Note: Adding a refueling / charging is only necessary when using the Actual Expense Method. In case of using the Standard Mileage Rate, you only need to log your arrival at the gas / charging station (the trip itself), as you would with any other client / location.

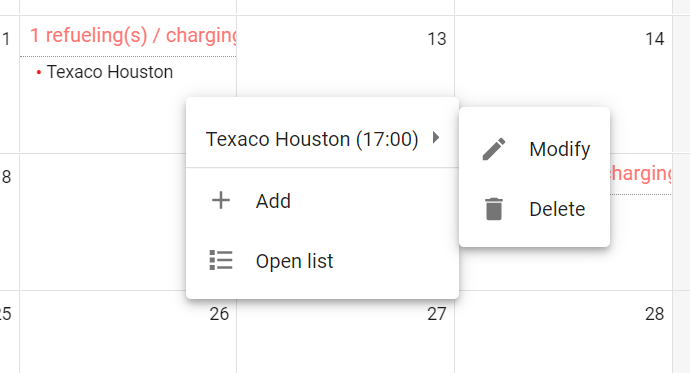

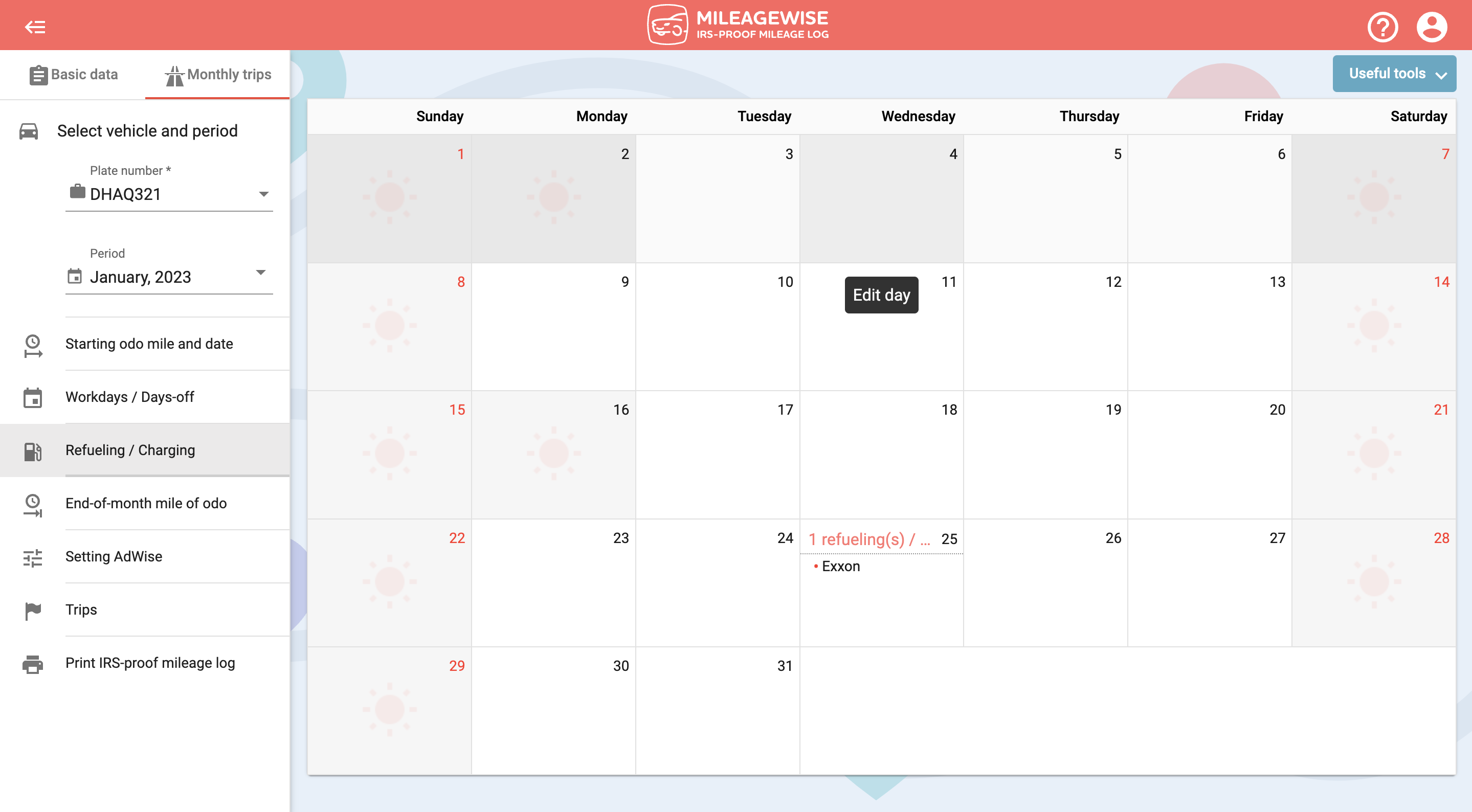

In the calendar view, double-click the day where you want to change a refueling / charging. Or right-click and select Delete from the drop-down menu.

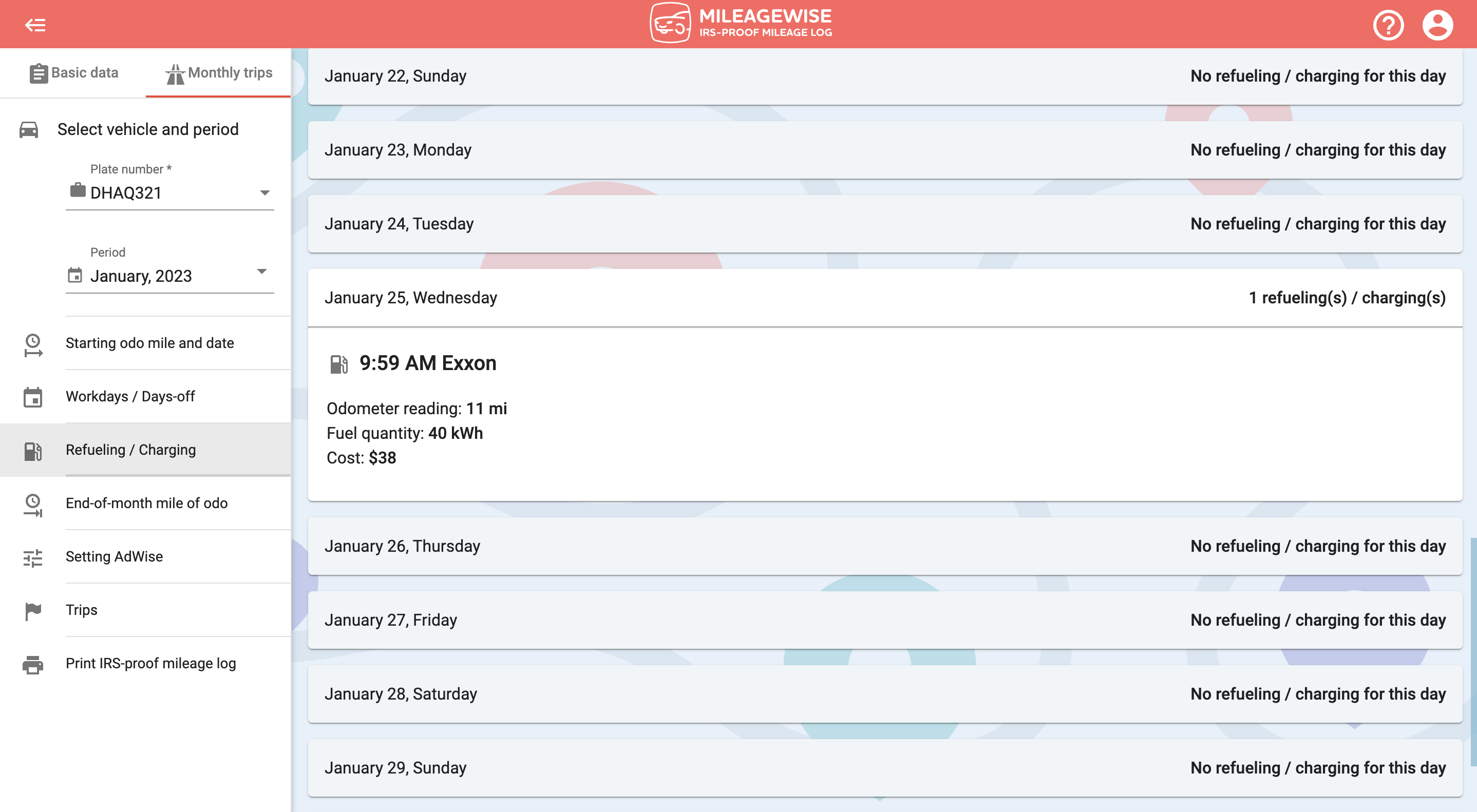

In list view, click on the pencil icon on the day you want to cancel refueling / charging!

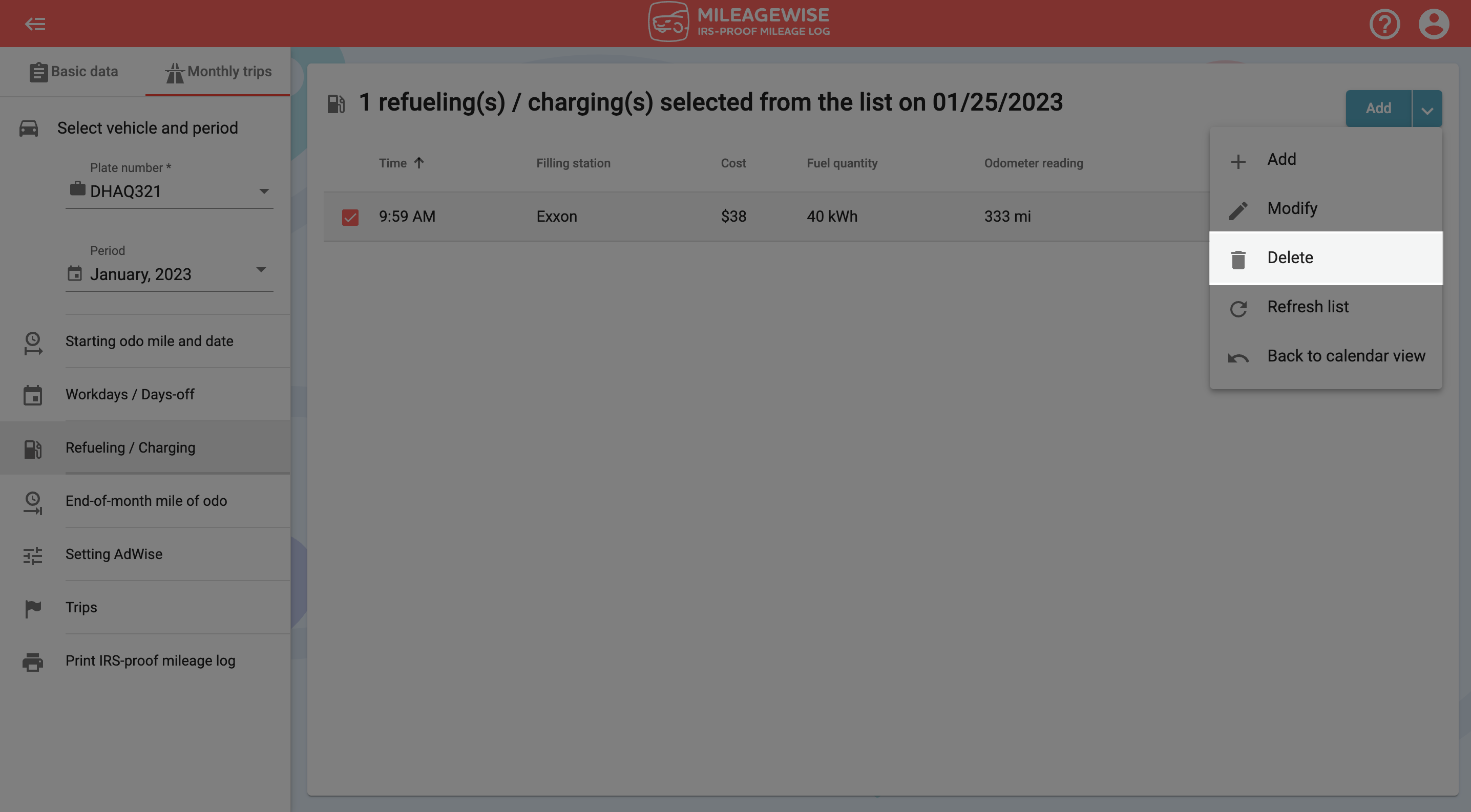

Use the checkbox to select the refueling / charging you want to delete.

Open the red menu in the top right corner and click the

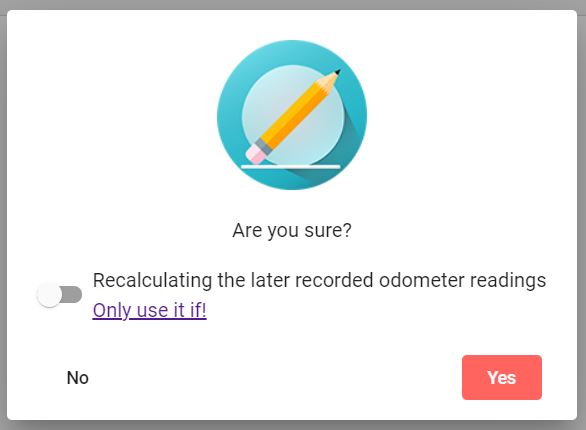

Click Yes to confirm your intention to delete.