise as a “top-rated app for gig drivers.”

- High Ratings: The app boasts impressive ratings: 4.9/5 stars on iOS and 4.6/5 on Android. These scores come from thousands of reviews as of 2025.

- Extensive Reach: Gridwise has over 650,000 total downloads and users across all platforms.

For a visual overview of Gridwise’s features, you can check out this YouTube review.

Gridwise Reviews from Customers

Drivers say this tool can be a big help for tracking work and taxes, but reliability and coverage vary by location and setup.

Satisfied Reviews of Gridwise

- Accurate mileage for many users, with helpful reminders

- Clear income and expense tracking in one place

- Easy tax time: exports, summaries, and year-to-date views

- Useful driving insights like airports, events, and peak times

- Works with multiple gig apps and allows manual edits

- Recent updates improved stability for some users

Main Complaints about Gridwise

- Auto mileage tracking and earnings sync can miss data

- App stability issues: crashes, battery or data drain

- Insights not available or relevant in some cities

- Login/linking problems with gig accounts; duplicate entries

- Missing or desired features (odometer, finer-grained insights)

- Pricing changes and limited free features raise concerns

How Gridwise Compares to Other Apps

When looking at alternatives like MileIQ, Hurdlr, and Mystro, Gridwise often comes out ahead in specific areas for rideshare and delivery drivers.

Gridwise distinguishes itself with its gig-economy-specific features and real-time demand analytics. While it might lack some backdated logging and editing features found in competitors like MileageWise, its strength lies in cross-platform tracking and actionable insights for gig market conditions.

The app’s role has grown significantly, evolving from a basic tracker into a “gig-driver business intelligence platform.” Its large user base and high ratings demonstrate its continued relevance and trustworthiness for gig workers.

Gridwise and Mileage Tracking: A Deeper Look

While Gridwise excels at giving you actionable insights for your gig work, we need to talk about mileage deductions. This is where you can truly save thousands of dollars each year. Gridwise helps with tracking, but its automatic tracking only logs business miles while your driver app is active. However, you can deduct any “offline” business-related trip, such as supply runs, trips to gas stations, repair shops, inspections etc. To make sure every deductible mile is accounted for, you need a specialized solution. That’s where MileageWise comes in.

Maximize your Mileage Deductions with MileageWise

MileageWise focuses on precision, compliance, and ease of use, making sure you don’t leave any money on the table when it comes to tax deductions. It offers an app for ongoing tracking and a desktop software for retroactive mileage tracking, thus catering to every mileage tracking need.

Mobile App for Mileage Tracking

- Automatic Trip Logging: Capture every drive with smart tracking modes, not just the miles recorded when your gig app is online.

- Simple Setup: Start recording within minutes so you can spend more time driving and less time figuring out settings.

- Ad-Free & Private: Track miles without interruptions or worries about client or trip data being shared.

- Reliable Start Point Capture: Avoid missing the beginning of your trips — a common issue in other mileage apps.

- Flexible Distance Options: Choose to log exact routes or optimized mileage, whichever works best for you.

- Waze Routing Integration: Navigate with Waze while MileageWise quietly logs your drives in the background.

- Expense Tracking Compatibility: Keep mileage and costs organized together for easier tax prep and cleaner records.

Dashboard for a Retroactive Mileage Log

- Google Maps Timeline Import: Pull in your Google Maps Location History to assemble your mileage log from past trips you didn’t track live.

- AI Mileage Wizard: Automatically reconstructs missing drives based on your driving patterns and preferences, saving you hours of manual edits while keeping reports accurate.

- IRS Compliance Check: Audit-proof your logs with built-in rules that match IRS standards and checks for potential red flags..

- Bulk Data Upload: Import client lists or fixed routes in one step — perfect for busy drivers managing repeat trips.

- Advanced Trip Management: Organize recurring drives, tag trips by purpose, and update logs in batches.

Bulk Data import: Import client lists, Excel trip lists that you tracked manually or extracted from your Toyota, Tesla, or Volvo car app.

Unique Benefits of MileageWise

We offer two standout features that set us apart:

- Lifetime Plans: We are the first and only in the industry to offer lifetime deals, which means long-term savings for you without recurring fees.

- Outstanding Support: Our dedicated customer service team and extensive resources are always available to help you navigate the platform and answer your questions.

Try MileageWise for free for 14 days. No credit card required!

Showdown of the Wise

| Category | Gridwise Focus | MileageWise Focus |

|---|---|---|

| Primary Goal | Optimize gig driving income and operations | Maximize IRS mileage deductions and ensure compliance |

| Mileage Tracking | Automatic, often good for real-time overview | Multiple tracking modes, flexible distance calculation, several customization options |

| Data Correction | Limited editing of past trips | AI-powered reconstruction, bulk editing |

| Reporting | Tax report export available (Plus) | Complete, audit-proof mileage logs |

| Insights | Demand insights, earnings analytics | Mileage deduction optimization, compliance alerts |

User Story: Gridwise and MileageWise

I used Gridwise for a while and thought I was covered when it came to mileage tracking. It logged my online miles from gig apps, which seemed fine at first. Then a friend told me I was leaving money on the table — those “offline” business miles I drove between jobs and errands were also deductible.

That’s when I tried MileageWise. The difference was huge. I finally had complete records that included every deductible mile, not just the ones Gridwise picked up while syncing with my rideshare apps. Last year, my mileage deduction almost doubled! If you’re relying only on Gridwise, I recommend checking out MileageWise.

Conclusion: Road to Smarter Mileage Deduction

Gridwise Review shows it’s an excellent tool for gig drivers looking to optimize their daily operations and maximize earnings. However, for bulletproof mileage deductions and maximum tax savings, a specialized solution like MileageWise is essential.

FAQ

What is Gridwise?

Gridwise is a companion app for rideshare and delivery drivers. It centralizes your earnings and mileage across apps (e.g., Uber, Lyft, DoorDash, Instacart, Grubhub, Amazon Flex), and adds tools like demand insights (airports, events, weather), analytics, and tax-ready mileage/earnings reports.

How does Gridwise work with my gig apps?

You can connect supported gig accounts so Gridwise can automatically import trips and earnings. You can also track mileage and shifts within Gridwise. If you prefer not to connect accounts, you can log activity manually, but you’ll lose some automation and analytics.

What are the main features of Gridwise?

Commonly praised functions are:

- automatic or easy mileage tracking for taxes

- consolidated earnings across multiple apps

- insights on when/where to drive (airport passenger volume, big events, weather); profitability analytics by hour/app/location

- and exportable reports for bookkeeping/taxes.

How much does Gridwise cost?

Gridwise offers a free version and a paid subscription with monthly and/or annual options. Prices and any trial offers can vary by platform and region and change over time. The most accurate, up-to-date pricing appears in the App Store or Google Play listing and within the app’s subscription screen. You can cancel through your app store subscriptions.