Home » MileageWise's Ad-free App » Google Mileage Tracker

Last Updated: August 5, 2025

Are you interested in the miles you covered? Do you need your past mileage to claim mileage deduction? Tracking mileage with Google Maps can unlock significant tax deductions and make reimbursements a breeze. This guide will show you how to leverage Google Timeline and smart integrations to count your miles and create Google mileage logs that are accurate and IRS-compliant.

Table of Contents

How to Determine Mileage with Google Maps

While there is no such thing as a dedicated Google Maps mileage tracker, it’s a powerful tool to estimate driven distances and, when combined with Google Timeline, can be incredibly helpful for reconstructing trips.

Using Google Maps for Route Calculation

First, let’s talk about calculating mileage for a single route. Google Maps is your best friend here. Open Google Maps and use the “Directions” trip planner. Enter your starting point and destination. Google Maps will offer routes and show you the distance in miles. You can even add multiple stops. The process is similar on the Google Maps app.

Alternatively, Google has a tool to measure distance. This is quick and good for visual search, but it doesn’t take driving routes into consideration

Leveraging Google Timeline for Past Trips

Tracking mileage with Google Maps is a hidden gem. If you have location services enabled on your phone and Google Timeline activated, Google has records of your movements.

- Accessing Timeline: Open Google Maps on your phone, tap on your profile, and select “Timeline” from the list.

- Exporting Data: While Google Timeline doesn’t offer a direct export button, you can download your raw location data from your smartphone. This raw data needs processing with a third-party tool to become a usable spreadsheet or other file format.

The Role of Google Sheets and Templates

For those who prefer a manual approach with a digital twist, Google Sheets can be a good option.

- Manual Entry: You can create a simple spreadsheet to log your trips. Include columns for date, start location, end location, or any other information you need.

- Templates & Add-ons: You can use formulas or add-ons within Google Sheets to help calculate distances based on addresses. However, this still requires a lot of manual input, especially if you need it to create an IRS mileage log. Here’s a video walkthrough of how to make it work.

Why Google Alone Isn’t Enough for IRS Mileage Logs

While Google Maps and Timeline provide valuable location history and distance data, they don’t automatically create an IRS-compliant mileage log. The IRS requires more than just miles. They want to know:

- The date of the trip

- The starting and ending locations

- The business purpose of the trip

- The total mileage for each trip

Google Maps might sound like a good free mileage tracker app, but it won’t magically know if your trips were for business or personal reasons. Relying on Google Timeline and a manual spreadsheet to add the missing details can be error-prone and time-consuming. The last thing you need is to work hours on end on your mileage log for it not to hold up during an IRS audit.

The Power of Third-Party Integrations

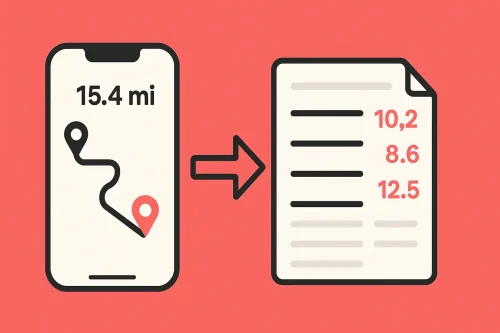

Many people, from independent contractors to realtors, have found that combining Google’s data with specialized third-party mileage apps is the most effective strategy. These apps bridge the gap, taking Google’s raw data and turning it into a compliant log.

At least until recently. Many of these programs rely on Google Takeout, a desktop exporting service. But these exports won’t contain your Location History anymore, as it is now only available on mobile devices due to a security update. But there is still a solution. One provider has taken on the challenge to integrate mobile-stored timelines…

MileageWise: Your Google Mileage Tracker

This is where MileageWise steps in, taking your Google data and molding it into an IRS-proof mileage log.

MileageWise specializes in making mileage tracking simple, accurate, and completely compliant. We understand that maximizing your deductions and avoiding audit headaches are top priorities.

Seamless Google Maps Timeline Integration

Imagine you lost your past trip data and need it for an audit. No problem! MileageWise lets you:

- Import your Google Location History: You can import your Google location data and convert it into an IRS-compliant mileage log.

- Automate your Trip Reconstruction: Our AI-powered Mileage Wizard fills in missing trips and corrects distances in case your mileage log doesn’t align with your odometer readings or your filed deduction.

Ensuring IRS Compliance and Audit Readiness

Our core mission is to make sure your mileage logs are audit-proof. We achieve this with:

- IRS Compliance Auditor: This built-in tool constantly checks your mileage log for compliance. It also identifies inconsistencies and potential IRS red flags.

- Trip Management Options: Beyond tracking, you can easily categorize your trips, import visited locations and trips, set recurring trips, and even edit trips in bulk.

Try MileageWise for free for 14 days. No credit card required!

AI Logs & Google Timeline Import

Customer Success Story: Google Mileage History into Audit-Proof Logs

I run a small landscaping business, and tax season used to be so much work. I drove constantly: for quotes, site visits, and picking up supplies. At year’s end, I’d work through my Google Timeline, copying my trips into a spreadsheet and looking up distances in Google Maps. I would notice mistakes or try to remember why I went to a certain location. And just like that, a dedicated afternoon turned into days of tiring work. My accountant kept warning me that these records wouldn’t fly with the IRS.

Everything changed when I found a tool that could use my Google mileage history. I imported all my past trips straight from my Location History into MileageWise. And it turned my trips into neat mileage logs like magic. It even helped me reconstruct trips that I missed. My accountant was finally content with my documentation, and I no longer stress about audits or missed deductions. It’s a huge relief knowing I’ve got it covered.

Conclusion

Google Maps mileage tracking is an incredible method for maximizing tax deductions and ensuring IRS compliance. By understanding the capabilities of Google Maps and Google Timeline, and pairing them with a robust solution like MileageWise, you can transform a tedious task into a streamlined, stress-free process.

Ready to take control of your mileage and your deductions?

- Ensure Google Timeline and Location services are active on your device to capture your movements.

- Use MileageWise for seamless Google Timeline integration and AI-powered log creation.

- Utilize MileageWise’s Compliance Auditor to ensure your logs are audit-proof.

- Enjoy the peace of mind and significant tax savings!

FAQ

How can I calculate driving mileage using Google Maps?

To calculate mileage with Google Maps, just enter your start and end locations into the “Directions” function. The app will show you the distance in miles or kilometers for each route. It’s a quick way to check your mileage, and many people use it as a simple Google Maps mile tracker when they need rough estimates.

Can I use Google Maps to track mileage for business or taxes?

You can use Google Maps to look up distances, but it doesn’t function as a full Google mileage tracker on its own. For business or tax reporting, it’s better to combine Google Maps with a third-party app that can convert it into IRS-compliant reports.

Is there a Google mileage tracker app?

Google doesn’t offer a dedicated mileage tracker app. However, many apps can substitute a Google Maps mileage tracker by tracking your miles. These apps make it easier to turn your trip into IRS-compliant logs.

How do I make a mileage log using Google Sheets?

You can create a simple log by setting up a Google Sheet with columns like Date, Start/End Locations, Distance, and Trip Purpose. Use Google Maps to find the distance for each trip, then enter the numbers manually. It’s a basic way to track mileage with Google Maps if you’re not using an app.

Can I export my mileage or driving history from Google Maps?

If you’ve enabled Location History and Timeline, you can access your trip history through the Google Maps app, available only on your phone. It shows where you’ve driven, and while it’s not a full Google mileage tracker, you can manually copy the data into a log or export it into a mileage tracker software.

Are there any downsides to using Google Maps for tracking mileage?

Yes. Google Maps is great for navigation or reminiscing about past vacations, but not built for recordkeeping. It doesn’t prompt you to categorize trips and doesn’t record your miles. If you’re trying to track mileage for taxes, a mileage tracker app is a better option.