Table of Contents

Thinking about getting a company car? This guide breaks down everything you need to know, from the upsides and downsides to how taxes work this year.

What is a Company Car? And How Does It Work?

A company car is a vehicle your employer gives you to use. You might use it just for work trips, or you might get to use it for personal things too, like driving to the store or going on vacation. When you can use it for personal travel, it’s seen as a perk, and that can affect your taxes. These cars are often part of job packages for people who travel a lot for work, like sales reps or managers.

The Facts: Numbers and Stats About Company Cars

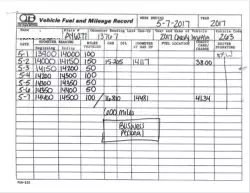

Let’s look at some figures to understand the impact of company cars:

| Benefit/Drawback | Detail | Data Source |

|---|---|---|

| Employee Savings | Average annual savings of £3,000 to £6,000 compared to personal car ownership (including costs like insurance, tax, maintenance, and depreciation) | Cardata[^1], NVC[^5] |

| BIK Tax (2024/25) | Zero-emission cars: 2% of P11D value | NVC[^5] |

| BIK Tax (2025/26) | Zero-emission cars: 3% of P11D value | NVC[^5] |

| Recruitment Boost | Companies with car schemes saw 10-15% lower staff turnover compared to those without[^1]. | Cardata[^1] |

| Company Trend | Growing shift towards electric vehicles (EVs) for tax benefits and environmental image[^5]. | NVC[^5] |

More and more businesses are switching to electric cars for their fleets because of the tax savings and because it shows they care about the environment.

Did you know the IRS also has rules about company cars? You can learn more here: Company Cars | Internal Revenue Service

The Good and Bad: Benefits and Drawbacks of a Company Car

Getting a company car can make life easier and save you money, but it also has some downsides. It’s important to look at both sides.

FAQ

What is considered a company car?

A company car is a vehicle provided by an employer to an employee primarily for business purposes, although personal usage may be allowed under certain conditions.

Is personal use of a company car taxable?

Yes, in some cases, the personal use of a company car is typically considered a taxable benefit, and the value of this usage must be reported as income to the IRS.

How can MileageWise help track company car usage?

MileageWise accurately tracks and separates personal and business mileage, simplifying reporting and ensuring compliance with IRS regulations.