The IRS has Announced the Standard Mileage Rates for 2025

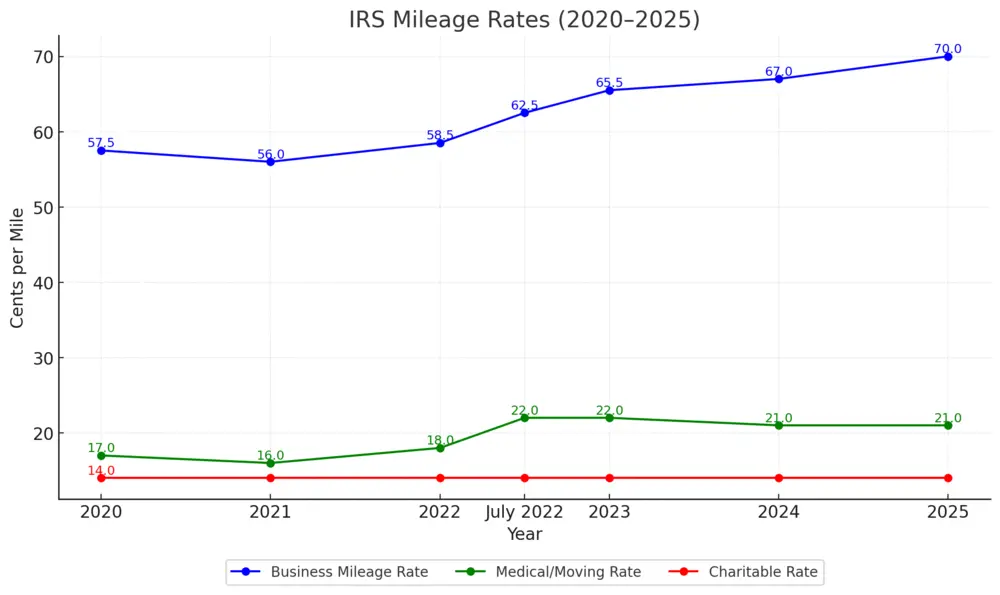

Last updated: December 20, 2024 Curious about how much you can deduct for driving in 2025? Staying updated on the IRS standard mileage rates is vital for maximizing deductions and staying compliant. This guide will show you the new rates and how you can prepare to maximize your tax deductions. Read on to stay ahead! Table of Contents What Are The IRS Mileage Rates for 2025? Good news for self-employed people and business owners! The business mileage rate has increased from 67 cents to 70 cents per mile! However, the