Last Updated: Novermber 10, 2025

Welcome to the Favor gig, where flexibility meets opportunity. This guide is crafted to provide a deep dive into what it means to be a Favor driver while exploring the benefits and challenges of this role. We will also discuss how you can effectively manage your earnings with smart tools like MileageWise, ensuring that your journey as a Favor Runner is as profitable as possible.

Table of Contents

Becoming a Favor Driver

Requirements for Favor Drivers

To kickstart your journey as a Favor delivery driver, you’ll need to adhere to certain requirements. For example, a valid driver’s license, proof of insurance, and a reliable vehicle are mandatory. Consequently, almost anyone owning a vehicle, a smartphone, and the drive to work can join the Favor team. Providing the required documents is straightforward and therefore ensures a smooth onboarding process for new drivers.

The Sign-up Process

Are you interested in joining the ranks of Favor Runners? The sign-up process is a breeze. Simply download the Favor Runner app, log in, fill out your details, and submit your application. Luckily, approval often comes quickly. Once you’re in, you can start accepting delivery tasks immediately.

Earnings as a Favor Driver

Understanding the Payment Structure

How do Favor drivers get paid? It’s quite simple: drivers earn a base rate for each delivery plus 100% of their tips. This setup means your earnings can significantly vary depending on the number of deliveries you make and the generosity of your customers. Additionally, understanding the payment structure is crucial for planning your finances and maximizing your earnings.

Promotional Bonuses and Incentives

To further boost your earning potential, Favor offers various runner promos. These promotions provide bonuses for completing a certain number of deliveries within a specified timeframe, thereby considerably enhancing your potential earnings. Such incentives not only make the job more exciting but also more rewarding.

Benefits of Driving for Favor

The Favor driver app provides a great level of flexibility, allowing you to set your own schedules and work as much or as little as you desire. This level of independence is a significant attraction of gig economy jobs, offering a perfect setup for those who value flexibility over the rigidity of traditional employment.

Furthermore, Favor stands out from other delivery services by encouraging more personal connections between runners and customers. For example, they can chat with each other once an order is placed. As a consequence, runners have the opportunity to enhance customer satisfaction and earn more tips.

Challenges Faced by Favor Drivers

A major challenge for many Favor Runners is the cost associated with vehicle maintenance and fuel since these expenses can take a significant bite out of your earnings. Understanding how to manage these costs effectively is crucial for maintaining your profitability as a Favor delivery driver.

What Are Mileage Deductions?

As a Favor runner, taking advantage of mileage deductions can significantly lower your taxes. You’re able to deduct a set amount for each mile you drive for business, effectively reducing your taxable income. This strategy not only saves you money during tax season but is also a crucial part of financial management for anyone using their vehicle for professional purposes.

Tracking and Calculating Mileage

To claim mileage deductions, you must keep accurate mileage logs, which means regular updates and accurate entries are crucial for IRS compliance. While this can seem daunting, tools like the MileageWise App make the task easier, while ensuring IRS-proof logs and maximum deductions.

MileageWise: A Comprehensive Tool for Favor Drivers

MileageWise is a powerful application tailored for gig workers and freelancers to track their business mileage effectively. It offers features that guarantee accurate, IRS-compliant logs. Among many options available, MileageWise is notable for its outstanding customer support and distinctive functionalities:

Mobile App for Mileage Tracking

- Automatic Mileage Tracking: Log every Favor trip automatically so no mile is missed between pickups and drop-offs.

- Quick Setup: Start tracking in minutes and focus on completing deliveries instead of complicated onboarding.

- Ad-Free & Privacy-Focused: Enjoy smooth tracking without ads, upsells, or data sharing.

- Backup Mileage Capture: Accurately records trip start and end points, even with minor signal interruptions and device issues.

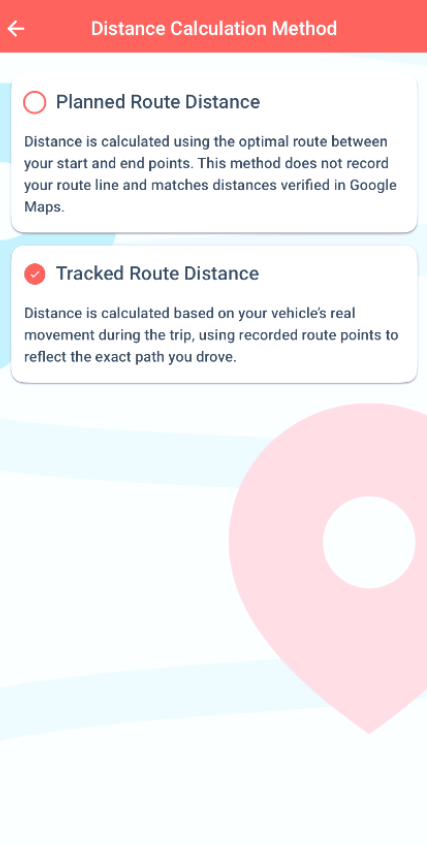

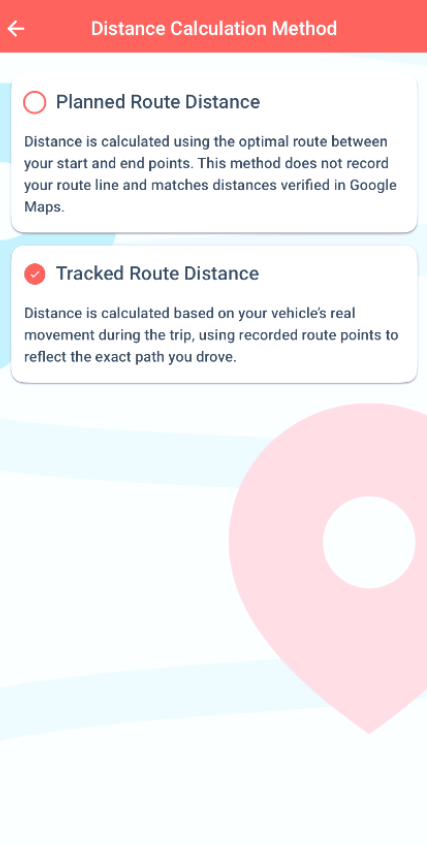

- Flexible Routing/Distance Calculations: Track exact delivery routes or use optimized distance calculations.

- Routing Integration with Waze: Navigate busy city streets with Waze while MileageWise logs your delivery miles.

- Expense Tracking Integration: Keep your mileage and delivery expenses organized in one place to simplify tax deductions.

Dashboard for a Retroactive Mileage Log

- Google Maps Timeline Integration: Import your driving history to rebuild untracked Favor delivery trips with ease.

- AI-Powered Mileage Wizard: Automatically reconstructs your past delivery routes, saving hours of manual work. Fills in any gaps to audit-proof your log.

- IRS Compliance Auditor: Reviews your logs for IRS accuracy and identifies potential red flags so you’re always audit-ready at tax time.

- Bulk Client & Trip Import: Add restaurant and delivery addresses or manually tracked routes in bulk, ideal for retroactive mileage logging.

- Comprehensive Trip Management: Manage daily routes, recurring deliveries, vehicles, and edit trip purposes in batches to keep your records clean and organized.

Try MileageWise for free for 14 days. No credit card required!

Customer Story: Favor Driver’s Mileage Tracker Success

As a Favor delivery driver, I spend my days zipping between restaurants and customers all over town. I used to rely on guesswork when it came to tracking my miles for taxes. So every year, I’d end up shortchanging myself. That changed when I started using the MileageWise mileage tracker.

Now, every trip I make is logged automatically, even during my busiest hours. The setup took just a few minutes, and I love that the app runs quietly in the background without annoying ads or pop-ups. It even captures start and end points accurately, so I never lose data if GPS drops.

With everything organized in one place, I no longer stress over lost miles or messy spreadsheets. MileageWise turned what used to be a frustrating chore into something effortless. For anyone driving for Favor, this app pays for itself fast.

Conclusion: Drive Smarter, Earn More

Driving for Favor offers flexibility, independence, and the satisfaction of helping customers every day. But to truly make the most of it, managing your miles and expenses wisely is key. With so much of your income tied to your vehicle, tracking every delivery mile accurately can make a big difference at tax time.

That’s where MileageWise comes in: the ideal companion for Favor Runners who want to keep their focus on deliveries, not paperwork. With automatic tracking, backup mileage capture, and ad-free reliability, it ensures that every business mile is logged and ready when you need it.

Whether you’re just starting with Favor or already know your delivery routes by heart, MileageWise helps you save money, stay organized, and drive with confidence — every trip, every mile, every time.

FAQ

How do Favor delivery areas impact my work?

Favor delivery areas determine where you can receive and fulfill orders. Your location within these areas affects the number and types of deliveries you can make, influencing your overall earning potential.

How do Favor drivers get paid?

Favor drivers earn a base rate for each delivery they complete plus 100% of the tips they receive from customers. This payment structure allows earnings to vary based on the number of deliveries and the generosity of customers.

How do Favor runner promos work?

Favor offers promotional bonuses that reward drivers for completing a certain number of deliveries within a specified timeframe. These promotions are designed to boost earnings and add an incentive for taking more delivery jobs.

How should I track mileage for tax deductions as a Favor Runner?

Effective mileage tracking is essential for claiming deductions. You should maintain accurate records of all business-related trips. Tools like MileageWise can automate this process, ensuring compliance with IRS standards.

What is MileageWise and how can it benefit me as a Favor Runner?

MileageWise is a tool designed to help gig workers track business mileage. It features automatic trip classification, IRS-compliant logs, and a built-in auditor to ensure accuracy. It simplifies mileage tracking and maximizes your potential tax deductions.

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Only at MileageWise: Choose the Way to Calculate Your Mileage

We’ve upgraded how mileage is calculated in our mileage tracker app. 🎉 From now on, you can choose between two distance calculation methods depending on

Company Car vs Car Allowance: Which is Better for Your Business?

Last Updated: January 19, 2025 Deciding between a company car vs car allowance for your employees involves weighing costs, flexibility, and tax implications. For U.S.

Vehicle Fleet Software to Boost Your Business

Last Updated: January 19, 2026 Vehicle fleet software helps businesses handle their vehicles much better, cutting down costs and making everything run smoother. This type

Is Mileage Reimbursement Taxable? The Need to Knows

January 16, 2026 Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard

Freshly Announced: See The IRS Mileage Rates for 2026

January 2, 2025 The IRS has officially announced the IRS mileage rates for 2026, and they bring important updates for self-employed individuals, gig workers, small

Try MileageWise for free for 14 days. No credit card required!

Related Guides

Related Blogposts

Now on the App Store: Mileage Log from Google Maps for iPhone

It’s Finally Here! Google Maps Timeline Import from Mobiles

Transform your Trip Lists into Mileage Logs with MileageWise

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Only at MileageWise: Choose the Way to Calculate Your Mileage

We’ve upgraded how mileage is calculated in our mileage tracker app. 🎉 From now on, you can choose between two distance calculation methods depending on

Company Car vs Car Allowance: Which is Better for Your Business?

Last Updated: January 19, 2025 Deciding between a company car vs car allowance for your employees involves weighing costs, flexibility, and tax implications. For U.S.

Vehicle Fleet Software to Boost Your Business

Last Updated: January 19, 2026 Vehicle fleet software helps businesses handle their vehicles much better, cutting down costs and making everything run smoother. This type

Is Mileage Reimbursement Taxable? The Need to Knows

January 16, 2026 Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard

Freshly Announced: See The IRS Mileage Rates for 2026

January 2, 2025 The IRS has officially announced the IRS mileage rates for 2026, and they bring important updates for self-employed individuals, gig workers, small

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Introducing the Mileage Log from Google Maps App

We’re excited to share our latest development! You can now convert your Google Maps Timeline drives directly into an IRS-compliant mileage log right on your

Was Your Google Timeline Deleted? Here’s What Happened:

Last updated: November 20, 2025 If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this

It’s Finally Here! Google Maps Timeline Import from Mobiles

Struggling to Manage Your Trips After Google’s Timeline Update? If you’re reading this, you’ve likely encountered the recent update affecting Google Maps Timeline. With Timeline

Transform your Trip Lists into Mileage Logs with MileageWise

Last Updated: October 1, 2025 Do you have a list of monthly trips from a data source like Excel or Google Timeline, but need to

How to Download Google Timeline Data: A Guide

Google Timeline Import Hub Last Updated: October 30, 2025 Want to download Google Timeline data? This guide shows you how to extract your location history

How to Export Google Maps Timeline: Get Your Data

Google Timeline Import Hub Last Updated: October 29, 2025 It can be tricky to export Google Maps Timeline data after Google’s recent updates. Many users

Google Maps Mileage Tracker: From Timeline to Mileage Log

Google Timeline Import Hub Last Updated: October 29, 2025 If you’re an active user of Google Maps Timeline you likely already know how convenient it

Timeero

Table of Contents Timeero Timeero is a time, location, and mileage tracking app designed for businesses and teams in the United States. It helps employers

Milewise by Allstate

Table of Contents Milewise by Allstate Milewise by Allstate is a pay-per-mile car insurance program offered by Allstate Insurance in the United States. It’s designed

Hurldr

Table of Contents Hurdlr Hurdlr is a finance and expense tracking app designed for self-employed professionals, freelancers, and gig workers in the United States. It