Last Updated: March 3, 2025

Are you a volunteer who drives for charities? You might get a tax break with the charitable mileage rate. This rate, approved by the IRS, helps cover costs of driving for good causes. Knowing about it can save you money when it’s time to file taxes.

The rate for charity is lower than others, but it’s still a big help for volunteers. It covers driving for approved charities. This includes trips to deliver food, go to meetings, or move goods for your charity.

Table of Contents

Understanding the Charitable Mileage Rate

It’s important to know the current rate and how to keep track of your miles. The IRS has rules for this deduction. Staying up-to-date helps you get the most from your tax benefits. Whether you’ve been volunteering for a while or just starting, understanding the charitable mileage rate can greatly impact your taxes.

Get the Most Out of Your Good Deeds with the Charitable Mileage Rate

When you volunteer, you might drive your car to different places. The IRS lets you deduct these miles on your taxes. This is why the charitable mileage rate is important.

Definition and Purpose

The charitable mileage rate is a fixed amount you can deduct per mile for charity. It’s meant to help volunteers by covering some car costs. Unlike business use, the charitable rate is always 14 cents per mile.

How Many Charitable Miles Can You Deduct for the Year 2024?

In general, charitable gifts can be deducted up to 60% of your AGI (Adjusted Gross Income) using the charitable mileage rate, but you may be limited to 20%, 30%, or 50% depending on the type of contribution and the organization (contributions to certain private foundations, veterans organizations, fraternal societies, and cemetery organizations come with a lower limit, for instance).

The specifics can be found in IRS Publication 526.

IRS Guidelines for Charitable Mileage Rates

The IRS has rules for claiming charitable mileage. You must volunteer for a qualified group and keep detailed records. These records should include dates, places, and mileage for each trip.

Current Charitable Mileage Rate

The 2025 IRS mileage rate for charitable purposes is 14 cents per mile. This rate has stayed the same for a few years, even with gas price changes. Remember, while other IRS rates change yearly, the charitable rate needs a law change to update.

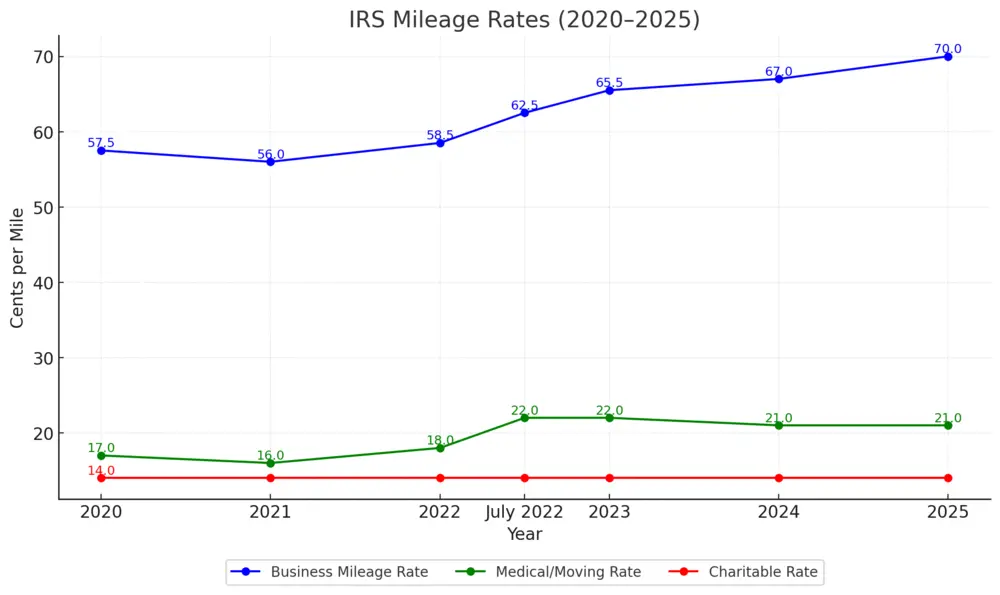

| Year | Charitable Mileage Rate | Business Mileage Rate |

|---|---|---|

| 2025 | 14 cents per mile | 70 cents per mile |

| 2024 | 14 cents per mile | 67 cents per mile |

| 2023 | 14 cents per mile | 65.5 cents per mile |

| 2022 | 14 cents per mile | 58.5 cents per mile |

Knowing these rules helps you get the most from your charity work. You can also claim your mileage correctly on your taxes.

Who Can Claim the Charitable Mileage Deduction?

If you volunteer or support nonprofits, you might get a tax break. The IRS lets some people deduct miles driven for charity. This is for those who use their cars for good causes.

To get this tax break, you must help a known charity. These are usually:

- Religious institutions

- Educational facilities

- Healthcare organizations

- Animal welfare groups

- Environmental protection agencies

Your work must help the charity. This could be driving to give meals, carry supplies, or go to meetings.

But, you can’t deduct just driving to and from your volunteer spot. Only the miles you drive for charity count.

Also, if a charity pays you back for your miles, you can’t deduct them. The IRS doesn’t let you get paid twice for the same thing.

To get the most from your deduction, keep good records. Write down when, where, and how far you drove for charity. This helps when you report your charitable donations on taxes.

Calculating Your Charitable Mileage Deduction

Knowing how to figure out your charitable mileage deduction is key to getting the most from your taxes. We’ll go over the steps and important things to keep in mind.

Step-by-Step Guide to Calculation

To figure out your deduction, multiply your charitable miles by the IRS rate. Keep good mileage records of your trips, like dates, places, and miles. Only miles for charity count for this deduction.

Examples of Deduction Scenarios

Here are some examples to help you understand how to calculate your deduction:

| Scenario | Miles Driven | Deduction Rate | Total Deduction |

|---|---|---|---|

| Volunteering at food bank | 500 | $0.14/mile | $70 |

| Delivering meals to seniors | 750 | $0.14/mile | $105 |

| Transporting donated goods | 1,000 | $0.14/mile | $140 |

Limitations and Restrictions

There are limits to your mileage deduction. The IRS only lets you deduct up to 60% of your income. You can’t deduct both mileage and actual expenses like gas.

Common Mistakes to Avoid

Here are some mistakes to avoid when claiming charitable mileage:

- Mixing personal and charitable miles

- Forgetting to keep detailed records

- Claiming mileage for non-qualifying organizations

- Using the wrong rate to calculate your deduction

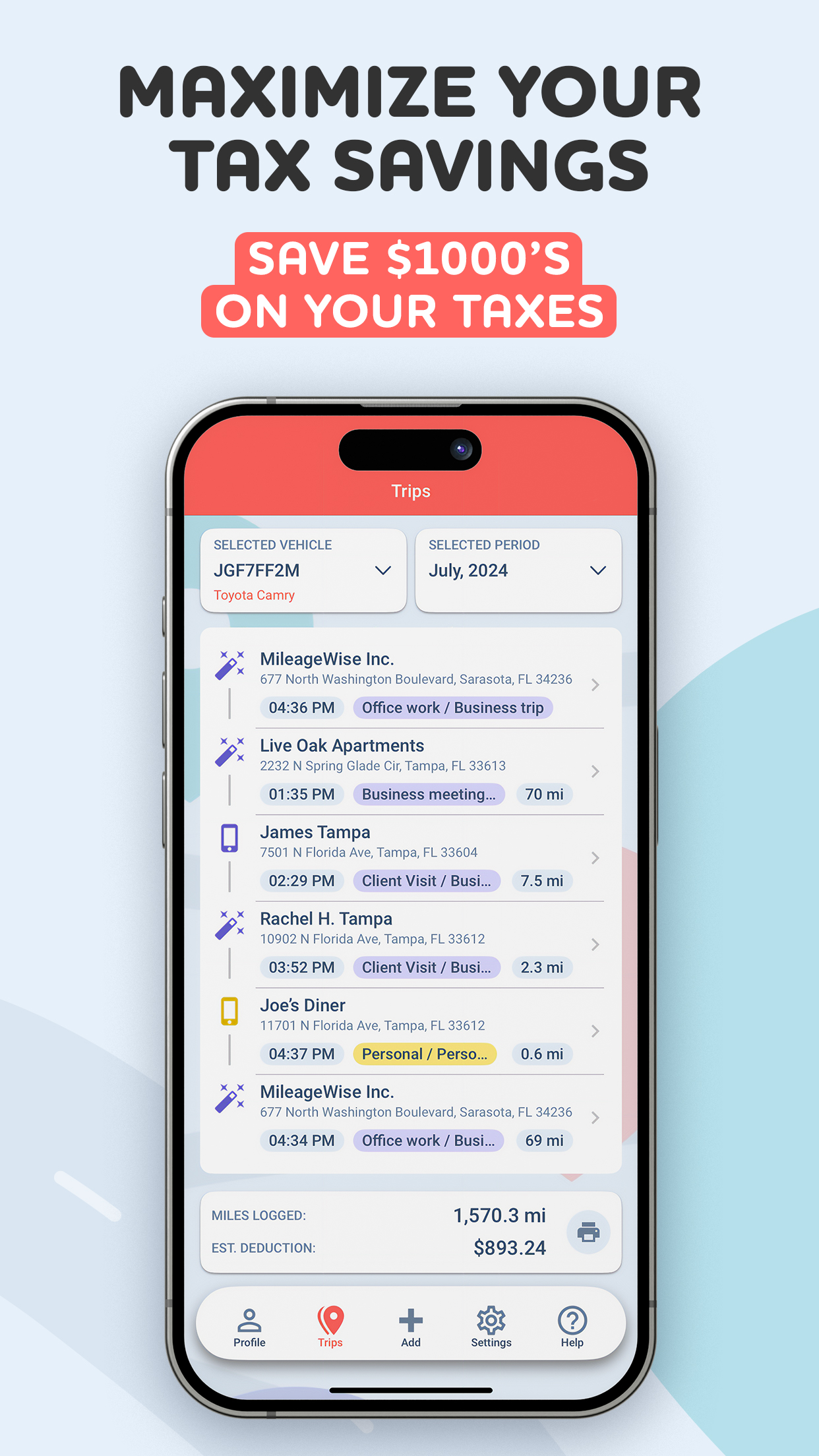

Avoiding these mistakes by using a mileage tracker app will help you report accurately and get the most tax benefits.

Level Up Your Charitable Mileage Tracking

Automatic Tracking: Tracks charitable trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-Powered Mileage Recovery: The AI Wizard helps reconstruct past mileage logs, filling gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 logical errors in logs, ensuring they meet IRS standards for tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

Charitable Mileage Rate vs. Other Mileage Rates

The IRS sets different mileage rates for various purposes. Knowing these rates helps you get the most from your deductions. It also makes sure you follow tax laws.

The rate for business use is higher than for charity. This is because business use includes costs like depreciation and maintenance.

The IRS has a separate moving and medical mileage rate. It’s lower than the business rate but higher than the charity rate.

| Purpose | 2025 Rate (cents per mile) |

|---|---|

| Business | 70 |

| Medical or Moving | 21 |

| Charitable | 14 |

Self-employed people or those not reimbursed for travel often use the business rate. But, you can’t use it for charity.

If your car is for different things, like work and charity, track each trip. For example, driving to a meeting and then to volunteer. Use the right rate for each trip.

Even though the charity rate is lower, every mile matters. Keep good records. This way, you can maximize your charitable and other deductible travel expenses.

Documenting Your Charitable Miles

Keeping accurate records of your charitable mileage is key for IRS compliance and to get the most from your deductions. Let’s look at the important steps to document your miles well.

Required Records for IRS Compliance

The IRS has rules for tracking charitable miles. You must keep a log with the date, where you went, why, and how many miles you drove. Also, save any receipts for costs like parking or tolls.

Manual Mileage Tracking

Begin by finding a tracking method that fits you. It could be a notebook in your car or a digital spreadsheet. Record your odometer at the start and end of each trip. Being consistent and detailed helps avoid problems when it’s time to file taxes. However, this method can be time consuming and prone to errors.

Digital Tools for Mileage Logging

Apps can make tracking miles easier. They can automatically track your trips, sort them, and create reports for taxes. Here’s a look at the top mileage tracking app:

Tracking Your Charity Miles Has Never Been Easier: Introducing MileageWise

Now, let’s talk about charity mileage deductions. This amount lowers your taxes based on the miles you drove for charitable purposes.

But you can’t just pull a number out of thin air. You need to keep a detailed charity mileage log. This document must include the date, destination, purpose, and number of miles driven.

The IRS requires contemporaneous documentation. Meaning you need to keep a detailed record of every mile you drive for charity.

That might sound like a lot of work. Luckily there are plenty of apps out there to help you out, and that’s where the MileageWise mobile app comes in handy! This app makes it easy to track your mileage, so you can focus on doing good without worrying about the paperwork.

But here’s the kicker: you can’t deduct the value of your time or services, no matter how much you might think they’re worth.

So if you’re volunteering at a soup kitchen, for example, you can’t just claim a deduction for your time spent expertly ladling ladles of soup.

Maximize Your Deductions and Minimize the Paperwork with MileageWise

MileageWise is the best app on the market that makes tracking your charity mileage log a breeze! With MileageWise, you can easily log your mileage and categorize it for tax purposes.

Do you plan to volunteer for a charity? If you are using your vehicle for any charitable purpose, MileageWise helps you keep track of every mile you drive.

The app allows you to create custom categories for your mileage, so you can easily separate your charity miles from your business or other types of personal miles.

This makes it a breeze to calculate your tax-deductible contributions and claim them on your tax return.

MileageWise: Your Ultimate Solution for Tracking and Categorizing Charity Mileage

MileageWise also allows you to track your charity mileage in real time, so you never forget to log a trip. The app automatically detects when you start driving. It even prompts you to categorize your trip when you finish.

Plus, with its intuitive interface and user-friendly design, MileageWise makes it easy to add notes and details about each trip. This is how you can remember exactly why you were driving and where you went.

Maximizing Your Charitable Deductions with IRS Mileage Rates and MileageWise App

In summary, to claim a tax deduction for charitable mileage, you need to adhere to certain regulations, including the IRS mileage rate for charity work, which is 14 cents per mile, and the requirement that you only deduct mileage for qualified charitable organizations.

Additionally, it’s crucial to keep meticulous records to substantiate your deductions.

But fear not, dear do-gooders! There’s an easy way to stay organized and track your charitable mileage logs without breaking a sweat. The MileageWise app is the ultimate app for hassle-free charity mileage logging.

With the MileageWise app, you can rest assured that your mileage logs are 100% IRS-Proof, and you can generate detailed charity mileage log reports with just a few clicks.

It’s the best option for tracking your charitable mileage logs and maximizing your charitable mileage tax deductions. Just get into the car, buckle up, and let the MileageWise app automatically track your charitable mileage for you.

So keep on giving, keep on logging, and let MileageWise do the heavy lifting for you by helping you with your tax deductions for charity mileage. With this app, you can make the most of your charitable contributions and feel good about supporting your favorite causes.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

FAQ

What is the charitable mileage rate?

The charitable mileage rate is a tax deduction for miles driven while volunteering. In 2024, it’s 14 cents per mile.

Who can claim the charitable mileage deduction?

You can claim it if you volunteer for a qualified nonprofit. This includes delivering meals or volunteering at schools.

How do I calculate my charitable mileage deduction?

Just multiply the miles driven for charity by 14 cents. You can use a log or our MileageWise mileage app to track your miles.

How does the charitable mileage rate differ from other mileage rates?

The IRS has different rates for different purposes. The charitable rate is lower than business but higher than medical or moving.

What records do I need to claim the charitable mileage deduction?

Keep records of miles, dates, and the charity’s purpose. A mileage log or app is recommended by the IRS.

How can I maximize my charitable mileage deduction?

Plan your volunteer trips well and keep good records. Use the MileageWise app to track your miles easily.