Home » Keeping a Mileage Log for Taxes in 2025 » Free Printable Mileage Logbook for Taxes and More

Last Updated: June 24, 2025

A mileage logbook is vital for tracking vehicle usage for business. It helps you save money on taxes and ensures accurate reimbursements. Whether you’re self-employed, run a small business, or work for a company, precise mileage tracking is key to avoiding audits and maximizing deductions.

Below you will find printable mileage log books for IRS tax deduction, each filled with sample data for ease of use. Scroll down and pick the one you need for your tax preparation.

Table of Contents

What is a Mileage Logbook and Why Do You Need One?

A mileage logbook is simply a record of your business-related driving. It can be a physical book or a digital file. Its main job is to show the IRS and your employer exactly how much you drove for work. This way, you can claim tax deductions or get paid back for your gas and vehicle wear and tear. Think of your mileage logbook as your financial proof for driving. It helps you:

- Claim Tax Deductions: The IRS offers a deduction from your vehicle expenses. You can either deduct your vehicle-related business expenses or the standard mileage rate for every business mile.

- Reduce Audit Risk: The IRS scrutinizes vehicle expenses often. If your mileage log is incomplete or inaccurate, it can trigger an audit.

- Get Accurate Reimbursement: If your company reimburses you for business travel, keeping a mileage log book for taxes ensures you get every penny you’re owed.

Old School vs. New School: Physical Logbooks and Digital Solutions

Many people start with what they know: a physical mileage logbook. These can be simple notebooks or custom-designed mileage books you order online.

The Appeal of Physical Mileage Logbooks

Physical logbooks offer a hands-on approach. You can:

- Buy them online: Many stationery stores and online marketplaces sell dedicated vehicle mileage log books for taxes. They often come with pre-printed columns for date, start/end odometer, destination, and purpose.

- Print them yourself: You can download many free templates online or create your own mileage sheet. Print it, and you have a neat tracker.

- Simplicity: It’s easy to keep one in your glove compartment. Just grab it and scribble down your trip info right after a drive.

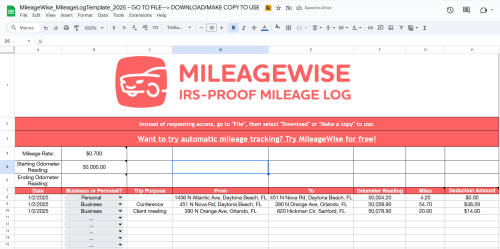

Download MileageWise’s Free IRS Mileage Logbook Templates here:

Downsides of Manual Tracking

While printable logbooks and physical mileage books seem straightforward, they have some big drawbacks:

- Time-Consuming: Writing everything down takes time. And then, you have to add it all up at the end of the month or year.

- Prone to errors: It’s easy to forget details like the exact purpose of a trip or the starting location, which the IRS requires.

- Audit Risk: A messy, incomplete, or inconsistent paper log can raise red flags with the IRS. To learn more about IRS rules, check out IRS Publication 463, Travel, Gift, and Car Expenses.

The Rise of Digital Mileage Logbooks

Today, digital mileage logbook apps are the new standard. Why? Because they automate tedious tasks and ensure accuracy.

Key Features of Top Digital Mileage Logbook Apps:

| Feature | Description |

| Automatic Trip Detection | Uses your phone’s GPS to record trips without you lifting a finger. |

| IRS/Tax Compliance | Generates ready-to-submit reports that meet IRS and other tax authority standards. |

| Cloud Backup | All your data is stored securely online, accessible from any device. |

| Route Mapping | Gives you a visual record of your routes and stops for each trip. |

MileageWise: Your Path to Seamless, Audit-Proof Mileage Tracking

As a mileage tracking expert, I can tell you that going digital is the smartest move for your finances and your peace of mind. And when it comes to digital solutions, MileageWise stands out from the crowd, especially for anyone serious about tax deductions and audit protection.

MileageWise Mobile App: Track with Ease

The MileageWise mobile app is designed to make mileage tracking effortless. It’s truly “set it and forget it.”

- Automatic Tracking: Our app uses smart technology to track your mileage. We offer multiple options like vehicle movement monitoring, phone charge monitoring, and even Bluetooth detection. Just drive, and we record it!

- Quick Setup: You can get started in no time. No complicated settings or long forms.

- Ad-Free Experience: We believe in a clean user experience. No annoying ads to distract you.

- Privacy-Focused: We respect your data. Your privacy is a top priority for us.

MileageWise Dashboard: Reconstruct and Perfect Your Past Logs

What if you haven’t tracked your mileage all year? Or maybe you have gaps in your records? This is where MileageWise truly shines!

- Google Maps Timeline Integration: You can import your Location History from Google Maps Timeline directly into MileageWise. From there, it’s incredibly easy to manage and fill in any missing trips. No competitor offers this unique feature!

- AI Wizard Mileage Log Tool: This exclusive tool is like having a tax expert create your log for you. Our AI Wizard reconstructs past trips, fills in missing details, and ensures everything is IRS-compliant.

- Comprehensive Trip Management: You have full control to edit, categorize, and perfect your trips.

Why MileageWise Is Different: Unbeatable Value

We’re proud to offer unique benefits that set us apart:

- Lifetime Plans: We’re the first in the industry to offer lifetime deals! Pay once and enjoy long-term savings without recurring fees. No more annual subscriptions eating into your profits.

- Comprehensive Support: Need help? Our dedicated customer service team is here for you. We provide expert advice and resources to help you navigate the platform and maximize your deductions.

Try MileageWise for free for 14 days. No credit card required!

AI Logs & Google Timeline Import

Customer Success Story: How Marcus Fixed His Mileage Log Mess

“I’m Marcus, a freelance interior designer, and my mileage tracking was a mess. I’d jot odometer readings in a notebook and guess the rest. Then came the audit. I spent days digging through old appointments, trying to rebuild trips. Desperate, I found MileageWise on Google. Their Google Maps Timeline integration changed everything. I uploaded my Timeline files, and there they were: all my drives, even ones I forgot. The AI Wizard filled in gaps and cleaned up errors. I thought it would be too complicated, but it was surprisingly easy. The IRS accepted my revised mileage log book without issue. I immediately signed up for their lifetime plan so I’d never go through that stress again. Lesson learned: work smart, not hard.”

Get Started Today: Your Path to Better Mileage Tracking

No matter if you’re a seasoned pro or just starting out, taking control of your vehicle mileage log book is crucial for your financial health.

- Understand Your Needs: Decide if a traditional paper logbook or a modern digital solution is best for you.

- Choose Your Tool: Consider the benefits of automated tracking with an app like MileageWise.

- Start Tracking Consistently: Make it a habit. With manual tracking, regular entry is key.

- Review and Categorize: Take time to review your trips and categorize them correctly (business, personal, commute).

- Generate Reports: At tax time, create accurate, IRS-compliant reports to maximize your deductions.

- Seek Expert Help: Don’t hesitate to use resources like IRS publications, tax professionals, or reach out to MileageWise support for guidance.

FAQ

What is a mileage logbook and why is it important for IRS taxes?

A mileage logbook is a record-keeping tool used to document the miles driven for business purposes. This log is essential for self-employed individuals and small business owners, as it allows them to track mileage accurately and claim mileage deductions on their tax returns. Keeping an accurate log not only simplifies the process of filing taxes but also provides evidence in case of an IRS audit. By maintaining a detailed mileage log, you can maximize your tax deduction and ensure compliance with IRS regulations.

Do I need an IRS compliant car mileage log book for tax return?

Yes, you need a mileage log for tax purposes if you plan to deduct vehicle expenses using the standard mileage rate. This log helps you track your business miles and ensure you have an IRS compliant mileage log with IRS requirements, which allows you to claim deductions effectively.

What information must a mileage logbook include for the IRS?

For each trip, record the date, starting point, destination, purpose (business/charity/etc), and the total business miles driven. Retain this for all deductible trips. Also include your personal information, the car’s information and the starting and ending odometer readings of the car.

How long do you need to keep a logbook for tax purposes?

You need to keep your mileage logbook for at least three years, as the IRS can request mileage records retrospectively for up to three years. It’s important to maintain these records to substantiate your mileage deductions if audited by the IRS.

Is a digital mileage logbook app acceptable to the IRS?

Yes. The IRS accepts both paper and electronic logbooks as long as they are accurate, complete, and backed up. Many modern apps are tailored to IRS compliance.

Do I need a mileage logbook if I claim actual expenses instead of the standard mileage rate?

Yes. Even if you claim actual vehicle expenses, you must keep a mileage log to show the percentage of miles driven for business versus personal purposes.