Note: Adding a refueling / charging is only necessary when using the Actual Expense Method. In case of using the IRS Standard Mileage Rate, you only need to log your arrival at the gas / charging station (the trip itself), as you would with any other client / location.

“If I’m on the road at night and there is a refueling / charging before arriving at my destination at 00:40 AM. In this case, the program indicates an error when I’m trying to finalize my monthly mileage log. The refueling / charging date is on the receipt so it can not be manually modified to show the date of the previous day.”

The problem is, in this case, is if you want to record your refueling / charging as the first trip of the day then it would have to be the last trip for the previous day as well, but this wouldn’t be realistic and therefore the program will not allow it.

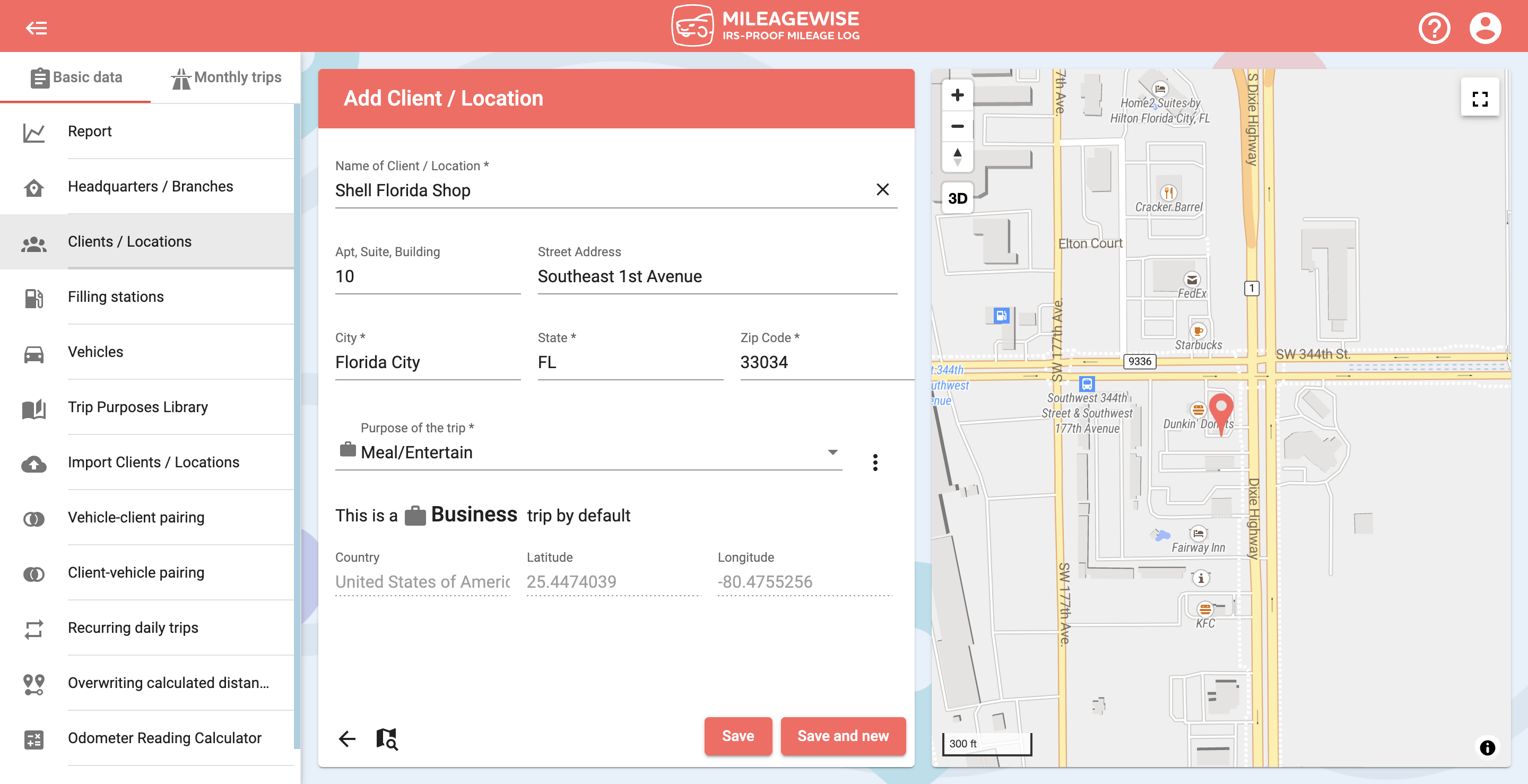

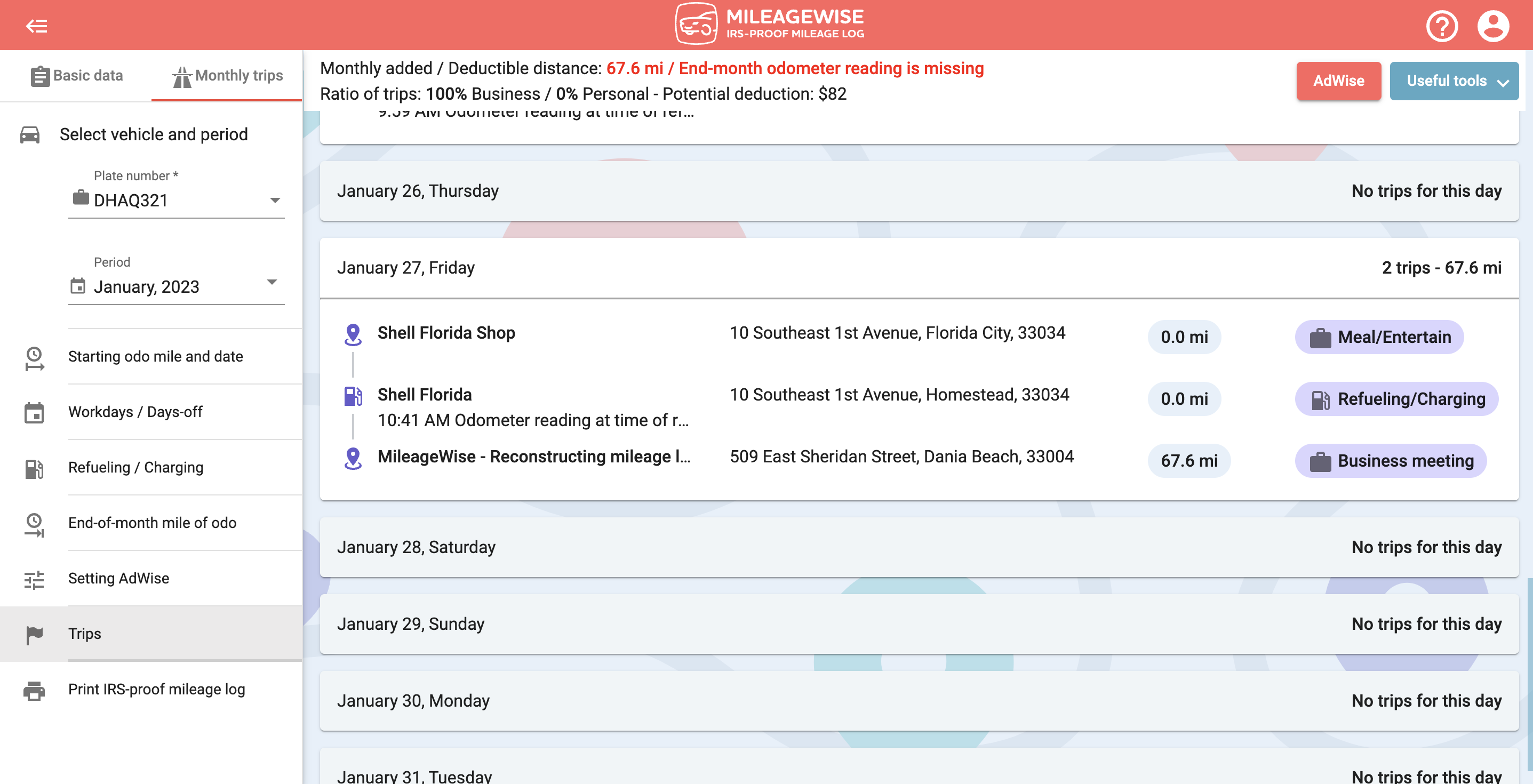

We recommend that you add a client with the same address as the Filling station instead of the actual Filling station, but with a different name, for example, “shop” (usually, there is a shop at most Filling stations). Like if there is a fast food restaurant at a Filling station, then add it, as the last stop of your day.

Then record a trip using this new client to the end of the day before refueling / charging and as the first trip on the day of the refueling / charging.

This first trip will show you only did 0 miles, but you do not have to worry about this, this will not cause you any problems.