IRS Mileage Guide

Home » Mileage Tax Deduction » IRS Standard Mileage Rates

Last Updated: January 5, 2026

Looking for the latest IRS mileage rate? You’ve come to the right place! We’ll break down the 2026 and 2025 mileage rates, explain who can use them, and show you how to maximize your mileage tax deduction. Whether you’re a small business owner, a freelancer, or a dedicated volunteer, understanding these rates is key to saving money.

Table of Contents

IRS Mileage Rates at a Glance

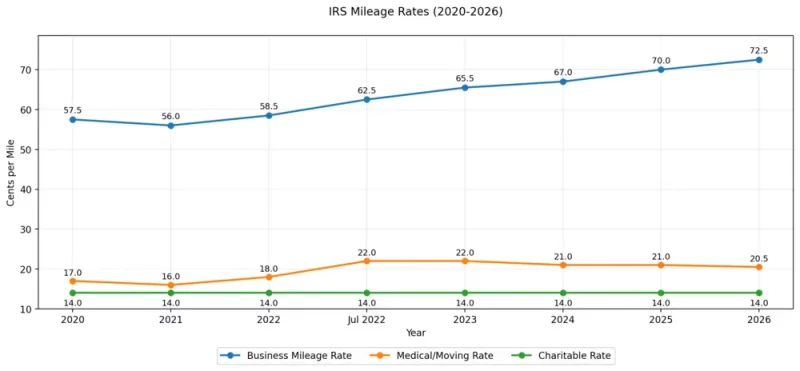

The IRS updates its standard mileage rates each year, and 2026 brings some important changes. These rates cover the cost of operating a vehicle for business, charitable, medical, or moving purposes. Knowing them is crucial for proper tax planning and reimbursement.

Current Mileage Rates

For 2026, the IRS has set the mileage rates based on careful studies of vehicle operating costs:

- Business use: 72,5 cents per mile – This rate is essential for self-employed individuals and small business owners to reduce their taxable income. It is aimed at covering their business-related vehicle expenses.

- Charitable purposes: 14 cents per mile – This rate is set by statute, meaning Congress would need to change the law for it to increase. Volunteers may be eligible to deduct their drives for charitable purposes.

- Medical or moving: 21,5 cents per mile. For most individuals, moving expenses are not deductible; only active-duty military personnel can claim this. There are special circumstances to deduct miles for medical reasons as well.

Comparing the IRS Mileage Rates of 2025 and 2026

To give you a clearer picture, here’s how the 2026 IRS mileage rates compare to last year, 2025:

| Purpose | 2025 Mileage Rate (per mile) | 2026 Mileage Rate (per mile) | Change (cents) |

| Business | 70 cents | 72.5 cents | +2.5 |

| Charitable | 14 cents | 14 cents | None |

| Medical / Moving | 21 cents | 20.5 cents | -0.5 |

As you can see, the biggest change is for the business mileage rate, reflecting rising costs associated with vehicle ownership and operation. See historical rates on the IRS’s website. Or check out this overview:

What Expenses Does The Business Mileage Rate Cover?

The business mileage rate covers the variable costs for vehicle operation, such as:

- gasoline

- oil

- tires

- maintenance

- repairs

They also account for the following fixed costs for business vehicle operation:

- insurance

- registration

- depreciation

- leasing

The same tariffs apply to all passenger cars, including cars, vans, pickups, and panel vans. Note that the IRS mileage rates do not cover the cost of parking and tolls. They may be deducted separately. Furthermore, these rates are set federally, so they are the same amount throughout the U.S.

Here’s a video breakdown of everything you need to know about standard mileage rates.

How the IRS Sets Mileage Rates

The IRS mileage allowance is based on cost data and analysis that Motus compiles and sends out to the IRS. Motus uses data from the whole country and measures gas/oil prices, service costs, automobile insurance premiums, travel expenses, depreciation, and other costs included in operating and maintaining a car.

The IRS looks at several things when setting the mileage rates:

- Fuel prices and how cars use fuel

- How much value cars lose over time

- Insurance costs

- Maintenance expenses

For charity purposes, the standard mileage rate is based on the minimum value established by federal law. It is meant to compensate taxpayers for expenses they usually pay out of their pocket and are not reimbursed for by anyone else but the IRS.

The Right Tool to Secure Claiming Those Rates

Understanding the IRS mileage allowance and eligibility is only half the battle. The other half, and arguably the more critical one for your tax return, is mileage tracking. An accurate and compliant mileage log is crucial to secure and maximize your mileage deduction.

This is where MileageWise shines.

Mobile App for Effortless Mileage Logging

- Smart Auto-Tracking: Capture every drive automatically with customizable tracking options.

- Ad-Free & Privacy-First: No distractions or worries. Your data stays yours, and your app stays clean.

- Reliable Trip Start Detection: Our backup system ensures the start of every drive is logged, even though other apps often miss it.

- Custom Route & Distance Options: Choose between actual routes or optimized distance calculation.

- Fast Onboarding: Set up in minutes and get straight to logging mileage for IRS reimbursements.

- Seamless Waze Integration: Use Waze for directions while MileageWise records your trip.

- Built-In Expense Tracker: Keep your mileage and car expenses organized in one place.

Web Dashboard for Missed Mileage

- Google Timeline Import: Bring in your Google Maps Location History to automatically recover trips you forgot to track.

- IRS-Proof Log Checker: Automatically reviews your mileage log to flag missing or incorrect entries, helping you stay compliant and audit-proof.

- AI-Powered Mileage Wizard: Our smart assistant rebuilds unlogged trips in minutes, saving you hours of guesswork and ensuring accuracy for tax reporting.

- Advanced Trip Management: Organize, filter, and edit trips in bulk, set custom categories, and set recurring trips with ease.

- Bulk Trip & Client Import: Upload entire client lists or import routes all at once. Perfect for busy professionals managing recurring drives or large fleets.

Lifetime Plans: One-Time Payment, IRS-Ready Forever

Skip monthly fees. MileageWise is the only tracker with one-time purchase options. Pay once and track forever with audit-proof tools.

- Small Lifetime Plan: Track unlimited miles, create mileage logs, and access smart features. All for just $119.

- Gold Lifetime Plan: Unlock everything: past trip recovery, Google Timeline import, and full IRS-ready reports. Great for those needing backlogs or audit support.

Customer Support That Gets the Mileage Game

Whether you’re new or prepping for tax time, our support team understands your needs. Expect fast, practical help — not endless response times or robotic answers.

Try MileageWise for free for 14 days. No credit card required!

A Courier’s Success Story with MileageWise

Before MileageWise, mileage tracking was my biggest headache. As a DoorDash courier, I spent hours on the road but never had a reliable system to log my drives. I knew the 2025 IRS mileage rate could lead to big deductions, but my notes were scattered and my logs incomplete. Every April, I stressed over missed write-offs and dreaded the thought of an audit.

Then I found MileageWise. With the AI-Wizard, I recovered unlogged trips from last year and made my logs IRS-compliant in minutes. I then started to use their app to never miss my miles again. Suddenly, mileage logging wasn’t a burden. Now I claim every mile with confidence, knowing I’m getting the deduction I deserve.

Summary and Final Steps

Understanding the IRS mileage rate is your first step. Turning that knowledge into significant tax savings requires action.

- Know the Rates: Keep the 2026 rates handy: 72.5 cents for business, 14 cents for charity, 20.5 cents for medical/moving (military).

- Keep Excellent Records: The IRS requires contemporaneous records, meaning you need to log miles as you drive them, or have a reliable system to reconstruct them accurately later.

- Use Technology: Consider a mileage tracking app like MileageWise that automates the process and ensures IRS compliance without the headache.

- Consult a Pro: If you have complex situations, always consult with a tax professional.

By following these steps and leveraging the right tools, you can confidently claim your deductions and keep more of your hard-earned money.

FAQ

What are the IRS mileage rates?

For 2026, the IRS standard mileage rates are:

- Business use: 72.5 cents per mile

- Medical or moving purposes: 20.5 cents per mile

- Charitable organizations: 14 cents per mile

Who can use the IRS standard mileage rate?

Business owners, self-employed individuals, and employees using their vehicles for work (but not commuting), qualified active-duty military for moving, and volunteers for charitable organizations can use the standard rates when reporting expenses on their tax returns.

What expenses does the IRS mileage rate cover?

The IRS mileage allowance covers fuel, oil, repairs, tires, maintenance, insurance, registration, and depreciation of your vehicle.

Can I claim actual vehicle expenses instead of the standard mileage rate?

Yes. Taxpayers can choose to deduct actual vehicle expenses. This is beneficial if you have high expenses, as it may result in a larger deduction. You must choose one method per year, per vehicle.

How often does the IRS update the mileage rates?

Typically, the IRS updates the mileage rates yearly, but they have occasionally updated mid-year due to unusual fuel price fluctuations.