Last Updated: December 8, 2025

If you regularly pay tolls for work-related travel, you may be wondering: Are tolls tax-deductible? The short answer is yes, but only under specific conditions. Understanding when and how to claim toll fees can help you maximize deductions and reduce taxable income. In this guide, we’ll cover when tolls are deductible, who can claim them, and how to ensure you’re following IRS guidelines.

Table of Contents

When Are Tolls Tax Deductible?

General Rule: tolls are tax-deductible only if they are directly related to business or work-related travel. You cannot write off tolls for personal trips or daily commuting to and from a regular work location. However, if you travel for business purposes, you may be eligible to claim toll fees on your taxes.

Who Can Deduct Toll Fees on Taxes?

Self-Employed Individuals & Business Owners

If you’re self-employed or own a business, you can deduct road toll fees as a business expense if:

- The tolls were incurred while driving for business purposes (e.g., meeting clients, making deliveries, attending work-related events).

- You keep proper documentation, such as highway toll receipts or a mileage log.

Employees (W-2 Workers)

Generally, employees cannot deduct toll fees from their taxes if they are W-2 workers. However, toll charges may be deductible if they are unreimbursed and part of a qualifying deduction (e.g., military reservists, performing artists, or fee-based government officials). If your employer reimburses you for tolls, you cannot claim them on your tax return.

Gig Workers & 1099 Independent Contractors

If you drive for Gig platforms like DoorDash or Instacart, or any other job as an independent contractor, tolls are tax-deductible as long as they are paid during business-related travel. However, if you are compensated for tolls (such as during passenger trips with Uber), you cannot include them in your mileage deduction.

How to Deduct Toll Fees on Your Taxes

Using the Actual Expense Method

If you deduct actual vehicle expenses, tolls can be written off separately. To qualify, you need:

- Toll receipts or electronic statements from toll passes.

- A business mileage log proving the trip was work-related.

If You Use the Standard Mileage Rate

If you use the IRS standard mileage rate, toll charges are not included in the mileage calculation. However, you can still write off tolls for work separately, along with parking fees.

Tracking Your Toll Expenses Properly

To ensure you claim all eligible toll deductions, follow these best practices:

- Use a mileage tracker app like MileageWise to log business-related trips.

- Save all receipts and toll invoices (paper or digital copies).

- Keep bank statements or in-app transaction logs from toll passes like E-ZPass or FasTrak.

Filing Your Tax Return

Tax season usually ends on April 15, so make sure to file your tax return on time.

- Self-employed individuals should report toll expenses on Schedule C (Form 1040) under business expenses.

- Employees eligible for deductions may need to use Form 2106 for unreimbursed expenses.

Make sure to keep your receipts and bank statements for at least three years after filing to support your deduction claims in case of an IRS audit.

Final Thoughts

Tolls are tax deductible if they are related to business travel, but they are not deductible for personal or commuting expenses. If you are self-employed, a gig worker, or a business owner, tracking tolls properly can lead to valuable tax write-offs. Make sure to keep accurate records and use a reliable mileage tracker like MileageWise to ensure you maximize your deductions and stay compliant with IRS rules.

Need a smart way to track mileage and tolls? Check out MileageWise for automated mileage logs and detailed expense reports that help you claim every eligible deduction!

Try MileageWise for free for 14 days. No credit card required!

FAQ

Are tolls tax deductible?

Yes, tolls are tax deductible if they are related to business or work-related travel. Personal or commuting tolls are not deductible.

Can I deduct tolls on my taxes if I use the standard mileage rate?

Yes! The IRS standard mileage rate does not include tolls, so they can be deducted separately along with parking fees.

Do I need receipts to deduct tolls on my taxes?

Yes, keeping toll receipts, bank statements, or electronic toll pass records is recommended to prove your expenses in case of an audit.

Can I deduct tolls if I don’t own the car?

Yes, as long as you paid for the tolls yourself and used the vehicle for business purposes, you can deduct the toll expenses, even if you don’t own the car.

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

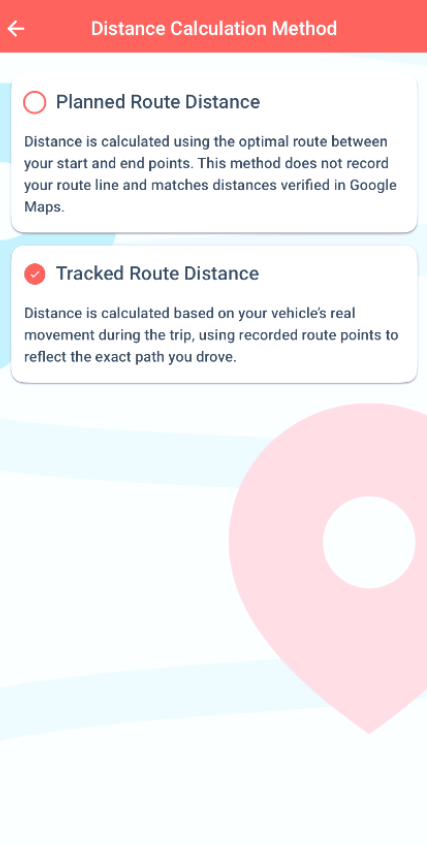

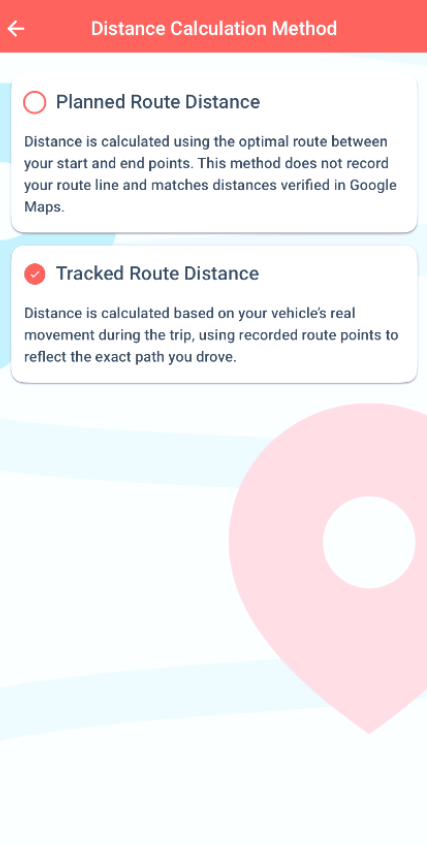

Only at MileageWise: Choose the Way to Calculate Your Mileage

We’ve upgraded how mileage is calculated in our mileage tracker app. 🎉 From now on, you can choose between two distance calculation methods depending on

Company Car vs Car Allowance: Which is Better for Your Business?

Last Updated: January 19, 2025 Deciding between a company car vs car allowance for your employees involves weighing costs, flexibility, and tax implications. For U.S.

Vehicle Fleet Software to Boost Your Business

Last Updated: January 19, 2026 Vehicle fleet software helps businesses handle their vehicles much better, cutting down costs and making everything run smoother. This type

Is Mileage Reimbursement Taxable? The Need to Knows

January 16, 2026 Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard

Freshly Announced: See The IRS Mileage Rates for 2026

January 2, 2025 The IRS has officially announced the IRS mileage rates for 2026, and they bring important updates for self-employed individuals, gig workers, small

Related Guides

Related Blogposts

Now on the App Store: Mileage Log from Google Maps for iPhone

It’s Finally Here! Google Maps Timeline Import from Mobiles

Transform your Trip Lists into Mileage Logs with MileageWise

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Only at MileageWise: Choose the Way to Calculate Your Mileage

We’ve upgraded how mileage is calculated in our mileage tracker app. 🎉 From now on, you can choose between two distance calculation methods depending on

Company Car vs Car Allowance: Which is Better for Your Business?

Last Updated: January 19, 2025 Deciding between a company car vs car allowance for your employees involves weighing costs, flexibility, and tax implications. For U.S.

Vehicle Fleet Software to Boost Your Business

Last Updated: January 19, 2026 Vehicle fleet software helps businesses handle their vehicles much better, cutting down costs and making everything run smoother. This type

Is Mileage Reimbursement Taxable? The Need to Knows

January 16, 2026 Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard

Freshly Announced: See The IRS Mileage Rates for 2026

January 2, 2025 The IRS has officially announced the IRS mileage rates for 2026, and they bring important updates for self-employed individuals, gig workers, small

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Introducing the Mileage Log from Google Maps App

We’re excited to share our latest development! You can now convert your Google Maps Timeline drives directly into an IRS-compliant mileage log right on your

Was Your Google Timeline Deleted? Here’s What Happened:

Last updated: November 20, 2025 If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this

It’s Finally Here! Google Maps Timeline Import from Mobiles

Struggling to Manage Your Trips After Google’s Timeline Update? If you’re reading this, you’ve likely encountered the recent update affecting Google Maps Timeline. With Timeline

Transform your Trip Lists into Mileage Logs with MileageWise

Last Updated: October 1, 2025 Do you have a list of monthly trips from a data source like Excel or Google Timeline, but need to

How to Download Google Timeline Data: A Guide

Google Timeline Import Hub Last Updated: October 30, 2025 Want to download Google Timeline data? This guide shows you how to extract your location history

How to Export Google Maps Timeline: Get Your Data

Google Timeline Import Hub Last Updated: October 29, 2025 It can be tricky to export Google Maps Timeline data after Google’s recent updates. Many users

Google Maps Mileage Tracker: From Timeline to Mileage Log

Google Timeline Import Hub Last Updated: October 29, 2025 If you’re an active user of Google Maps Timeline you likely already know how convenient it

Timeero

Table of Contents Timeero Timeero is a time, location, and mileage tracking app designed for businesses and teams in the United States. It helps employers

Milewise by Allstate

Table of Contents Milewise by Allstate Milewise by Allstate is a pay-per-mile car insurance program offered by Allstate Insurance in the United States. It’s designed

Hurldr

Table of Contents Hurdlr Hurdlr is a finance and expense tracking app designed for self-employed professionals, freelancers, and gig workers in the United States. It