January 2, 2025

The IRS has officially announced the IRS mileage rates for 2026, and they bring important updates for self-employed individuals, gig workers, small business owners, and anyone who drives for work. Staying current with these rates helps you maximize deductions, reduce taxable income, and remain compliant with IRS requirements.

Below, you’ll find the new 2026 mileage rates, how they’re calculated, who can use them, and how to make sure your mileage records are accurate as you prepare for the 2026 tax season.

Table of Contents

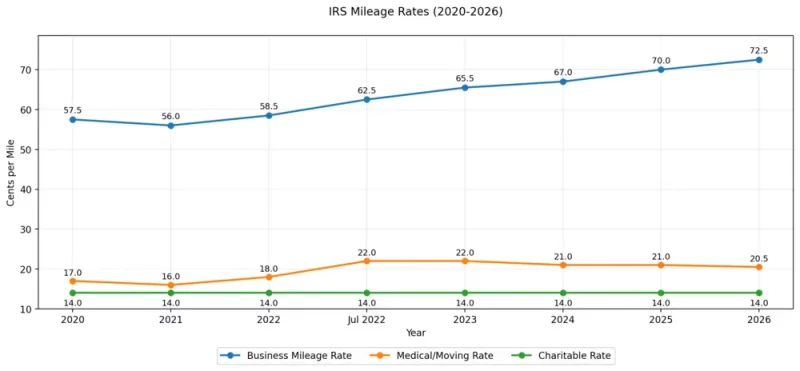

What Are the IRS Mileage Rates for 2026?

The IRS mileage rates set the amount taxpayers can deduct per mile driven for approved purposes. These rates apply to business travel, medical-related driving, charitable work, and eligible military moves.

IRS Mileage Rates 2026

- Business mileage rate: 72.5 cents per mile, used for business-related driving by self-employed individuals and business owners.

- Medical and military moving rate: 20.5 cents per mile, applies to qualifying medical travel and eligible military relocation expenses.

- Charitable mileage rate: 14 cents per mile, used for miles driven while volunteering for qualified nonprofit organizations.

These rates apply to miles driven during the 2026 tax year and can be claimed when filing your return.

How the IRS Determines Mileage Rates

The IRS reviews nationwide driving cost data each year before setting the standard mileage rates. Several key factors influence the final numbers:

- Fuel costs: Changes in gas prices directly affect driving expenses

- Vehicle maintenance and depreciation: Repairs, tires, and long-term wear

- Insurance and registration fees: Ongoing ownership costs

- Inflation trends: Broader economic conditions impacting vehicle use

Adjustments to the mileage rate reflect real-world changes in what it costs to operate a vehicle.

Who Can Use the IRS Mileage Rates?

The 2026 IRS mileage rates apply to a wide range of taxpayers, including:

- Self-employed individuals and freelancers deducting business mileage

- Employees receiving mileage reimbursement from employers

- Employers creating accurate mileage reimbursement reports

- Volunteers driving for charitable organizations

- Active-duty military members with qualifying moves

- Taxpayers with eligible medical travel expenses

If you drive your personal vehicle for any of these purposes, mileage deductions can significantly lower your tax liability.

Preparing for the 2026 Tax Season

With the 2026 tax season underway, accurate mileage records matter more than ever. Missing or incomplete logs can lead to lost deductions or problems during an IRS review. MileageWise offers tools to help you reconstruct past driving accurately!

Google Timeline to Mileage Log Feature

MileageWise can convert Google Maps Timeline data into an IRS-compliant mileage log, even after the trips have already happened. This solution is ideal if Google recorded your trips, but you didn’t keep track of them yourself.

AI Wizard Mileage Log Creator

When Google Timeline data is incomplete or missing, the AI Wizard Mileage Log Creator rebuilds your trips automatically using intelligent reconstruction. This tool saves you from hours of manual work and ensures audit-ready records.

These tools are especially helpful for self-employed drivers and gig workers catching up before filing.

Track Mileage Automatically Going Forward

Once your past mileage is in order, automatic tracking makes staying compliant much easier. MileageWise offers an Automatic Mileage Tracker App designed to automatically track your miles and provide you with a mileage log for next season.

Try MileageWise for free for 14 days. No credit card required!

FAQ

What are the IRS mileage rates for 2026?

For 2026, the IRS mileage rates are:

- Business: 72.5 cents per mile

- Medical and military moving: 20.5 cents per mile

- Charitable: 14 cents per mile

Who can claim the 2026 mileage rate?

Self-employed individuals, employees, employers, volunteers, active military members, and taxpayers with qualifying medical expenses can all use the 2026 mileage rates.

How do I prove mileage deductions to the IRS?

You need an IRS-compliant mileage log that includes the date, distance, purpose of the trip, and total miles driven.

Can I recreate past mileage logs?

Yes. MileageWise allows you to rebuild past trips using Google Maps Timeline data or the AI Wizard mileage log creator.