Gas Mileage Tracker: Your Key to Savings

Last Updated: August 8, 2025 A gas mileage tracker helps drivers watch their vehicle’s fuel use, mileage, and related costs. You might want one to

Motus Acquires Everlance: What’s Next?

Last updated: October 8, 2025 Big news in the world of mileage tracking: Motus acquires Everlance. Motus, a leader in corporate mileage reimbursement, has officially

Last Updated: November 17, 2025

Are you one of the thousands of Instacart shoppers hustling to make deliveries across town and confused about Instacart taxes?

Here’s the thing: over 90% of Instacart shoppers work as independent contractors, not W-2 employees. This means you’re basically running your own business, which comes with different tax responsibilities than a regular job. As you start working in the gig economy, opening that 1099 form for the first time will feel like reading a foreign language! But don’t worry, this guide will walk you through everything you need to know about Instacart shopper taxes.

Table of Contents

Understanding Your Instacart Tax Situation

Let’s get one thing straight: as an Instacart shopper and deliverer, you’re not an employee – you’re an independent contractor. What does this mean for your taxes?

- No tax withholding: Unlike a regular job, Instacart doesn’t take taxes out of your pay

- Self-employment tax: You’re responsible for both the employer AND employee portions of Social Security and Medicare taxes (15.3% total)

- 1099-NEC form: If you earn over $600, Instacart will send you this form instead of a W-2

Many shoppers mistakenly believe they don’t need to report income under $20,000. This is FALSE! You must report all income to the IRS, even if it’s just a few hundred dollars.

“But I only did Instacart on weekends!” It doesn’t matter – the IRS still wants to know about that money.

Essential Tax Obligations for Instacart Shoppers

Remember when you got your first paycheck from a regular job and saw all those deductions? Well, now as a self-employed worker, you’re responsible for handling that yourself. Here’s what you need to know:

Quarterly Estimated Tax Payments

If you expect to owe $1,000 or more in taxes, the IRS wants you to make payments throughout the year. Think of it like paying as you go, rather than one big bill in April.

Payment due dates:

- April 15

- June 15

- September 15

- January 15 (of the following year)

Missing these deadlines can cost you big time! The IRS charges penalties of up to 5% per month on unpaid amounts. That’s like paying extra interest on a loan you didn’t even want!

Filing Your Annual Tax Return

April is when everything becomes official. As an independent contractor, you must file:

- Form 1040 (your main tax return)

- Schedule C (reports your Instacart income and deductions)

- Schedule SE (calculates your self-employment tax)

This is where you:

- Report all the income Instacart paid you

- Claim deductions like mileage, phone bill, hot bags, parking, and other business expenses

- Calculate how much tax you still owe after quarterly payments

If you skipped or underpaid your estimated taxes, April is when the remaining amount gets settled.

Multi-State Considerations

Do you cross state lines for deliveries? This complicates things. You may need to file non-resident tax returns in other states where you earned income. Many learn this the hard way when they pick up deliveries in a neighboring state during a busy holiday season. Each additional state filing typically costs $50-$100 extra when using tax software.

Maximizing Deductions for Instacart Taxes

Here’s where things get interesting! As an independent contractor, you can deduct business expenses to lower your taxable income. Think of deductions as little tax gifts – they can save you thousands!

Phone and Technology Deductions

Your smartphone isn’t just for TikTok anymore – it’s a business tool! You can typically deduct 50-70% of your phone bill if you use it for Instacart.

Think about it: you’re constantly using your phone to:

- Check orders

- Navigate to stores and customers

- Communicate with customers

- Take delivery photos

Don’t forget about other tech expenses like phone mounts, chargers, and portable batteries!

Equipment and Supplies

Remember all those things you bought to do your job better? They’re probably deductible:

- Hot bags and coolers

- Insulated grocery totes

- Car organizers

- Delivery bags

- Portable phone chargers

Even small purchases add up. That $20 phone mount might not seem like much, but combine it with other deductions, and you’re looking at real savings!

Home Office Deduction

Did you know you might qualify for a home office deduction? Even though your car is your main workspace, many shoppers use part of their home to:

- Plan routes

- Track expenses

- Manage orders

- Handle administrative tasks

To qualify, the space must be used exclusively for business. That means your living room couch doesn’t count if you also watch Netflix there!

How it works: Calculate what percentage of your home is used for business, then apply that percentage to eligible expenses like rent, utilities, and internet.

For example, if your home office takes up 10% of your living space, you could deduct 10% of your rent and utilities as a business expense.

Vehicle Expenses

Your car is your most important work tool. You have two options for deducting vehicle expenses:

- Standard mileage rate: 70¢ per mile in 2025

- Example: 10,000 miles = $7000 deduction

- Simpler method, just track your miles

- Actual expenses method: Track all car-related costs

- Gas, repairs, insurance, depreciation

- Must calculate the percentage used for business

- More paperwork, but might be worth it for high-cost vehicles

Which is better? For most shoppers, the standard mileage rate is simpler and often more beneficial.

Record-Keeping Strategies for Instacart Shoppers

Keeping track of mileage, expenses, and receipts can get overwhelming fast, especially when you’re juggling multiple batches a day. That’s why many Instacart shoppers rely on digital tools to stay organized and avoid losing money at tax time. The right apps can help you log your miles, store receipts, track expenses, and generate the records the IRS expects to see.

Among mileage trackers, MileageWise stands out. It doesn’t just track your trips, it helps you rebuild missed miles, create fully IRS-compliant mileage logs, and stay audit-ready without hours of manual work. If you want to simplify record-keeping and maximize your deductions, this is the tool that gives you an edge.

Try MileageWise for free for 14 days. No credit card required!

Handling Audits and Compliance

The word “audit” strikes fear in most people, but knowing what to expect can help ease anxiety.

While the IRS pays attention to gig workers, most taxpayers never get audited. If you do receive an IRS audit notice:

- Respond promptly

- Provide requested documentation

- Consider hiring a tax professional for help

Remember: good record-keeping is your best defense against audit headaches!

Special Considerations for Instacart Shoppers

Joint Filing Benefits

If you’re married, filing jointly typically results in significant tax savings – potentially $3,000 to $7,000 compared to filing separately!

Tax Software Recommendations

For most Instacart shoppers, tax software like TurboTax, H&R Block, or TaxSlayer can handle your needs. Just be prepared to pay extra for:

- Self-employment tax forms

- Multiple state filings

- Additional Instacart shopper tax forms for deductions

Conclusion

Managing your Instacart taxes might seem overwhelming at first, but breaking it down into manageable steps makes it much easier. Remember these key points:

- Track everything: miles, expenses, receipts

- Save for taxes: set aside 25-30% of your earnings

- Make quarterly payments: avoid penalties by paying as you go

- Maximize deductions: don’t leave money on the table

- Stay organized: use apps and digital tools to make life easier

By understanding your tax obligations and taking advantage of all eligible deductions, you can significantly reduce your tax burden and keep more of your hard-earned money. Have questions about your specific situation? It’s always best to consult with a tax professional who can provide personalized advice. Happy shopping and happy tax saving!

Try MileageWise for free for 14 days. No credit card required!

FAQ

Will Instacart send me a 1099 form?

Instacart sends a 1099-NEC if you earn $600 or more in a calendar year. But even if you don’t receive a form, the IRS expects you to report all earnings — tracked or untracked.

Does Instacart track my mileage for taxes?

No. Instacart does not track or report your mileage. You are responsible for tracking your business miles.

Leading gig apps like Uber, Lyft, and DoorDash provide you with a mileage estimate, but apps like MileageWise track every eligible mile, not just online miles. Not tracking those miles can mean hundreds in lost deductions.

What happens if I don’t track mileage as an Instacart shopper?

You could miss out on thousands of dollars in tax deductions. Without a mileage log, the IRS may disallow your mileage claim during an audit.

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

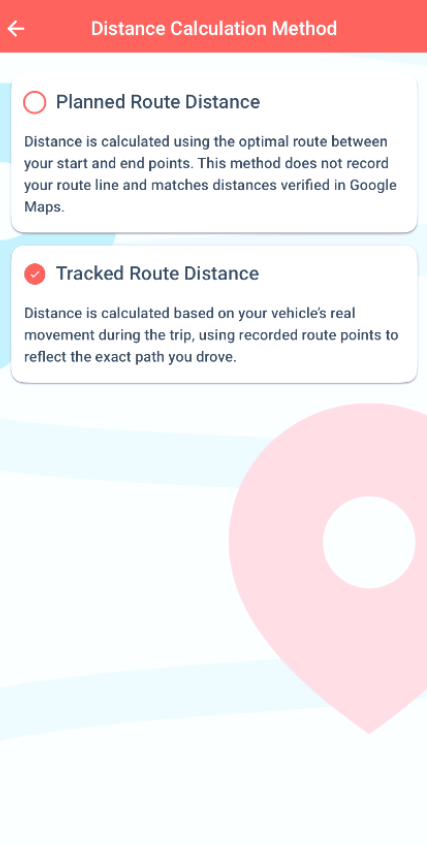

Only at MileageWise: Choose the Way to Calculate Your Mileage

We’ve upgraded how mileage is calculated in our mileage tracker app. 🎉 From now on, you can choose between two distance calculation methods depending on

Company Car vs Car Allowance: Which is Better for Your Business?

Last Updated: January 19, 2025 Deciding between a company car vs car allowance for your employees involves weighing costs, flexibility, and tax implications. For U.S.

Vehicle Fleet Software to Boost Your Business

Last Updated: January 19, 2026 Vehicle fleet software helps businesses handle their vehicles much better, cutting down costs and making everything run smoother. This type

Is Mileage Reimbursement Taxable? The Need to Knows

January 16, 2026 Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard

Freshly Announced: See The IRS Mileage Rates for 2026

January 2, 2025 The IRS has officially announced the IRS mileage rates for 2026, and they bring important updates for self-employed individuals, gig workers, small

Related Guides

Related Blogposts

Now on the App Store: Mileage Log from Google Maps for iPhone

It’s Finally Here! Google Maps Timeline Import from Mobiles

Transform your Trip Lists into Mileage Logs with MileageWise

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Only at MileageWise: Choose the Way to Calculate Your Mileage

We’ve upgraded how mileage is calculated in our mileage tracker app. 🎉 From now on, you can choose between two distance calculation methods depending on

Company Car vs Car Allowance: Which is Better for Your Business?

Last Updated: January 19, 2025 Deciding between a company car vs car allowance for your employees involves weighing costs, flexibility, and tax implications. For U.S.

Vehicle Fleet Software to Boost Your Business

Last Updated: January 19, 2026 Vehicle fleet software helps businesses handle their vehicles much better, cutting down costs and making everything run smoother. This type

Is Mileage Reimbursement Taxable? The Need to Knows

January 16, 2026 Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard

Freshly Announced: See The IRS Mileage Rates for 2026

January 2, 2025 The IRS has officially announced the IRS mileage rates for 2026, and they bring important updates for self-employed individuals, gig workers, small

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Introducing the Mileage Log from Google Maps App

We’re excited to share our latest development! You can now convert your Google Maps Timeline drives directly into an IRS-compliant mileage log right on your

Was Your Google Timeline Deleted? Here’s What Happened:

Last updated: November 20, 2025 If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this

It’s Finally Here! Google Maps Timeline Import from Mobiles

Struggling to Manage Your Trips After Google’s Timeline Update? If you’re reading this, you’ve likely encountered the recent update affecting Google Maps Timeline. With Timeline

Transform your Trip Lists into Mileage Logs with MileageWise

Last Updated: October 1, 2025 Do you have a list of monthly trips from a data source like Excel or Google Timeline, but need to

How to Download Google Timeline Data: A Guide

Google Timeline Import Hub Last Updated: October 30, 2025 Want to download Google Timeline data? This guide shows you how to extract your location history

How to Export Google Maps Timeline: Get Your Data

Google Timeline Import Hub Last Updated: October 29, 2025 It can be tricky to export Google Maps Timeline data after Google’s recent updates. Many users

Google Maps Mileage Tracker: From Timeline to Mileage Log

Google Timeline Import Hub Last Updated: October 29, 2025 If you’re an active user of Google Maps Timeline you likely already know how convenient it

Timeero

Table of Contents Timeero Timeero is a time, location, and mileage tracking app designed for businesses and teams in the United States. It helps employers

Milewise by Allstate

Table of Contents Milewise by Allstate Milewise by Allstate is a pay-per-mile car insurance program offered by Allstate Insurance in the United States. It’s designed

Hurldr

Table of Contents Hurdlr Hurdlr is a finance and expense tracking app designed for self-employed professionals, freelancers, and gig workers in the United States. It