Table of Contents

Trip Purpose

Your trip purpose is the main reason you take a journey. Recording it clearly—what you did, where you went, and why—is required for an IRS-compliant mileage log.

Understanding Trip Purpose

Think about why you’re traveling. Is it for work, leisure, to see family, or to run errands? That reason is your trip purpose.

Tax & Expense Tracking: Employers and the IRS require a clear business justification for each mileage deduction.

Data & Planning: Transportation planners use trip-purpose data to improve routes and services.

Common Trip Purposes

Commuting

Travel between home and your regular workplace (not deductible).Business Travel

Trips for work beyond your usual commute—client meetings, conferences, site visits.Leisure Travel

Vacations, day trips, or any non-work enjoyment.Visiting Friends or Family

Personal, nondeductible travel to see loved ones.Shopping & Errands

Grocery runs, post office visits, and similar tasks.Medical Appointments

Doctor visits, therapy sessions, or picking up prescriptions.Events

Weddings, funerals, concerts, and other special occasions.Other

Voting, volunteering, or unique one-off reasons.

FAQ

What is a trip purpose?

Your trip purpose is the reason for your journey—work, personal, or medical mileage—documented to justify mileage claims and satisfy IRS requirements.

Why is documenting trip purpose important?

The IRS mandates a business reason for each deductible trip. Clear trip purposes (e.g. real estate showing for potential buyers) help you maximize deductions and protect you in an audit.

How do I record trip purposes in MileageWise

MileageWise prompts you to tag each trip to a new destination with a purpose when reviewing your log—choose from preset categories or enter a custom description for complete, compliant records. While apps like Stride or MileIQ require you to categorize each trip, MileageWise remembers the purpose you assigned to a client, saving you time.

Try MileageWise for free for 14 days. No credit card required!

Related Terms

Is There a Maximum Mileage Deduction?

You’re wondering if there’s a maximum mileage deduction the IRS allows, the straightforward answer is no. There’s no maximum mileage limit for the IRS standard

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

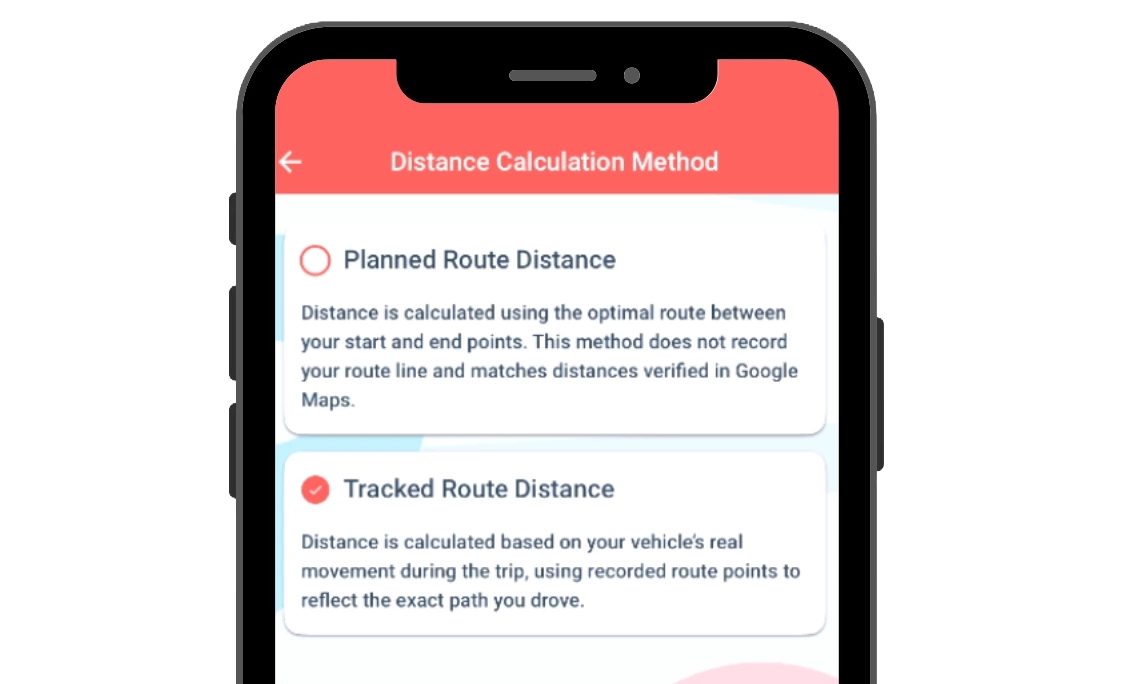

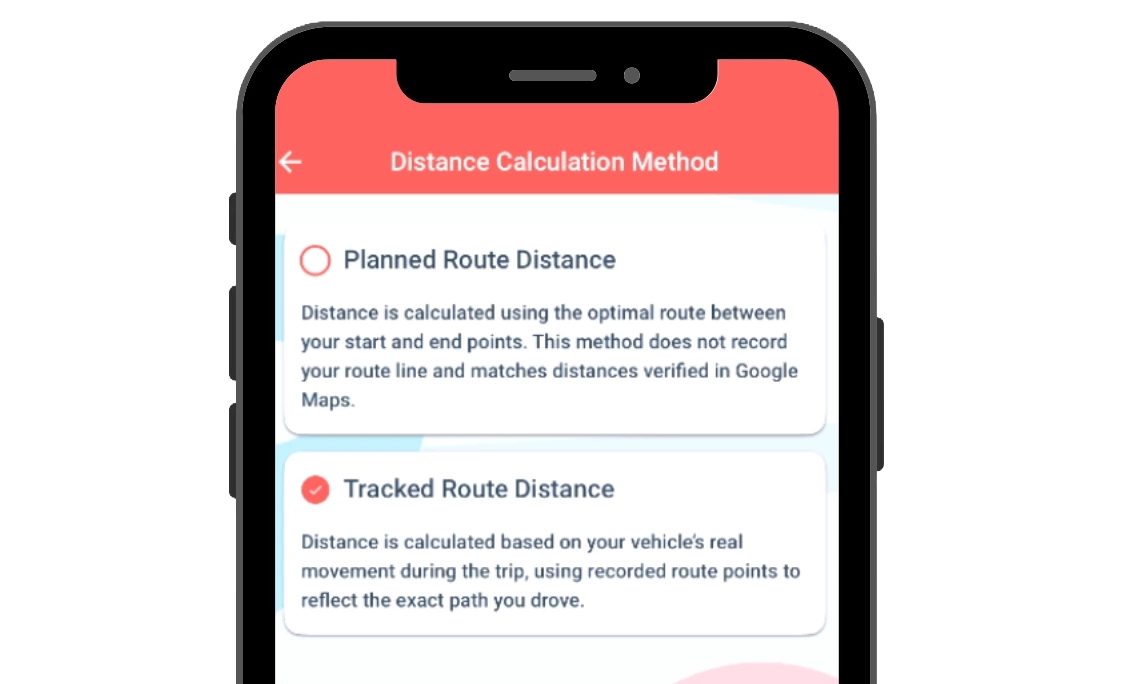

Only at MileageWise: Choose the Way to Calculate Your Mileage

We’ve upgraded how mileage is calculated in our mileage tracker app. 🎉 From now on, you can choose between two distance calculation methods depending on

Company Car vs Car Allowance: Which is Better for Your Business?

Last Updated: February 27, 2025 Deciding between a company car vs car allowance for your employees involves weighing costs, flexibility, and tax implications. For U.S.

Vehicle Fleet Software to Boost Your Business

Last Updated: January 19, 2026 Vehicle fleet software helps businesses handle their vehicles much better, cutting down costs and making everything run smoother. This type

Is Mileage Reimbursement Taxable? The Need to Knows

January 16, 2026 Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard

Related Guides

Now on the App Store: Mileage Log from Google Maps for iPhone

It’s Finally Here! Google Maps Timeline Import from Mobiles

Transform your Trip Lists into Mileage Logs with MileageWise

Related Blogposts

Is There a Maximum Mileage Deduction?

You’re wondering if there’s a maximum mileage deduction the IRS allows, the straightforward answer is no. There’s no maximum mileage limit for the IRS standard

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Only at MileageWise: Choose the Way to Calculate Your Mileage

We’ve upgraded how mileage is calculated in our mileage tracker app. 🎉 From now on, you can choose between two distance calculation methods depending on

Company Car vs Car Allowance: Which is Better for Your Business?

Last Updated: February 27, 2025 Deciding between a company car vs car allowance for your employees involves weighing costs, flexibility, and tax implications. For U.S.

Vehicle Fleet Software to Boost Your Business

Last Updated: January 19, 2026 Vehicle fleet software helps businesses handle their vehicles much better, cutting down costs and making everything run smoother. This type

Is Mileage Reimbursement Taxable? The Need to Knows

January 16, 2026 Mileage reimbursement is not taxable if your company follows IRS rules. Specifically, if you reimburse employees at or below the IRS standard

Now on the App Store: Mileage Log from Google Maps for iPhone

Our Mileage Log from Google Maps app is now available in the Apple App Store! iPhone users can convert Google Maps Timeline drives into an

Introducing the Mileage Log from Google Maps App

We’re excited to share our latest development! You can now convert your Google Maps Timeline drives directly into an IRS-compliant mileage log right on your

Was Your Google Timeline Deleted? Here’s What Happened:

Last updated: November 20, 2025 If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this

It’s Finally Here! Google Maps Timeline Import from Mobiles

Struggling to Manage Your Trips After Google’s Timeline Update? If you’re reading this, you’ve likely encountered the recent update affecting Google Maps Timeline. With Timeline

Transform your Trip Lists into Mileage Logs with MileageWise

Last Updated: October 1, 2025 Do you have a list of monthly trips from a data source like Excel or Google Timeline, but need to

How to Download Google Timeline Data: A Guide

Google Timeline Import Hub Last Updated: October 30, 2025 Want to download Google Timeline data? This guide shows you how to extract your location history

How to Export Google Maps Timeline: Get Your Data

Google Timeline Import Hub Last Updated: October 29, 2025 It can be tricky to export Google Maps Timeline data after Google’s recent updates. Many users

Google Maps Mileage Tracker: From Timeline to Mileage Log

Google Timeline Import Hub Last updated: February 26, 2026 If you’re an active user of Google Maps Timeline you likely already know how convenient it

Timeero

Table of Contents Timeero Timeero is a time, location, and mileage tracking app designed for businesses and teams in the United States. It helps employers

Milewise by Allstate

Table of Contents Milewise by Allstate Milewise by Allstate is a pay-per-mile car insurance program offered by Allstate Insurance in the United States. It’s designed

Hurldr

Table of Contents Hurdlr Hurdlr is a finance and expense tracking app designed for self-employed professionals, freelancers, and gig workers in the United States. It