Last Updated: November 11, 2025

In the bustling world of gig economy platforms, TaskRabbit and other similar apps have carved out a niche for themselves by offering a wide array of services, from assembling IKEA furniture to handling home repairs and moving services. For those navigating the city streets as a TaskRabbit driver, understanding and implementing efficient mileage tracking is not just a practice. It’s an essential strategy that significantly impacts earnings. This discussion will shed light on why every TaskRabbit tasker, whether they are delivering a TV mount, cleaning, or setting up a new office, should prioritize accurate mileage logging. Additionally, it will explore the benefits of using dedicated apps to ensure every mile is counted.

Table of Contents

The Importance of Tracking Mileage for TaskRabbit Drivers

For TaskRabbit drivers, saving money on road traveled is as important as being cost-effective in everyday tasks. Every mile driven while on the clock can translate into deductible expenses when the time comes to file taxes. With the IRS offering deductions for every business mile, accurate mileage tracking can significantly reduce your taxable income. Therefore, this is especially relevant to those managing tasks at TaskRabbit, such as delivery jobs or furniture assembly, where travel can form a substantial part of the day’s work.

Understanding Tax Benefits and Mileage Deductions

For a TaskRabbit driver, each mile translates into potential savings during tax season. Taskers have to file their earnings and deductible costs every year to the IRS. While tax documents received from TaskRabbit, such as 1099 forms, reflect your earnings, accurate mileage logs serve as proof to your business travels. Therefore, they are key to claiming the mileage deductions you are eligible for. It’s not just about reducing your tax liability but about maximizing your profitability through meticulous record-keeping.

Other Expense Deductions

Additionally, many other costs that are connected to your business are also deductible, such as mobile phone and data plans, health insurance premium, parking, meals, and the costs of supplies. The latter is especially important, since TaskRabbit electricians, plumbers, and other handymen often rely on their own tools and supplies for work.

Challenges TaskRabbit Drivers Face in Tracking Mileage

Despite the clear benefits, maintaining consistent mileage logs poses challenges for many TaskRabbit drivers.

Manual or Digital?

The manual process can be tedious, often leading to gaps and inaccuracies in the records compared to digital solutions. This not only complicates tax filings but also risks missing out on valuable deductions. The pitfalls of manual paper logs or Excel mileage spreadsheets include forgotten trips, inaccurately logged miles, and the potential for overlooking significant tax deductions and triggering an IRS mileage audit.

Harnessing Technology for Enhanced Financial Outcomes

Technology offers a robust solution to the challenges of manual mileage tracking. Mileage trackers can automate the process, ensuring every trip is recorded accurately and effortlessly. Therefore, for TaskRabbit taskers, this means less time spent on paperwork and more time focused on earning. By integrating tools like the MileageWise app, drivers can ensure that their mileage logs are precise and fully compliant with IRS requirements, paving the way for optimal tax savings.

Drive with MileageWise’s Mileage Tracker App

MileageWise provides a tailored solution for those working through TaskRabbit with its robust Mileage Tracker App. This is designed to cater specifically to the needs of gig economy workers, offering powerful tools to make their workday simpler and more efficient.

Unique Features of MileageWise

- Automatic Mileage Tracking: Detects trips automatically while you work between clients. Choose from multiple tracking modes!

- Quick Setup: Get started in minutes so you can focus on tasks, not settings or a lengthy onboarding process.

- Ad-Free & Privacy-Focused: Track drives without distractions or data sharing.

- Backup Mileage Capture: Ensures trip starts and stops are always recorded accurately, even with patchy signal and device glitches.

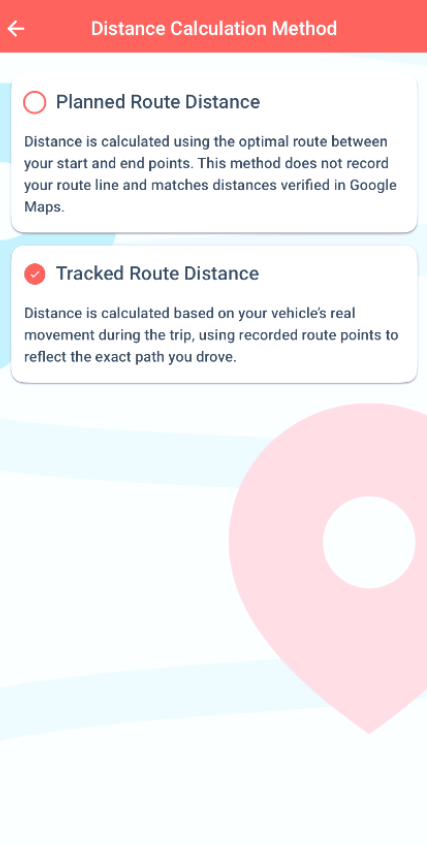

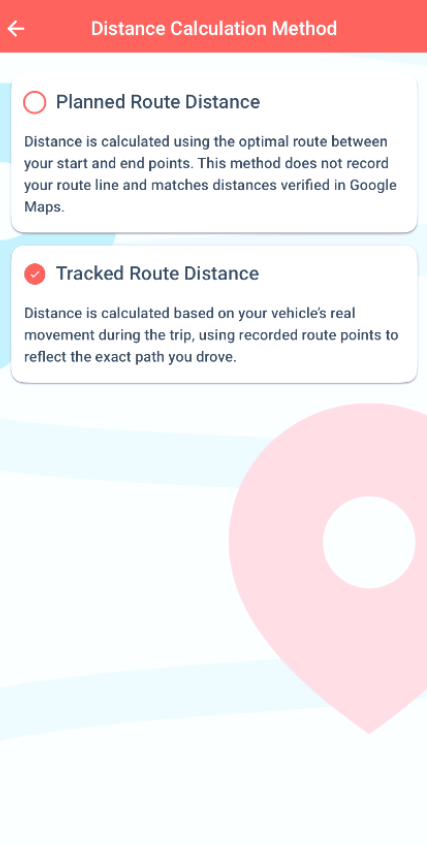

- Flexible Routing Options: Choose between actual routes or optimized distance calculation to your preference.

- Navigation Integration: Access Waze for navigation and log your miles with just a few taps.

- Expense Tracking Integration: Keep fuel and job-related expenses organized for easy tax prep.

- Dedicated Customer Support: Get fast, helpful assistance from a team that understands gig drivers’ needs.

Try MileageWise for free for 14 days. No credit card required!

Conclusion: Simplifying Mileage Tracking for TaskRabbit drivers

The Mileage Tracker by MileageWise simplifies the tracking process by automating most tasks. After setting up the app, the TaskRabbit driver can start by putting their smartphone in their pocket, and the app handles the rest. This streamlined process eliminates the hassle of manual logging and increases the accuracy of mileage records, ensuring that taskers maximize their deductions and reimbursements without added stress.

FAQ

How do taxes work for Taxrabbit drivers?

TaskRabbit drivers work as independent contractors, meaning they’re responsible for handling their own taxes. This includes paying quarterly estimated taxes, covering self-employment and income taxes, and filing an annual return. The same applies to other gig workers such as Grubhub couriers, Uber drivers, Instacart shoppers, and Walmart Spark drivers.

What are the tax benefits of mileage tracking for TaskRabbit drivers?

TaskRabbit drivers can significantly reduce their taxable income by logging each mile they drive for tasks. The IRS allows deductions for each business mile traveled, making accurate tracking crucial for maximizing tax returns.

Why is manual mileage tracking challenging for TaskRabbit drivers?

Manual mileage tracking can be tedious and error-prone, often leading to inaccurate logs and missed deductions. The challenges include forgetting to record trips, logging incorrect mileages, and the potential for overlooking significant tax deductions.

How does the MileageWise app benefit TaskRabbit drivers?

The MileageWise app automates mileage tracking, ensuring that every business mile is recorded accurately and effortlessly. It also provides features like auto-classification and IRS-compliant logs, which simplify tax filings and potentially prevent audit issues.

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Only at MileageWise: Choose the Way to Calculate Your Mileage

We’ve upgraded how mileage is calculated in our mileage tracker app. 🎉 From now on, you can choose between two distance calculation methods depending on

Company Car vs Car Allowance: Which is Better for Your Business?

Last Updated: January 19, 2025 Deciding between a company car vs car allowance for your employees involves weighing costs, flexibility, and tax implications. For U.S.

Vehicle Fleet Software to Boost Your Business

Last Updated: January 19, 2026 Vehicle fleet software helps businesses handle their vehicles much better, cutting down costs and making everything run smoother. This type

Is Mileage Reimbursement Taxable? The Need to Knows

January 16, 2026 Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard

Freshly Announced: See The IRS Mileage Rates for 2026

January 2, 2025 The IRS has officially announced the IRS mileage rates for 2026, and they bring important updates for self-employed individuals, gig workers, small

Try MileageWise for free for 14 days. No credit card required!

Related Guides

Related Blogposts

Now on the App Store: Mileage Log from Google Maps for iPhone

It’s Finally Here! Google Maps Timeline Import from Mobiles

Transform your Trip Lists into Mileage Logs with MileageWise

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Only at MileageWise: Choose the Way to Calculate Your Mileage

We’ve upgraded how mileage is calculated in our mileage tracker app. 🎉 From now on, you can choose between two distance calculation methods depending on

Company Car vs Car Allowance: Which is Better for Your Business?

Last Updated: January 19, 2025 Deciding between a company car vs car allowance for your employees involves weighing costs, flexibility, and tax implications. For U.S.

Vehicle Fleet Software to Boost Your Business

Last Updated: January 19, 2026 Vehicle fleet software helps businesses handle their vehicles much better, cutting down costs and making everything run smoother. This type

Is Mileage Reimbursement Taxable? The Need to Knows

January 16, 2026 Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard

Freshly Announced: See The IRS Mileage Rates for 2026

January 2, 2025 The IRS has officially announced the IRS mileage rates for 2026, and they bring important updates for self-employed individuals, gig workers, small

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Introducing the Mileage Log from Google Maps App

We’re excited to share our latest development! You can now convert your Google Maps Timeline drives directly into an IRS-compliant mileage log right on your

Was Your Google Timeline Deleted? Here’s What Happened:

Last updated: November 20, 2025 If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this

It’s Finally Here! Google Maps Timeline Import from Mobiles

Struggling to Manage Your Trips After Google’s Timeline Update? If you’re reading this, you’ve likely encountered the recent update affecting Google Maps Timeline. With Timeline

Transform your Trip Lists into Mileage Logs with MileageWise

Last Updated: October 1, 2025 Do you have a list of monthly trips from a data source like Excel or Google Timeline, but need to

How to Download Google Timeline Data: A Guide

Google Timeline Import Hub Last Updated: October 30, 2025 Want to download Google Timeline data? This guide shows you how to extract your location history

How to Export Google Maps Timeline: Get Your Data

Google Timeline Import Hub Last Updated: October 29, 2025 It can be tricky to export Google Maps Timeline data after Google’s recent updates. Many users

Google Maps Mileage Tracker: From Timeline to Mileage Log

Google Timeline Import Hub Last Updated: October 29, 2025 If you’re an active user of Google Maps Timeline you likely already know how convenient it

Timeero

Table of Contents Timeero Timeero is a time, location, and mileage tracking app designed for businesses and teams in the United States. It helps employers

Milewise by Allstate

Table of Contents Milewise by Allstate Milewise by Allstate is a pay-per-mile car insurance program offered by Allstate Insurance in the United States. It’s designed

Hurldr

Table of Contents Hurdlr Hurdlr is a finance and expense tracking app designed for self-employed professionals, freelancers, and gig workers in the United States. It