Our Reviews & Experiences

Home » MileIQ Alternatives » Hurdlr Review

Last Updated: October 1, 2025

Looking for a detailed Hurdlr review? This article cuts straight to the chase, helping freelancers, gig workers, and small business owners decide if Hurdlr is the right choice for managing expenses, tracking mileage, and estimating taxes. We’ll look at its features, pros, cons, and see how it compares to other tools, ensuring you get the most out of your financial tracking.

Table of Contents

What is Hurdlr?

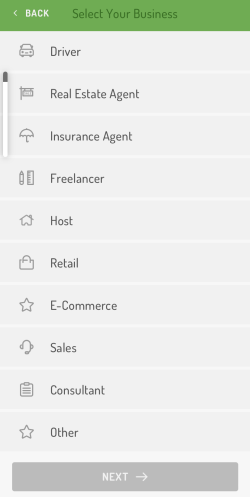

Hurdlr is a popular expense, mileage, and tax tracking app designed for self-employed individuals and small business owners. Its main goal is to help you maximize tax deductions and keep your financial records organized. Let’s dig into what makes Hurdlr stand out, based on what current users and industry experts say.

What Makes Hurdlr Tick

Core Features

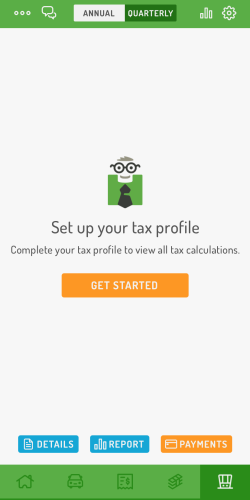

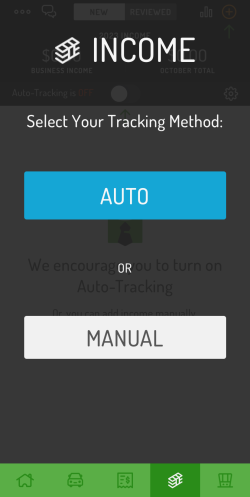

- Automatic Mileage and Expense Tracking: Hurdlr automatically tracks your mileage and expenses, cutting down on manual entry and reducing mistakes. You can easily categorize trips as business or personal with a quick swipe.

- Real-Time Tax Estimates: Hurdlr shows you real-time tax calculations based on your income and spending. This helps you, especially if you’re a freelancer, to put aside the correct amount for quarterly taxes.

- Bank & Platform Integrations: Hurdlr connects with many banks and popular gig platforms like Uber, Lyft, Square, PayPal, and Airbnb. This means your financial data imports smoothly. Income from these platforms or other payment processors comes into the app automatically.

- Reporting and Export: Hurdlr makes it easy to export summaries for taxes, both quarterly and yearly. This is super helpful for your CPA or when you file your own taxes.

- Invoicing: If you use a premium version, Hurdlr lets you create and send invoices directly from the app.

Important Stats and Facts

- Potential Savings: Hurdlr claims its users can save “thousands of dollars in IRS tax deductions” by accurately tracking deductible expenses and mileage.

- IRS Mileage Rate Utilized: The app uses the official IRS standard mileage rate to figure out your deductible mileage in real-time. You can always check the current rates on the IRS’s website.

- Market Position: Compared to apps like MileIQ and QuickBooks Self-Employed, Hurdlr often offers more features, even in its free version, and its premium version costs less.

Here is a quick video overview of Hurldlr.

User Reviews of Hurdlr

Hurdlr receives mixed reviews across platforms. On Google My Business, users rate it at 3.0, while it performs better on mobile app stores, earning 4.3 on the Play Store and 4.7 on the App Store. This difference shows that while many find it helpful, some users report ongoing frustrations with reliability and integrations.

✅ Positive Feedback

Many users praise Hurdlr for its ability to simplify mileage tracking, expense management, and tax prep.

- Unlimited free mileage tracking – Unlike competitors, Hurdlr’s free version allows unlimited mileage logging, which users appreciate.

- Strong customer support – Many reviews highlight fast and helpful responses through the in-app chat, often resolving issues quickly.

- Useful for freelancers and gig workers – Uber, DoorDash, Instacart drivers and small business owners find it a practical tool to track expenses, mileage, and income in one place.

- Time-saver at tax season – The app generates detailed reports, separating business and personal expenses, which users say makes tax filing less stressful.

- Accurate mileage and income tracking – Several reviewers note it captures trips reliably and integrates smoothly with bank accounts and platforms like Square.

⛔ Negative Reviews

While many users love Hurdlr, others report recurring frustrations that affect usability:

- Mileage tracking reliability – Some users complain that the app misses trips, fails to auto-start, or inaccurately records miles, causing lost deductions.

- Bank account integration issues – Frequent glitches with syncing transactions frustrate users, especially when they must repeatedly re-link their accounts.

- Subscription and refund complaints – A few reviewers felt misled by automatic plan upgrades or were denied refunds after paying for annual subscriptions.

- Clunky interface and missing features – Users noted limited customization, lack of sorting options, and the need to use both the app and web version for efficiency.

- Inconsistent performance across devices – Some Android users (e.g., OnePlus owners) reported compatibility problems, and others noted bugs after updates.

Hurdlr Versus Alternatives: Finding the Right Fit for You

When you’re searching for an expense and mileage tracker tax tool, it’s helpful to see how options stack up against each other. Here’s a brief comparison to put Hurdlr’s features in perspective to alternative expense and mileage tracker apps:

| Feature | Hurdlr | QuickBooks | MileIQ | MileageWise |

|---|---|---|---|---|

| Mileage Tracking | Automatic (some Android issues noted) | Automatic, often reliable | Automatic, primary focus | Highly accurate, multiple options, backup capture |

| Expense Tracking | Yes, integrated | Yes, integrated | N/A | In-app car expense tracker |

| Tax Estimates | Yes, real-time | Yes, integrated | N/A | N/A (provides IRS-compliant logs) |

| Invoicing | Premium plans only | Yes | N/A | N/A |

| Bank Integration | Yes | Yes | N/A | N/A |

| Cost | Mid-range | Higher | Mid-range | Affordable pricing, lifetime plans available |

| Key Advantage | All-in-one for freelancers/gig workers | Full suite for small businesses | Straighforward mileage tracking | Unmatched accuracy, IRS compliance for mileage |

While Hurdlr provides a solid all-in-one solution for many freelancers, particularly with its expense tracking and tax estimation, its mileage tracking can sometimes fall short, especially for those who rely on it heavily for significant tax deductions. This is where dedicated mileage solutions can make a big difference.

MileageWise: Your Premier Mileage Tracking Solution

You’ve seen that Hurdlr is a great tool for overall expense and tax management. But when it comes to mileage tracking, accuracy and IRS compliance are non-negotiable. This is especially true if driving is a core part of your business, or if you want to maximize your mileage deductions. That’s where MileageWise steps in, complementing your existing tax software with top-notch mileage logs.

MileageWise isn’t just another mileage app. We are experts in mileage logs, company mileage reimbursement, and optimizing your mileage tax deductions. Our solutions are built to be accurate, efficient, and completely IRS-proof.

Mobile App for Mileage Tracking

- Smart Mileage Tracking: Record every trip automatically with multiple tracking options.

- Easy Setup: Get started in just minutes, so you can focus on clients instead of tech headaches.

- Ad-Free & Secure: Track without distractions and keep client information private.

- Reliable Trip Start Detection: Never miss the beginning of a drive—something many other apps struggle with.

- Flexible Route & Distance Options: Choose to log exact routes or optimized mileage, depending on your needs.

- Waze Integration: Let Waze handle navigation while MileageWise quietly logs trips in the background—perfect for busy schedules.

- Expense Tracking Sync: Combine mileage with business expenses to simplify reporting and tax preparation.

Dashboard for a Retroactive Mileage Log

- Google Maps Timeline Import: Bring in your saved Location History to automatically fill in trips you forgot to track, making it easy to recover busy workdays.

- AI-Powered Mileage Wizard: Rebuild past drives in minutes instead of hours, saving you from manual data entry while keeping your mileage log tax-ready.

- IRS Compliance Auditor: Automatically checks your logs against IRS requirements, ensuring that your mileage records stay audit-proof and stress-free.

- Bulk Client & Route Upload: Add client lists or fixed routes all at once—ideal for professionals managing frequent property tours or multiple service calls.

- All-in-One Trip Management: Organize recurring drives, categorize business vs. personal trips, and batch-edit logs, making it simple to stay on top of every journey.

Customer Support That Understands Your Business

We know your time is valuable. MileageWise support is designed to keep you moving, whether you’re setting up your account or fine-tuning your mileage reports. Instead of waiting days for answers, you get quick, practical help from a team that understands the challenges of busy professionals.

Lifetime Plans: A MileageWise Exclusive

MileageWise is the only mileage tracker offering lifetime plans, helping you save compared to ongoing subscriptions. Pay once and get full access to the tools you need, without worrying about annual renewals or hidden costs.

-

Small Lifetime Deal: Track unlimited miles with our easy-to-use app and get AI assistance for creating reports — all for a one-time payment of $119. Perfect if you want simple, reliable mileage tracking without recurring fees.

-

Gold Lifetime: Unlock every tool for both current and past mileage. Import Google Maps Timeline history and generate IRS-compliant logs whenever you need them. This plan is ideal for professionals who require detailed records for audits or previous tax years.

Try MileageWise for free for 14 days. No credit card required!

User Testimonial: Hurdlr and MileageWise

I started out using Hurdlr, and I’ll admit it was a pretty good tool for tracking expenses and pulling together tax reports. If you’re looking mainly for an expense tracker, it does the job. But when it came to mileage tracking, it just didn’t hold up. I kept running into missed trips and inconsistent logs.

After reading a few MileageWise reviews, I decided to give it a try. The difference was immediate. MileageWise is the only mileage tracker app that actually works the way I need it to. No missed drives, no gaps, just accurate logs every time. For me, it’s been the perfect upgrade. I still stay on top of my taxes, but now I also know my mileage records are rock solid.

Conclusion

This Hurdlr review shows it’s a strong contender for freelancers and small business owners needing an all-in-one tool for expenses, mileage, and tax estimates. Its automation and ease of use are clear benefits. However, if precise and IRS-compliant mileage tracking is your top priority, you might find Hurdlr’s mileage features less robust than dedicated solutions.

FAQ

What is Hurdlr and how does it work?

Hurdlr is an expense, mileage, and tax tracking app designed for freelancers, gig workers, and small business owners. It automatically tracks mileage, syncs with bank accounts, estimates taxes in real time, and lets users generate reports for tax filing.

Is Hurdlr free to use or do I need a paid plan?

Hurdlr has a free version that includes unlimited mileage tracking and basic expense management. The premium plans unlock invoicing, advanced reports, and additional integrations, with pricing that is considered mid-range compared to competitors.

What do user reviews say about Hurdlr?

User reviews are mixed. Many praise its all-in-one features, unlimited free mileage tracking, and responsive customer service. On the downside, some mention issues with mileage tracking accuracy, bank integration glitches, and refund concerns.

How does Hurdlr compare to other apps like MileIQ and QuickBooks?

Compared to QuickBooks, Hurdlr is more affordable but less comprehensive for full business accounting. Compared to MileIQ, Hurdlr offers more features beyond mileage, such as tax estimates and expense tracking, while MileIQ focuses on mileage accuracy.